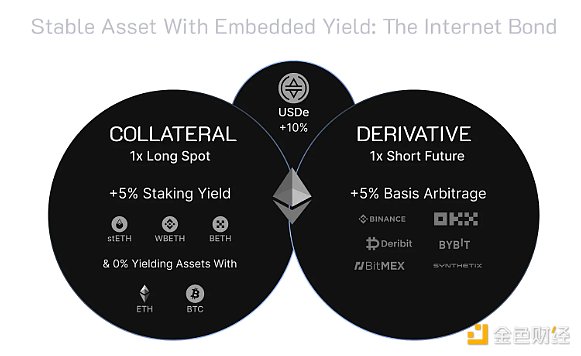

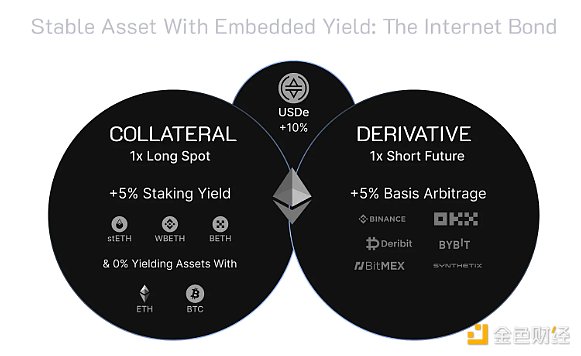

How does Ethena work? Like Maker’s DAI, Ethena’s USDe is a stablecoin pegged to the US dollar, backed primarily by ETH and stETH deposits. The difference, however, lies in how USDe yields are generated. USDe yields come from a delta hedging strategy that exploits the difference in funding rates between CEX and DEX perpetual futures markets. When the funding rate on a CEX is positive, Ethena earns funding fees through short positions on that exchange. At the same time, Ethena pays funding fees through long positions on DEXs with negative funding rates. These simultaneously held positions enable USDe to maintain its peg regardless of directional headwinds on ETH.

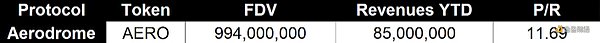

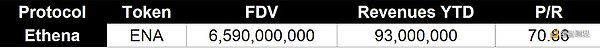

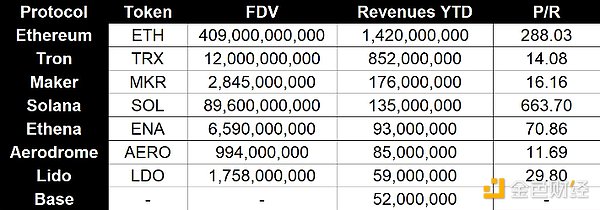

Ethena currently does not charge any protocol fees. Currently, its main revenue comes from staking ETH deposited by users to earn network issuance and MEV capture. According to TokenTerminal, Ethena is the fifth largest revenue protocol today, with annual revenue of $93 million. After accounting for costs paid in sUSDe earnings, Ethena's earnings are $41 million, making it the most profitable dapp so far this year.

However, it is worth noting that Ethena's business is designed to excel in bull markets, which cannot last forever. Ethena's successful points activities are also unsustainable. With each wave of ENA unlocked, people's interest and confidence in Ethena are constantly eroded. To cope with this situation, Ethena has tried to introduce utility into ENA in two ways: locking ENA in Season 2 to obtain the highest points, and recently using the vault on Symbiotic to obtain re-staking income.

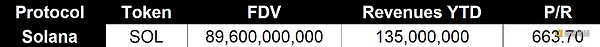

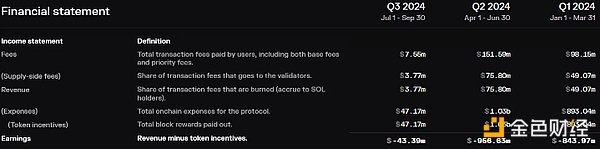

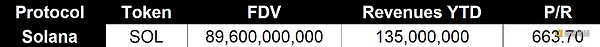

Fourth Place: Solana

For a blockchain that was almost declared dead less than a year ago, Solana has performed quite well. Solana's resurgence has been facilitated by a combination of factors: memecoin transactions, its "state compression" update (which helped attract DePIN) and a resurgence in NFT transactions, as well as the much-lauded JTO airdrop in December 2023, which triggered a huge capital inflow into Solana.

Solana currently ranks fourth in terms of revenue generation, with $135 million in annual revenue year-to-date. This is the transaction fees that users pay to validators for using the network. However, if we take token issuance (costs) into account, Solana does not appear to be profitable, having paid out $311 million in token rewards in the last 30 days alone.

Source: Token This brings us to the thorny issue of valuation of L1 businesses. Solana supporters may argue that assessing the profitability of L1 blockchains on the “revenue - cost = profit” basis described above is irrelevant. This criticism argues that network issuance is not a cost because L1 token holders on PoS chains can access these value streams by staking on popular liquidity staking platforms, such as Jito on Solana or Lido on Ethereum.

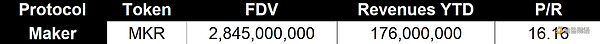

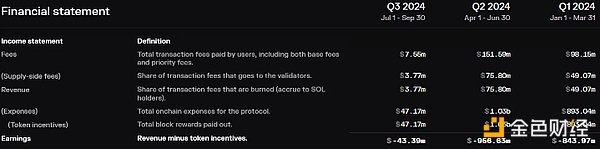

Third place: Maker

Maker in 2019 Launched at the end of the year, its business model is simple and easy to understand - issuing DAI stablecoins with crypto collateral that the protocol charges an interest rate. However, behind the scenes, the inner workings of Maker are quite complex.

Since its initial inception, Maker has undergone many changes. To stimulate demand for DAI, Maker incurred costs through the "DAI Savings Rate" (DSR), which is the collateral yield for locking up DAI. To survive the bear market, Maker established a core department focused on purchasing real-world assets such as US Treasuries. In order to scale, Maker has relied on USDC stablecoin deposits through the pegged stability module since 2022, sacrificing decentralization.

Today, the total supply of DAI is 5.2 billion, down 55% from the all-time high of about 10 billion during the bull run in 2021. The protocol has generated $176 million in revenue so far this year. According to Makerburn data, the protocol has an annualized revenue of $289 million. A large portion of revenue in recent months (14.5%) is attributed to the DAO's controversial decision in April to allow DAI loans to be issued against USDe collateral in Ethena held in Morpho's vault. RWA revenue has also been sizable, at $74 million annualized, or 25.6% of total revenue.

How much money does Maker make? As mentioned above, one of the ways Maker is trying to incentivize demand for DAI is through the DSR, a yield paid to users who stake DAI. Not every DAI holder can take advantage of the DSR, as it is also used for a variety of purposes in DeFi. Assuming a DSR of 8% and a collateralization rate of 40%, this would cost Maker around $166 million. Therefore, after deducting another $50 million in fixed operating costs, Maker's annualized revenue can be estimated to be around $73 million.

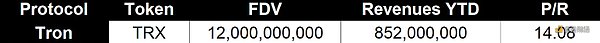

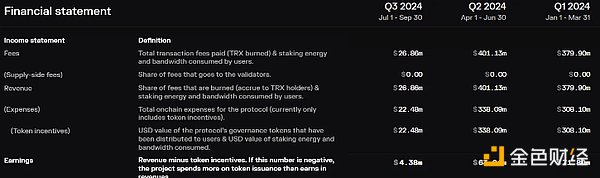

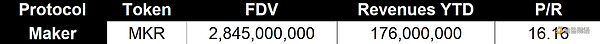

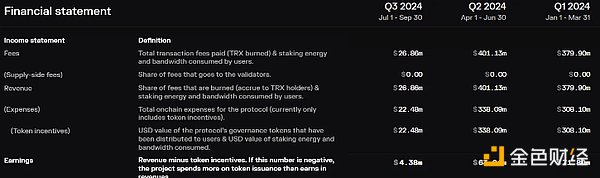

Second place: Tron

The second largest revenue in Web3 is the L1 public chain Tron network. According to TokenTerminal data, its revenue so far this year is approximately US$852 million.

Source: Token Terminal

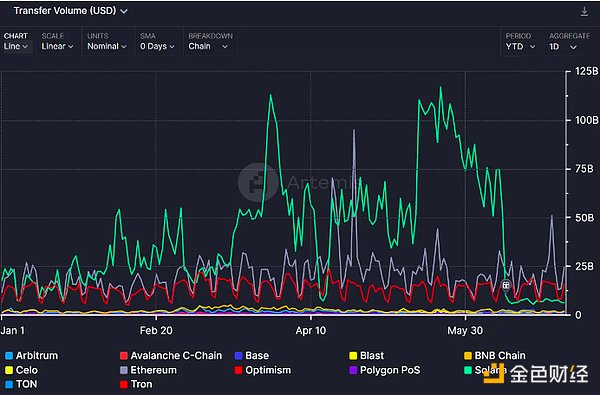

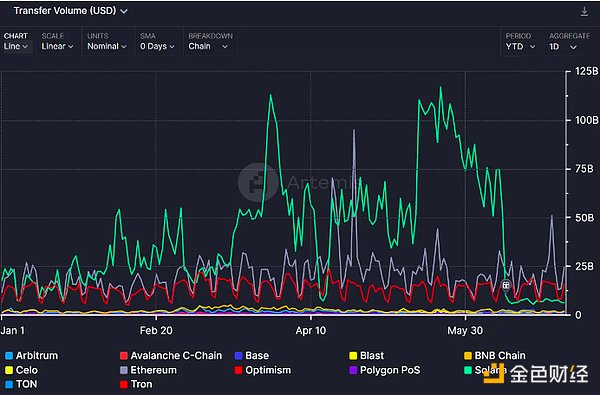

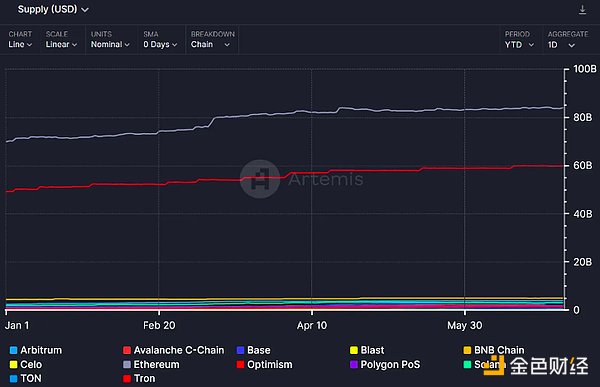

Tron's success is largely due to the large amount of stablecoin activity on its network. In Artemis' interview with David Uhryniak, head of ecosystem development at Tron DAO, most of this stablecoin traffic comes from users in developing economies such as Argentina, Turkey, and African countries. According to the figure below, we can see that Tron is often tied with Ethereum and Solana for the highest stablecoin transfer volume.

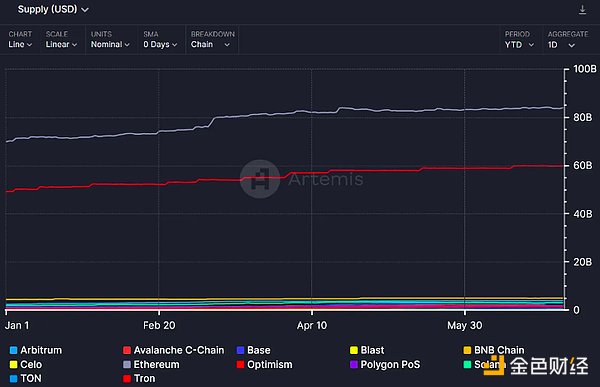

Tron’s main use case as a stablecoin network is also reflected in its stablecoin supply of 50-60 billion, second only to Ethereum.

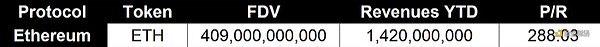

First place: Ethereum

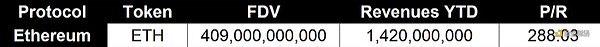

Finally, we come to the highest revenue earning business in Web3 today: Ethereum. On a year-to-date basis, Ethereum has revenue of approximately $1.42 billion.

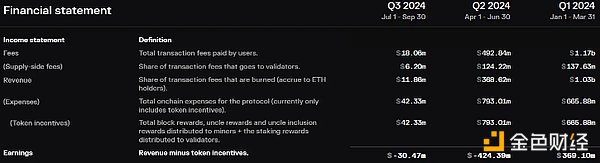

So what is Ethereum’s profitability like? When we take the transaction fees paid by users using the Ethereum mainnet minus the inflation rewards paid to PoS validators, we can see from the chart below that the network was profitable in Q1 but lost money in Q2. The Q2 loss was likely due to the majority of transaction activity moving to Ethereum Rollup to take advantage of lower gas costs.

Source: Token Terminal

However, as with other L1s, the “revenue minus profit” framework used to assess blockchain profitability obfuscates the true value flow to ETH stakers, as users can earn a percentage of network issuance by staking on liquid staking platforms.

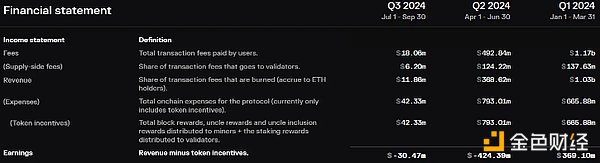

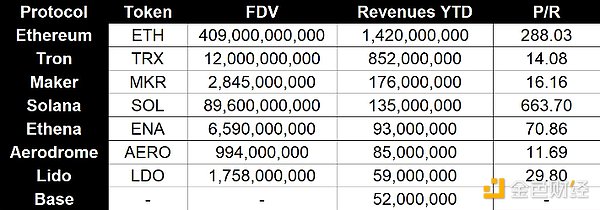

The Eight Biggest Cash Cows So Far in 2024

Summarizing all of the above, we get the following table:

Honorable Mention: Aave

In the DeFi lending space, Aave is unsurprisingly at the top with $31 million in revenue year-to-date. Aave has been the market leader in lending for the past three years and currently has a 62% market share based on active loans.

Aave's last major release was V3 in March 2022, which introduced features such as cross-chain swaps and independent lending markets. The protocol recently announced in May that V4 is coming soon, scheduled for release in 2025. The key upgrade of V4 is a unified liquidity layer powered by Chainlink's CCIP that aggregates liquidity between different chains. Other improvements include Aave dedicated chains, automatic interest rate curves, smart accounts, and an updated liquidation engine.

JinseFinance

JinseFinance

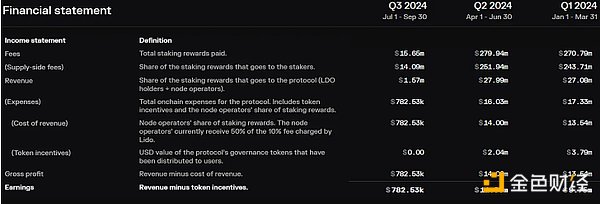

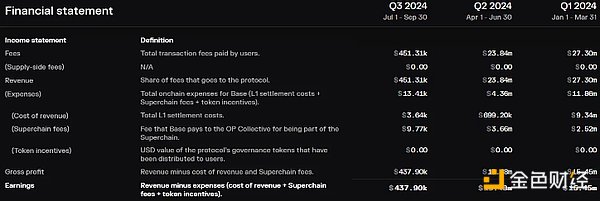

Lido's business model is fundamentally linked to Ethereum. Historically, Lido's responsibility was to lock up staked ETH on the beacon chain. With its stETH derivative, Lido allows ETH stakers to simultaneously earn network rewards (i.e., ETH issuance, priority fees, and MEV rewards) by staking ETH and unlock the illiquidity of their staked capital. This all changed in April 2023 when the Shapella hard fork upgrade allowed beacon chain withdrawals.

Lido's business model is fundamentally linked to Ethereum. Historically, Lido's responsibility was to lock up staked ETH on the beacon chain. With its stETH derivative, Lido allows ETH stakers to simultaneously earn network rewards (i.e., ETH issuance, priority fees, and MEV rewards) by staking ETH and unlock the illiquidity of their staked capital. This all changed in April 2023 when the Shapella hard fork upgrade allowed beacon chain withdrawals.