Author: Will Awang

If I were to imagine how finance would work in the future, I would undoubtedly introduce the many advantages that digital currency and blockchain technology can bring: 7/24 all-weather availability, instant global liquidity, fair access without permission, asset composability, and transparent asset management. And this imagined future financial world is being gradually built through tokenization.

Blackrock CEO Larry Fink emphasized the importance of tokenization to future finance in early 2024: "We believe that the next step in financial services will be the tokenization of financial assets, which means that every stock, every bond, and every financial asset will run on the same general ledger."

Asset digitization can be fully rolled out with the maturity of technology and measurable economic benefits, but the large-scale and widespread adoption of asset tokenization will not happen overnight. One of the most challenging aspects is that in the highly regulated industry of financial services, the transformation of traditional financial infrastructure requires the participation of all players in the entire value chain.

Despite this, we can already see that the first wave of tokenization has arrived, mainly benefiting from the investment returns in the current high interest rate environment and driven by practical use cases of existing scale (such as stablecoins, tokenized US bonds). The second wave of tokenization may be driven by use cases of asset classes that currently have a small market share, less obvious returns, or need to solve more severe technical challenges.

This article attempts to examine the potential benefits and long-standing challenges of tokenization from the perspective of traditional finance through McKinsey & Co's analytical framework for tokenization, and at the same time, combined with realistic and objective cases, concludes that although challenges still exist, the first wave of tokenization has arrived.

TL;DR

Tokenization refers to the process of creating a digital representation of an asset on a blockchain;

Tokenization can bring many advantages: 24/7 availability, instant global liquidity, fair access without permission, asset composability, and transparent asset management;

In the financial services sector, the focus of tokenization is shifting to "blockchain, not cryptocurrency";

Despite the challenges, the first wave of tokenization has arrived with the substantial adoption of stablecoins, the launch of tokenized U.S. bonds, and the clarification of the regulatory framework;

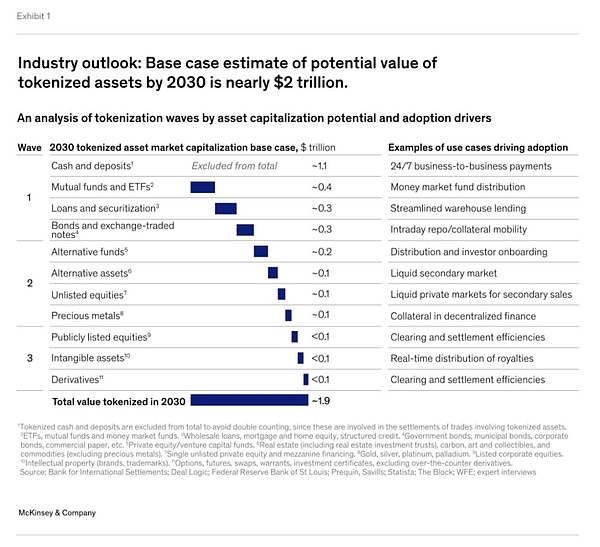

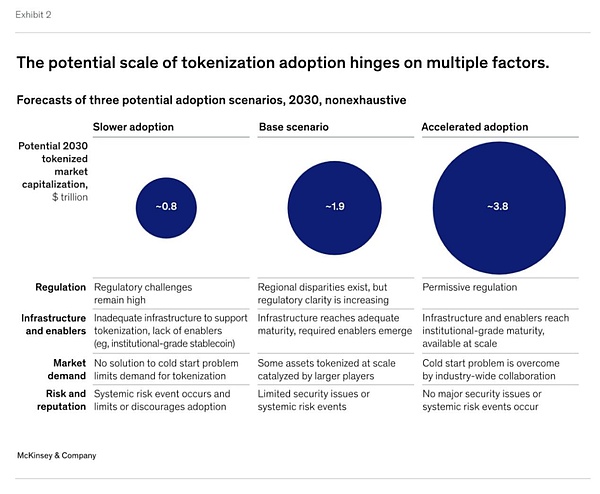

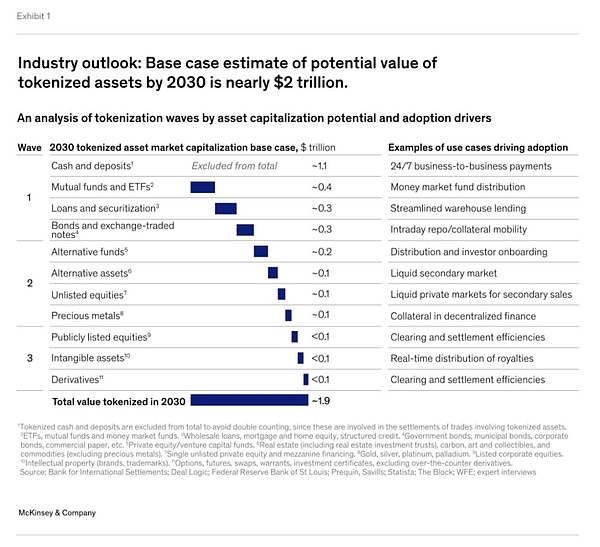

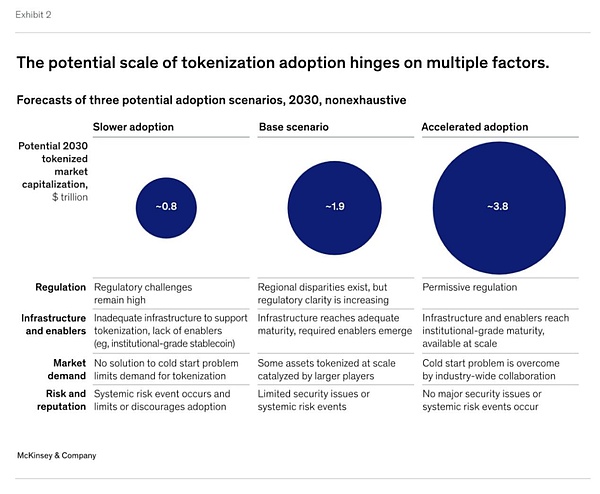

McKinsey predicts that by 2030, the total market value of the tokenized market may reach approximately US$2 trillion to US$4 trillion (excluding the market value of cryptocurrencies and stablecoins);

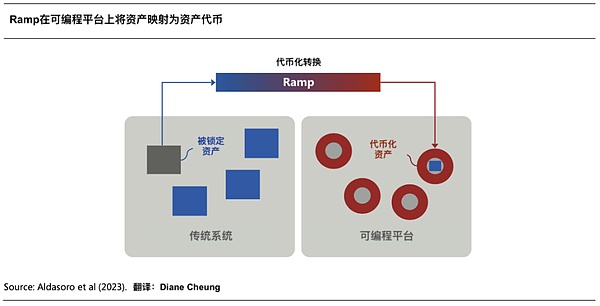

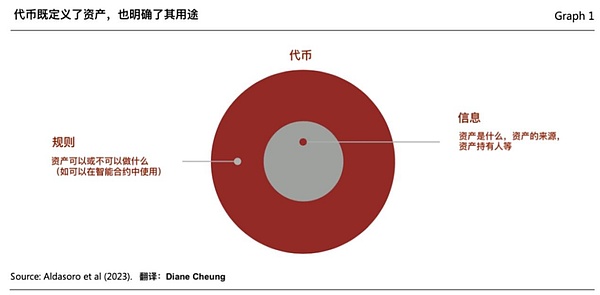

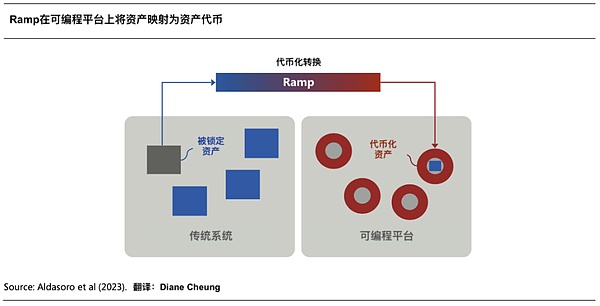

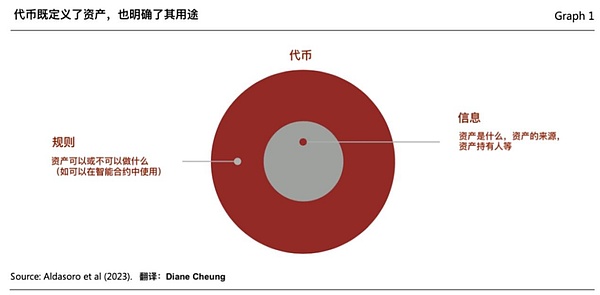

The resulting "tokens" refer to the ownership certificates (Claims) recorded on the blockchain programmable platform for trading. Tokens are not just single digital certificates, but also usually combine the rules and logic that manage the transfer of underlying assets in traditional ledgers. Therefore, tokens are programmable and customizable to meet personalized scenarios and regulatory compliance requirements.

(Tokenization and Unified Ledger - Building a Blueprint for the Future Monetary System)

The "tokenization" of assets involves the following four steps:

1.1 Determine the underlying assets

The process begins when the asset owner or issuer determines that the asset will benefit from tokenization. This step requires clarifying the structure of the tokenization, because the specific details will determine the design of the entire tokenization scheme, for example, the tokenization of a money market fund is different from the tokenization of carbon credits. The design of the tokenization scheme is critical, which helps to clarify whether the tokenized assets will be considered securities or commodities, which regulatory frameworks will apply, and which partners will be worked with.

1.2 Token Issuance and Custody

Creating a blockchain-based digital representation of an asset requires first locking up the underlying asset to which the digital representation corresponds. This will involve the need to transfer the asset to a controlled entity (whether physical or virtual), usually a qualified custodian or licensed trust company.

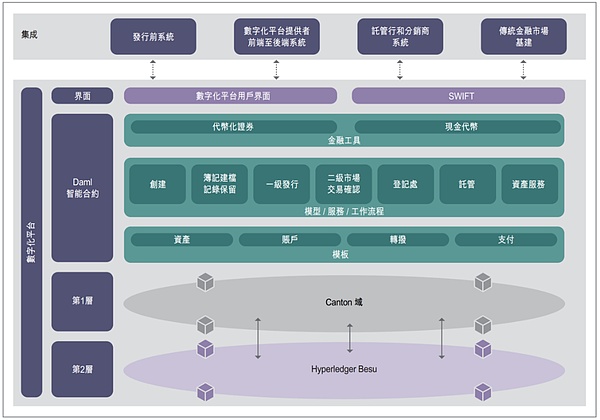

The digital representation of the underlying asset is then created on the blockchain in the form of a specific token with embedded functionality to execute code that executes predetermined rules. To do this, the asset owner chooses a specific token standard (ERC-20 and ERC-3643 are common standards), a network (private or public blockchain), and the functionality to be embedded (e.g., user transfer restrictions, freezing capabilities, and clawbacks), which can be implemented by a tokenization service provider.

1.3 Token Distribution and Trading

Tokenized assets can be distributed to end investors through traditional channels or new channels such as digital asset exchanges. Investors need to set up an account or wallet to hold digital assets, and any physical asset equivalents remain locked in the issuer's account with a traditional custodian. This step typically involves a distributor (e.g., the private wealth department of a large bank) and a transfer agent or broker-dealer.

Depending on the issuer and asset class, it is also possible to create a liquid market for these tokenized assets after issuance through listing on secondary market trading venues.

1.4 Asset Servicing and Data Verification

Digital assets that have been distributed to end investors still require ongoing servicing, including regulatory, tax and accounting reporting, and regular calculation of net asset value (NAV). The nature of the servicing depends on the asset class. For example, the servicing of carbon credit tokens requires different audits than fund tokens. Services need to coordinate off-chain and on-chain activities and handle a wide range of data sources.

The current tokenization process is complex. In a money market fund tokenization scheme, up to nine parties are involved (asset owners, issuers, traditional custodians, tokenization providers, transfer agents, digital asset custodians or trading brokers, secondary markets, distributors and end investors), two more than the traditional asset process.

Second, the advantages of tokenization

Tokenization enables assets to access the huge potential brought by digital currency and blockchain technology. Broadly speaking, these advantages include: 7/24 all-weather operations, data availability, and so-called instant atomic settlement (Atomic Settlement). In addition, tokenization also provides programmability - the ability to embed code in tokens and the ability of tokens to interact with smart contracts (composability) - to achieve a higher degree of automation.

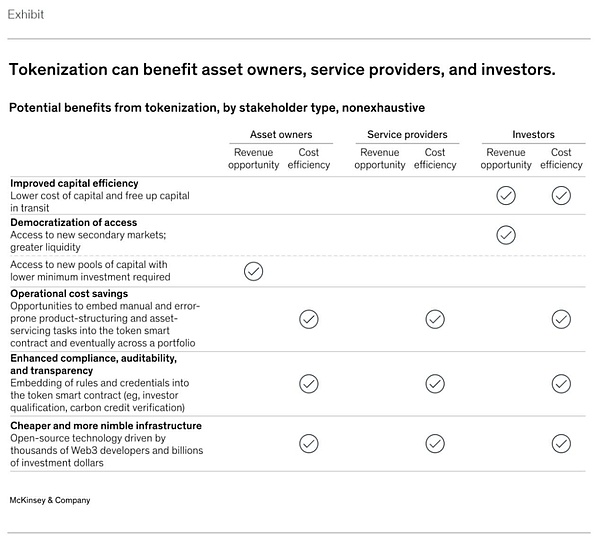

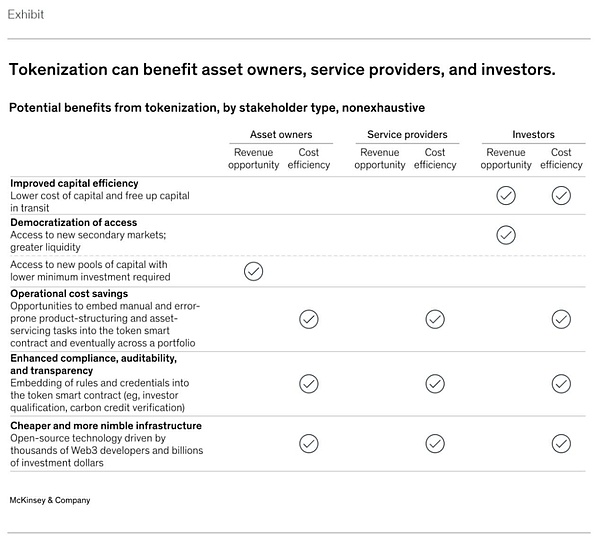

More specifically, when asset tokenization is promoted on a large scale, in addition to proof of concept, the following advantages will become increasingly prominent:

2.1 Improve capital efficiency

Tokenization can significantly improve the capital efficiency of assets in the market. For example, the redemption of repurchase agreements (Repo) or money market funds after tokenization can be completed instantly in a few minutes T+0, while the current traditional settlement time is T+2. In the current high-interest market environment, shorter settlement time can save a lot of money. For investors, these savings in funding rates may be the reason why recent tokenized U.S. debt projects can have a huge impact in the near future.

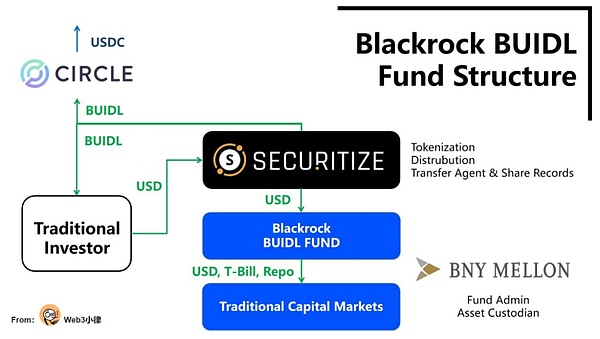

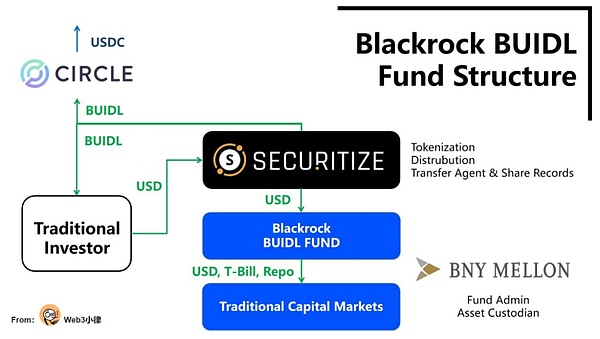

On March 21, 2024, Blackrock and Securitize jointly launched the first tokenized fund BUIDL on the public blockchain Ethereum. After the fund is tokenized, it can realize real-time settlement of the unified ledger on the chain, which greatly reduces transaction costs and improves capital efficiency. It can realize (1) 24/7/365 fund subscription/redemption of legal currency USD. This instant settlement and real-time redemption function is what many traditional financial institutions are very eager to achieve; at the same time, in cooperation with Circle, (2) 24/7365 real-time exchange of stable currency USDC and fund token BUIDL at a 1:1 ratio.

This tokenized fund that can link traditional finance and digital finance is a milestone innovation for the financial industry.

(Analysis of Blackrock's tokenized fund BUIDL, which opens up a brave new world of DeFi for RWA assets)

2.2 Unlicensed democratic access

One of the most touted benefits of tokenization or blockchain is the democratization of access. This permissionless access threshold may increase asset liquidity after the fragmentation of tokens (i.e., dividing ownership into smaller shares and lowering the investment threshold), but the premise is that the tokenization market can be popularized.

In some asset classes, simplifying intensive manual processes through smart contracts can greatly improve unit economics, thereby providing services to smaller investors. However, access to these investments may be subject to regulatory restrictions, which means that many tokenized assets may only be available to qualified investors.

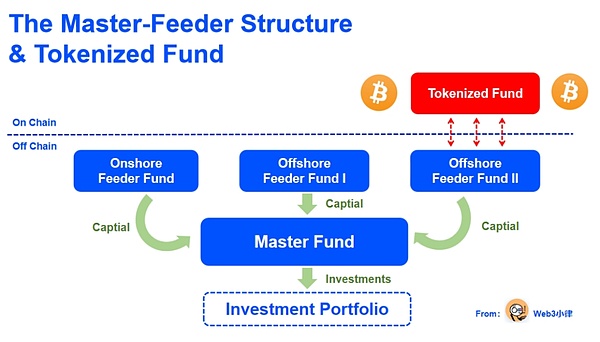

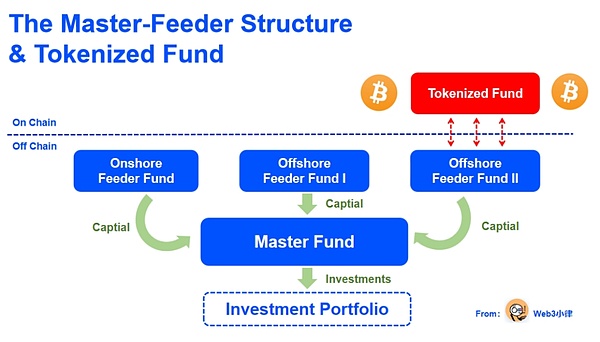

We can see that the well-known private equity giants Hamilton Lane and KKR have respectively cooperated with Securitize to tokenize the Feeder Fund of the private equity funds they manage, providing investors with a "cheap" way to participate in top private equity funds. The minimum investment threshold has been greatly reduced from an average of US$5 million to only US$20,000, but individual investors still need to pass the qualified investor verification of the Securitize platform, and there is still a certain threshold.

(RWA 10,000-word research report: the value, exploration and practice of fund tokenization)

2.3 Save operating costs

Asset programmability can be another source of cost savings, especially for asset classes whose services or issuances are often highly manual, error-prone and involve numerous intermediaries, such as corporate bonds and other fixed-income products. These products often involve customized structures, imprecise interest calculations and coupon payment expenses. Embedding operations such as interest calculations and coupon payments into the smart contracts of tokens will automate these functions and significantly reduce costs; system automation achieved through smart contracts can also reduce the costs of services such as securities lending and repurchase transactions.

In 2022, the Bank for International Settlements (BIS) and the Hong Kong Monetary Authority launched the Evergreen project to issue green bonds using tokenization and a unified ledger. The project makes full use of the distributed unified ledger to integrate the participants involved in bond issuance on the same data platform, supports multi-party workflows, and provides specific participant authorization, real-time verification and signature functions, which improves transaction processing efficiency. The bond settlement realizes DvP settlement, reduces settlement delays and settlement risks, and the platform's real-time data updates of participants also improve transaction transparency.

(https://www.hkma.gov.hk/media/chi/doc/key-information/press-release/2023/20230824c3a1.pdf)

Over time, tokenized asset programmability can also create benefits at the portfolio level, enabling asset managers to automatically rebalance portfolios in real time.

2.4 Enhanced Compliance, Auditability, and Transparency

Current compliance systems often rely on manual checks and retrospective analysis. Asset issuers can automate these compliance checks by embedding specific compliance-related operations (e.g., transfer restrictions) into tokenized assets. Additionally, the 24/7 data availability of blockchain-based systems creates opportunities for streamlined consolidated reporting, immutable record keeping, and real-time auditability.

(Tokenization and Unified Ledger - Building a Blueprint for the Future Monetary System)

An intuitive case is carbon credits. Blockchain technology can provide tamper-proof and transparent records of credit purchases, transfers and exits, and build transfer restrictions and measurement, reporting and verification (MRV) functions into the smart contract of the token. In this way, when a carbon token transaction is initiated, the token can automatically check the latest satellite imagery to ensure that the energy-saving and emission reduction projects underlying the token are still in operation, thereby enhancing the trust of the project and its ecology.

2.5 Cheaper and More Flexible Infrastructure

Blockchain is essentially open source and continues to develop under the impetus of thousands of Web3 developers and billions of dollars in venture capital. Assuming financial institutions choose to operate directly on public permissionless blockchains, or public/private hybrid blockchains, these blockchain technology innovations (such as smart contracts and token standards) can be easily and quickly adopted, further reducing operating costs.

(Tokenization: A digital-asset déjà vu)

Given these advantages, it is not difficult to understand why many large banks and asset managers are so interested in the prospects of this technology.

However, at present, due to the lack of use cases and scale of adoption of tokenized assets, some of the listed advantages remain theoretical.

III. Challenges to Mass Adoption

Despite the numerous benefits that tokenization may bring, few assets have been tokenized at scale to date, with the following potential influencing factors:

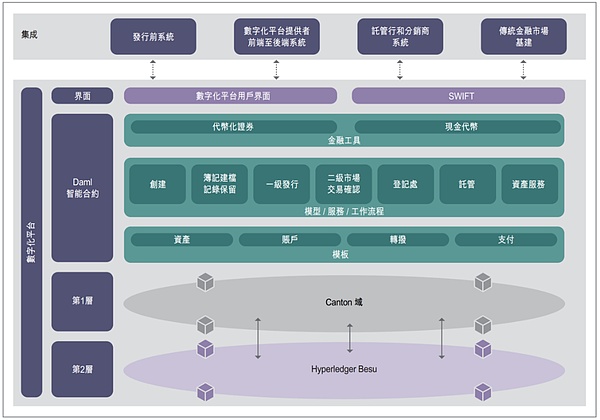

3.1Inadequate Technology and Infrastructure Readiness

The adoption of tokenization is hampered by the limitations of existing blockchain infrastructure. These limitations include the continued shortage of institutional-grade digital asset custody and wallet solutions that do not provide sufficient flexibility to manage account policies, such as transaction limits.

In addition, blockchain technology, especially permissionless public blockchains, has limited ability to operate the system normally at high transaction throughput, which cannot support tokenization for certain use cases, especially in mature capital markets.

Finally, decentralized private blockchain infrastructure (including developer tools, token standards, and smart contract guidelines) poses risks and challenges to interoperability between traditional financial institutions, such as interoperability between chains, cross-chain protocols, liquidity management, etc.

3.2 CurrentBusiness Cases Are Limited and Implementation Costs Are High

Many of the potential economic benefits of tokenization will only be realized on a large scale when tokenized assets reach a certain scale. However, this may require an education cycle to transition and adapt to mid- and back-office workflows that are not designed for tokenized assets. This situation means that short-term benefits are unclear and business cases are difficult to gain organizational recognition.

Not everyone can master digital currency and blockchain technology at the beginning, and operations during the transition period will appear complex and may involve running two systems at the same time (for example, digital and traditional settlement, on-chain and off-chain data coordination and compliance, digital and traditional custody and asset services).

Finally, many traditional clients in the capital markets have not yet shown interest in 24/7 trading infrastructure and value liquidity, which poses further challenges to the way tokenized products are listed.

3.3MarketSupportisuntil

Tokenization requires instant cash settlement to achieve faster settlement times and higher capital efficiency. However, despite progress in this regard, there is currently no large-scale cross-bank solution: tokenized deposits are currently only piloted within a few banks, and stablecoins currently lack regulatory clarity and cannot be regarded as bearer assets, and cannot provide real-time ubiquitous settlement. Secondly, tokenization service providers are still in their infancy and are temporarily unable to provide comprehensive and mature one-stop services. In addition, the market lacks large-scale distribution channels for appropriate investors to obtain digital assets, which is in stark contrast to the mature distribution channels used by wealth and asset managers.

3.4 Regulatory uncertainty

To date, regulatory frameworks for tokenization vary by region or simply do not exist. Challenges facing US participants include, in particular, unclear settlement finality, the lack of legal binding force of smart contracts, and unclear requirements for qualified custodians. Further unknowns remain regarding the capital treatment of digital assets. For example, the US Securities and Exchange Commission has stated through Regulation SAB 121 that digital assets must be reflected on the balance sheet when providing custody services - a standard that is more stringent than for traditional assets, making it too expensive for banks to hold or even distribute digital assets.

3.5 Industry needs coordination

Capital market infrastructure participants have not yet demonstrated a concerted willingness to build tokenized markets, or move markets to the chain, and their participation is critical because they are the ultimate recognized holders of assets on the ledger. The impetus to move to new infrastructure on-chain through tokenization is not uniform, especially considering that the role of many financial intermediaries will change significantly, or even be disintermediated.

Even carbon credits, as a relatively new asset class, have encountered challenges in their early days on blockchain. Despite the obvious benefits of tokenization, such as enhanced transparency, it seems that only Gold Standard is currently the only registry that publicly supports tokenized carbon credits.

Fourth,The first wave oftokenization has arrived

Despite the many challenges mentioned above, as well as the unknown unknowns, we can see from the trends and mass adoption in recent months that tokenization has reached a turning point in certain asset classes and their use cases, and the first wave of tokenization has arrived (Tokenization in Waves).

4.1Massive Adoption

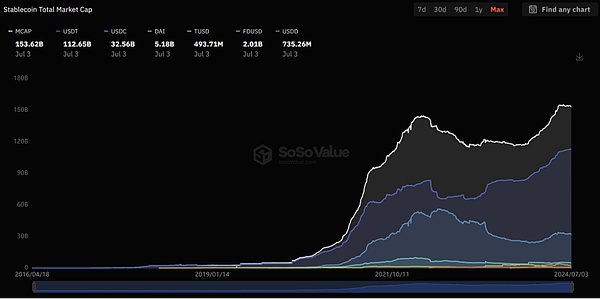

Tokenized assets that are settled 24/7 and instantly must be supported by tokenized cash, and the representative of tokenized cash, stablecoins, is the most important part of the tokenized market.

Definition of stablecoins: Most digital currencies have large price fluctuations and are not suitable for payment, just as Bitcoin may fluctuate greatly in a day. Stablecoins are digital currencies that aim to solve this problem by maintaining a stable value, usually pegged 1:1 to fiat currencies (such as the US dollar). Stablecoins have the best of both worlds: they maintain low daily volatility while providing the advantages of blockchain - efficient, economical and globally applicable.

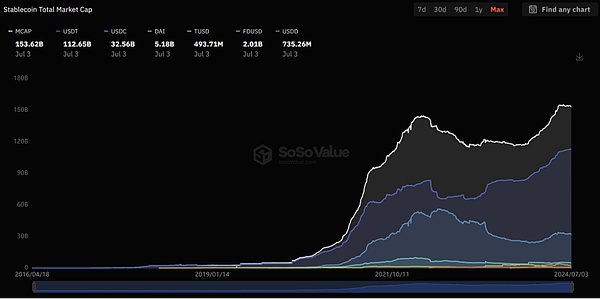

According to SoSoValue data, there is currently about $153 billion in tokenized cash in circulation in the form of stablecoins (such as USDC, USDT). Some banks have launched or are about to launch tokenized deposit functions to improve the cash settlement of commercial transactions. These nascent systems are by no means perfect; liquidity is still fragmented, and stablecoins are not yet recognized as bearer assets. Even so, they have proven sufficient to support meaningful trading volumes in the digital asset market. Stablecoin on-chain trading volume typically exceeds $500 billion per month.

(https://sosovalue.xyz/dashboard/Stablecoin_Total_Market_Cap)

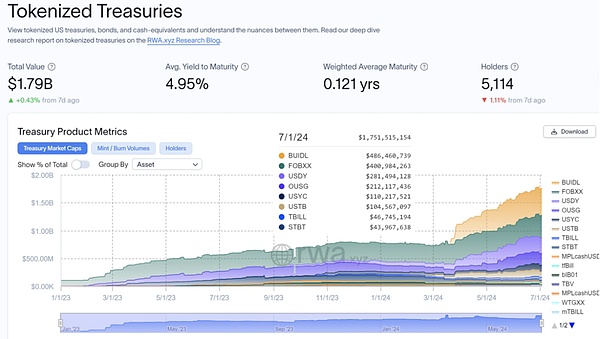

4.2 Tokenized U.S. Treasuries for Short-term Commercial Demands

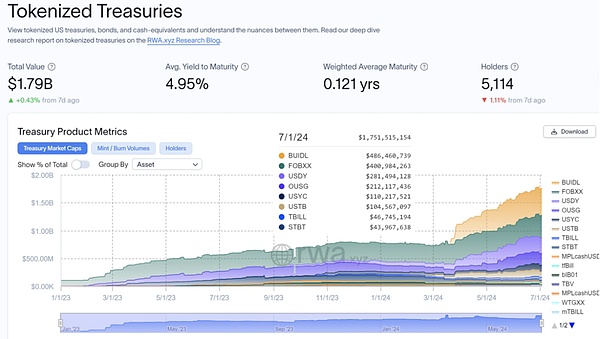

The current high interest rate environment has attracted much attention from the market for tokenized use cases based on U.S. Treasuries, and its products can indeed achieve economic benefits and improve capital efficiency. According to RWA.XYZ data, the size of the tokenized U.S. Treasury market has risen from $770 million at the beginning of 2024 to $1.75 billion today (as of July 1), an increase of 227%.

(https://app.rwa.xyz/treasuries)

At the same time, short-term liquidity transactions (such as tokenized repo and securities lending) are more attractive when interest rates rise. JPMorgan Chase's institutional-level blockchain payment network Onyx is currently able to process $2 billion in transactions per day. Onyx's trading volume can be attributed to JPMorgan Chase's "Coin System" and "Digital Asset" solutions.

In addition, in the United States, traditional banks have welcomed a number of large (and often lucrative) digital asset business customers, such as stablecoin issuers. Retaining these customers requires 24/7 all-weather value and tokenized cash flow, which further promotes the business case for accelerating tokenization capabilities.

4.3 Gradual Clarity of the Tokenization Regulatory Framework

At the end of June, the European Union has implemented the regulatory requirements for stablecoins in the Crypto Asset Market Regulation Act (MiCA), while Hong Kong is also seeking opinions on the implementation of stablecoins. Other regions such as Japan, Singapore, the UAE and the United Kingdom have also issued new guidelines to increase regulatory clarity for digital assets. Even in the United States, market participants are exploring various tokenization and distribution methods, using existing rules and guidance to mitigate the impact of current regulatory uncertainty.

Following the House Digital Assets, Financial Technology and Inclusion Subcommittee’s hearing on “Next Generation Infrastructure: How to Promote Efficient Market Operations by Tokenizing Real-World Assets?” on June 7, SEC Commissioner Mark Uyeda emphasized the potential of tokenization to change the capital market at a securities market event on June 14. Especially with the advancement of the important issue of digital currency in the US election process, whether it is the demand for financial innovation or the relaxation of supervision, the traditional financial capital’s attention to digital currency has shifted from the previous passive “speculation” to how to “actively” transform traditional finance.

4.4 Market Popularization and Infrastructure Maturity

In the past five years, many traditional financial services companies have increased digital asset talents and capabilities. Several banks, asset management companies, and capital market infrastructure companies have established digital asset teams of 50 or more people, and these teams are still growing. At the same time, the understanding of the technology and its prospects by established market participants is also increasing.

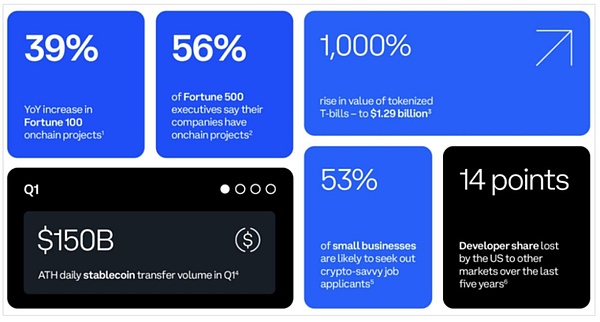

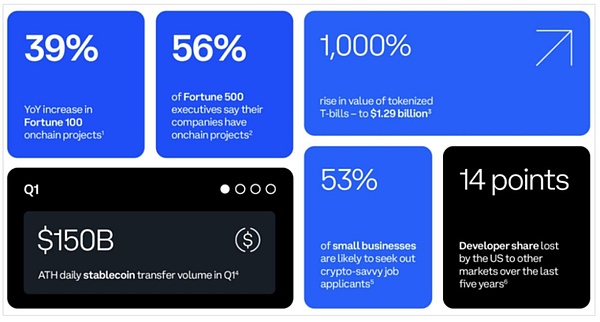

(Coinbase, The State of Crypto: The Fortune 500 Moving Onchain)

According to Coinbase's Q2 Cryptocurrency State Report, 35% of Fortune 500 companies are considering launching tokenization projects. Executives from 7 of the top 10 Fortune 500 companies are learning more about stablecoin use cases, primarily for low-cost, real-time settlement of stablecoin payments. 86% of Fortune 500 executives recognize the potential benefits of asset tokenization for their companies, and 35% of Fortune 500 executives said they are currently planning to launch tokenization projects (including stablecoins).

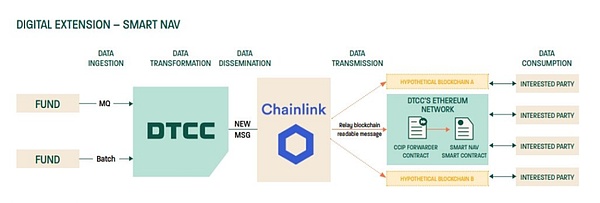

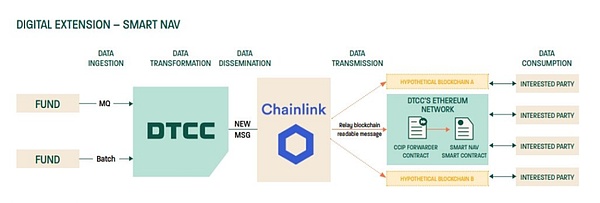

In addition, we are currently seeing more experiments and planned functional expansions in some important financial market infrastructures. For example, on May 16, the world's largest securities settlement system, the Depository Trust & Clearing Corporation (DTCC), which handles more than $200 trillion in transactions each year, completed the pilot Smart NAV project with blockchain oracle Chainlink. The project uses Chainlink's cross-chain interoperability protocol CCIP to enable the introduction of mutual fund net asset value (NAV) quote data on almost any private or public blockchain.

The market participants in the pilot include American Century Investments, Bank of New York Mellon, Edward Jones, Franklin Templeton, Invesco, JPMorgan Chase, MFS Investment Management, Mid-Atlantic Trust Company, State Street Bank and Bank of America. The pilot found that by providing structured data on the chain and creating standard roles and processes, the basic data can be embedded in a variety of on-chain use cases, opening up a variety of innovative application scenarios for the tokenization of funds.

(DTCC, Smart NAV Pilot Report: Bringing Trusted Data to the Blockchain Ecosystem)

Although tokenization has not yet reached the scale required to realize all its benefits, the ecosystem is maturing, the potential challenges are becoming clearer, and the business cases for adopting tokenization are gradually increasing.

Especially in the current high interest rate environment, the argument that tokenization can improve capital efficiency has been strongly supported by the successful launch of Blackrock's tokenized fund (traditional finance perspective), the large-scale adoption of Ondo Finance's tokenized US debt products (crypto finance perspective), and the popular real-life cases of $ONDO tokens. It can be said that the first wave of tokenization has arrived.

As for the argument that tokenization can provide liquidity for traditional illiquid assets in the future, it remains to be further demonstrated by the market. This argument will be built on the large-scale adoption of tokenized assets.

In any case, these real-world use cases show that tokenization can continue to gain attention and create positive and meaningful value for the global market in the next two to five years.

V. Asset Classes with the Most Widespread Adoption

Asset classes with large market size, high value chain friction, less mature traditional infrastructure, or low liquidity may be most likely to gain huge benefits from tokenization. However, the most likely to benefit does not mean the most likely to be implemented first.

The rate of adoption and timing of tokenization will depend on the attributes of the asset class, which will vary in expected returns, feasibility of implementation, timing of impact, and risk preferences of market participants. These factors will determine whether and when the relevant asset class can be widely adopted.

Specific asset classes can lay the foundation for the subsequent adoption of other asset classes by introducing clearer regulation, more mature infrastructure, better interoperability, and faster and more convenient investment. Adoption will also vary by region and be influenced by the dynamic and changing macro environment, including market conditions, regulatory frameworks, and buyer demand. Finally, the success or failure of star projects may drive or limit the further adoption of tokenization.

(Tokenization and Unified Ledger - Building a Blueprint for the Future Monetary System)

5.1 Mutual Funds

Tokenized money market funds have attracted more than $1 billion in assets under management, indicating that investors with on-chain capital have a large demand for tokenized money market funds in a high-interest environment. Investors can choose funds managed by established companies, such as Blackrock, WisdomTree, Franklin Templeton, and Web3 native projects such as Ondo Finance, Superstate, and Maple Finance. The underlying assets of these tokenized money market funds are basically U.S. Treasuries.

This is the first wave of tokenization at present, that is, the large-scale adoption of tokenized funds. As the scope and scale of tokenized funds continue to expand, additional related products and operational advantages will be realized.

As Paypal said when it launched its stablecoin on Solana at the end of May: the first step towards mass adoption is cognitive awakening - that is, simply introducing people to the fact that new technologies exist; the next step in adopting new payment technologies is to achieve utility, that is, to transform the initial cognitive awakening of ideas into utility in real life. The idea of Paypal promoting its stablecoin can also be used in the mass adoption of the tokenized market.

(Analysis of the internal logic of Paypal stablecoin payment and the evolutionary thinking towards Mass Adoption)

The transition to on-chain tokenized funds can greatly improve the practicality of funds, including instant 24/7 execution, instant settlement, and the use of tokenized fund shares as payment tools. In addition, based on the composability of the chain, Web3 native project issuers are improving the utility of tokens based on their own characteristics. For example, Superstate, the team behind $USTB (initiated by the founder of Compound), announced that their tokens can now be used to pledge and guarantee transactions on FalconX. Ondo Finance, the team behind $USDY and $OUSG, announced that $USDY can now be used to pledge and guarantee perpetual contract transactions on Drift Protocol.

In addition, highly customized investment strategies will become possible through the composability of hundreds of tokenized assets. Putting data on a shared ledger can reduce errors associated with manual reconciliation and increase transparency, thereby reducing operational and technical costs.

While the overall demand for tokenized money market funds depends in part on the interest rate environment, it undoubtedly plays a vital role in driving the development of the tokenized market. Other types of mutual funds and ETFs can also provide on-chain capital diversification for traditional financial instruments.

5.2 Private Credit

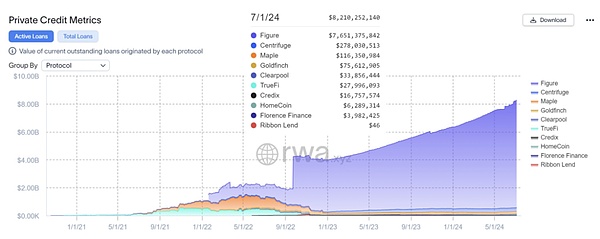

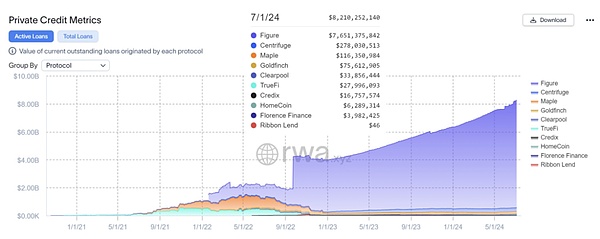

While blockchain-based private credit is still in its infancy, disruptors are beginning to succeed in this field: Figure Technologies is one of the largest non-bank home equity line of credit (HELOC) lenders in the United States, with billions of dollars in loan issuance. Web3 native projects such as Centrifuge and Maple Finance, along with companies such as Figure, have facilitated the issuance of over $10 billion in on-chain credit.

(https://app.rwa.xyz/private_credit)

The traditional credit industry is a process-labor-intensive industry with high levels of intermediary involvement and high barriers to entry. Blockchain-based credit offers an alternative with many advantages: Real-time on-chain data, stored in a unified general ledger, serves as a single source of truth, promoting transparency and standardization throughout the loan lifecycle. Smart contract-based payout calculations and simplified reporting reduce the costs and labor required. Shortened settlement cycles and access to a wider pool of funds speed up the transaction process and potentially reduce borrowers' funding costs.

Most importantly, global liquidity can provide funds for on-chain credit without permission. In the future, tokenizing the borrower's financial metadata or monitoring its on-chain cash flow can achieve fully automated, fairer and more accurate financing for projects. Therefore, more and more loans are turning to private credit channels, and financing cost savings and fast and efficient financing are extremely attractive to borrowers.

Private credit, a non-standardized business, may have greater potential for explosion, and Securitize CEO has also clearly stated that he is optimistic about the development of the tokenized private credit industry.

5.3 Bonds

In the past decade, tokenized bonds with a total nominal value of more than $10 billion have been issued worldwide (while the total outstanding nominal bonds worldwide are $140 trillion). Issuers worth paying attention to recently include Siemens, City of Lugano and World Bank, as well as other companies, government-related entities and international organizations. In addition, blockchain-based repo transactions (Repo) have been adopted, with monthly volumes in North America reaching trillions of dollars, creating value through operational and capital efficiencies in existing funding flows.

Digital bond issuance is likely to continue, as its potential benefits are high once it scales up and barriers to entry are relatively low at present, partly due to the desire to stimulate the development of capital markets in certain regions. For example, in Thailand and the Philippines, issuing tokenized bonds has enabled small investors to participate through decentralization.

While the advantages to date have been mainly on the issuance side, an end-to-end tokenized bond lifecycle could improve operational efficiencies by at least 40% through data clarity, automation, embedded compliance (e.g., transferability rules are programmed into the token), and streamlined processes (e.g., asset intermediation services). In addition, reducing costs, speeding up issuance, or asset fragmentation could improve financing for small issuers by enabling “instant” funding (i.e., optimizing borrowing costs by raising a specific amount at a specific time) and expanding the investor base by tapping into global capital pools.

5.4 Repo

Repurchase agreements (Repo) are an example where tokenization adoption and its benefits can be observed today. Broadridge Financial Solutions, Goldman Sachs, and JPMorgan Chase currently trade trillions of dollars in repo volume per month. Unlike some tokenization use cases, repo trading does not require the entire value chain to be tokenized to realize real benefits.

Financial institutions that tokenize repo mainly achieve operational and capital efficiencies. On the operational side, supporting the execution of smart contracts automates daily lifecycle management (e.g., collateral valuation and margin replenishment), which reduces system errors and settlement failures, and simplifies reporting. On the capital efficiency level, 24/7 instant settlement and real-time analysis of on-chain data can improve capital efficiency by meeting intraday liquidity requirements through short-term borrowing and lending while enhancing collateral.

Historically, most repurchase agreements have a term of 24 hours or longer. Intraday liquidity can reduce counterparty risk, lower borrowing costs, enable short-term incremental borrowing, and reduce liquidity buffers.

Real-time, 24/7, cross-jurisdictional collateral flows can provide access to higher-yielding, high-quality liquid assets and enable optimized flows of these collateral between market participants, maximizing their availability.

After the first wave of tokenization

The tokenization market is currently progressing steadily and is expected to accelerate as network effects strengthen. Given their characteristics, certain asset classes may enter a realistic mass adoption stage faster, with tokenized assets exceeding $100 billion in 2030.

McKinsey expects that the asset classes that will be realized first will include cash and deposits, bonds, mutual funds, ETFs, and private credit. For cash and deposits (stablecoin use cases), adoption rates are already high, thanks to the high efficiency and value gains brought by blockchain, as well as greater technical and regulatory feasibility.

McKinsey estimates that by 2030, the tokenized market value of all asset classes may reach approximately $2 trillion, with pessimistic and optimistic scenarios ranging from approximately $1 trillion to approximately $4 trillion, respectively, driven primarily by the following assets. This estimate does not include stablecoins, tokenized deposits, and central bank digital currencies (CBDCs).

(From ripples to waves: The transformational power of tokenizing assets)

Previously, Citi also predicted in its research report on money, tokens and games (blockchain's next billion users and trillions of value) that in addition to tokenized cash, the tokenized market size will reach US$5 trillion by 2030.

(Citi RWA Research Report: Money, Tokens and Games (The Next Billion Users and Trillion Value of Blockchain))

The first wave of tokenization described above has completed its arduous task of mass market penetration. The tokenization of other asset classes is more likely to expand in scale only after the previous first wave of asset tokenization has laid the foundation or when a clear catalyst appears.

For several other asset classes, the pace of adoption may be slower, either because the expected returns are only incremental or due to feasibility issues, such as difficulty in meeting compliance obligations or lack of incentives for key market participants. These asset classes include publicly traded and unlisted stocks, real estate and precious metals.

(From ripples to waves: The transformational power of tokenizing assets)

VII. How should financial institutions respond

Whether or not tokenization is at a turning point, a natural question is how financial institutions should respond to this moment. The specific time frame and ultimate adoption of tokenization are unclear, but early institutional experiments with certain asset classes and use cases (e.g., money market funds, repo, private equity, corporate bonds) suggest that tokenization has the potential to scale in the next two to five years. Those who want to ensure a leading position in this ecosystem can consider the following steps.

7.1 Revisit the Basic Business Case

Institutions should reassess the specific benefits and value proposition of tokenization, as well as the path and cost of implementation. Understanding the impact of higher interest rates and volatile public markets on specific assets or use cases is critical to properly assessing the potential benefits of tokenization. Similarly, continually exploring the provider landscape and understanding early applications of tokenization will help refine estimates of the costs and benefits of the technology.

7.2 Build Technical and Risk Capabilities

Regardless of where existing institutions are in the tokenization value chain, they will inevitably need to build knowledge and capabilities to prepare for the new wave. The first and most important thing is to build a basic understanding of tokenization technology and its associated risks, especially with respect to blockchain infrastructure and governance responsibilities (who can approve what and when), token design (restrictions on assets and the enforcement of those restrictions), and system design (decisions about where books and records are stored and the impact on the nature of asset holders). Understanding these basic principles can also help to stay proactive in subsequent communications with regulators and customers.

7.3 Build Ecosystem Resources

Given the relatively fragmented landscape of the current digital world, institutional leaders must develop an ecosystem strategy in a timely manner to integrate it with other (traditional) systems and partners to maintain an advantageous position.

7.4 Participate in Standards Development

Finally, institutions that want to take a leading position in the tokenization space should maintain communication with regulators and provide input on emerging standards. Some examples of key areas that can be considered for standard development include control (i.e. appropriate governance, risk and control frameworks to protect end investors), custody (what constitutes qualified custody of tokenized assets on private networks, when to use digital twins vs. digital native records, what is a good control position), token design (what types of token standards and related compliance engines are supported), and blockchain support and data standards (what data is kept on-chain rather than off-chain, reconciliation standards).

VIII.The Way Forward

Comparing the current state of the tokenization market to major paradigm shifts in other technologies shows that we are in the early stages of the market. Consumer technologies (such as the Internet, smartphones, and social media) and financial innovations (such as credit cards and ETFs) typically show the fastest growth (over 100% per year) within the first five years after their birth. After that, we see annual growth slowing to around 50%, eventually achieving a more modest compound annual growth rate of 10% to 15% more than a decade later.

Although tokenization experiments began as early as 2017, it has not been until recent years that a large number of tokenized assets have been issued. McKinsey's estimate of the tokenization market in 2030 assumes an average compound annual growth rate of 75% across all asset classes, with asset classes that emerged in the first wave of tokenization taking the lead.

Although it is reasonable to expect that tokenization will drive the transformation of the financial industry in the coming decades, and it can be seen that mainstream financial institutions in the market are already actively participating in the layout, such as Blackrock, Franklin Templeton, and JPMorgan Chase, but more institutions are still in a "wait-and-see" mode, looking forward to clearer market signals.

We believe that the tokenization market is at a tipping point and that tokenization will advance rapidly once we see some important signs, including:

Infrastructure: blockchain technology is able to support trillions of dollars in transaction volume;

Integration: blockchain is used to seamlessly interconnect different applications;

Enablers: widespread availability of tokenized cash (e.g., CBDC, stablecoins, tokenized deposits) for instant settlement of transactions;

Demand: Buy-side participants’ interest in investing in on-chain investment products at scale;

Regulation: actions that provide certainty and support a fairer, more transparent, and more efficient financial system across jurisdictions, clarifying data access and security.

While we still have to wait for more catalysts to emerge, we expect the wave of mass adoption to follow the first wave of tokenization described above. This will be led by financial institutions and market infrastructure participants, who will jointly capture market value and establish a leading position.

End of article

This article is for learning and reference only. I hope it will be helpful to you. It does not constitute any legal or investment advice, not your lawyer, DYOR.

—— Swipe up to browse ——

Reference:

[1] Tokenization and Unified Ledger - Building a Blueprint for the Future Monetary System

https://www.mckinsey.com/industries/financial-services/our-insights/tokenization-a-digital-asset-deja-vu

[4] What is tokenization?

https://www.mckinsey.com/featured-insights/mckinsey-explainers/what-is-tokenization

[5] Coinbase, The State of Crypto: The Fortune 500 Moving Onchain

https://www.coinbase.com/blog/the-state-of-crypto-the-fortune-500-moving-onchain

JinseFinance

JinseFinance