Author: Climber, Golden Finance

On March 1st, the Blast mainnet was officially launched. Early access users can bridge to the mainnet and use Dapps on Blast. At present, the Blast mainnet TVL has exceeded US$2.36 billion and has approximately 210,000 community users.

Blast official website claims to be the only Ethereum L2 network that provides native income for ETH and stablecoins. Platform users and development teams have the opportunity to earn Blast points through Ways to get Blast airdrops.

p>

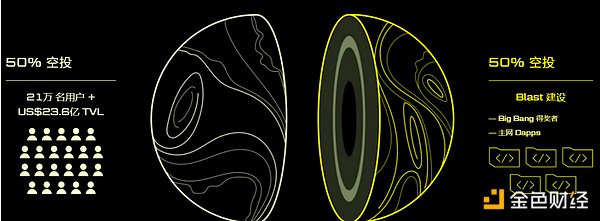

The project party also made it clear that 50% of the Blast airdrop will be allocated to Blast point users, and the other 50% will be allocated to Blast Dapp. In addition, “GOLD” airdrops will be allocated to Dapps every two weeks, and Dapps can choose to retain the airdrops, although some Dapps have committed to distributing all airdrops to users.

On the 24th of last month, Blast announced the results of the BIG BANG competition. A total of 118 potential projects were screened out from more than 3,000 participating teams, including 47 winners. Projects (Winners), 31 runner-up projects (Runner-Ups), and 40 honorable projects (Honorables), involving multiple sectors such as lending, DEX, derivatives, GambleFi, NFT/Gaming, and Infra.

Since there are over a hundred projects selected, covering multiple sector categories, Golden Finance decided to select projects with greater development potential among sectors when the Blast mainnet was launched. . In this issue, we will first select from the DEX track. The specific projects are as follows:

1. Winners< /h2>

SynFutures:

SynFutures is a decentralized derivatives exchange that anyone can Futures and perpetual contracts on any asset can be listed and traded. SynFutures positions itself as the Amazon of derivatives by creating an open and trustless derivatives marketplace, introducing a permissionless asset list and offering the broadest diversity of trading pairs.

The project has had three financing experiences, with a total of US$37.4 million raised. The founding team of SynFutures comes from Asia's CeFi super platform Matrixport, and investors include Polychain Capital, Pantera Capital, Dragonfly Capital, Standard Crypto, etc.

Ambient Finance:

Ambient is an AMM. It combines centralized liquidity, fungibility across the full range of xyk LP tokens and pure on-chain price orders into a common liquidity pool. Ambient is a singleton contract that supports hooks, dynamic fees, automatic compounding and gas saving.

In July 2023, it completed a seed round of financing of US$6.5 million at a valuation of US$80 million.

Thruster:

ThrusterThruster is Blast's native DEX, using Blast native yields, custom liquidity solutions, and a simpler UI/UX benefit traders, LPs, and developers.

Mangrove:

Mangrove is an order book-based The DEX allows liquidity providers to publish arbitrary smart contracts as quotes. This new flexibility enables liquidity providers to post quotes that are not fully available. Mangrove’s order book lists commitments rather than locked commitments. Liquidity can be shared, borrowed, lent, and displayed in Mangrove's order book, and can only be accessed at any time when a quote is reached.

The project will complete a $270 seed round of financing in July 2021 and a $7.4 million Series A round of financing in February 2023.

Ring Protocol:

Ring protocol is Blast decentralization A new era of automated transactions, maximizing asset utilization. Our spot DEX Ring Swap allows liquidity providers to earn swap fees and revenue by staking the underlying asset and/or RWA.

On March 1, 2024, the DEX project Ring Protocol announced the completion of a pre-seed round of financing, with an undisclosed amount.

100x Finance:

100x is built for Blast Low latency CLOB DEX, focused on scalability, capital efficiency and liquidity. Blast users can trade pre-launch futures and any asset with 100x leverage.

Blast Futures Exchange (BFX):

Blast Futures Exchange (BFX) is a fully integrated, order-based perpetual futures exchange with native yields. BFX provides full-chain liquidity and the most efficient integrated trading platform.

InfinityPools.finance:

InfinityPools is a DEX , offering unlimited leverage on any asset, no liquidation, no counterparty risk, and no oracles.

2. Runner-Ups

Blaster Swap:

Blaster is a spot Dex based on Blast and a Meta-DeFi aggregation with batch swap function Explorer to simplify browsing various DeFi features in one place. Batch Exchanges - Enable multiple exchanges in a single transaction with optimal routes and prices.

BladeSwap:

BladeSwap is a veDEX that Return 100% of platform fees to token holders and redirect emissions through voting. Blade simplifies the complexities of DeFi into a fun one-click experience with native bulk trading, real-time voting, and daily free loot boxes.

HMX:

HMX is a decentralized permanent On the renewal contract and spot exchange, users can open long or short positions with leverage up to 10,000 times on the platform without slippage. Users can also become market makers for HMX traders by depositing eligible assets into the PLP Fund, which serves as liquidity for HMX leveraged and spot traders.

Completed a private placement round of financing in June 2023, with an undisclosed amount.

Opyn:

Opyn Markets is the perpetual contract version Uniswap. Anyone can deploy a contract trading market on any asset without permission. TradFi margin meets linear, curve, single lp and flexible collateral.

The project raised a total of US$8.86 million.

3. Honorables

Definitive:< /strong>

Definitive is DeFi's execution platform and API, providing non-custodial smart contracts and automation services across multiple DeFi protocols. Each Definitive smart contract is powered by a powerful and proprietary off-chain engine. They work together to simplify DeFi execution for end users, from complex yield strategies to high-frequency trading algorithms.

In November 2023, the project completed US$4.1 million in financing.

RogueX:

RogueX is license-free and permanent DEX that allows perpetual and spot trading on any liquidity pool hosted by RogueX. Rogue is also Maverick’s liquidity engine, providing users with the opportunity to gain voting rights for veMAV without having to lock up MAV themselves, while providing higher yields for Maverick’s AMM LP.

Core Markets:

Intent-based permanent DEX offering : The most pairs available anywhere on the chain, currently over 250; the deepest liquidity on the chain. The OTC intent architecture eliminates the need for LPs.

SuperCharged:

Gamified prediction markets, including x1000 Cryptocurrency futures and prediction markets.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance CoinBold

CoinBold TheBlock

TheBlock Beincrypto

Beincrypto