Two days ago, we proposed that the United States would not let go of the Bitcoin spot ETF market easily. After ten years of sharpening the sword, today, this milestone has finally arrived. The U.S. Securities and Exchange Commission (SEC) has approved 11 Bitcoin spot ETFs, which will be listed on the Chicago Board Options Exchange (CBOE), the New York Stock Exchange (NYSE) and the Nasdaq Exchange (NASDAQ), which means Bitcoin will be officially connected to the global financial system.

This journey has not been easy. To this day, there are still many doubts about the “approval” of the resolution itself and about the future challenges faced by the Bitcoin ETF that has been passed.

Avoid the "circus atmosphere" and treat Bitcoin "normally" first

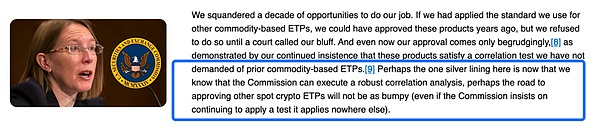

With the release of the SEC's approval document, SEC commissioners also issued a statement of different positions, including support from SEC Commissioner Hester Pierce, a long-time Crypto advocate, and elaborated on the thoughts of this decade-long "rejection" and her personal views on the SEC, saying “By failing to follow our normal standards and processes when considering spot Bitcoin ETPs, we have created an artificial frenzy around them. If these products are not treated in the same way as other similar products, By entering the market, we can avoid the circus atmosphere we are in now."

Picture "SEC has created an artificial frenzy"

The SEC, which most wants to maintain "market neutrality", has also been integrated into the huge carnival of the market.

Bitcoin is as groundbreaking as the gold dug out of mines thousands of years ago. However, now that people are in the digital age, the tools for mining have changed, and the precious metals mined have also become digital goods. Like gold ETFs, the adoption of Bitcoin spot ETFs can enable investors to obtain Bitcoin investment returns by purchasing ETF shares without directly holding and managing Bitcoins.

If we look at Bitcoin from a "normal" perspective, the market may not need to wait ten years.

Two major factors holding back the SEC

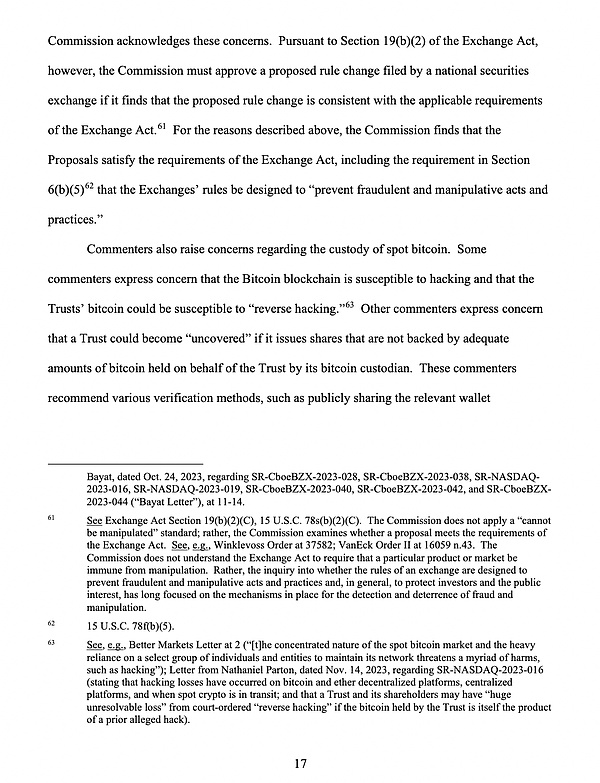

In the past ten years, the two most questioned aspects were mainly "Bitcoin custody security issues" and "Bitcoin ETFs may be manipulated", strong>It has also been emphasized again in the approval document.

Just like the gold ETF just mentioned, the emergence of Bitcoin spot ETF is to provide investors with convenient and low-threshold investment methods. So who exactly are the “investors” here?

ETFs are prepared for funds, institutional investors and retail investors who are unable to hold underlying assets. In other words, unified and centralized custody by a custody institution helps investors who cannot directly hold underlying assets. Technically speaking, for Bitcoin custody security issues, leaders in the wallet business in the Web3 industry can be referred to or directly cooperated with.

Screenshot of SEC approval document

And for Bitcoin Concerns that ETFs may be manipulated were also detailed in a statement from SEC Commissioner Caroline A. Crenshaw. She believes that the global spot market behind Bitcoin ETPs is troubled by fraud and manipulation, concentration and lack of adequate supervision.

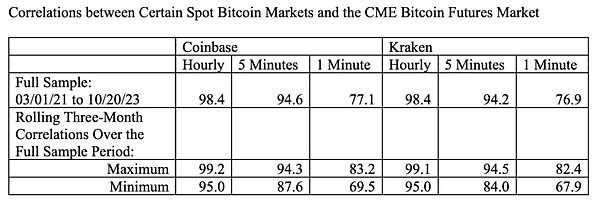

Figure "Relevance does not protect investors"

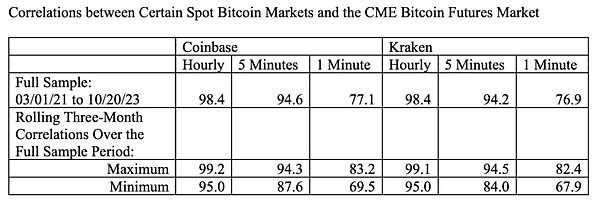

Despite the approval The document has calculated the correlation between the BTC price (spot) of the two crypto exchanges Coinbase and Kraken and the CME futures price starting in 2021. Calculated on an hourly basis, the correlation is as high as 95% to 99%. Therefore, if there is market manipulation, the SEC can detect it through the futures market.

Screenshot of SEC approval document

But by monitoring the futures market To predict the spot market, it can be used as an investment data indicator by investors, but it cannot be fully used by regulatory agencies as an indicator for comprehensive monitoring of market manipulation. Futures and spot markets are completely different. The futures market is a trading venue where contracts are fulfilled at a future point in time, while the spot market is where real assets are traded immediately.

The Bitcoin spot market is like the first gold mined and subsequently mined in ancient Mesopotamia and Egypt around 4000 BC. Just as countries and regions such as ancient Greece were gradually priced, the global market that is gradually forming is decentralized and multi-centered.

Relying on a regulatory agency or through the futures market to regulate the already booming spot market cannot provide investor protection. of. Therefore, using technology to solve the problems caused by technology is the right answer. Through the analysis of on-chain data, large-scale changes, etc., we can learn the evidence that this market may be manipulated from the first time.

3 views on the future

Companies that provide technical solutions in the Web3 industry will be in the spotlight.

In this SEC approval document, we see the public’s lack of technical security, custody security and monitoring concerns about other issues. The market’s concerns are also the market’s huge needs. Thus, as crypto asset markets and financial markets continue to expand connectivity, the need for this will continue to expand.

Data analysis tool companies such as Chainalysis, OKLink, Ellipitics and companies with mature security technologies for cold and hot wallets will usher in the trend. For Bitcoin custody security issues, leaders in the wallet business in the Web3 industry can be consulted or directly cooperated with.

ETF and decentralization do not conflict.

With development, the Bitcoin spot market had begun to take shape before ETFs were added. Otherwise, there would not be institutions that would lower fees to attract investors. In addition to hoping to attract investors to enter, there is also a "scale effect" in the rate. When an ETF grows in size, management fees and operating costs can be spread over more assets, resulting in lower rates per ETF. Therefore, it can also reversely illustrate the confidence of financial institutions.

Whether VanEck founder Jan van Eck issued a statement this morning mentioning that 5% of the proceeds will be directly contributed to the Bitcoin developer community, or Bitcoin holders who have overcome transaction costs, Bitcoin and blockchain The concept that technology is a public good has been deeply rooted in the hearts of the people.

Bitcoin spot ETF for other non-security crypto ETPs Provides a groundbreaking precedent.

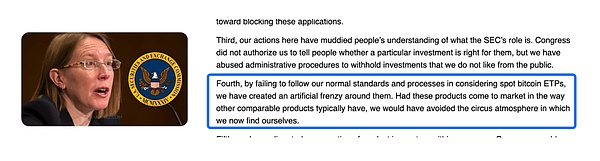

Hester Pierce said in her statement that "Now we know the committee can perform a robust correlation analysis and perhaps approve The road for other spot crypto ETPs will be less bumpy."

Picture "The road to other spot crypto ETPs is less bumpy"

However, we should note that this approval is based on a non-securities Crypto spot ETF. The SEC Chairman’s statement mentioned that today’s action by the Commission is limited to ETPs holding Bitcoin, a non-security commodity. "Therefore, subsequent "other" crypto-assets need to be clarified as to whether they are securities.

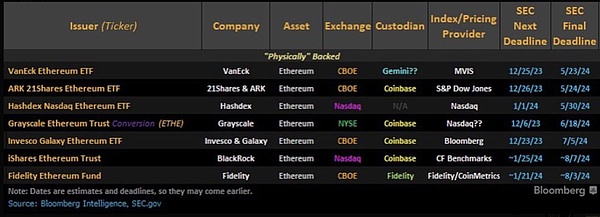

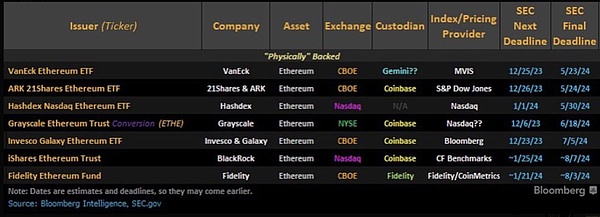

As for Ethereum , is in a fuzzy zone.However, various financial giants have already laid out their plans. According to the table below, the SEC’s final response deadline for the first VanEck application is May 23, 2024.

No matter how many "worries there are "This accelerated approval document was released anyway. The SEC, which least wanted to become a promoter of the market's fanatical atmosphere, was tolerated by this tolerant market and became a member of this "circus atmosphere." As With the gradual expansion of compliant and low-threshold investment channels and the continuous maturation of supporting tools and technologies, this market will gradually mature, and only then can we fundamentally break away from the "circus atmosphere".

This time, the market won! Tonight, a new era in the U.S. crypto market is about to begin.

Edmund

Edmund