In the early morning of January 10, just as the market was eagerly awaiting the final result of the spot Bitcoin ETF application, the U.S. Securities and Exchange Commission (SEC) made a big fuss. Dragon - SEC

This false news first caused Bitcoin to rise rapidly, once touching US$48,000, and then fell sharply after being falsified, with the lowest falling below US$44,700. This once again supported the current situation in spot ETFs. In fact, every move in the news has a huge influence on the secondary market conditions.

It has been less than 20 hours since the final result of the ETH application was released. Let us briefly review the development history of Bitcoin ETF and what impact it may have in the future. ?

10-year road to ETF listing

Since 2013 The Winklevoss brothers first opened the Bitcoin ETF in 2010. In the past 10 years, different institutions have applied for Bitcoin ETF every year, but without exception, they all ended in failure (either rejected by the US SEC or actively withdrawn), and even became A "spell that passes forever into next year."

Unlike many Bitcoin ETFs in the United States, which have been waiting for several years without success, on February 18, 2021, the Canadian Purpose Investment Company suffered a "Bitcoin ETF failure" The first crab”-Purpose Bitcoin ETF:

It launched the world’s first Bitcoin ETF-Purpose Bitcoin ETF and was listed on the Toronto Stock Exchange Trading, the trading volume reached nearly US$400 million on the first day of issuance, which shows the market's expectations for Bitcoin ETF.

According to CoinGlass data, as of January 10, 2024, the number of Bitcoins held by the Canadian Purpose Bitcoin ETF has reached 35,500, and the asset management scale exceeds 16.5 One hundred million U.S. dollars.

And the day after the launch of the Purpose Bitcoin ETF, the Canadian asset management company Evolve Funds Group launched its second Bitcoin ETF. However, the one that attracted the most market attention was undoubtedly the SEC’s application for a US Bitcoin ETF. Situation - After Canada approved a series of Bitcoin ETFs, U.S. ETF applications also began to trend significantly upward.

After 2021, VanEck, NYDIG, Valkyrie, Simplify, Anthony Scaramucci’s hedge fund SkyBridge Capital and Fidelity subsidiary FD Funds Management, etc. Bitcoin ETFs from financial companies have been launched one after another.

Grayscale also plans to convert its Bitcoin Trust (GBTC) into an exchange-traded fund (ETF). The timing of the conversion depends on the regulatory environment.

In general, since the Winklevoss brothers first submitted a Bitcoin ETF application to the U.S. Securities and Exchange Commission (SEC) in 2013, the SEC has not approved any one With the application of an American company, it is still uncertain who will take the lead in “the first Bitcoin ETF in the United States”.

New variables since 2023: the entry of traditional giants

However, unlike the previous sources of applications, which were mostly concentrated in the industry, since 2023, especially in the past six months, key players in the traditional financial migrant world such as asset management companies and investment banks have also begun to The intensive entry into the market can even be called a blowout, and the intention to share the pie is obvious.

According to the author's incomplete statistics, U.S. asset management giants BlackRock, Franklin Templeton, and Ark Investment Management have been reported since June 2023. Company (Ark Investment Management), Swiss cryptocurrency ETP issuer 21Shares, asset management giant Invesco, etc.:

In addition, on October 24, 2023 In the early hours of the morning, BlackRock's iShares Bitcoin Trust was once listed on the Depository and Clearing Corporation's (DTCC) exchange-traded fund (ETF) list, with the trading code IBTC. This is also a push for Bitcoin. A step in the listing of currency spot ETF.

However, DTCC also emphasized that adding securities to the NSCC securities qualification documents to prepare for the launch of new ETFs to the market is standard practice, and appearing on the list does not Indicates the outcome of any outstanding regulatory or other approval proceedings for a particular ETF Fund.

What is particularly interesting is that a DTCC spokesperson stated that BlackRock’s spot ETF has actually been in existence since August, which means that the past two months have only been It was not widely publicized by the media.

Generally speaking, for the numerous Bitcoin ETF applications in the United States, the most noteworthy thing currently is the attitude of regulators. Although the Chairman of the U.S. SEC Gary Gensler was considered a friend of the crypto industry before he took office, but he has not taken a significantly more positive stance since he took over (ETF still failed), and has even violently criticized the crypto industry many times.

What exactly is the impact of ETFs?

Once the ETF is passed, what will be its specific impact on the crypto industry?

Grayscale's GBTC Trust is actually the best example - the latest data shows that Grayscale's GBTC negative premium rate has further narrowed to 6%. Last night, the main The reason is that the market expects the U.S. SEC to approve the increasing possibility of converting GBTC into ETFs.

Once converted to an ETF, GBTC will no longer trade at a significant discount or premium due to the flexibility of the ETF structure. This also explains the impact of ETFs on the Bitcoin spot market:

It brings a huge amount of incremental funds and opens up traditional mainstream investors. The road to investing in cryptocurrencies and promoting the large-scale acceptance of Bitcoin and others by Wall Street as much as possible will allow crypto asset allocation to gain wider recognition.

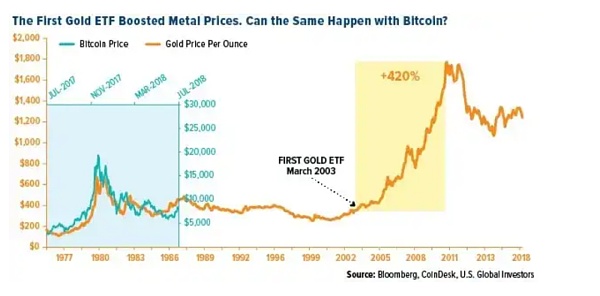

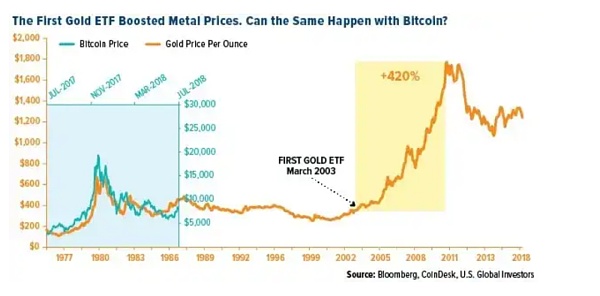

We use gold as a reference. The first gold ETF SPDR Gold Trust (GLD) was listed in the United States in 2004 Within a year after listing, the price of gold rose by 25%, and in the next five years, gold rose by 500%.

Generally speaking, for the "Bitcoin ETF" which began to sound the clarion call for attack in 2013, after a full 10 years of continuous "application-failure-re-application" cycle by everyone in the industry, This year, we finally saw the closest glimmer of success.

Especially as BlackRock, Fidelity and other giant traditional financial institutions have fallen out of business, Wall Street and the media have paid unprecedented attention.

From this perspective, whether or not it can pass tomorrow, the spot Bitcoin ETF has already won a big step.

JinseFinance

JinseFinance