Author: Choze Source: X, @AlwaysBeenChoze Translation: Shan Ouba, Golden Finance

A new meta-narrative is emerging: loud, fast, and full of speculation. It's called the Internet Capital Markets (ICM). This may be the most exciting evolution in the crypto world, or the most dangerous distraction - depending on who you ask.

But one thing I know for sure:

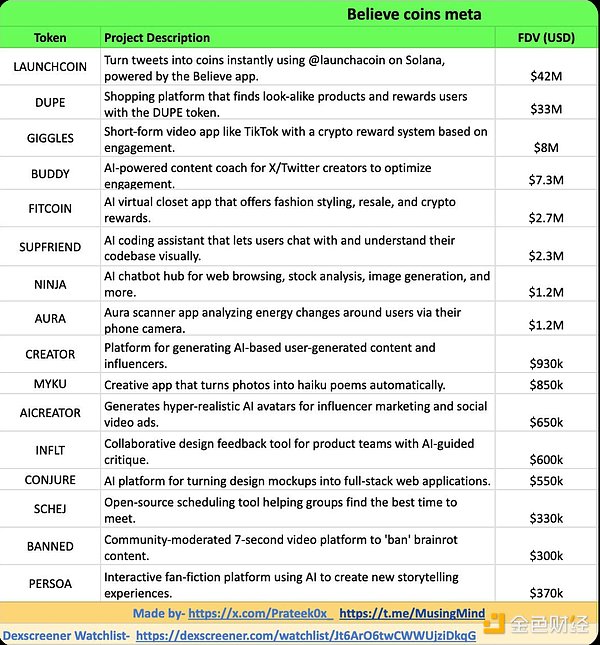

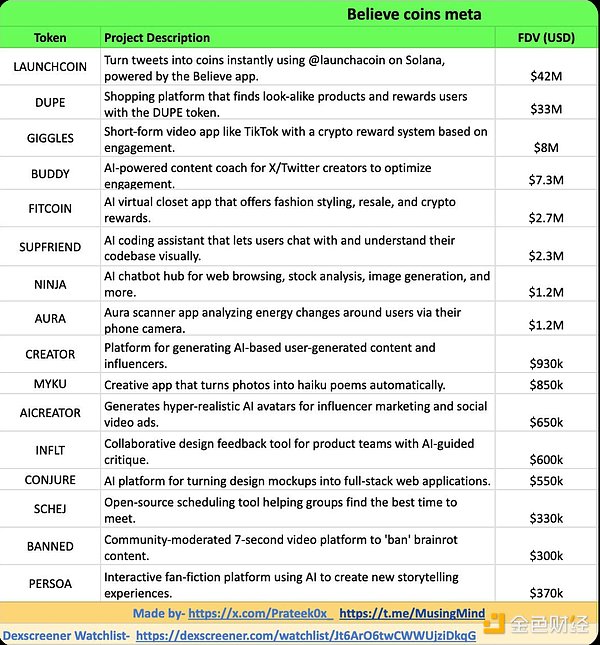

By 2025, a wave of independent developers will begin issuing tradable tokens for their internet-native applications directly through X (yes, this platform), with the help of tools like @launchcoin and @believeapp. The result: a permissionless market is born, where ideas become tokens, enthusiasm becomes capital, and speculation becomes product growth.

ICM is already starting to attract attention. But the real question isn’t whether it will catch on, but rather: is this model sustainable?

What is Internet Capital Markets?

Internet Capital Markets (ICM) is a decentralized platform where money flows directly to app developers and creators — no VCs, no banks, no app stores. It blurs the lines between crowdfunding, token issuance, and equity speculation.

Developers publish an idea, and the public participates by buying tokens. Trading volume rises, fees accumulate, and developers earn revenue. If enough people believe in the idea, the token price soars; if no one believes in it, it goes to zero. This is the core mechanism of platforms like Believe and Launchcoin.

Supporters believe that ICM has democratized innovation; critics say it is just a financial package for "pie in the sky". Both may be correct.

Bull Logic: Hype First, Build Later

The most powerful bullish logic for ICM can be summarized in four key points:

Permissionless Creative Financing:Anyone with an Internet connection can support developers, no venture capital meetings, no intermediaries.

Incentive-aligned revenue model:Developers can earn 50% of transaction fees and directly own the capital to launch products.

Frictionless propagation speed:Token issuance is dynamically linked to X, and its distribution speed is comparable to the propagation of meme coins.

Cultural breakthrough:ICM rides on the wave of "vibe coding" to enable independent developers, niche creators, and individual entrepreneurs to go from 0 to 1 through retail capital.

This flywheel effect has already shown results:

$DUPE's market value reached $38 million in a few days

$BUDDY's annual recurring revenue (ARR) reached $300,000 based on AI creation tools

$FITCOIN received 300,000 downloads and millions of impressions

This story is very tempting: Fund the idea immediately, grow on the heat, and then polish the product based on the community's belief.

Bearish View: Noise of Tokenization

But beneath the surface prosperity, there are deep structural risks:

Product-Market Mismatch: Many ICM tokens were launched without any functionality or market demand verification, driven only by atmosphere and meme.

Hype over substance: Retail investors buy based on hype, not on the business foundation of the project.

Short-termism: Developers can immediately profit from transaction fees, lacking incentives to maintain long-term value.

Lack of legal protection: Most ICM tokens are neither equity nor have a governance mechanism, so liability cannot be guaranteed.

Extremely low user stickiness: Tokens can soar quickly, but can also quickly return to zero, and there is almost no long-term binding relationship between users and projects.

In my opinion, this trend risks hijacking the title of "Internet Capital Market". The original vision of "on-chain IPO and digital equity" has been diluted into a speculative market and a "pump and dump" arena for meme coins.

Even among active traders, many people admit that they are just for quick arbitrage. This shows that even "believers" are mostly short-term players.

Believe: Infrastructure, or hype tool?

At the core of the ICM model is the Believe ecosystem, which allows anyone to send coins in seconds. The operation process is very simple:

Post a tweet containing $TICKER + name on X to issue coins

The system automatically generates a bonding curve and a liquidity pool

Developers can get 50% of the transaction fee income

When the token market value reaches $100,000, it can enter a deeper liquidity pool

Developers do not need to conduct traditional financing. But this also brings problems:

When you can get income before the product is launched, the boundary between developers and "farmers" (cashers) becomes blurred.

While projects like $DUPE and $GIGGLES have shown growth momentum, more tokens look more like empty shells of memes. The infrastructure is indeed impressive, but the tools cannot create a sense of mission.

Two Visions

People's understanding of ICM is splitting into two visions:

Idealistic version: ICM is the final form of Web3 - on-chain IPO, decentralized equity, and a financial layer that never closes, providing infrastructure for Internet-native companies.

Realistic version: A field full of token MVP speculation with no roadmap, no moat, and no accountability mechanism.

These two visions are unfolding simultaneously. And whoever gains dominance first may determine which one will dominate the mainstream.

My candid view: promises and traps

ICM undoubtedly touches on some real desires: support creativity in advance, finance culture, and speculate on projects that may become popular.

But the same lack of threshold also brings dilution risk. If there is a lack of discipline and long-term consensus, ICM is likely to evolve into another paradise for "pump and dump" - meme coins are dressed in the guise of "productivity", and liquidity conceals the reality of their lack of content.

Some participants see ICM as the future of startup financing, while others just use it as a means of profit. This duality makes it difficult to distinguish between signals and noise.

Ways to Go

For ICM to move beyond short-term hype and toward maturity, several important changes are needed:

Real sustainable developers: Projects need to actually launch products and retain users, not just quickly raise money. They should be led by teams with product-market fit.

Reliable data metrics: Dashboards and monitoring systems should highlight real user engagement, not just trading volume or volatility.

Progressive regulation: If tokenized startups want to give back value, a legal framework that combines compliance and practicality may be needed in the future.

Narrative self-discipline: Not all tradable ideas can be called "Internet capital markets". This term must retain its value.

ICM is not the enemy, but it is not yetthe final solution.

It is a canvas, and the key lies in what we draw on it.

This "meta" is new, but the mechanism is familiar. The real question is: Can it evolve into an important structural financial tool, or will it be short-lived like many crypto trends? Time and practical results will tell us the answer.

Catherine

Catherine