There are less than 24 hours left until the fourth Bitcoin halving.

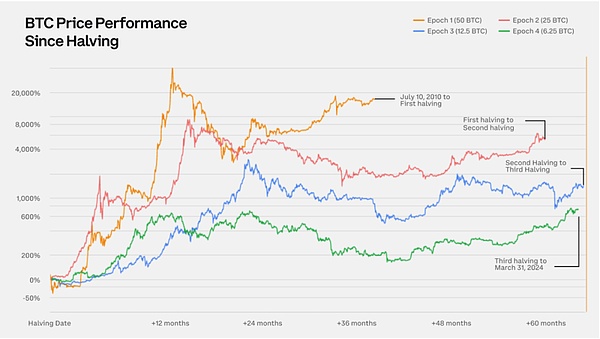

When the Bitcoin block height reaches 840,000, the number of Bitcoins entering circulation per day will drop from 900 to around 450 per day. Historically, the 12 months after the halving are usually accompanied by a sharp rise in Bitcoin prices. According to Glassnode data, after the first halving, the price of Bitcoin soared by more than 1,000%; the second halving increased by 200%; and after the third halving, the price rose by more than 600%.

The experience of the first three halvings brought overwhelming bullish sentiment to the first three months of 2024. Institutions were the main force, high-net-worth retail investors continued to flow in, and the price of Bitcoin also created a new high.

However, when the halving was approaching, it fell for several days; the market's views suddenly became "long and short".

The optimism of market sentiment can easily cover up many unnoticed risks. The fourth halving of Bitcoin is completely different from the previous three times because of the existence of ETFs, coupled with changes in the macro environment and Bitcoin ecology. We need to recognize short-term risks from more perspectives and recognize long-term opportunities.

ETFs may make Bitcoin "priced" in advance

Bitcoin spot ETFs were the main driver of the market in January-March, and to some extent solved one of the biggest problems in the industry: legalization.In the past few years, the biggest buyers of Bitcoin were Michael Saylor's relatively unknown software company MicroStrategy, well-known Bitcoin fan Jack Dorsey's Block and Elon Musk's Tesla. But it was due to environmental issues that Tesla gave up many of its promises about Bitcoin and highlighted the uncertainty of regulation.

ETFs have changed this forever. This does not mean that there are no more Bitcoin critics on Wall Street, but it is worth noting that companies such as BlackRock, Fidelity, Franklin Templeton, VanEck and WisdomTree are clamoring to be the first to enter the market, which will undoubtedly completely open up the traditional entrance to this emerging digital market. According to Bloomberg Intelligence, just 17 days after the launch of BlackRock iShares Bitcoin Trust (IBIT), inflows became one of the top five exchange-traded funds (ETFs) in 2024. The market's response was beyond many people's imagination. But it was the emergence of ETFs that weakened the narrative of Bitcoin halving. Like other markets from emerging to mainstream, volatility caused by small specific events will continue to decrease as liquidity and scale increase; Bitcoin halving is one of such specific events, not to mention that this halving originally had a smaller quantitative impact than the previous three halvings. On the other hand, although ETFs have brought Bitcoin to more investors who have never had contact with it, we still can't find evidence that the government and the masses have fully accepted Bitcoin and are willing to "all in". Before Bitcoin is widely accepted and adopted, it is hard to believe that Bitcoin will have a "skyrocketing" price breakthrough.

ETFs will certainly help more money flow into Bitcoin, but that is a time-span thing, and the story of "halving" itself is likely to have been digested by the market.

Macroeconomics and mining difficultiesare not conducive to the short-term price rise of Bitcoin

The macroeconomics has not yet gathered the elements to drive the rapid rise of Bitcoin prices. The macroeconomic conditions in 2024 are completely different from the low interest rates and low inflation of the previous decade. The current higher interest rates may reduce the attractiveness of high-risk investments such as cryptocurrencies. If the Federal Reserve quickly changes its interest rate cut policy, the liquidity brought to the economy may support Bitcoin's performance; but before the interest rate cut is actually implemented, the accuracy of predicting price trends based on this will be difficult to guarantee.

Analysts at Goldman Sachs and JPMorgan Chase both issued reports this week, warning the market to be cautious about the idea that "halving will bring new buyers."

In its investment report, Goldman Sachs said clients should avoid over-interpreting past halving cycles. For history to repeat itself, the macro environment must fully support risky investments. In fact, the M2 money supply of the world's major central banks, including the Federal Reserve, the European Central Bank, the Bank of Japan and the People's Bank of China, grew rapidly during the first three halving cycles. At that time, interest rates in developed countries remained at or below zero, which largely stimulated high-risk investment behavior in financial markets.

JPMorgan Chase gave an analysis from another perspective. A report on Tuesday pointed out that the weakness of mining stocks before the halving is a signal to pay attention to. From March 31 to April 15, the total market value of 14 U.S.-listed bitcoin miners tracked by the bank fell 28%, or $5.8 billion, to $14.2 billion. All stocks underperformed Bitcoin and all fell at least 20%. The report also noted that Bitcoin has risen 43% so far this year and 130% in the past six months, and it seems that the "typical post-halving rally" has occurred in advance due to multiple factors.

JPMorgan Chase pointed out that "network computing power growth has exceeded Bitcoin price appreciation" and mining profitability was low in the first two weeks of April. Another institution, Ki Young Ju, CEO of CryptoQuant, said: "In order to survive and develop after the halving, miners need to improve efficiency, generate cash flow and have proper financial management.Even if Bitcoin remains at a price level of $60,000, many companies' current mining machines will not be profitable, leading to a wave of bankruptcies."

The decline in profitability may cause enough miners to shut down. Looking back at the history of several halvings, Bitcoin's computing power fell by 15% after the halving in 2020, 5% after the halving in 2016, and 13% after 2012. The decline in computing power will increase the network security risk of Bitcoin in the short term.

Bitcoin ecology is a new variable

Although there are many pessimistic signals in the short-term outlook, Bitcoin is also welcoming more new opportunities in the long run. Bitcoin ecology is one of them.

The launch of the Ordinals protocol has taken the Bitcoin ecology to a higher level. After the halving, the Runes protocol created by Ordinals founder Casey Rodarmor will also be launched. The Runes protocol allows the creation, minting and transfer of tokens on Bitcoin and is scheduled to be launched immediately after the halving.If Runes can successfully set off a wave of Bitcoin network MeMe as Rodarmor said, the increased income of miners due to increased handling fees will be able to help them survive the halving crisis.

From another perspective, the previous inscriptions similar to NFT changed the rules of the game for Bitcoin, and also rekindled the interest of investors and developers in expanding Bitcoin as an ecological network. Institutions have begun to pay attention to and deploy Bitcoin infrastructure; various Bitcoin second-layer networks have begun to emerge, such as BEVM, BOB and other Bitcoin Layer2 have completed millions or even tens of millions of financing; Nervos' RGB++, Merlin Chain and other projects have soared in the market. Regardless of whether these second-layer networks can ultimately succeed, they have the potential to bring more development and opportunities to Bitcoin itself.

If the Bitcoin ecosystem can form a larger-scale prosperity, then Bitcoin will quickly pass the uncertain stage after the halving, and is expected to enter a steady rise soon.

After a short-term fluctuation

Bitcoin will become more robust

Although the voices in the market this time are "long and short", in general, the majority are still optimistic about the long-term steady growth of Bitcoin.

In a report published in early April, Binance Resarch showed that Bitcoin's halving has prompted miners to re-evaluate the underlying technology and network dynamics of cryptocurrencies. The enhancement of these areas will increase the robustness of the Bitcoin network and enhance the confidence of users and enterprises, thereby creating a favorable environment for the adoption of Bitcoin.

A survey conducted by Binance in the Australian market provides evidence for this view. A survey of more than 2,000 Australian cryptocurrency investors found that more than 80% of respondents believed that the upcoming halving was positive for the industry, and even more than half expected that the price of Bitcoin would directly rise as a result.

On the other hand, the existence of Bitcoin spot ETFs will also provide lasting impetus for Bitcoin to continue to rise. ETF issuers in the United States still need more time for institutions and more retail investors to recognize Bitcoin. When more investors realize that "increasing asset allocation by 5% to cryptocurrencies is beneficial to improving risk-return", there will be a larger wave of investment.

Not only in the United States, the "legalization" of Bitcoin in the global market will also benefit Bitcoin's stable performance. In the Hong Kong market, Bitcoin and Ethereum spot ETFs are about to be listed. And unlike the United States, Hong Kong's Bitcoin spot ETF will allow ETF shares to be subscribed in kind, which will provide traditional institutions with better price discovery opportunities and will also improve the overall liquidity of Bitcoin. If Hong Kong forms a legal format, there will be an opportunity for more traditional institutions around the world to participate in the Bitcoin network; whether a more large-scale recognition can be formed is the key to whether Bitcoin can continue to rise.

No matter what the result is, one thing is certain: the fourth halving of Bitcoin is only the fuse for the future market. We look forward to Bitcoin ushering in the "Ten Years of Golden Age" and expecting Bitcoin to become a globally recognized value storage and safe-haven asset. Perhaps Bitcoin will exist forever like gold.

JinseFinance

JinseFinance

JinseFinance

JinseFinance Xu Lin

Xu Lin Beincrypto

Beincrypto Bitcoinist

Bitcoinist

Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph