Author: Martin Young, CoinTelegraph; Compiler: Deng Tong, Golden Finance

The chances of Solana, Cardano and other crypto assets being approved as spot exchange-traded funds (ETFs) in the United States are slim, and attracting investors may be even more difficult.

In an interview, Katalin Tischhauser, head of investment research at Sygnum Bank, joined several recent commentators in expressing doubts about whether other altcoins can follow Ethereum and Bitcoin in becoming spot cryptocurrency ETFs in the United States.

Tischhauser said that the main obstacle to the approval of other cryptocurrency ETFs in the United States is the lack of trading venues with market oversight that the U.S. Securities and Exchange Commission considers acceptable.

The SEC has a responsibility to ensure they prevent market abuse, fraud, and market manipulation, so for products it approves, it monitors the underlying markets by looking at regulated market venues like the Chicago Mercantile Exchange (CME) to ensure trading practices are fair, transparent, and not manipulated, Tischhauser explained.

“The CME offering Bitcoin and Ethereum futures is a workaround.”

The SEC requires regulated market venues to assess market integrity, but currently considers cryptocurrency exchanges to be “unregulated securities exchanges.”

If these issues are addressed and the SEC accepts cryptocurrency exchanges like Coinbase as monitored markets, it could lead to the creation of more cryptocurrency ETFs.

More stringent requirements

Even if approved, Tischhauser doesn’t think there will be much demand for altcoin ETFs.

“We don’t think there will be much demand for ETFs outside of Bitcoin and Ethereum. Ethereum has half the visibility of Bitcoin, and other tokens like Solana have little visibility outside of the crypto market.”

Since launching in January, spot Bitcoin ETFs have generated a total of $17.7 billion in inflows, indicating that there is clear demand for the asset class and that the new ETFs have outperformed other major asset funds.

Spot Ethereum ETFs have had a slow start, with the first week of trading dominated by total outflows. However, this was largely expected due to the large withdrawals from the Grayscale Ethereum Trust.

Tischhauser said a very different picture could emerge for the cryptocurrency market outside of Bitcoin and Ethereum ETFs.

Tischhauser noted that the high premium on Grayscale’s Solana Trust (GSOL) suggests there is some demand, but he also stressed that its much smaller assets under management compared to its Bitcoin and Ethereum trusts suggest that overall interest is limited.

BlackRock’s Samara Cohen speaks on alternative spot cryptocurrency ETFs on July 29. Source: Bloomberg

The GSOL fund currently has just $78.6 million in assets under management, or about 1.2% of its Ethereum Trust (ETHE), which still has $6.3 billion in AUM despite the ongoing outflows.

BlackRock’s head of ETFs and index investing Samara Cohen and the asset manager’s head of digital assets Robert Mitchnick also expressed concerns about the lack of demand for altcoin ETFs in July.

Cohen noted that altcoin spot ETFs like Solana were unlikely to emerge in the short term, while Mitchnick said, “I don’t think we’re going to see a long list of cryptocurrency ETFs.”

VanEck’s head of crypto research disagrees

Not everyone is pessimistic about other altcoin ETFs.

In a July 31 interview, Matthew Sigel, head of digital asset research at VanEck, said: “We disagree with the view that Bitcoin and Ethereum will be the only ETFs. The European market already has a variety of crypto ETPs, including single tokens and basket options.”

“Our goal is to lead this innovation in the United States as well,” he added. VanEck filed its Solana ETF application with the U.S. Securities and Exchange Commission (SEC) on June 27.

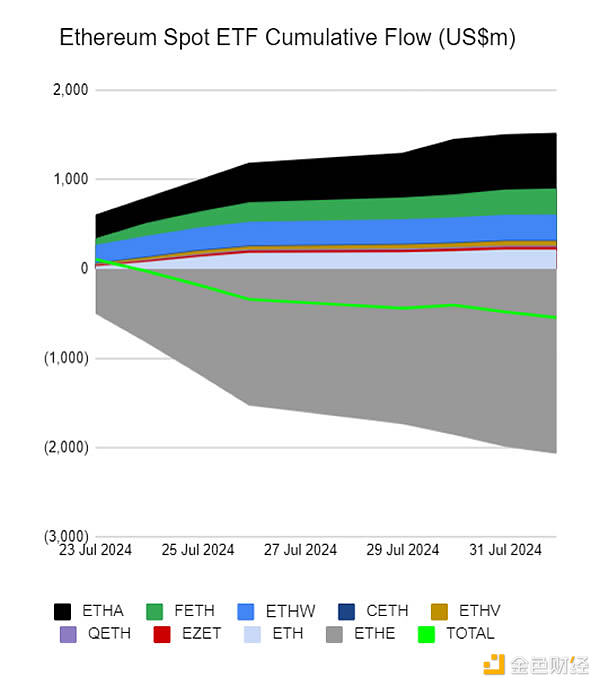

Cumulative flows of spot ETH ETFs. Source: Farside Investors

On August 1, total flows for spot Ethereum ETFs turned positive again, with Grayscale’s ETHE fund seeing the smallest outflow to date at $78 million, bringing total inflows for the day to $28.5 million.

JinseFinance

JinseFinance

JinseFinance

JinseFinance Huang Bo

Huang Bo JinseFinance

JinseFinance Edmund

Edmund JinseFinance

JinseFinance Cointelegraph

Cointelegraph Bitcoinist

Bitcoinist Ftftx

Ftftx Ftftx

Ftftx Ftftx

Ftftx