The Helium Mobile project of the Solana ecosystem has exploded recently, and the market value of its token MOBILE has skyrocketed, reaching a maximum of US$700 million. Subsequently, the DePIN track, to which Helium Mobile belongs, received widespread attention from the market and became an important narrative following the BTC inscription and protocol.

What is DePIN? In addition to Helium Mobile, what other concept projects have potential? What are the security risks? Today the Beosin team will analyze it one by one for everyone.

The origin of DePIN

DePIN (Decentralized Physical Infrastructure Networks ) is a decentralized physical infrastructure network that uses blockchain technology and token rewards to incentivize individuals and businesses around the world to build any infrastructure of the physical world (WiFi, hard drive storage, batteries, etc.) in a decentralized manner. , providing services to anyone.

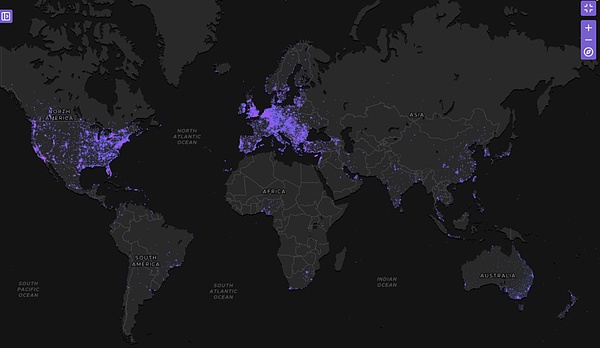

DePINscan: DePIN equipment distribution map

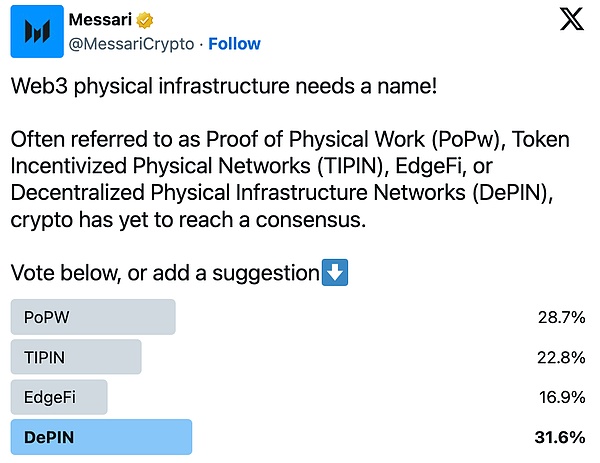

Previously, there was no unified description of the emerging track of DePIN. In 2019, Kyle Samani, a partner at Multicoin Capital, called the related decentralized physical facility project the Internet Infrastructure Stack. In 2021, IoTeX, which focuses on the Internet of Things public chain, named this track MachineFi, and later names such as "Token Incentived Physical Network" appeared. In November 2022, Messari voted on the name of the Web3 Physical Infrastructure Track and used DePIN in annual reports and special reports. DePIN subsequently became the unified name of the track.

link: https://twitter.com/MessariCrypto/status/1588938954807869440

DePIN concept project and its risks

DePIN covers a wide range of industries. According to Messari's classification, it can be divided into two categories: Physical Resource Network and Digital Resource Network, depending on the hardware and resources, goods and services provided by the network.

Physical resource networks include wireless networks, mobile networks and energy networks; digital resource networks include storage, bandwidth and computing networks. Representative projects in each field are shown below:

source: Messari

Due to the numerous projects of the DePIN concept, only DePIN will be analyzed below. The four key projects of the track, the business/narrative and risks of other projects are similar:

Note: The following content does not constitute investment advice.

1. Helium and Helium Mobile

Helium is a decentralized wireless network protocol. Starting in 2017, Helium uses blockchain technology and token incentives to deploy wireless networks for users. Its concept of a decentralized network and the low threshold of Helium hotspot devices have attracted a large number of users to participate. As of the end of 2021, total sales of Helium hotspot devices exceeded US$250 million.

In 2022, due to the low number of users using the Helium network and the low rewards for Helium network nodes, the monthly income of a Helium hotspot device is only US$20. Helium decided to migrate to the Solana network to gain more users.

At the same time as the migration, Helium's Helium Mobile business is providing SIM cards and free trials to its mobile phone users through Solana Labs' Saga mobile phone. On December 6, 2023, Helium Mobile launched a $20 monthly unlimited phone package in the United States, covering data, text messages and calling services. Users who purchase this package can receive an NFT and receive airdrop rewards of MOBILE tokens.

Helium Mobile's business is similar to that of a telecom operator, offering cheap phone plans. Users can obtain MOBILE tokens through eSIM. The flywheel of its business is that Helium Mobile attracts users through low-priced services and tokens. The growth of users drives the growth of token prices, thereby attracting more users to pay for Helium Mobile's services.

Currently, the MOBILE token is only used as the governance token of Helium Mobile.The current market value has exceeded US$400 million, and FDV has exceeded US$1.1 billion. , users need to be careful of short-term hype risks.

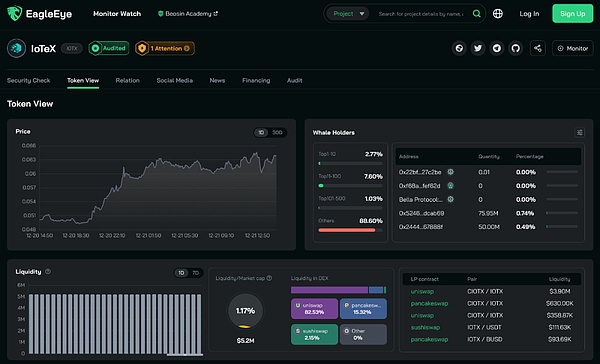

2. IoTeX

IoTeX is a decentralized IoT public chain that is committed to combining blockchain networks, trusted hardware and edge computing to achieve trusted interconnection of all things. IoTeX mainly builds products by connecting billions of physical facilities in the real world with Web3 infrastructure. Its ecosystem currently covers tracks such as DeFi, NFT, DAO, Metaverse and DePIN.

IoTeX: https://eagleeye.space/detail/iotex

According to EagleEye on-chain data analysis, the current IoTeX on-chain Liquidity mainly exists in the Uniswap trading pool and its on-chain DEX Mimo, and more liquidity mainly exists in centralized exchanges. More than 90% of its tokens are fully circulated, with a market value of approximately US$600 million.

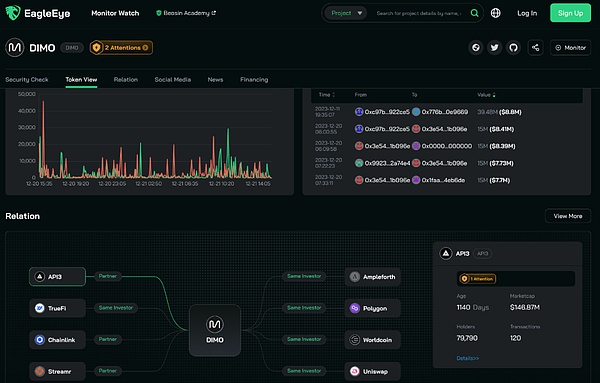

3. DIMO Network

DIMO Network is an automotive IoT platform that allows drivers to collect and share their vehicle data to earn tokens DIMO. In 2022, his team completed US$9 million in financing from institutions such as CoinFund. According to DIMO’s official website, DIMO Network currently connects more than 28,000 vehicles. DIMO's revenue comes from two parts, vehicle data provided by users and paid data API services.

DIMO: https://eagleeye.space/detail/dimo

The current market value of DIMO exceeds US$96 million, and its token is DIMO. Full circulation, current price fluctuations are large, users should pay attention to risks when trading.

4. Streamr Network

Streamr Network It is a decentralized network designed to collect and publish low-latency real-time data streams from IoT sensors, machines and other smart devices. According to EagleEye's project relationship analysis map, Streamr has currently cooperated with DIMO Network, Swash and other data platforms.

Streamr: https://eagleeye.space/detail/streamr

The current market value of Streamr exceeds US$70 million, and its token is DATA, basically Full circulation, current price fluctuations are large. According to EagleEye’s detection, its token contract has certain centralization risks.

The influence and significance of DePIN

and the basis of traditional physics Compared with facility networks, DePIN has the following advantages:

1. Quick start: Operation and maintenance costs of the DePIN project At a fraction of the cost of traditional hardware infrastructure companies, such as telecommunications companies that require billions of dollars of investment and a large number of employees to start a business, DePIN only requires hundreds of thousands to millions of dollars by drastically reducing the upfront capital requirements and token incentives. It can be started immediately, lowering industry entry barriers and achieving rapid start-up faster than traditional projects.

2. Community first: In DePIN, the community owns all the hardware that makes up the network and provides what the community needs and uses. products and services. Users of the DePIN community do not need to rely on companies and businesses that are primarily interested in profits and financial reports. This aligns stakeholder interests to promote adoption and growth of DePIN services.

3. Open Governance: Traditional infrastructure projects often end up with a centralized entity dictating what you can execute and use terms and conditions, but DePIN is open, democratic and accessible. Anyone in any region can use DePIN’s services, and anyone can participate and build the physical infrastructure that enables them to benefit.

Summary

Benefited from market liquidity and sentiment Since its resumption, the DePIN circuit and its concept project have gained huge popularity and funding inflows in a few weeks. DePIN is an application layer for real-world users that has huge potential to be rolled out to Web2 users and enterprises, bringing Web3 into mass adoption.

But users need to note that for the DePIN project, the current project narrative and flywheel effect are obvious, and its adoption rate is the same as Market conditions are closely related. The currently popular Hivemapper, Render, Helium and Helium Mobile are all Solana ecological projects. Part of the reason for their popularity is the recovery of Solana. As the market matures and the project develops, users' evaluation of the project's value will eventually come back to profitability, rather than narrative and hype. Whether the projects on the DePIN track can truly achieve a certain profit model, the security of their smart contracts, and whether they can be stably developed and implemented are still unknown.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Coinlive

Coinlive  Cointelegraph

Cointelegraph