Author: Tyler

Have you traded US stocks on the chain?

When I woke up, Kraken launched xStocks, which supported the trading of 60 US stock tokens in the first batch; Bybit followed closely and launched popular stock token pairs such as AAPL, TSLA, and NVDA; Robinhood also announced that it would support US stock trading on the blockchain and planned to launch its own public chain.

Whether the tokenization wave is old wine in a new bottle or not, US stocks have indeed become the "new darling" of the chain overnight.

Only when you think about it carefully, this new narrative woven by the US dollar stablecoin, US stock tokenization and on-chain infrastructure seems to be making Crypto deeply trapped in financial narratives and geopolitical games, and inevitably slide into a new role positioning.

Tokenization of US stocks is not a new thing

Tokenization of US stocks is actually not a new concept.

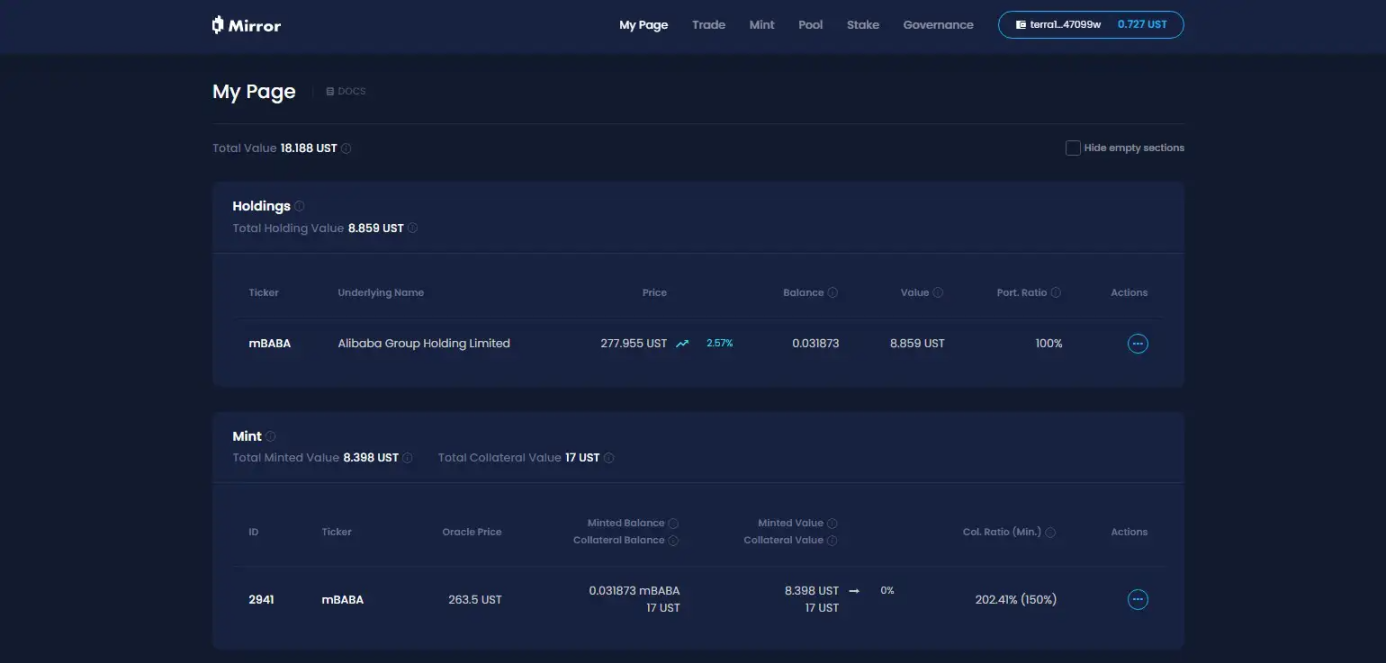

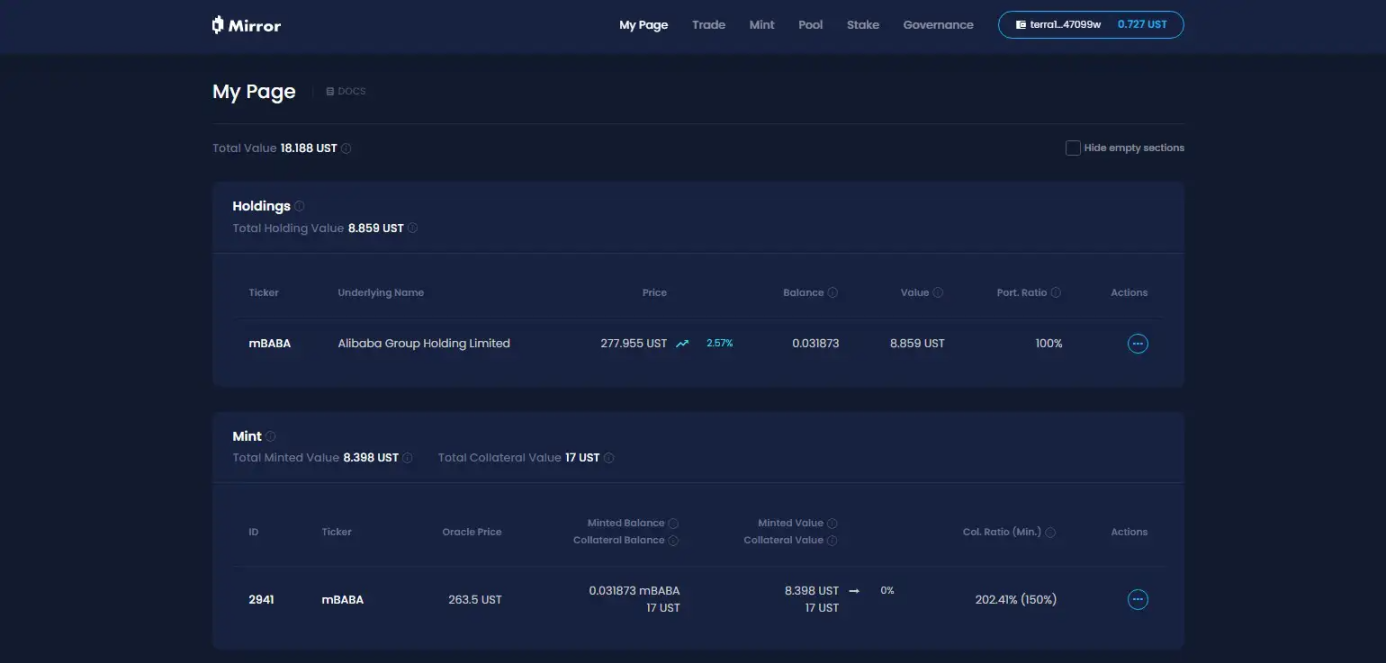

In the last cycle, representative projects such as Synthetix and Mirror have explored a complete set of on-chain synthetic asset mechanisms. This model not only allows users to mint and trade "US stock tokens" such as TSLA and AAPL through over-collateralization (such as SNX and UST), but also covers legal currency, indexes, gold, crude oil, and almost all tradable assets.

The reason is that the synthetic asset model is to mint synthetic asset tokens by tracking the underlying assets and over-collateralizing: for example, if the collateral rate is 500%, it means that users can pledge $500 of crypto assets (such as SNX and UST) into the system, and then mint synthetic assets (such as mTSLA and sAAPL) anchored to the asset price and trade them.

Since the entire operating mechanism uses oracle quotes + on-chain contract matching, all transactions are completed by the internal logic of the protocol, and there is no real counterparty, it also theoretically has a core advantage, which is the ability to achieve unlimited depth and no slippage liquidity experience.

So why is this synthetic asset model moving towards large-scale adoption?

In the final analysis, price anchoring ≠ asset ownership. The US stocks minted and traded under the synthetic asset model do not represent the real ownership of the stock in reality. It is just a "bet" on the price. Once the oracle fails or the mortgage assets burst (Mirror fell on the collapse of UST), the entire system will face the risk of liquidation imbalance, price de-anchoring, and user confidence collapse.

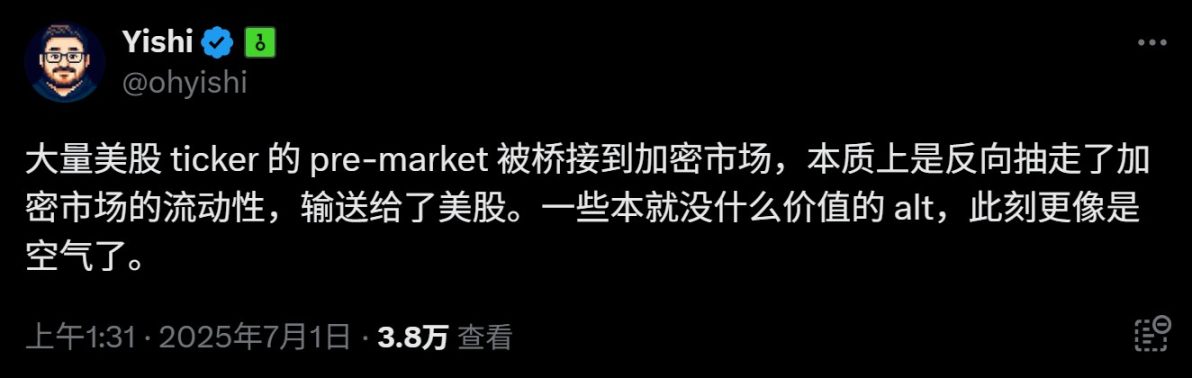

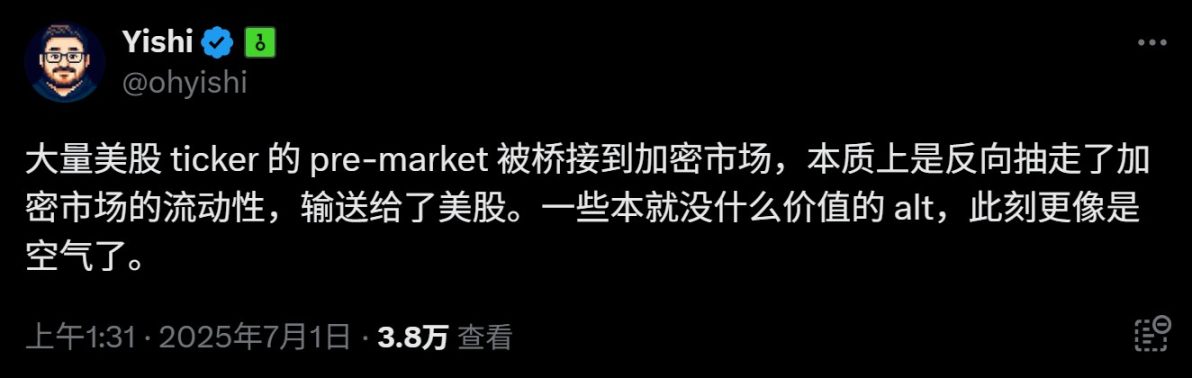

At the same time, an easily overlooked long-term factor is that US stock tokens under the synthetic asset model are destined to be a niche market in Crypto - Funds only circulate in the closed loop on the chain, without the participation of institutions or securities firms, which means that it will always remain at the "shadow asset" level. It can neither integrate into the traditional financial system, establish real asset access and capital channels, nor are there many people willing to launch derivative products based on this, making it difficult to leverage the structural inflow of incremental funds.

So, although they were popular before, they ultimately failed to become popular.

The structure of capital diversion of US stocks under the new structure

This time, the tokenization of US stocks has changed its gameplay.

Take the US stock token trading products launched by Kraken, Bybit, and Robinhood as an example. From the disclosed information, it is not price anchoring, nor on-chain simulation, but real stock custody, and funds flow into US stocks through brokers.

Objectively speaking, under this model of US stock tokenization, any user only needs to download a crypto wallet and hold stablecoins, and can easily buy US stock assets on DEX anytime and anywhere without the threshold of opening an account and identity review.In the whole process, there is no US stock account, no time difference, and no identity restriction, and funds are directly directed to US stocks on the chain.

From a micro perspective, this means that global users can buy and sell U.S. stocks more freely, but from a macro perspective, this is actually the U.S. dollar and the U.S. capital market, using Crypto as a low-cost, highly flexible, 7×24 pipeline to attract global incremental funds - after all, under this structure, users can only go long, not short, and there is no leverage and non-linear return structure (at least as of now).

Imagine a scenario like this: a non-Crypto user in Brazil or Argentina suddenly finds that he can buy U.S. stock tokens on the chain or CEX. He only needs to download the wallet/exchange, exchange the local assets for USDC, and then click to buy AAPL or NVDA.

It sounds nice to simplify the user experience, but in fact it is a "low-risk, high-certainty" U.S. stock fund drainage structure created for global funds. The hot money of Crypto users around the world can flow into the U.S. asset pool with unprecedented low friction and cross-border flow through Crypto, allowing people all over the world to buy U.S. stocks anytime and anywhere.

Especially when more and more L2, exchanges, wallets and other native infrastructures are connected to these "U.S. stock trading modules", the relationship between Crypto and the U.S. dollar and Nasdaq will become more secretive and more stable.

From this perspective, a series of "new/old" narratives around Crypto are being designed as a set of distributed financial infrastructure, and are specifically designed for US financial services:

US debt stablecoins → world currency liquidity pool

US stock tokenization → Nasdaq's traffic entrance

On-chain transaction infrastructure → US brokerage's global transit station

This may be a flexible way to siphon global funds. Regardless of whether the conspiracy theory is strong or not, at least Trump or the new American speaker after him may fall in love with this new narrative of "US stock tokenization".

How should we view the pros and cons of "US stock tokenization"?

If we look at it purely from the perspective of the Crypto circle, is the tokenization of U.S. stocks attractive, or what impact may it have on the on-chain cycle?

I think we need to look at it dialectically.

For users who lack investment channels for U.S. stocks, especially Crypto natives and retail investors in third world countries, the tokenization of U.S. stocks is equivalent to opening an unprecedented low-threshold channel, which can be called "asset equality" across barriers.

After all, as a supermarket where star stocks such as Microsoft, Apple, Tesla, and Nvidia have emerged one after another, the "historic long bull" of U.S. stocks has always been talked about by the investment community and is one of the most attractive asset classes in the world. However, for most ordinary investors, the threshold for participating in transactions and sharing dividends has always been relatively high: account opening, deposits and withdrawals, KYC, regulatory restrictions, trading time differences... Various thresholds have discouraged countless people.

Now, as long as you have a wallet and a few stablecoins, you can buy Apple, Nvidia, and Tesla anytime and anywhere, even in Latin America, Southeast Asia, and Africa, and realize the inclusiveness of US dollar assets among global users. In short, for those underdeveloped regions where local assets cannot outperform US stocks or even inflation, the tokenization of US stocks undoubtedly provides unprecedented accessibility.

On the other hand, within the Crypto circle, especially the trading users represented by the Chinese-speaking region, the overlap with the US stock investment circle is quite high. Most people already have US stock accounts and can access the global financial system with one click through banks + overseas brokers such as Interactive Brokers (I personally use a combination of SafePal/Fiat24+ Interactive Brokers on a daily basis).

For these users, the tokenization of US stocks seems a bit half-hearted - it can only go long, there is no derivatives support, and even basic options and securities lending are not available, which is really not trading-friendly.

As for whether the tokenization of US stocks will further suck blood from the crypto market, don’t rush to deny it. I think this may be an opportunity window for a new round of "asset Lego" after the DeFi ecosystem clears out inferior assets.

After all, one of the biggest problems of DeFi on the current chain is the serious lack of high-quality assets. In addition to BTC, ETH, and stablecoins, there are not many assets with real value consensus, and a large number of altcoins are of poor quality and volatile.

If these real-stock custody and on-chain issued US stock tokens can gradually penetrate into DEX, lending agreements, on-chain options and derivatives systems in the future, they can completely become new basic assets, supplement the on-chain asset portfolio, and provide DeFi with more certain value materials and narrative space.

Moreover, the current US stock tokenization products are essentially spot custody + price mapping, without leverage and non-linear income structure, and naturally lack deep financial instrument matching. It depends on who can make products with strong composability and good liquidity first, and who can provide an integrated on-chain experience of "spot + short selling + leverage + hedging".

For example, as high-credit collateral in lending agreements, constructing new hedging targets in option agreements, and forming a composable asset basket in stablecoin agreements, from this perspective, whoever can take the lead in creating an integrated on-chain trading experience of spot + short selling + leverage + hedging will be able to create the next on-chain Robinhood or on-chain Interactive Brokers.

For DeFi, this may be the real turning point.

It depends on who can get the on-chain product dividends from this new narrative.

Written at the end

Starting from 2024, "whether Crypto can still revolutionize TradFi" is no longer a question worth discussing.

Especially since this year, penetrating the geographical restrictions of traditional financial channels through stablecoins, bypassing sovereign barriers, tax barriers, and identity checks, and ultimately using Crypto to establish a new dollar channel, has become a core theme of many recent narratives led by compliant dollar stablecoins.

Crypto bless America, may not just be a joke.

Weatherly

Weatherly