No-threshold casino Pump.fun knows how to exploit human nature

Pump.fun will not disappear, but will make more money in this cycle

JinseFinance

JinseFinance

Source: Question 3

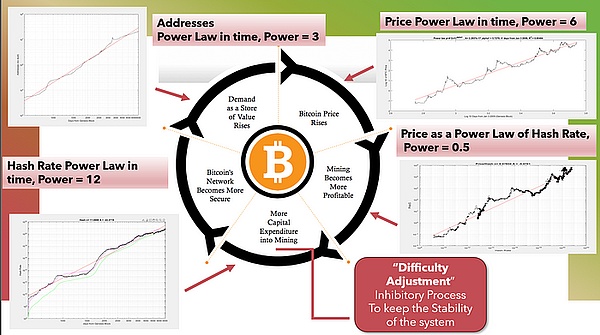

Why Bitcoin is not a common asset, but more akin to natural phenomena governed by universal power laws, because the system has recursive, infinite feedback loops.

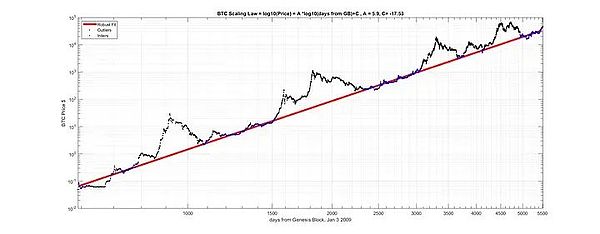

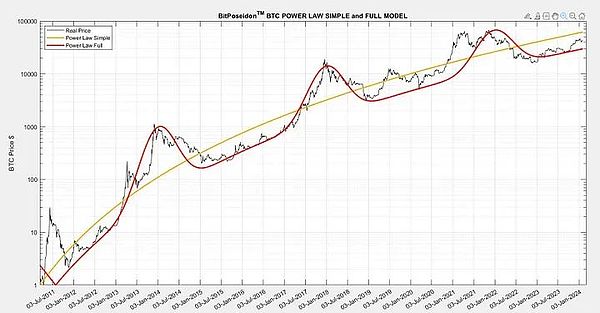

The BTC power law is not only a model, but a powerful theory about the nature and behavior of Bitcoin.

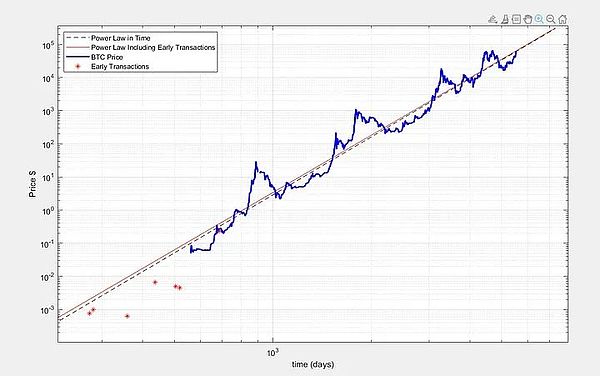

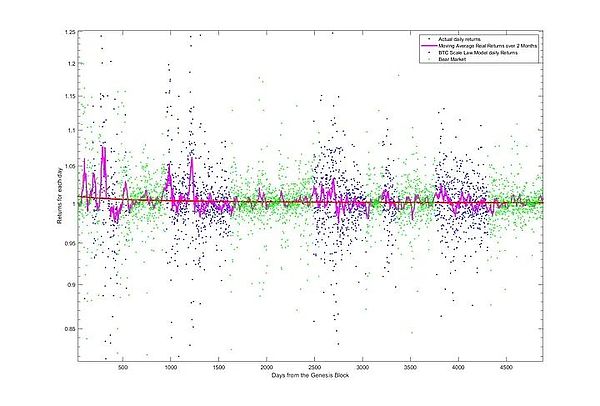

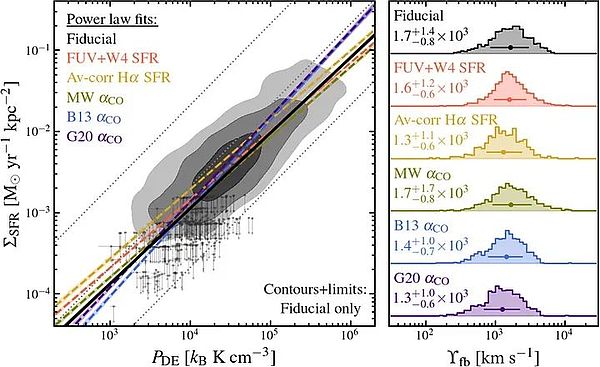

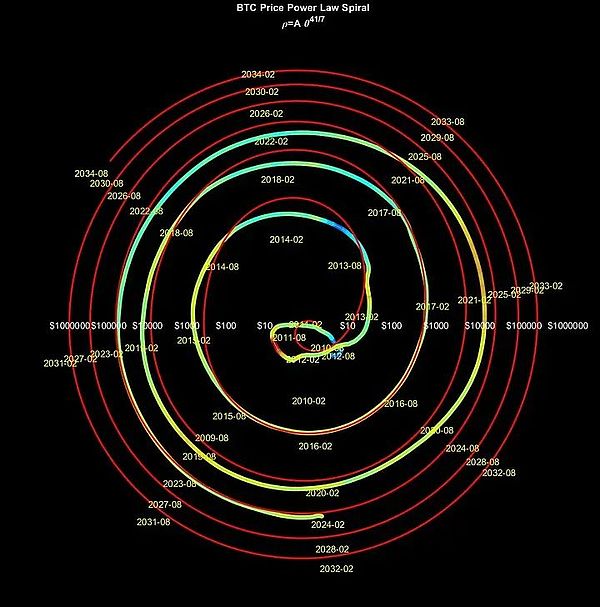

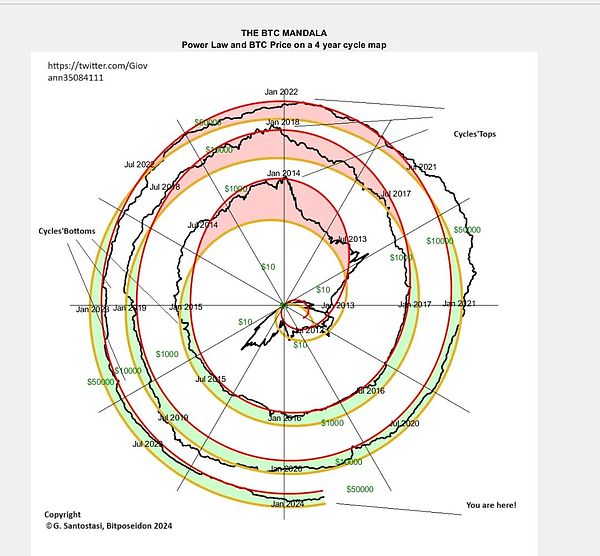

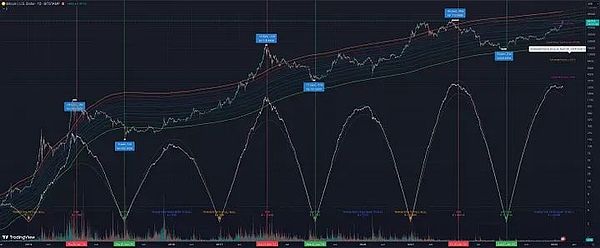

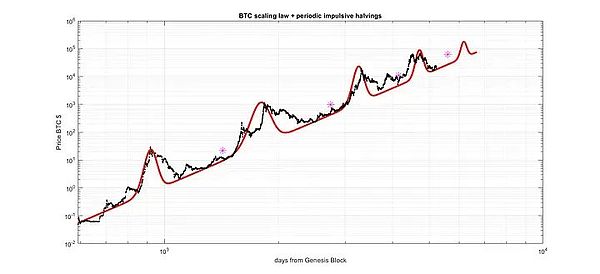

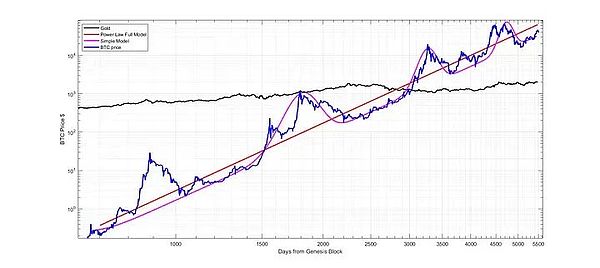

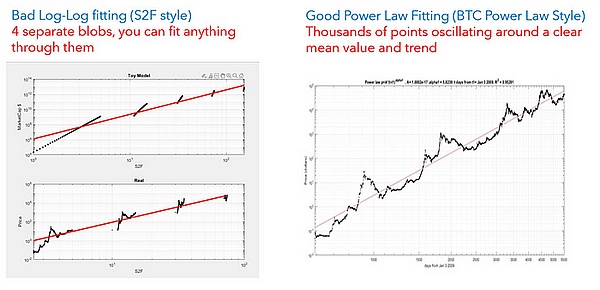

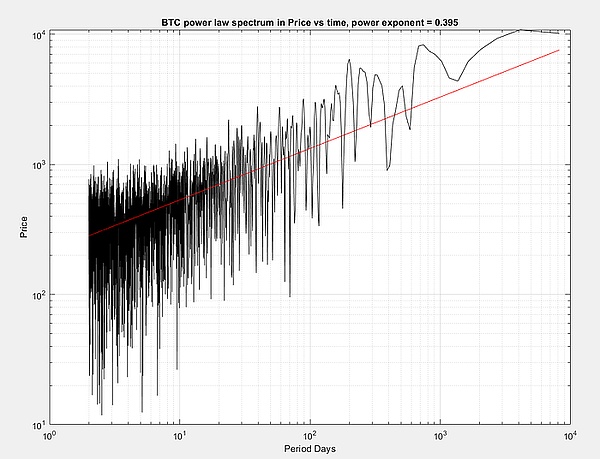

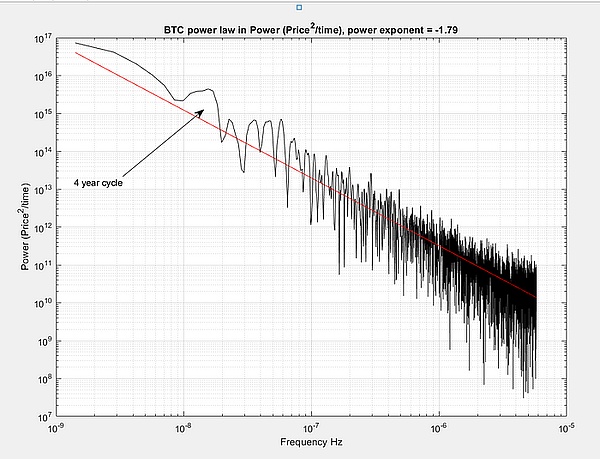

The BTC power law started out as an empirical observation of the regularity of Bitcoin prices. But it is now evolving into a coherent, powerful theory of Bitcoin behavior. Recently we found that hash rate, addresses, transactions, prices are all power laws of each other (which we already knew from previous work), and also all power laws of time.

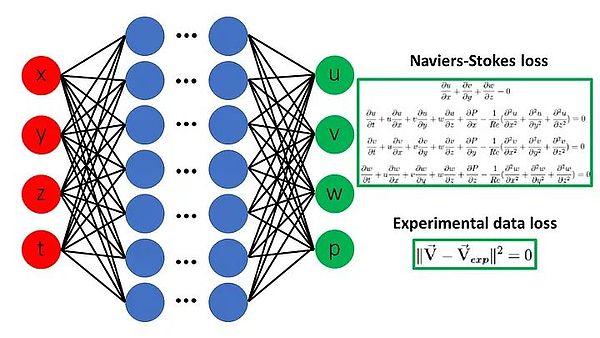

This is incredible because it shows that Bitcoin's evolution is driven by scale-invariant properties. It also fits perfectly with what Bitcoin actually is: a self-referential and adaptive network. In particular, difficulty adjustment, one of Satoshi’s most genius innovations, is the key mechanism behind the power law, not scarcity. This constitutes Bitcoin’s adaptive property. A power law is a mathematical and physical expression of an iterative process where the output becomes the input (hash rate now affects hash rate later due to difficulty adjustment). As I have demonstrated, this is not just in words, but also by showing the exact math that produces the power law over time that we observe.

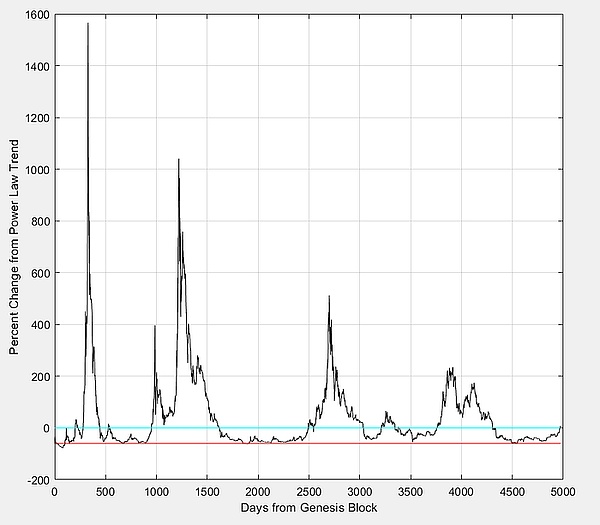

Thus, while before the BTC power law had no causal power, now it is more complete and powerful than any competing model. In fact, we can now explain why we see such a strong barrier at the bottom (it is due to miner capitulation and is perfectly reproduced by Bitcoin’s iterative model), we can explain the decoupling of addresses and price from hash rate during bull runs (hash rate does not follow the frenzy during bull runs because it takes time to catch up with millions of dollars invested in infrastructure and new chip technology), and much more. Almost every aspect of Bitcoin’s behavior can be explained by the power law theory of Bitcoin’s behavior, and it is powerful.

I normally don’t include these early transactions because most early adopters traded Bitcoin for pizza. However, when you include them (adding the earliest known US-to-BTC transaction to the dataset, which is very close to the trend), the difference between the current slope and the slope of all data is almost non-existent, which confirms how good the model is. The dashed line is the current model, and the red is including the earliest transactions.

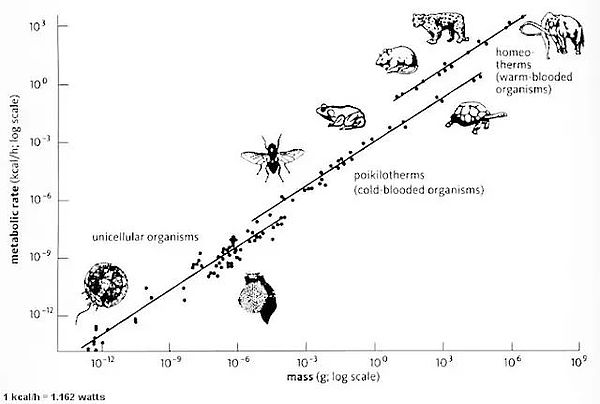

Power Laws Are Everywhere!

I mentioned earlier the power law called Kleiber’s Law. It governs the relationship between an animal’s weight and the amount of energy it needs to survive. The scale of size ranges from small creatures like fruit flies to elephants, over 7 orders of magnitude. This is essentially what BTC went through when it went from trading 10,000 BTC = 1 USD toda

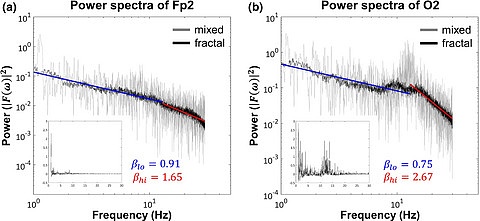

Let me give you an example from another area of research I work in (outside of astrophysics), which is sleep neuroscience. Specifically, brain waves during sleep. I know this sounds irrelevant, but listen to me and you will understand.

I specialize in a stage of sleep called slow wave sleep. In this stage, we have large and slow brain waves (about 30 per second compared to 1 per second for brain waves when awake), which is considered a sign of deep sleep. The larger the waves, the deeper the sleep. So when you do a sleep study in the clinic, it is important to count them or use them to determine how well someone is sleeping. In my work, I have to try to understand this phenomenon. Given my training as a physicist, I came into this field as a newbie, but it sometimes helps to ask questions that people who are inside the field don't usually ask. For example, the manual that sleep doctors use to identify these waves says that only very large waves that exceed a certain threshold are considered slow waves. If it is smaller than this threshold, a smaller wave with similar characteristics (such as its frequency) is not a slow wave.

It sounds ridiculous to have an arbitrary threshold, so I did a study to collect all the waves that had such characteristics (such as their frequency range, shape, and other things that all waves have in common, but I excluded size). What I discovered is: they are scale invariant! No one even knows that. Slow waves come in big and small sizes, doctors focus on the big waves that are easily visible to the naked eye, they don't really get into the details of the phenomenon.

Most doctors don't know about scale invariance and how it's relevant. These big waves are the extreme end of the range and don't represent the phenomenon at all, they are large rare events at the tail. The distribution of these waves has a very, very long tail, and these events are at the very side of the tail. Most slow waves (thousands) are much smaller, and there is no artificial threshold to distinguish between big and small, it was just made up randomly by some doctor in the past who decided how big the slow waves needed to be. But that's not how the brain works. All of these slow waves are important. Maybe for young, healthy subjects, big waves can be a good measure of good sleep, but for older patients (waves get smaller with age and are associated with cognitive decline) is a very poor measure and can cause some diagnostic problems.

I've proven this in my research. You can publish a paper, get some praise from other researchers, but nobody in applied medicine cares, and they don't change their way of doing medical research, which is a very sad part of medical research. Anyway, what does that have to do with BTC?

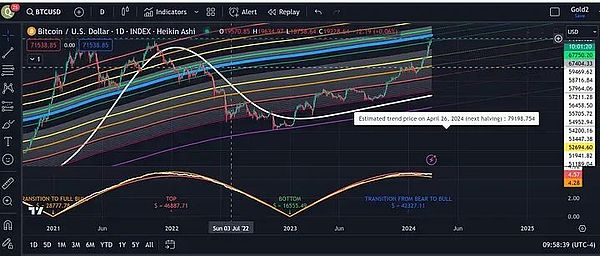

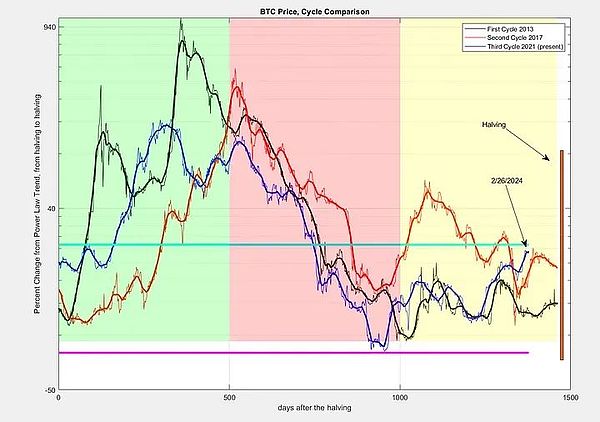

ETFs are large slow waves. We notice them because they are large, they are at the end of the distribution, and our human attention is illuminated. But BTC has experienced many such small-to-large events, like when the network was small and few more people joined, a website talking about BTC, the first media discussing it, etc. There are proportional events at any point. We don't remember them because they are small and ignored by all other slow wave doctors. If my findings about BTC being a scale-invariant system are correct, then ETFs are the events that BTC needs to take the next step in its evolution. Nothing has changed. I know some people think this is bearish news. It is not. ETFs appear to affect current prices and may amplify the bull run that seems to be coming after the halving.

The peak of the cycle may be larger than we expect, and instead of falling like in the past, it may be as large as some of the earlier peaks. But these are only "local" effects (they involve changes in this moment), not long-term trajectories. As I have said many times, the fact that Bitcoin follows a power law is a sign of health and strength, and we want to support this. But in terms of understanding BTC's scale invariance, they don't change BTC's long term trajectory because there is no evidence that ETFs are different from all other events when understood from a scale perspective. Maybe I need to dig deeper into this and prove that BTC's inflows have some kind of double logarithmic relationship with BTC's price and show that it is scale invariant like the price itself, but for now this is my intuition and a systematic suggestion for understanding scale invariance.

Fibonacci spirals are related to power-law spirals, they are similar but not identical. There are many growth processes that follow power-law spirals instead of Fibonacci laws. For example, the growth of animal teeth and horns or tree rings.

Bitcoin is a deep network full of power laws, and it shows up everywhere:

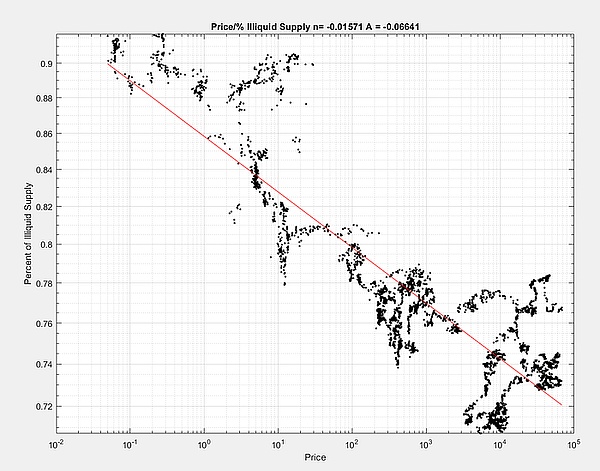

Price, hash rate, addresses, and transaction volume are all power laws of each other, and they all follow power laws over time. Even holding time and wealth distribution are power law distributions (the last of which are power law distributions, subtly different in nature from the others).

But transaction volume rises with price. They are also related to power laws. What is happening is a self-regulating process. It takes higher and higher prices to change the number of transactions by a factor of 10. Power laws are sometimes not intuitive, but if you don’t understand BTC, you can’t understand BTC literally. Every Bitcoin enthusiast should catch up and try to understand how power laws work. Higher prices mean more transactions, so in a sense there are more Bitcoins available on the open market. This seems contradictory, but only if you don’t understand power laws or use them to understand Bitcoin. Note that transactions are in BTC, not USD, so not only are more USD being traded, but also the amount of BTC being traded.

The math of an iterative process is the math of a power law

The power law is a result of an iterative process, and we were able to prove this: dPrice/dt = 5.82 * price/time. Super cool! You can iterate this formula into the future, but of course, as you add more future points, it tends to converge to a general power law trend. So it's better to tell us 1-2 days in advance what the price should be. Basically, you can create a chart with different weights of how much these contributors contribute to the price. The booth bundle price itself seems to give a good estimate of the current price, not the trend price, but the current price (a bit conservative during bubbles, but still reacting to them). The hash seems to indicate where the bottom is. Solve the problem in between.

Probably most of you have never studied advanced calculus or any calculus at all (or hate it). But for those who did or want to learn a little here is why the power law is a result of iteration. Let me show you the math (a bit long, but I assure you it's worth it if you have the patience to read through): Let's consider an equation of the form: dy/dt=n y/t. This is an equation called a differential equation. It is something used in mathematics and physics to represent the change in some quantity. For example, if I want to represent the change in distance y of an object as a function of a constant acceleration a, I can write dy/dt=at, where dy/dt represents the change in distance over time. Here, I'm just saying that the change in distance is proportional to the acceleration and time. It is one of the simplest differential equations. Solving an equation means finding an equation for y that satisfies the equation (which means the right side and left side are equal). Once you find such a y, you know how the distance changes with time. There are many ways to solve differential equations. But one of my best professors told me (I always remember how surprised and confused I was when I heard this, but it was the smartest math advice ever) to guess a solution that seems to make sense, and test if it works. Easy! So, what would be a good guess for this equation? Well, the left side is a derivative, and the derivative of t² is 2 t, so I suggest a solution of the form y=1/2 a t², so the 2 cancels out after the derivative, and there is a on both sides. You substitute to check if this solution satisfies the following equation: The left side dy/dt=d(1/2a t²)dt=1/2 a 2 t=a t, which is equal to the right side = a t. So y=1/2 a t² is my solution, and interestingly, the distance increases as the square of time.

Note: This is of course an easy guess for a calculus expert given the properties of derivatives, but I'm trying to make a point. Ok, let's go back to the original equation we wanted to study. dy/t=n y/t. Notice that this equation is fancy because the quantity we want to solve for is also on the right hand side, so basically the change in this quantity depends on the quantity itself! Or to put it another way, the output of the equation is also part of the input. That's why I use this as one of the simplest examples of an iterative or feedback loop process. Let's make a good guess about the solution to the above equation, what about y=A t^n? Where A is just a constant, it's not that important. Let's substitute: Left side: dy/dt=d(At^n)=An t^(n-1), Right side: n y/t = n A t^n /t=An t(n-1). Left side = Right side. Solved! But what is y=A t^n? That's the power law! For BTC it is Price=At⁵.82, or for Hash=B*t¹¹.4, or Price=C*Hash¹/2, and so on. All power laws or iterative processes (output = new input). So you see now you can add the change dy/dt to y, you get the new y, which can be used to solve for the change in y, and so on. So power laws are a result of feedback loops, which we know exist due to miner and user interactions in the network. This is why hashrate, addresses, and price themselves are all power laws of each other, and all power laws of time. So power laws of value, energy, time, and adoption. How cool is that????

The reason we see such a strong and consistent wall at the bottom is because of “miner capitulation” after the bubble burst. This is the bottom where miners lose money by mining. The system cannot survive.

Organism as a Network

Cities and Social Networks

Unstoppable Time Machine

This is a very short-sighted view of economic activity. The entire way modern society works, based on increasing productivity through science and technology, is overcoming these limitations. For example, famine is now only a political issue, not a resource issue. We have the resources to defeat world hunger if we really want to. BTC's fixed supply is more about not diluting "stakeholders" and thus creating false scarcity. This is a very different property and more important than scarcity. Malthusian Scarcity Theory: This theory states that the supply of food cannot keep up with the growth of the population, inevitably leading to disease, famine, war and disaster.

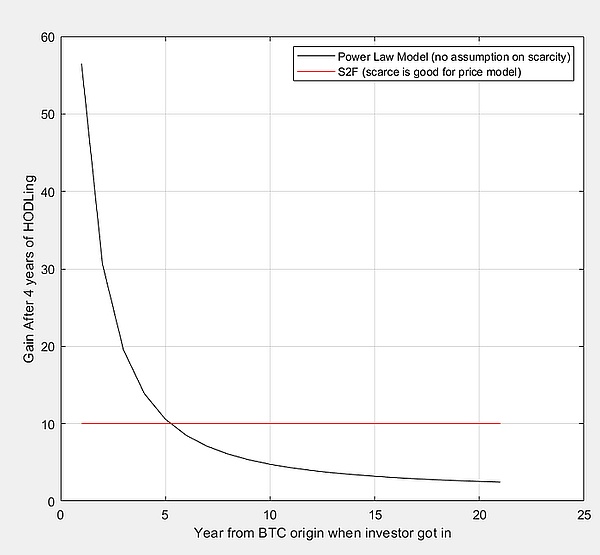

The same person who told me she was using the scarcity argument to tell people to hurry up and get some BTC (which is great news, by the way) also told me to “stick to the numbers”. I followed her advice (not sure exactly what she meant, but again I know her intentions were good). But math is math. There are two models here, the power law model makes zero assumptions about scarcity and is based solely on the observation that prices go up in a predictable way. Scarcity is not part of the model at all. The other is S2F, where scarcity is the primary driver and, in fact, assumes that scarcity increases over time. The power law (which makes no assumptions about scarcity) leads to “hurry up and buy some Bitcoin now”. As you can see, S2F says you can join at any time and still get the same amount of gains, whether you joined 10 years ago (same 4 year HODLING time) or 10 years from now (same 4 year HODLING time). Both investors would have made 10x returns during that time. When you notice the power law model, it’s important to join as soon as possible. So do you see how people use the scarcity argument to draw illogical conclusions that are not supported by facts?

I will post this post and then spend some time focusing on other content because this topic is not that popular for a lot of people. But it is very important and I think I got it right when most people were confused about it (which is very surprising to me because it seems that almost everyone gets it wrong). Thesis: Scarcity is only needed in a monetary system as a security tool to prevent counterfeiting. Bitcoin does not need scarcity because it is already protected against counterfeiting (with one exception). Note: This discussion revolves around "monetary systems" so it does not apply to investments, stamp collecting, or other types of valuable things or activities. Monetary systems only, so please focus the discussion on that. Let's explain this with 4 examples.

This post is a bit long but I think it is worth reading because it will clarify a very important misunderstanding.

1) Casino: A casino can be understood as a monetary system. Customers come in, and in exchange for something "valuable" (like dollars), they get some chips. The chips are exchanged at a precise exchange rate, red is worth 10, blue is worth 50, and yellow is worth 100. The tokens are made of cheap plastic, so there is no correlation to the scarcity of the material used. It is not as valuable as gold. But they are hard to counterfeit, because no one is going to make more of these chips in the bathroom. They function perfectly as currency. They are not even a fixed token system, because as more customers come in, the cashier will give away more tokens, but these more tokens do not dilute everyone else's tokens. Their value is fixed at the entrance, and does not change during the night time that customers play. But the system works well as a currency system, because it has clear rules for trading, it is pegged to something valuable outside the system, and no one counterfeits the tokens. Scarcity plays zero role in such a system.

2) Monopoly game. Similar argument. The whole game is supposed to simulate a competitive economy, even if it is in a very simple way, where their are winners and losers. There are some very cheap tokens (we even use them as a meme for worthless money), but are meaningful and worthwhile in the game. The supply is limited, but actually increases as players move around the board and are rewarded with in-game currency proportional to their luck and/or ability to play the game. No one counterfeits money (a cheater can take money from another game, pocket it, then show up in the game and pull it out when no one is watching, but it's not a fun way to play the game, and it's also probably easily detectable by other players). The system is closed; no money goes in or out of the system except as given by the fair, everyone-understood-and-agreed-to rules of the game. So again, no need for scarcity, or even a fixed supply.

3) An ideal, non-existent, but possible in people's imaginations, society that never lies or cheats. These aliens (of course they can't be humans) never lie or cheat, their brains aren't made that way. I know it's hard to imagine, but play along with me. The system doesn't have to be closed, it can interact with other systems in this imaginary world (there are different countries and people there, but all are super fair and respect rules and laws). In this case, one could use anything that is strong and durable to serve as money. All you have to do is mark the "money" with some recognizable sign to indicate that it is money, or use some recognizable shape or color. Color-coded stones coated with paint that won't peel off, or stones with special markings made by some central agency, or anything that can be used as money. Scarcity is not needed, because again, counterfeiting doesn't exist. You can also keep track of the money by having stores and banks like keep track of the total supply, and when coins are lost or damaged from wear and tear, other coins can be provided in a fair and consistent manner. In this crazy world, even governments are fair and honest (ok, I know I'm stretching it), so they don't do anything that amounts to printing money (except what I said about replacing lost or damaged coins and keeping a steady supply).

4) The Roman Empire used gold and silver coins. This was also an open system. The Roman Empire issued coins made of precious metals. Units that represented more valuable were made of a rare, durable metal called gold. The government stamped the coins and guaranteed (at least initially) the purity of the metal, and each coin had a value for its weight (which meant that you could get the value of the metal on the open market even if you melted it down). The two metals, especially the more valuable one, were chosen because they were "scarce" (relative to other metals or even other valuable things). Considering the above example, there is only one reason for this. To reduce and/or avoid (which is basically impossible in the real world) counterfeiting. Since gold is difficult to mine (in fact, mining technology had reached its limits in Roman times), it would be difficult for bad agents to get some gold and mix it with other cheaper and rarer metals and create more coins. One could melt down existing coins and then dilute them (which, by the way, happened quite often, especially in the outer regions of the empire), but the coins still needed to contain at least a lot of gold to pass as gold coins (in terms of weight and other typical features of gold), so this counterfeiting process was at least curbed by the fact that the material used for the currency was scarce and valuable. But you can see that this choice of material was based entirely on security issues and had nothing to do with giving value to the money itself. In a society where everyone is honest, all that is needed is some kind of fixed supply, or even an unfixed supply, with simple and clear rules of exchange that are fair and agreed to by everyone.

So what about Bitcoin? BTC solves all of this by having: 1) a fixed, unchangeable total supply. Because it is a digital technology, this is the first time in human history that this has been achieved. The algorithm behind BTC guarantees that this supply cannot be changed unless the entire system reaches consensus, and that is difficult to achieve anyway. 2) a supply that is gradually increased until the total fixed supply is reached, through a very precise, understandably agreed upon (by participating in the system, you implicitly agree to its rules), transparent method, backed by a security measure that amounts to "scarcity", which is the exchange of hashpower, or the energy and work that goes into mining coins. You don't get anything for free, but you can exchange your BTC rewards for something valuable (energy). This is the equivalent of buying chips with dollars at a casino, exchanging something "valuable" for another. This is again a security measure to avoid counterfeiting and is the only place where the concept of scarcity is embodied (but again people can mine coins using the abundant solar energy so it's not really scarcity per se but more of a conversion of one form of energy into another)

This question gets a bit far fetched when we discuss BTC. The number of coins, their divisibility and the fact that the supply is fixed has nothing to do with scarcity per se. It's all about the fact that the rules of the system are clear and based on consensus. The fact that the total supply is fixed is a means of reaching consensus (via prior laws or rules) around the question of the total supply of the currency (which can be a stumbling block for any other monetary system where a central authority or democratic process periodically decides on the supply). The total supply and the supply output over time are chosen by the system itself at the beginning. That's it. These rules make things much simpler and that's why it's so genius. I hope my example sheds some light on why scarcity is a poor concept when it comes to the idea of giving value to BTC. I believe this creates confusion in the community and even more confusion when we try to explain what BTC is to others. I won’t insist on this anymore, at least for now, haha, let people think about it and see if this is a useful way of reasoning. Thanks for listening.

Bitcoin is the pizza that can nourish the world (take the Italians at their word). You know the big debacle about the fund manager lady (not sure her name, never mind) who said something “obviously” stupid about diluting the value of BTC by having many moons? Sure, she said something stupid and the internet went crazy and made fun of her for days. But the reason she said it was because the emphasis on scarcity was confusing to people, especially non-Bitcoiners (and Bitcoiners). While the Bitcoiners who followed her were not wrong, they were not right either. They were right from a logical and mathematical perspective, but they were wrong from a narrative and educational perspective. One of the favorite examples people used to prove her wrong was that you can’t solve world hunger by slicing pizza billions of times. But you know what? With Bitcoin, you can. In fact, that’s exactly what we’re trying to do.

We want BTC to be the world monetary system, so in a sense it’s like nourishing (or serving some function) the entire world. We’re highlighting the wrong concept. This is why I insist, at the expense of creating some friction and defending an unpopular idea, that scarcity is the wrong perspective and narrative to use for BTC. We are missing a huge opportunity to point out that yes, there is a way to nourish the world with 1 pizza, by making the pizza very very very nutritious, where 1 small slice is very nutritious and can satisfy every person on the planet.

If BTC is destined to be the world monetary system, then it needs to be that magical pizza we talk about, which is impossible. We are only shooting ourselves in the foot by focusing on scarcity, and it is giving us and people outside the community a false view of the value of BTC and why it is so unique and important. Let’s start thinking about BTC in terms of abundance and infinite utility, not scarcity. BTC solves all of these problems and even the world’s desire for a fair and just monetary system.

S2F Model

Other Measures of Bitcoin Scarcity

I use the word “model” for power law in BTC to curb its significance and be cautious about its meaning. But it is not a “model” in the sense of a mathematical model as most people think. If this is true, and I say if, then it tells us something bigger about BTC. It is a fundamental property of the system. This means:

1. Scale invariance.

2. Sustainability.

3. Adaptability.

4. Order and organization.

5. Predictability.

6. Intelligence and information.

7. BTC is like a city and a living organism.BTC is like a city and a living organism.

8. Long lasting and resilient.

9. Good things come in time.

10. Unavoidability of 1 M and even 10 M BTC.

BTC will do what BTC will do. We are all humble observers of this amazing phenomenon. But if my findings are even close to the truth, you would expect BTC to have these properties, and the math tells us they are not wishful thinking, but its mathematical and scientific truth.

One thing to consider when we talk about BTC value is that human productivity and capabilities are growing at an exponential rate (while BTC value is growing at a power law rate). BTC’s goal is to capture more and more of the value of human productivity and eventually represent the entire monetary system (with ever-increasing value). Given a limited supply, the value will continue to grow due to the growth of human productivity. The cap is not meant to dilute or let arbitrary forces capture a large portion of that value through this arbitrary dilution. But this is not scarcity, it’s the exact opposite.

Pump.fun will not disappear, but will make more money in this cycle

JinseFinance

JinseFinanceThe Paris Olympics on July 26 this year may also be transformed into an object of hype for MEME tokens and become a new major event casino.

JinseFinance

JinseFinanceRUNES wants to be the "Las Vegas" of the Bitcoin network, but BRC20 does not want to be "Atlantic City".

JinseFinance

JinseFinanceScorpion Casino disrupts the crypto scene with a staggering $3.4M presale success, challenging Dogecoin and PulseChain's surges. This clickbait-worthy article explores the remarkable rise of Scorpion Casino, from its financial prowess to a potential industry revolution.ble, setting a new standard for future presales.

Joy

Joy Beincrypto

BeincryptoBitcoin, Ethereum, and cryptocurrencies are one of the most innovative and best performing assets in the past 10 years. It’s ...

Bitcoinist

BitcoinistWith Bitcoin at the forefront of decentralized finance, it's no wonder the online gambling industry has embraced it with open ...

Bitcoinist

BitcoinistCrashino is the world’s leading Bitcoin casino specializing in the beloved crypto game of all blockchain enthusiasts - Bitcoin crash! ...

Bitcoinist

BitcoinistCryptocurrencies are one of the most exciting technologies to have emerged over the course of the past decade. Almost everybody ...

Bitcoinist

BitcoinistCrypto casinos are online casinos that use cryptocurrency as their primary means of payment. While traditional online casinos tend to ...

Bitcoinist

Bitcoinist