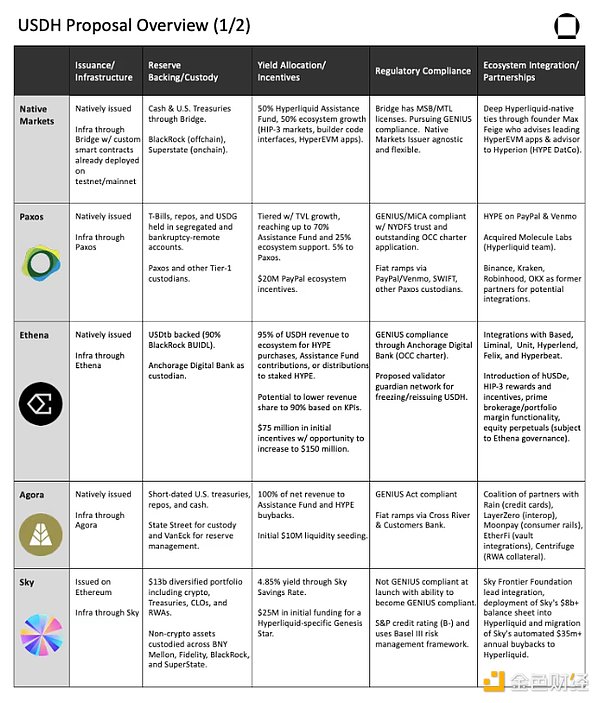

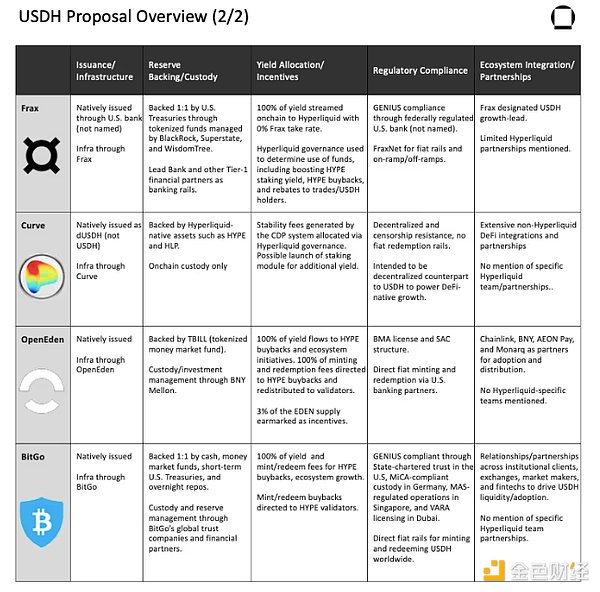

Reserve Backing and Custody: Backed by Sky's diversified $13 billion portfolio, including cryptocurrency collateral, US Treasuries, and Collateralized Loan Obligations (CLOs). Transparency provided via a real-time dashboard at info.sky.money. Revenue Distribution and Incentives: All USDH will earn a 4.85% yield, with all proceeds going to the Assistance Fund's HYPE repurchase program. Sky has also committed $25 million to incubate Hyperliquid Genesis "Star." "Star" is based on Sky's application module Spark and aims to advance DeFi. Regulatory Compliance and Fiat Gateways: While the Sky platform will not initially be GENIUS-compliant, its modular design may open the door for USDH to be customized to GENIUS standards in the future. Sky is the only stablecoin protocol with an official credit rating of B- from Standard & Poor's and compliant with the Basel III collateral risk management framework. Ecosystem Integration and Collaboration: This initiative is led by the Sky Frontier Foundation (Sky's senior leadership and developers). Sky will deploy its $8 billion+ balance sheet directly to Hyperliquid and migrate its $35 million+ annual repo system from Uniswap to Hyperliquid. In the future, USDH will be spun off into an independent "generator agent," achieving full autonomy with independent governance, token mining on Hyperliquid, and customizable strategies (e.g., increasing risk to achieve competitive yields or regulatory focus). Frax Finance is renowned for its innovation in hybrid stablecoin design. Its products, including FRAX, FraxLend, and sfrxETH, have generated billions of dollars in trading volume. Its flagship stablecoin, FRXUSD, has a market capitalization of $101 million. Frax submitted its initial proposal on September 5th and revised it on September 8th. Key elements of the proposal include: Stablecoin Issuance and Infrastructure: Frax initially proposed issuing a non-native USDH but later updated its proposal to partner with a federally regulated US bank issuer (the name of which has not been disclosed, pending a signed agreement and legal review) to issue a native Hyperliquid stablecoin. The design uses FraxNet as the account layer, enabling instant multi-chain connectivity across over 20 chains, with LayerZero providing interoperability support. Reserve Backing and Custody: Reserves will be backed 1:1 by US Treasuries through tokenized funds managed by BlackRock, Superstate, and WisdomTree, with Fidelity joining soon. Banking support will be provided by Fintech-focused Lead Bank and other Tier 1 financial partners. Revenue Distribution and Incentives: All underlying Treasury bond proceeds will be programmatically transferred on-chain to Hyperliquid, with Frax incurring 0% fees. Hyperliquid governance will determine how the proceeds will be used, including increasing HYPE staking returns, targeted HYPE buybacks for a relief fund, or providing rebates to active traders/USDH holders. Regulatory Compliance and Fiat Gateway: Issued by an undisclosed, federally regulated US bank, GENIUS-compliant currencies will be issued at scale. 1:1 minting/convertibility between USDC, USDT, and fiat currencies is powered by FraxNet, the team's cross-chain interoperability infrastructure, providing institutional-grade accessibility. Ecosystem Integrations and Partnerships: Frax did not include any major partnerships or integrations in its proposal, but stated in a subsequent Q&A session that it would take a lead in USDH growth and focus on expansion/distribution. 7. Curve Curve is best known for launching one of the first decentralized exchanges optimized for stablecoin trading with its stablecoin AMM design and for pioneering the voter custody (veCRV) token governance model, now widely adopted in the DeFi space. In 2023, Curve launched crvUSD, a decentralized stablecoin with $231 million in circulation. Its proposal is unique in that it proposes reserving a second ticker symbol, dUSDH, for a decentralized stablecoin built on the crvUSD collateralized debt position (CDP) model. Curve submitted its proposal on September 9th. Key features include: Stablecoin Issuance and Infrastructure: The system will be powered by Curve's LLAMMA architecture, which employs continuous rebalancing rather than binary liquidations, improving resilience during periods of volatility. dUSDH governance will be handled by Hyperliquid, with Curve providing the tech stack and operational support. Reserve Backing and Custody: dUSDH will be backed by ultra-liquid native assets like HYPE and HLP, directly tying stablecoin issuance to ecosystem growth. dUSDH's peg will be maintained through automatic exchange rate adjustments and Curve's "pegkeeper" system, using Hyperliquid assets to stabilize its USD value. Revenue Distribution and Incentives: Stability fees generated by the CDP system flow back to Hyperliquid governance, which determines how to best allocate them. The staking module also provides a stable annual interest rate for dUSDH holders while enabling recycling and leverage strategies for minters. Regulatory Compliance and Fiat Gateways: Unlike other solutions, Curve's dUSDH will be fully decentralized and censorship-resistant. However, it will not provide fiat on-ramps or compliance coordination, positioning it as a complementary offering to regulated USDH. Ecosystem Integration and Partnerships: By supporting minting for both hype and high liquidity providers (HLPs), dUSDH will create a flywheel effect: users can borrow, lend, trade, and recycle within Hyperliquid, thereby increasing the utility of the native token. This complements the regulated USDH path and gives Hyperliquid a dual stablecoin strategy: one for institutional adoption, the other for DeFi-native leverage and growth. 8. OpenEden OpenEden is an institutional-grade issuer of tokenized real-world assets and the largest on-chain provider of US Treasuries in Asia. Founded in 2022, the company has launched several products, including USDO, a stablecoin issued under a Bermuda regulatory license, and TBILL, a tokenized money market fund, one of the oldest in the industry. OpenEden submitted its proposal on September 9th. Key elements of the proposal include: Stablecoin Issuance and Infrastructure: USDH will be issued through OpenEden Digital, a wholly-owned subsidiary authorized by the Bermuda Monetary Authority (BMA) and holding a Category M Digital Asset Business License. USDH issuance will utilize a bankruptcy-remote Separate Accounts Company (SAC) structure, ensuring that USDH reserves are legally isolated from the issuer's liabilities. Reserves will be backed by TBILL, creating a transparent and independently rated foundation. Reserve Backing and Custody: USDH will be backed by TBILL, a tokenized money market fund that invests in short-term U.S. Treasury bonds and holds independent ratings (Moody's A, S&P AA+f/S1+). Custody and investment management will be provided by Bank of New York Mellon. Chainlink oracles will be used for data feeds, proof of reserves, and cross-chain interoperability (via Chainlink's Cross-Chain Interoperability Protocol (CCIP)). Revenue Distribution and Incentives: All minting and redemption fees will be used to buy back HYPE and redistribute it to validators. All underlying reserve revenue (approximately 4% from TBILL) will also be used for HYPE buybacks and ecosystem initiatives. In addition, 3% of the total EDEN token supply will be used to incentivize USDH adoption on Hyperliquid. Regulatory Compliance and Fiat Gateway: OpenEden emphasizes its regulatory coverage through its BMA license and SAC structure. USDH will support direct minting and redemption of fiat currency through US banking partners, as well as redemption via USDC. Ecosystem Integration and Collaboration: In addition to BNY Mellon, OpenEden is also partnering with Chainlink to provide data, proof of reserves, and cross-chain transfer support. These integrations aim to ensure USDH's widespread adoption within DeFi and institutional settlement systems. 9. BitGo BitGo is one of the oldest custodians in the cryptocurrency space, founded in 2013 and currently managing over $90 billion in assets on its platform. The company operates six regulated trust entities globally and provides custody services for major tokenized assets, such as WBTC and USD1 (the stablecoin launched by the Trump family's World Liberty Financial). BitGo submitted its proposal on September 10th. Key elements of the proposal include: Stablecoin Issuance and Infrastructure: USDH will be natively issued on Hyperliquid and deployed on the HyperEVM and HyperCore, redeemable 24/7 against fiat, USDC, and USDT through integrated banking channels. BitGo emphasizes that USDH is not a wrapper but is fully backed by an equivalent amount of US dollars. Interoperability with other blockchains will be achieved through Chainlink's CCIP. Reserve Backing and Custody: Each USDH token will be fully backed 1:1 by cash, money market funds, short-term US Treasuries, and overnight repos. Custody and reserve management will be provided by BitGo's Global Trust Company, supplemented by financial institution partners in multiple jurisdictions. Transparency will be provided through twice-monthly third-party audits, verified on-chain via Chainlink's Proof of Reserves service. Revenue Distribution and Incentives: Reserve revenue will be used programmatically to purchase and stake HYPE, with each validator capped at 20% to mitigate concentration risk. Staking rewards will be distributed proportionally to USDH holders, with a portion selectively allocated to the Assistance Fund by Hyperliquid Governance. BitGo will charge a 30 basis point fee on reserve balances, citing the need to ensure sustainability even in a low-interest rate environment. Regulatory Compliance and Fiat Gateways: BitGo maintains an extensive global regulatory network, including a US state-chartered trust company, a MiCA-compliant custodian in Germany, a MAS-regulated operation in Singapore, and a VARA license in Dubai. These networks, combined with established banking relationships, ensure seamless fiat access for direct minting and redemption of USDH worldwide. Ecosystem Integration and Partnerships: BitGo plans to leverage its thousands of institutional clients and strong relationships with exchanges, market makers, and fintech firms to drive immediate liquidity and adoption for USDH. With its deep staking infrastructure already in place, BitGo emphasizes its ability to quickly integrate USDH into global institutional workflows. 10. Other Proposers: Bastion (Ultra Sound Dollar on Hyperliquid (only available via Discord) and the Konelia Team (only available via Discord) V. Ongoing Voting Results: What to Expect With the official proposal window closing, focus has shifted to validator declarations, with the final announcement expected Thursday at 10:00 UTC. Excluding the Foundation validators, a total of 19 validators are eligible to participate. As of Thursday morning, nine validators had declared, representing 43% of the eligible stake. These weights are subject to change before the final vote on Sunday, as HYPE stakers may allocate their stake to validators that meet their preferences. Early voting preferences highlight several key trends: Hyperliquid alignment is paramount: Validator endorsements to date overwhelmingly prioritize Hyperliquid-first alignment. Native Markets has garnered broad validator support through its singular focus on Hyperliquid, without prioritizing competing chains, tokens, or externalities. Supporters argue that this unique dedication is crucial for maintaining network sovereignty and stands in stark contrast to Native Markets' involvement with other large issuers, such as Paxos or Ethena, which may have conflicts of interest with other stablecoin products. Even validators who ultimately supported Paxos or Ethena acknowledged the importance of consistency and positioned their choice as fostering ecosystem growth without compromising Hyperliquid's independence. The prevailing view was that while compliance frameworks and technology stacks could be replicated, a true Hyperliquid-first commitment could not be commoditized. For many validators, this ecosystem loyalty outweighed the resources and scale offered by experienced issuers. Regulatory Compliance and Experience: Those who did not vote for Native Markets emphasized the importance of proven regulatory compliance and an institutional track record. Paxos supporters noted that Native Markets' New York Trust License, global licensing coverage, and history of issuing over $160 billion in stablecoins uniquely positioned it to issue USDH under the GENIUS Act and Europe's MiCA. Ethena supporters emphasized the company's scale, ability to securely manage billions of dollars, and its ability to deploy through Anchorage custody and BlackRock-backed reserves, providing infrastructure typically reserved for large stablecoins. These validators believe that compliance and operational resilience are crucial for long-term survival, especially in navigating crises and regulatory scrutiny. Furthermore, concerns have been raised about Native Markets' reliance on third-party issuance, such as Stripe, raising questions about its vendor dependence. This debate reflects a shift in focus between those who prioritize proven compliance and those who trust newer, ecosystem-aligned teams to catch up. Promoting Ecosystem Growth through Revenue Sharing and Incentives: A core motivation in the validators' statements is how USDH revenue and incentives will drive Hyperliquid's growth. Native Markets' supporters emphasize its dual strategy of reinvesting reserve revenue in HYPE buybacks and ecosystem expansion, defining it as a sustainable flywheel. Ethena's proposal appealed to validators because it promised to provide at least 95% of revenue, provide up to $150 million in ecosystem grants to cover migration costs, and provide liquidity loans to market makers. Paxos supporters point to its $20 million incentive commitment with PayPal and the promise of eventual expansion to global consumer and enterprise adoption. Validators generally agree that revenue-sharing models, liquidity commitments, and integrations are key levers for driving adoption, but differences emerge over whether to prioritize short-term incentives over long-term reinvestment. Rigorous Evaluation Process and Community Engagement: A final trend in validator communications is the emphasis on presenting decisions as the product of a rigorous and transparent process. Many validators cited staker consultations, AMAs, and proposal reviews, often publicly sharing scoring frameworks or evaluation criteria. Validators emphasized independence. Validators, including Imperator, explicitly deny any financial ties to issuers to emphasize their neutrality. Other validators, such as IMC and Infinite Field, emphasize community engagement at the core of their deliberations, positioning themselves as stewards rather than gatekeepers. HypurrCollective, the validator with the largest stake, has not yet announced its voting results, but it has even released a comprehensive framework for making decisions based on staker preferences, Telegram and X polls, and its own team's stance. The USDH decision goes beyond simply selecting an issuer; it also demonstrates the growing maturity of Hyperliquid's governance mechanisms. Ultimately, the landscape emerges between idealistic support for Native Markets, the leader in Hyperliquid's native ecosystem, and pragmatic support for compliance-focused incumbents like Paxos and Ethena. However, a common thread across all camps is optimism. Each validator concluded their statement by urging cooperation, regardless of the outcome. Polymarket's prediction market also provides some clarity on the potential outcome of the vote. Native Markets has maintained a leading position since the market launched, consistent with the current voting distribution. USDH's competition highlights a shift in the stablecoin issuance landscape, with issuers facing an increasing number of issuance fees. Just days after the USDH issuance process launched, Ethena exemplified this trend by announcing its listing on the Ethereum Layer-2 platform MegaETH. The proceeds from its stablecoin will be used to cover sequencer costs. Instead of accumulating all revenue, issuers must reinvest it back into the ecosystem they launched in, essentially subsidizing adoption to gain traction. In this model, besides brand recognition, the most important factor is how much value the issuer is willing to return. Currently, Tether (the largest stablecoin issuer) is the primary stablecoin winner due to its unparalleled reach and ability to maintain issuance without making such concessions. A central question in the USDH competition is what happens if the winning team fails to deliver on its promises. Building secure, compliant, liquid, and integrated stablecoin infrastructure is no easy task, and the tight voting timeline has been a recurring criticism throughout the process. Proposals may look good on paper, but teams have less than a week to develop them, and key details remain unknown, magnifying execution risk. As a result, many proposals resemble letters of intent rather than binding commitments. This raises the question of whether the governance process should delay voting until teams can submit more concrete, audited, and actionable proposals. This hasty approach can prioritize speed over thorough due diligence and raises questions about what will happen if teams fail to deliver on their promises. While most proposals highlight US regulatory status and GENIUS Act compliance as competitive advantages, it's worth questioning whether pegging USDH to a US-regulated issuer actually poses risks to Hyperliquid and its market. The RFI calls for a "compliant" stablecoin but doesn't specify the type of compliance. Validators can weigh whether tying USDH to an OCC-chartered or state-chartered entity inadvertently creates an unwanted US nexus for Hyperliquid. This could unnecessarily expose Hyperliquid's market if US authorities take a hostile stance against the protocol. That said, issuers can structure their issuance through offshore entities while still adopting the collateral quality and design of the GENIUS Act framework. Therefore, validators may want to consider whether a US regulatory link represents stability and trustworthiness, or a potential source of risk that should be avoided. Deployment and First-Mover Advantage Another uncertainty is whether the winning team will be the first to deploy. Several issuers, including Native Markets, Paxos, Agora, Sky, and Ethena, have stated that they may launch Hyperliquid's native stablecoin regardless of the outcome. Native Markets suggests the stablecoin could be deployed as early as next week. If so, the "winner" of the vote may not be the first team to list. This further complicates the calculus for validators and the community: Does the symbolic weight of the code outweigh the speed and quality of actual deployment? USDH as a Governance Precedent This is the first time Hyperliquid has run a governance process outside of the delisting process. What other issues will the community vote on next? Validators will need to weigh not only technical readiness but also value alignment, counterparty trust, and execution risk. Future votes on protocol revenue, upgrades, or cross-ecosystem partnerships could emulate this strategy. USDH is both a test of Hyperliquid's governance maturity and its stablecoin strategy. Ethereum has been talking about "alignment" for years, but in reality, few of the largest protocols or Layer 2 projects have returned meaningful value to ETH holders. Instead, they create value by expanding the reach of the EVM and fostering the broader development of the Ethereum ecosystem. One of the most striking features of the USDH proposal is the degree of value alignment with Hyperliquid. Each major USDH competitor has pledged to dedicate 95% to 100% of reserve revenue to adding value to the Hyperliquiquit ecosystem. This is a stark departure from the Ethereum norm, and if the model proves sustainable, it could become a decisive advantage for Hyperliquiquit. That said, this alignment also has a potential downside: it could weaken user demand for USDH. Without some form of holder incentive, users might prefer to hold their funds in yield-generating alternatives, converting them to USDH only when needed. This could limit the circulating supply of USDH and slow its adoption. VII. Conclusion: Hyperliquid Wins Either Way Regardless of the USDH vote's outcome, one conclusion is clear: the true winner is Hyperliquid. This process has forced some of the largest stablecoin players not only to compete for the USDH code but also to publicly commit to unprecedented alignment with the Hyperliquid ecosystem. Issuers portray themselves as indispensable partners, but in reality, they need Hyperliquid far more than Hyperliquid needs them. Issuers want distribution, Hyperliquid's liquidity, traders, and narrative momentum. In effect, USDH forces issuers to compete for distribution within Hyperliquid, not the other way around. Whether through a regulated fiat-backed model or a decentralized design, issuers are aligning their economics, partnerships, and infrastructure to benefit Hyperliquid. The vote will determine who gets to use the USDH code, but Hyperliquid has already secured what matters most: recognition as a network powerful enough to reshape the landscape of stablecoin value accumulation.

8. Appendix

JinseFinance

JinseFinance