Author: Pantera Capital Partner Franklin Bi; Compiler: Deng Tong, Golden Finance

If I tell you that the asset has:

– A market value of US$900 billion (higher than Visa 60%);

–$26 billion in daily trading volume (250% more than Apple);

–50% annualized volatility (20% less than Tesla) ;

– 220+ million holders worldwide (number of countries with a population of more than 220+ million: six).

…Ignored and banished for 10 years by the world’s “leading” financial institutions? Will an ETF satisfy you?

No. Especially relative to its size, when Bitcoin continues to be one of the most overlooked and underfinancialized assets in the world.

Bitcoin is one of the most unique assets in the cryptocurrency ecosystem. Its market capitalization and trading volume are approximately 2.5 times that of Ethereum. The Bitcoin network is a vault of digital gold. This is a fortress powered by approximately 500 times the computing power of the world’s fastest supercomputer. There are more than 200 million Bitcoin holders worldwide, while there are only 14 million Ethereum holders. And Bitcoin stands alone in a regulatory gray area, being recognized, classified, and treated as a digital commodity.

If Wall Street’s financial system is not built for Bitcoin, then Bitcoin will have to build a financial system for itself.

If blockchain technology can help bring banking services to the unbanked, the most obvious way to do so is through Bitcoin’s global distribution in Latin America, Africa, and Asia. This already includes millions of people. If we expect trillions of dollars of value to eventually flow on-chain, there is no network more secure and resilient than the Bitcoin network. As Bitcoin reaches more than 1 billion users, they will want to do more than just store and transfer assets. Capital and technology rarely stand still. This time is no exception.

Bitcoin is technology

While Bitcoin is overlooked as an asset, it may be even more overlooked as a technology. Bitcoin lags behind in scalability, programmability, and developer interest. I first tried building applications on Bitcoin in 2015, during the earliest stages of cryptocurrency research and development at JPMorgan Chase. Apart from colored coins and sidechains, there is little else to explore. Those were the early ancestors of today’s NFT renaissance and Layer-2 rollups.

The conclusion at the time was: it was too difficult to build on Bitcoin. Just ask David Marcus, the former president of PayPal and co-founder of the Meta Diem stablecoin. He is now starting a Bitcoin payments company called Lightspark. David recently tweeted: “Building on Bitcoin is at least 5 times harder than building on other protocols.”

As a currency and technology, Bitcoin’s Its blessing is also its curse:

Resistance to change:This makes Bitcoin extremely resilient, but It also led to its slow development. Upgrades are difficult to get approved and can take 3-5 years to progress.

Simplicity of design: This makes Bitcoin less exploitable, but also makes it less flexible. The UTXO model of the Bitcoin blockchain is ideally suited as a simple payment transaction ledger. However, it is largely unsuitable for complex logic or loops, which are required for more advanced financial applications.

10-minute block time: This has helped maintain 100% uptime of the Bitcoin network since 2013 (this is a a rare achievement), but made it unable to meet massive consumer demand.

The signs I see today suggest that Bitcoin’s stagnation is a temporary, unstructural state of affairs. A decentralized financial system may finally emerge with Bitcoin as its foundation. Although it follows a different evolutionary path, its potential is the same as or greater than the current DeFi on Ethereum.

Why now?

In the past few years, Bitcoin has embarked on a new development trajectory:

– Taproot upgrade (November 2021):Extended Bitcoin The amount of data and logic that currency transactions can store can be upgraded.

– Ordinal inscriptions (January 2023): A Taproot-enabled protocol for writing rich data to a single satoshi (21 million total 100 million). This enables a metadata layer for non-fungible tokens.

– BRC-20 Token (March 2023): An Ordinals inscription that enables deployment, minting, and transfer capabilities.

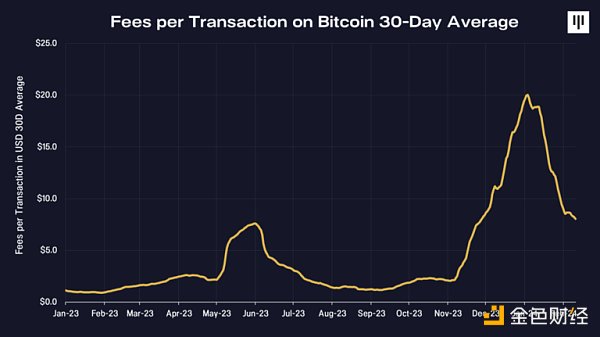

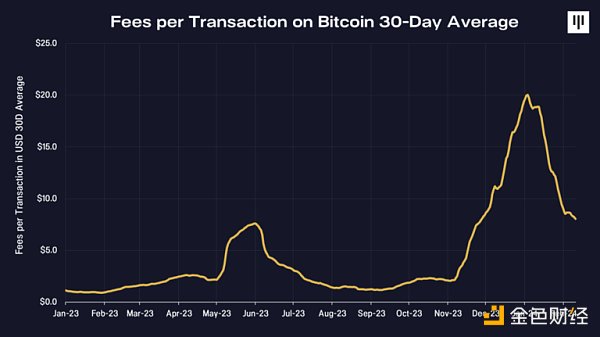

The release of fungible and non-fungible assets kicked off the first wave of DeFi and NFT activity on Ethereum in 2016-2017. Early signs of the same growth are now emerging. The average fee per Bitcoin transaction rose 20x in 2023, driven by Ordinal.

Bitcoin is bound to follow its own path, but it is clear that a new design space has opened up for Bitcoin builders.

More Large macro trends trigger a psychological shift in the Bitcoin community and reignite Bitcoin investor interest in Bitcoin decentralized finance:

-

Layer 2 Adoption: Arbitrum-like Layer 2 technology dominates new DeFi activity in 2023. This shows that the capacity and programmability of the blockchain can be expanded without changing the base layer.

Traditional Institutional Acceptance:Bitcoin breaks through a major regulatory hurdle with ETF approval, attracting capital flows and entrepreneurial thinking back to its ecosystem in the system. BlackRock and Fidelity are activating Wall Street's slow but powerful engine. Traders are gearing up to find every possible source of Bitcoin liquidity. This may soon attract them to the DeFi space, especially with the emergence of new institutional DeFi gateways like Fordefi.

The failure of crypto-native institutions: When counterparties such as FTX, BlockFi, Celsius, and Genesis fell, it became the crypto space’s own global economic crisis. An entire generation of investors has lost faith in entrusting their Bitcoin to centralized financial services.

In hindsight, it’s clear:Technological unlocking and macro trends are converging toward a breakout moment for Bitcoin DeFi. Now is the time to seize the moment.

$500 Billion Opportunity

The rewards for enabling Bitcoin to be DeFi are exciting. Social and economic importance aside, every early-stage builder and investor should ask themselves: What if this works? How much is DeFi on Bitcoin worth?

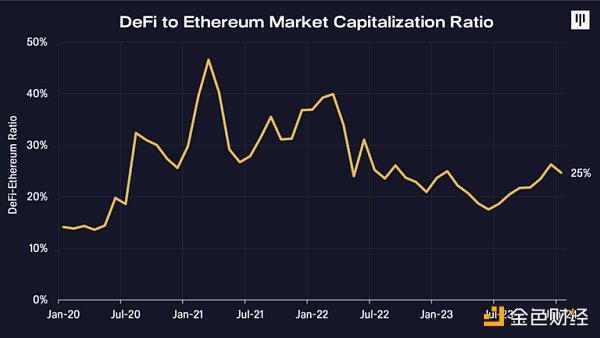

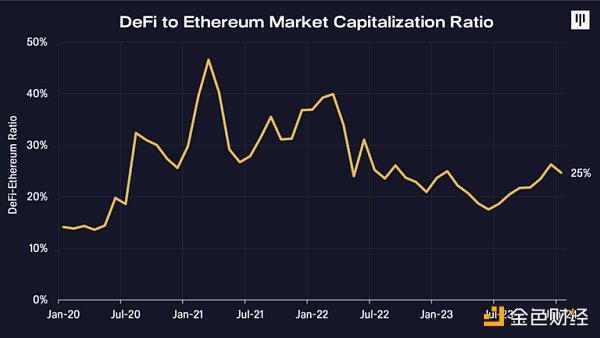

Ethereum currently has a market value of approximately US$300 billion and hosts most of today’s DeFi activities. DeFi applications built on Ethereum have historically accounted for between 8% and 50% of Ethereum's market capitalization. They currently account for about 25%. Uniswap is the largest DeFi application on Ethereum, with a value of $6.7 billion, accounting for approximately 9% of all DeFi applications on Ethereum.

If DeFi is in Bit Once the currency reaches the size of Ethereum, we can expect the total value of DeFi applications on Bitcoin to be $225 billion (25% of Bitcoin). Over time, it could fluctuate between $72 billion and $450 billion (8% to 50% of Bitcoin). This assumes that Bitcoin’s current market cap does not change.

The leading DeFi application on Bitcoin could ultimately be worth $20 billion (2.2% of Bitcoin), with fluctuations ranging from $6.5 billion to $40 billion. This would make it one of the top ten most valuable assets in the crypto ecosystem. Bitcoin is almost back to a trillion dollar asset size. However,it still holds an untapped $500 billion opportunity.

Looking to the future

In the past three years, the focus on Bitcoin programmability A wave of progress has been taking shape. For example: Stacks, Lightning Network, Optimistic Rollups, ZK-rollups, Sovereign rollups, Discreet Log Contracts, etc. More recent proposals include Drivechains, Spiderchain, and BitVM.

But the winning solution breaks through on more than just its technical merits. A winning approach to implementing DeFi on Bitcoin will require the following:

Economic consistency with Bitcoin:Any programmable Bitcoin layer should directly integrate with Bitcoin’s economic value and security. Otherwise, users may view it as hostile or parasitic to Bitcoin. Consistency could take the form of a bridge using BTC as L2 collateral and gas payments. It can also involve using the Bitcoin network for settlement and data availability.

Feasibility without base layer changes: Some proposed solutions require a hard or soft fork of Bitcoin. This means an upgrade of the entire system. Given the rarity of these upgrades, these solutions are unlikely to be early contenders. However, some solutions are worth pursuing over the long term.

Modular Architecture:The winning solution needs to be sufficiently upgradeable to incorporate new technological advancements. We have seen recent technological developments in on-chain hosting, consensus design, virtual machine execution, and zero-knowledge applications. Semi-closed systems with proprietary stacks will not be able to keep up.

Trustless bridging: Bridging assets from one chain to another is very difficult. Done right, it can be just as challenging as shipping between stars, as all sorts of problems can arise, from latency mismatches to destructive exploits. Only a few distributed bridges have been tried and proven in the wild. One example is tBTC, which continues to improve its design and degree of decentralization.

A relentless ground game:Two audiences for growth are important. 1) existing Bitcoin holders and 2) future Bitcoin builders. Both are distributed in peculiar ways. Exchanges hold approximately 10-20% of the total Bitcoin supply. Approximately $10 billion in Bitcoin exists on Ethereum in various tokens. Developer attention is spread across a multi-chain, multi-layer stack. Engaging both groups requires a “meet them where they are” mentality.

Bitcoin’s days of neglect may finally be over. In the post-ETF era, Wall Street is finally waking up to the obviousness of Bitcoin as an asset. The next era will be one of Bitcoin as technology and the renewed enthusiasm for building Bitcoin.

JinseFinance

JinseFinance