Author: Jack Inabinet, Bankless; Compiler: Baishui, Golden Finance

The SocialFi app has managed to attract widespread attention among crypto native users over the past year, but its hottest brand seems to be fading from people's sight. Will crypto investors have a sustainable SocialFi app?

The first wave of SocialFi attention in this cycle was captured by friend.tech, a Layer 2-based encrypted private chat room. By implementing one of the earliest points programs, providing users with a clear path to qualify for future airdrops, and directly incentivizing influencers to promote the platform through a 5% token swap fee paid in ETH, friend.tech successfully promoted impressive initial adoption.

Unfortunately, the platform's hype peaked in mid-September last year. Many indicators never regained their highs from this period, and not even the arrival of the FRIEND airdrop or V2 update could restore any momentum. Daily active users are nearing their lower limits, with friend.tech recording just 611 transactions on Monday, the lowest level on record and a far cry from its all-time high of 540,000 daily transactions.

In late April, Blast’s native crypto influencer card game “fantasy.top” made its mark in the crypto Twitter lexicon after its mainnet launch, receiving widespread acclaim from influencers who own cards on the platform.

Similar to friend.tech, fantasy.top directly incentivizes its influencers to promote the platform, offering them a 3% fee on all single card sales and 10% of the revenue from initial card pack sales.

While the collaboration between fantasy.top and its influencers has garnered public support, leading to FOMO among users, as demonstrated by friend.tech, it may be difficult to sustain this momentum in the long term as activity tapers off.

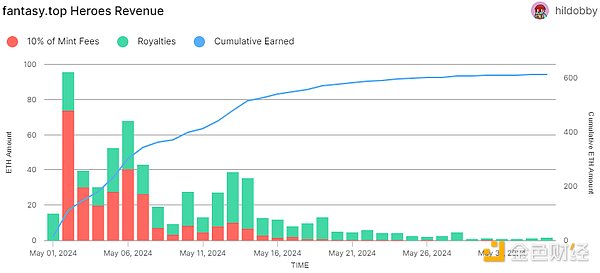

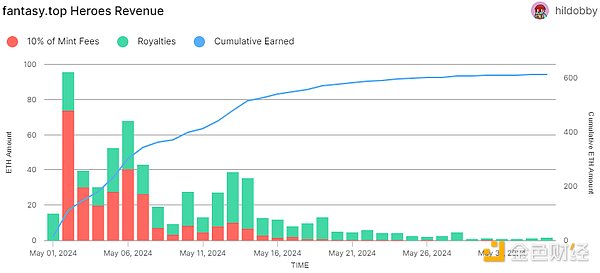

Daily active users peaked on the first day of fantasy.top’s mainnet launch and have been trending downward since then, resulting in the platform earning just a few ETH in the past week and drastically reducing the payouts it can give to influencers.

Ironically, while activity on more speculative apps like SocialFi has almost completely subsided, usage metrics for decentralized social platforms such as Farcaster and Lens have been growing in recent months!

Crypto investors have clearly expressed demand for crypto-backed social apps and the benefits they offer, such as easy access to on-chain interactions and strong censorship resistance.

Financialized social apps have struggled to achieve the sustainable revenues required for long-term adoption; in the absence of this factor, each concept has faced declining usage and falling asset prices, prompting users to increasingly abandon these platforms.

While the continued adoption of Farcaster and Lens assets gives credence to the idea that cryptocurrencies may have a sustainable variant of more gamified concepts, the significant struggles experienced by early adoption suggest this will be a difficult balance to strike.

Wilfred

Wilfred