Author: Mario's View of Web3 Source: X, @Web3Mario

In general, I found that the official TON ecological construction ideas are different from the traditional execution layer projects, that is, the so-called public chain. It seems to choose traffic-driven rather than asset-driven. This brings a new requirement to developers. If you want to get official endorsement, or more directly become a project that the official prefers, the core operating indicators in the cold start phase need to transition from asset-related, such as TVL, market value, number of coins held, etc., to traffic-driven, such as DAU, PV, UV, etc.

Abstract: Recently, I have been learning the relevant technologies for TON DApp development and trying to think about some product design logic. With the increase in the popularity of TON, some AMA, roundtable discussions and other activities have become more and more. I also participated in some and found some interesting things, hoping to share with you. Let me start with the conclusion. In general, I found that the official ecological construction ideas of TON are different from traditional execution layer projects, that is, the so-called public chains. It seems to choose traffic-driven rather than asset-driven. This brings a new requirement to developers. If they want to obtain official endorsement, or more directly become a project that the official prefers, the core operating indicators in the cold start phase need to transition from asset-related, such as TVL, market value, number of coins held, etc., to traffic-driven, such as DAU, PV, UV, etc.

Asset-driven has always been the core of Web3 project development and operation

For a long time, the core criterion for judging whether a public chain project is successful is how many assets have been deposited, and whether it is sustainable and its core competitiveness is judged based on the composition and distribution of assets. In layman's terms, it is how much TVL a chain has, how these TVLs are composed, what proportion of native assets, what proportion of blue-chip coins and altcoins, what proportion of voucher assets, and the degree of Matthew effect. So what conclusions do these questions correspond to? Let's give a few examples to illustrate:

Assuming that BTC, ETH and other blue-chip coins account for a high proportion of the total value in a chain, and the top 10% of people own 80% of the assets, it generally means that the chain is relatively friendly to traditional cryptocurrency whales, or it has a strong attraction to traditional cryptocurrency whales. Usually, there may be endorsements and support from projects such as CEX.

Assuming that the proportion of native assets in a chain is high, the distribution is relatively even, and the standard deviation of user assets is small, it generally means that the chain team has good operational capabilities, or has relevant community resources, good community construction, and a relatively active developer ecosystem. Usually, it may be driven by a community with a successful background and has relatively broad community support.

Assuming that a chain has a high proportion of voucher assets, it needs to be treated with caution. This roughly means that it is probably still in the early stage of construction and has not effectively attracted core assets. However, the team will have some whale resources, but the cooperation reached is not close or the attraction is not strong, which makes the whales reluctant to transfer core assets directly to it. Web3 projects on this chain are easily harvested by whales in a tidal manner.

Of course, there will be different interpretations according to different situations, but everyone will find that assets are the key to judgment. The reason for this is that the core value of Web3 lies in digital assets. This topic has been fully discussed in my previous article "The popularity of Runes is a regression in the development of encryption technology, but it is also the best embodiment of the core value of Web3". Interested friends can discuss with me. Therefore, for a long time, Web3 developers have focused on how to create and maintain asset value, or how to effectively attract assets in product design, cold start solutions, economic model design, etc. The priorities of these two issues will be different depending on different types of projects.

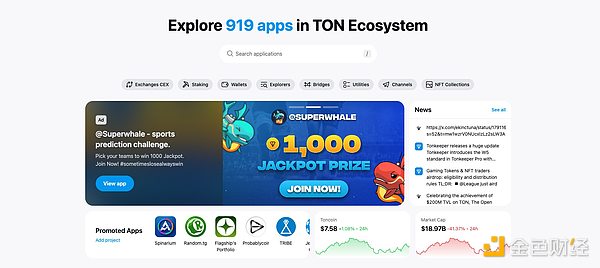

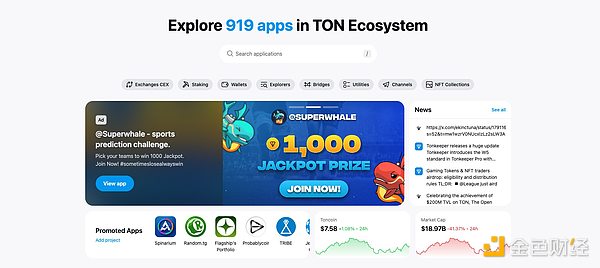

However, the TON team did not seem to follow this idea in the process of ecological construction, but chose Web2 projects, or the conventional method in traditional Internet projects - traffic drive, to guide or support products and build ecology. There are two reasons for this. First, there are already many articles analyzing TON ecological DApps. I believe everyone should have a certain understanding of the current status of TON ecology. The most active APP category at present is the traffic mini-game similar to Notcoin. Looking closely at its technical architecture, it cannot even be considered a DApp, because usually, Web3 games have two significant features, asset props on the chain, and core algorithm on the chain, both of which use the trust-free ability of blockchain to reduce the trust cost in the game operation process. Notcoin does not have such a feature, but only maps a final reward point to a FT token on the TON public chain and issues an airdrop. You can find many similar examples, and their current situation is naturally inseparable from the support of TON. This shows that in the eyes of TON officials, some traditional Web3 values are not important compared to traffic. As long as there are users, you can even not be a Web3 project, and you will get official support.

Secondly, in some public occasions, TON officials also choose to actively guide the community to do product design in this direction. Last Friday, I participated in a twitter space about TON ecology, which included TON foundation officials and some Web3 VCs. My feeling after listening to it is that there is a big gap between the two in their views on TON ecology. Officials seem to like to compare TON ecology with WeChat applet ecology, and try their best to guide users to associate the two, and encourage traffic-driven products, while Web3 VCs talk more about digital asset considerations. This also shows that the official is likely to have a relatively large difference from the traditional Web3 model in the process of building the ecosystem.

So why did the TON official make such a choice? This involves the core narrative logic of TON's ecological construction, which is the potential to break the circle, rather than the ability to precipitate assets.

The core narrative logic of TON's ecological construction: the potential to break the circle rather than the ability to precipitate assets

How to understand this sentence? We know that the core narrative logic of most public chain projects is mainly the competition for digital assets, that is, through certain technologies on the basis of ensuring that the core values of Web3 are met, such as decentralization, etc., greatly improve network throughput, reduce usage costs, and improve usage efficiency. Its core value lies in the ability to precipitate digital assets. A cheaper and faster public chain will obviously attract more digital assets, and more digital assets are the value support of the business model of these public chain project parties, because a higher adoption rate means more demand for official tokens as handling fees, which will help support the value of a large number of tokens in the hands of the project parties.

However, the narrative that TON hopes to create is not here, but its potential to break the circle. You can easily find such soft articles or such views on the Internet: Telegram has the highest number of communication application users in the world, up to 800 million people, and TON will have unparalleled advantages in breaking the circle with this large user base. Breaking the circle is the core narrative logic of TON in its ecological construction.

Why is there such a difference? The core involves two issues:

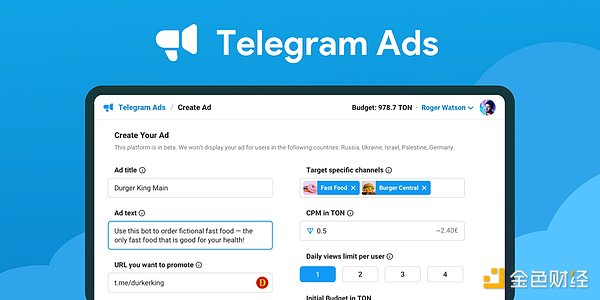

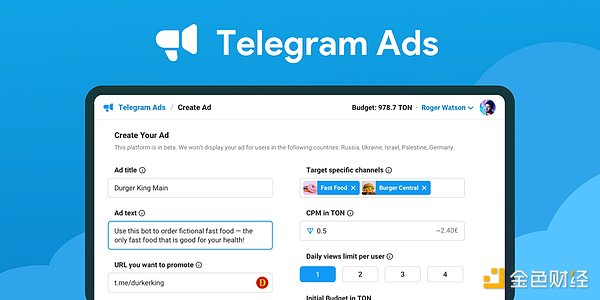

First of all, the core business logic of the TON team is similar to that of most public chain projects, all of which are based on the maintenance of the value of TON tokens. However, for TON, the maintenance path has an additional option compared to other projects, that is, Telegram's advertising system. We know that since the beginning of this year, TON tokens have an important use as a settlement token in Telegram's advertising commission system. Advertisers use TON tokens to pay for traffic purchases, and this part of the fee will be paid to the channel owner of the corresponding channel as a commission, and Telegram officials will extract a certain percentage of the fee.

This means that in addition to the handling fee for using the chain, there is a second choice for how to support the value of TON tokens, which is to expand the cake of Telegram's advertising system. This is actually a common traffic-driven model for Web2 projects, except that the settlement token has switched from legal currency to cryptocurrency. In order for Telegram to optimize the efficiency of the advertising system, it will specifically involve two aspects: creating more valuable advertising space and labeling Telegram users. The TON team found that an efficient scenario for achieving these two effects is Mini App. First of all, as long as Mini App is used frequently, it can become a high-quality advertising space after the introduction of the advertising commission system.

Secondly, we know that Telegram is an application that emphasizes privacy protection. It is extremely difficult and sensitive to label users and give advertisers the ability to conduct precision marketing. Therefore, Telegram cannot provide advertisers with precision marketing services, such as distributing a dessert brand advertisement to Indian users who like desserts. This affects Telegram's ability to commercialize. However, in Mini App, since the user's participation is not Telegram, but this third-party application, Telegram is just a carrier, which brings conditions for users to label. In the process of users participating in Mini App, users' habits and preferences will be labeled, and the whole process is not easy to cause users to be disgusted, and it is relatively smooth.

The above two aspects also explain the phenomenon mentioned above. In the choice of project support, TON does not value some traditional Web3 values. As long as there is traffic, it can get official support.

Some friends may wonder, shouldn’t the construction process be led by Telegram? As a public chain, TON should still follow some traditional Web3 values in order to build a cohesive community. This involves the second question, the relationship between TON and Telegram. The relationship between TON and Telegram has been introduced in my previous article. In general, from a phenomenal point of view, TON's status is actually more like a subsidiary supported by Telegram. The subsidiary has made certain legal isolation, so that it can operate through the subsidiary when dealing with certain risky businesses, thereby reducing its own risks. For Telegram, an APP with such a high adoption rate and emphasis on privacy protection, it is naturally "focused on" by government departments of various countries. In order to explore a more stable and less easily disturbed profit model, Telegram chose to use cryptocurrency instead of legal currency as the subject of advertising settlement. However, this will bring new risks to some areas that are unfriendly to crypto assets. Therefore, the current architecture can effectively reduce this risk. Based on this understanding of the relationship, we can easily draw a conclusion that the two are essentially a master-slave relationship. Therefore, when developers are designing applications, in order to more easily obtain official support from TON, it is recommended that they should think from the perspective of Telegram rather than the TON public chain.

Finally, in summary, in general, TON's ecological construction path has chosen traffic-driven rather than asset-driven in the short term. This brings a new requirement to developers. If they want to obtain official endorsement, or more directly become a project that the official prefers, the core operating indicators in the cold start phase need to transition from asset-related, such as TVL, market value, number of coins held, etc., to traffic-driven, such as DAU, PV, UV, etc.

JinseFinance

JinseFinance