16% of Web3 companies use .io

16% of Web3 companies use .io. ccTLDs have been removed five times in history.

JinseFinance

JinseFinance

Author: Simon shieh, Source: MetaTrust Labs

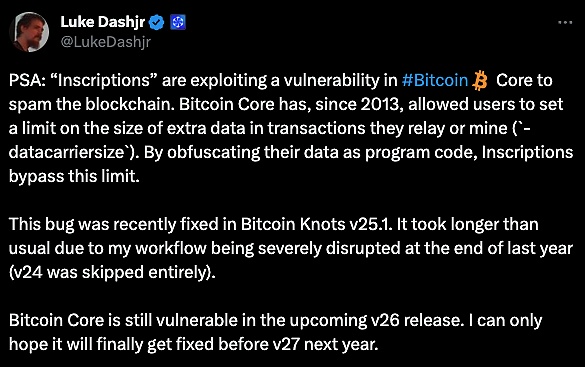

On December 6, 2023, Bitcoin investors are While cheering for the growth that Inscriptions has brought to Bitcoin, Luke Dashjr, the developer of the Bitcoin Core node client, poured cold water on it. He believed that the inscription was a "spam" attack and submitted a fix code and a CVE vulnerability report (CVE-2023-50428). Then the Bitcoin community exploded. Following the chaos of the hard fork in 2017, the Bitcoin community once again fell into fierce debate.

Then Bitcoin should pay more attention to security Should we abandon some unexpected features for the sake of safety, or should we be more tolerant of unexpected innovations and tolerate a little more possible security issues?

We know that Bitcoin’s journey is not just speculation and hype, but also the continuous evolution of its ecosystem and security landscape. This article aims to delve into the twin narratives of Bitcoin’s growth: expanding utility within its ecosystem and strengthening security measures. We’ll explore how the synergy of innovation and strong security protocols can pave the way for a new era of digital assets.

We know that as the cornerstone of the cryptocurrency revolution, Bitcoin has always been used as a store of value like gold. While other public chain DEFI innovations are in full swing, people seem to have forgotten the existence of Bitcoin.

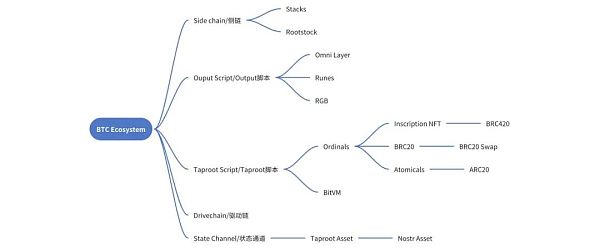

However, it was precisely on Bitcoin that the pioneers first started experiments with stablecoins, Layer2, and even DEFI. For example, USDT, the current hard currency in the currency circle, was first issued on the Bitcoin Omnilayer network. The figure below is a basic classification of the Bitcoin ecosystem from the perspective of technical implementation.

Includes side-by-side anchoring based on two-way anchoring Chain, text parsing based on output script (OP_RETURN), engraving based on Taproot script, drive chain based on BIP300 update and upgrade, and lightning network based on state channel and other technologies.

You may not understand many of the terms above, so don’t worry. Let’s get familiar with the following basic knowledge first, and then explain the technical principles of these ecology one by one and discuss the security issues involved.

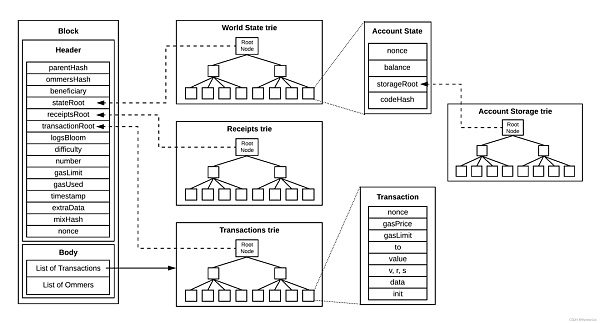

Unlike Ethereum’s account balance system, there is no concept of an account in the Bitcoin system. Ethereum introduces four complex Merkle Patricia Tries to store and verify changes in account status. In contrast, Bitcoin cleverly uses UTXO to solve these problems more concisely.

Four trees of Ethereum

Bitcoin input and output

UTXO (Unspent Transaction Outputs, unspent transaction outputs), the name sounds particularly awkward, but in fact, understand the input, output and transaction After these three concepts, it is easy to understand.

Friends familiar with Ethereum should know that a transaction is the basic communication unit in the blockchain network. Once a transaction Being packaged and confirmed as a block means that the status change on the chain is confirmed. In Bitcoin transactions, there is not a single address-to-address status operation, but multiple input scripts and output scripts.

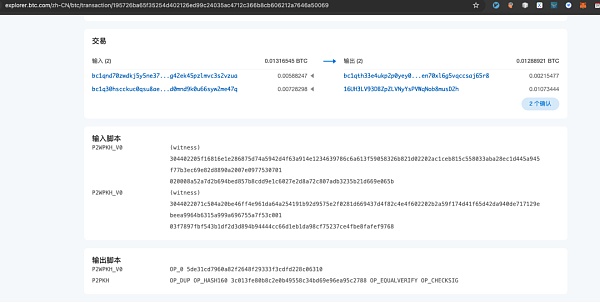

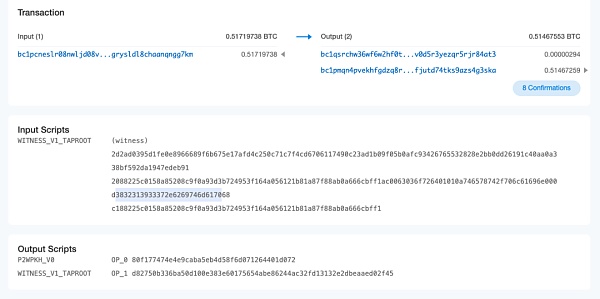

The picture above is a very typical one Bitcoin 2 to 2 trading. Theoretically, the number of BTC input and the number of BTC output should be equal. In fact, the BTC output that is less than the input is earned by the block miners as miners' fees, which is equivalent to the Gas Fee in Ethereum.

We can see that when transferring BTC, the two input addresses need to be verified in the input script to prove that these two input addresses can spend these two inputs (that is, the previous The unspent output of the pen, UTXO), and the output script stipulates the conditions for spending two outputs of Bitcoin, that is, what conditions should be met the next time this unspent output is used as input (general ordinary transfer, conditions It is the signature of the output address. For example, in the picture above, P2wPKH means that signature verification of the taproot address is required, and P2PKH means that the signature of the legacy address private key is required).

Specifically, the data structure of Bitcoin transactions is as follows:

In a Bitcoin transaction, the basic structure consists of two key parts: input and output. The input part specifies the initiator of the transaction, while the output part specifies the recipient of the transaction and the change (if any). The transaction fee is the difference between the total input amount and the total output amount. Since the input of each transaction is the output of a previous transaction, the output of the transaction becomes the core element of the transaction structure.

This structure forms a chain connection. In the Bitcoin network, every legitimate transaction can be traced back to the output of one or more previous transactions. The starting point of these transaction chains is the mining reward, and the end point is the transaction output that has not yet been spent. All unspent outputs in the network are collectively called UTXO (Unspent Transaction Output) of the Bitcoin network.

In the Bitcoin network, the input of each new transaction must be an unspent output. In addition, each input also requires the corresponding private key signature of the previous output. Each node in the Bitcoin network stores all UTXOs currently on the blockchain to verify the legitimacy of new transactions. Through UTXO and signature verification mechanisms, nodes are able to verify the legitimacy of new transactions without tracing the entire transaction history, thus simplifying the network operation and maintenance process.

Bitcoin’s unique transaction structure is designed in line with its white paper "Bitcoin: A Peer-to-Peer Electronic Cash System". Bitcoin is an electronic cash system, and its transaction structure simulates cash transactions. process, the amount that can be spent on an address depends on the amount of cash received previously. Each transaction requires all the cash on this address to be spent as a whole, and the output address of the transaction is usually a receiving address and a finding address. Zero address, like change when using cash transactions in supermarkets.

Scripts play a vital role in the Bitcoin network. In fact, each output of a Bitcoin transaction actually points to a script rather than a specific address. These scripts are like a set of rules that define how the recipient can use the assets locked in the output.

The legality verification of transactions relies on two scripts: lock script and unlock script. A locking script exists within a transaction's output and defines the conditions required to unlock that output. Unlocking scripts correspond to this and must follow the rules defined by locking scripts to unlock UTXO assets. These scripts are located in the input part of the transaction. The flexibility of this scripting language allows Bitcoin to achieve a variety of condition combinations, demonstrating its characteristics as a "partially programmable currency."

In the Bitcoin network, each node runs a stack interpreter that interprets these scripts based on the "first in, first out" rule.

The most classic Bitcoin scripts mainly have two commonly used types: P2PKH (Pay-to-Public-Key-Hash) and P2SH (Pay-to-Script-Hash). P2PKH is a simple transaction type in which the recipient simply signs with the corresponding private key to use the asset. P2SH is more complex, such as in the case of multi-signatures, where a combined signature of multiple private keys is required to use the asset, or.

These scripts and verification mechanisms together form the core operation of the Bitcoin network, ensuring the security and flexibility of transactions.

For example, in Bitcoin, the output script rules of P2PKH are as follows:

Pubkey script: OP_DUP OP_HASH160 OP_EQUALVERIFY OP_CHECKSIG

Input requires a signature

Signature script: sig

The output script rules of P2SH are as follows:

Pubkey script: OP_HASH160 OP_EQUAL

Input requires multiple signatures List

Signature script: [sig] [sig...]

In the above two script rules, Pubkey script represents the locking script, and Signature script represents the unlocking script. The words starting with OP_ are related script commands and are also instructions that the node can parse. These command rules are divided according to different Pubkey scripts, which also determine the rules for unlocking scripts.

The scripting mechanism in Bitcoin is relatively simple. It is just a stack-based engine that interprets relevant OP instructions. There are not too many script rules that can be parsed, and it cannot implement very complex logic. But it provided a prototype for blockchain programmability, and some subsequent ecological projects were actually developed based on scripting principles. With the updates of Segregated Witness and Taproot, the types of OP instructions have become more abundant, the size of the scripts that can be included in each transaction has been expanded, and the Bitcoin ecosystem has ushered in explosive growth.

The popularity of inscription technology cannot be separated from the popularity of Bitcoin SegWit and Taproot updates.

Technically, the more decentralized a blockchain is, the lower its efficiency is usually. Taking Bitcoin as an example, the size of each block remains at 1MB, which is the same size as the first block originally mined by Satoshi Nakamoto. Faced with the problem of expansion, the Bitcoin community did not choose the path of simply and directly increasing the block size. Instead, they adopted an approach called Segregated Witness (SegWit), an upgrade scheme that does not require a hard fork and aims to improve the network by optimizing the data structure in the blocks. processing power and efficiency.

In Bitcoin transactions, the information of each transaction is mainly divided into two parts: basic transaction data and witness data. Basic transaction data includes key financial information such as account balances, while witness data is used to verify the user's identity. For users, their main concern is information directly related to assets, such as account balances, while identity verification details do not require too many resources in transactions. In other words, the party receiving the asset is primarily concerned with whether the asset is available and does not have to pay too much attention to the details of the sender.

However, in the transaction structure of Bitcoin, witness data (i.e. signature information) occupies a large amount of storage space, which leads to reduced transfer efficiency and increased transaction packaging costs. In order to solve this problem, Segregated Witness (SegWit) technology was introduced. Its core idea is to separate the witness data from the main transaction data and store it separately. The result of this is optimized storage space usage, thus increasing transaction efficiency and reducing costs.

In this way, the original 1M As long as the small blocks remain unchanged, each block can accommodate more transactions, and Segregated Witness data (that is, various signature scripts) can occupy an additional 3M space, laying a storage foundation for the enrichment of Taproot script instructions.

Taproot is an important soft fork upgrade of the Bitcoin network, designed to improve the privacy, efficiency, and smart contracts of Bitcoin scripts processing capabilities. This upgrade is considered a major improvement since the 2017 SegWit upgrade.

This Taproot upgrade includes three different Bitcoin Improvement Proposals (BIPs): Taproot (Merkle Abstract Syntax Tree, MAST), Tapscript, and a new multi-signature friendly digital signature scheme , called "Schnorr signature". The purpose of Taproot is to provide Bitcoin users with multiple benefits, including increased transaction privacy and reduced transaction costs. Additionally, it will enhance Bitcoin’s ability to perform more complex transactions, thereby expanding its scope of applications.

The Taproot update directly affects three ecologies: one is the ordinals protocol, which uses Taproot’s script-path spend scripts to implement additional data; the other is the upgrade of the Lightning Network to Taproot Asset, from simple Point-to-point BTC payment has evolved into point-to-many and supports the issuance of new assets; another one is the newly proposed BitVM, which uses op_booland and op_not in Taproot to "etch" the bool circuit into the Taproot script to realize the smart contract virtual machine function .

Ordinals is a protocol invented by Casey Rodarmor in December 2022. It gives each Satoshi a unique serial number and Track them in transactions. Anyone can attach additional data, including text, images, videos, etc., to UTXO's Taproot script through Ordinals.

Friends who are familiar with Ordinals must know: the total number of Bitcoins is 21 million, and each Bitcoin contains 10^8 Satoshi (Satoshi), so there are a total of 21 million*10^8 on the Bitcoin network Satoshi, the Ordinals protocol will distinguish these satoshis, and each satoshi has a unique number. This is theoretically possible, but in practice it cannot be done.

Because the BTC network is resistant to dust attacks, there is a limit of at least 546 satoshis (segwit is at least 294 satoshis) for transfers, that is, transfers of 1 satoshi and 1 satoshi are not allowed. Depending on the address type of the transfer, At least 546 Satoshi or 294 Satoshi must be transferred, and according to the first-in-first-out numbering theory of Ordinals, at least Satoshi No. 1 to Satoshi No. 294 of each block are indivisible.

So the so-called engraving is not engraved on a certain Satoshi, but engraved in the script of a transaction, and this transaction must contain at least a transfer of 294 Satoshi, and then the centralized indexer (such as unisat) to track and identify the transfer of 294 satoshis or 456 satoshis.

In principle, Taproot scripts can only be spent from existing Taproot output, so inscriptions should theoretically is conducted through a two-stage commit/reveal process. First, in the commit transaction, create a Taproot input based on the content of the script path spend, and specify the spending/revealed signature conditions in the output. Second, in a reveal transaction, the output created by the commit transaction is spent, revealing the inscription content on the chain.

However, in the actual indexer scenario, we do not pay much attention to the role of revealing transactions. Instead, we directly read a script fragment consisting of an OP_FALSE OP_IF ... OP_ENDIF in the input script and read from it. The content of the inscription.

Because the combination of OP_FALSE and OP_IF instructions will cause the script to not be executed, bytes of arbitrary content can be stored in it without affecting the logic of the original script.

A text inscription containing the string "Hello, world!" is serialized as follows:

OP_FALSE OP_IF OP_PUSH "ord"OP_1OP_PUSH

"text/ plain;charset=utf-8"OP_0OP_PUSH "Hello, world!"OP_ENDIF

Ordinals protocol essentially serializes this code into the Taproot script.

We find a transaction from the chain to explain in detail the encoding principle of ordinals:

https://explorer.btc.com/btc/transaction/885d037ed114012864c031ed5ed8bbf5f95b95e1ef6469a808e9c08c4808e3ae

We can view the details of this transaction:

We analyze the encoding of the witness field starting from 0063 (OP_FALSE OP_IF), and we can understand the serialized encoding content:

So as long as we can decode this part of the code in the witness script, we can know the inscribed content. What is encoded here is plain text information, and other data such as html, pictures, videos, etc. are also similar.

Theoretically, you can also define your own encoding content, or even encrypted content that only you know, but these content cannot be displayed in ordinary browsers.

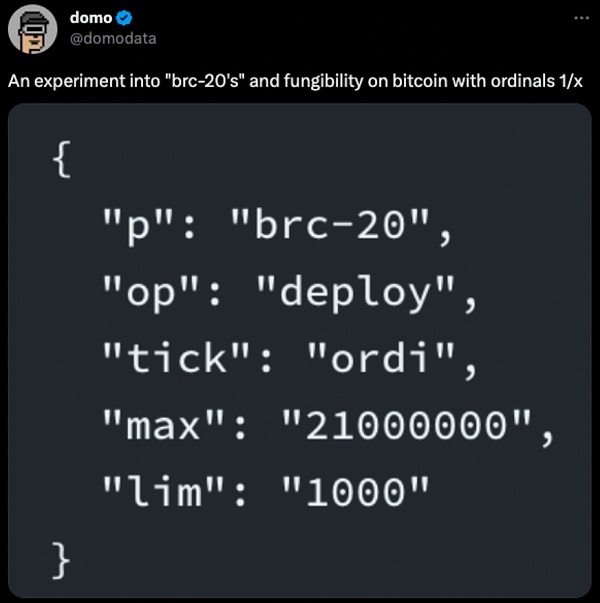

On March 9, 2023, an anonymous Twitter user named domo posted a tweet on Ordinals Create a homogeneous token standard on top of Protocol, called the BRC20 standard. The idea is that JSON string data can be inscribed into Taproot scripts via the Ordinals protocol to deploy, mint, and transfer fungible BRC-20 tokens.

Figure 1: The humble beginnings of the BRC-20 token (domo’s first post on the subject)

Source: Twitter (@domodata)

Figure 2: Three possible initial operations of the BRC-20 token (p = protocol name, op = operation, tick = ticker/identifier, max = maximum supply, lim = minting limit, amt = quantity)

Source: https: //domo-2.gitbook.io/brc-20-experiment/, Binance Research

The initiator of Token deploys the brc20 token on the chain through deploy, and then the participants use mint To obtain Token at almost no cost (only mining fees), when the number of mint exceeds the max, the inscription of the mint inscription will be considered invalid by the indexer. After this, the address that owns the Token can transfer the Token through the transfer inscription.

It is worth noting that Casey, the founder of Ordinals, is very unhappy that BRC-20 transactions account for the majority of the Ordinals protocol. He has publicly stated that the BRC-20 brought a load of garbage to the Ordinals he created. Therefore, the Casey team publicly sent a letter asking Binance to delete Ordinals in the ORDI token introduction. He did not want the Ordinals protocol to be related to ORDI.

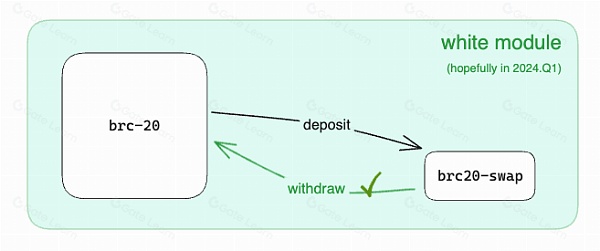

BRC20 swap

Currently the largest market, indexer and wallet supply for inscription trading The merchant Unisat has proposed the BRC20 swap protocol for BRC20 transactions, which is now available for early users to try out.

Previous inscription transactions could only be carried out through a method called PSBT (Partially Signed Bitcoin Transaction), which is similar to Opensea’s off-chain signature scheme and is “matched” through centralized services. Signatures of the buyer and seller. This results in that BRC20 assets can only be traded through pending orders like NFT assets, and the liquidity and transaction efficiency are very low.

brc20 swap introduces a mechanism called a module in the json string of the brc20 protocol. In this module, a set of scripts similar to smart contracts can be deployed. Taking the swap module as an example, the user can lock BRC20 into the module through transfer, that is, initiate a transfer transaction to himself, but the inscription in the transaction is locked in the module. After the user completes the transaction or withdraws from LP, You can initiate a transaction and withdraw the brc20 tokens.

Currently, brc20 swap operates in the extended mode of the black module. The black module is for security reasons. Without consensus and verification, the funds that users can withdraw are determined by the sum of funds in the module. , that is, no user can withdraw more than the total assets locked into the module.

When the behavior of the black module is blocked by the user Understand and execute, gradually become reliable, and gradually be accepted by more indexers, the product transitions from black module to white module, reaching consensus for upgrade. Users can freely deposit and withdraw assets.

In addition, because the brc20 agreement and even the entire The Ordinals ecosystem is still in its early stages, and Unisat occupies a greater influence and reputation. It provides complete indexing services such as transactions and balance inquiries for the protocol, and there is a single centralization risk. Its modular operation architecture allows more service providers to participate, thereby achieving a more decentralized index.

BRC420

The Brc420 protocol was developed by RCSV. They expanded upon the original inscription by adding a recursive index. More complex asset formats are defined recursively. At the same time, Brc420 establishes a binding relationship between usage rights and royalties on the basis of a single inscription. When a user mints assets, he or she needs to pay royalties to the creator, and when he owns an inscription, he can allocate the right to use it and set a price for it. This move can encourage more innovation in the Ordinals ecosystem.

The proposal of Brc420 provides a broader imagination space for the inscription ecology. In addition to constructing a more complex metaverse through recursive references, smart contract ecology can also be constructed through recursive references of code inscriptions.

ARC20

The ARC20 token standard is provided by the Atomics protocol. In this standard, "atoms" are the basic units built on Bitcoin. Above the smallest unit Satoshi (sat). This means each ARC20 token is always backed by 1 sat. Additionally, ARC20 is the first token protocol to mint via Proof of Work (PoW) inscriptions, allowing participants to directly mine inscriptions or NFTs in a manner similar to mining Bitcoin.

Equating 1 ARC20 token to 1 sat brings several benefits:

1. First, the value of each ARC20 token will never be less than 1 sat, which allows Bitcoin to act as a “digital gold anchor” in the process.

2. Secondly, when verifying a transaction, you only need to query the UTXO corresponding to sat, which is in contrast to BRC20, which requires off-chain ledger status records and the complexity of a third-party sequencer.

3. In addition, all operations of ARC20 can be completed through the Bitcoin network without additional steps.

4. Finally, due to the composability of UTXO, the direct exchange of ARC20 tokens and Bitcoin can theoretically be achieved, which provides the possibility of future liquidity.

The Atomics protocol sets special prefix parameters for Bitwork Mining for ARC20 tokens. Token issuers can choose a special prefix, and users must calculate the matching prefix through CPU mining before they are eligible to mint the ARC20 token. This “one CPU, one vote” model is consistent with the philosophy of Bitcoin fundamentalists.

The inscription seems to be just a "harmless" text uploaded to the chain and parsed through a centralized indexer. It seems to be a security issue. This is just a security consideration for centralized services, but in terms of on-chain security, you still need to pay attention to the following points:

1. Increase the burden on nodes

Inscription Will increase the size of Bitcoin blocks, which will increase the resources required by nodes to propagate, store and verify blocks on the network. If there are too many inscriptions, it will reduce the decentralization of the Bitcoin network and make the network more vulnerable to attacks.

2. Reduced security

Inscriptions can be used to store any type of data, including malicious code. If malicious code is added to Bitcoin blocks, it could lead to network security vulnerabilities.

3. Transactions need to be structured

Inscription transactions need to be structured, and pay attention to the first-in, first-out rule of ordinals to prevent inscriptions from being caused by negligence. indexability is destroyed.

4. There are risks in buying and selling

Inscription’s trading market, whether it is OTC or PSBT, has the risk of asset loss.

The following are some specific security issues:

1. The orphan block rate and fork rate increase

The inscription will increase the area block size, which results in increased orphan block rate and fork rate. Orphan blocks refer to blocks that are not recognized by other nodes, and forks refer to the existence of multiple competing blockchains in the network. Orphaned blocks and forks reduce the stability and security of the network.

2. Attackers tamper with inscriptions

An attacker can take advantage of the openness of inscriptions to conduct tampering attacks.

For example, an attacker can replace the information stored in the inscription with malicious code to penetrate the indexer's server or invade the user's device through a Trojan horse.

3. Improper use of wallet

If the wallet is used improperly and the wallet cannot index the inscriptions, it is likely that the inscriptions will be transferred by mistake, resulting in asset losses. .

4. Phishing or Fraud

An attacker may use fake unisat and other indexer websites to induce users to conduct inscription transactions, thereby stealing user assets.

5. PSBT signature omission

Atomics Market once used the wrong signature method, causing damage to user assets

Related Read:

<The Analysis of the Atomicals Market User Asset Loss>

https://metatrust.io/company/blogs/ post/the-analysis-of-the-atomicals-market-user-asset-loss

To address these security issues, the following measures can be taken:

1. Limit the size of inscriptions

You can limit the size of inscriptions to reduce the impact on node burden, which Luke mentioned at the beginning of the article is already doing.

2. Encrypt the inscription

The inscription can be encrypted to prevent malicious code attacks.

3. Use trusted inscription sources

You can use trusted inscription sources to prevent signature issues and phishing.

4. Use a wallet that supports inscriptions

Use a wallet that supports inscriptions for transfer activities.

5. Pay attention to the review of inscription codes and related scripts

In the new experiments of brc20-swap and recursive inscriptions, due to the introduction of codes and related scripts , need to ensure the security of these codes and scripts.

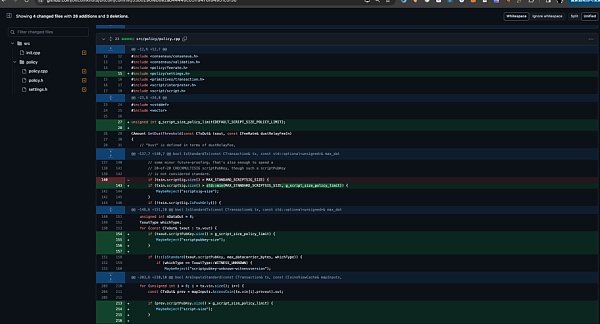

From a technical and security perspective, Bitcoin Inscription is essentially a rule-bypassing vulnerability. The taproot script does not appear to store data, and there are also some security issues with it. Luke's changes to the bitcoin core code are correct from a security perspective. Luke did not directly modify the consensus layer of Bitcoin, but chose to adjust the Spam Filter (strategy filter) module so that nodes can automatically filter out Ordinals transactions when receiving P2P broadcast messages. In this strategy filter, there are several functions named isStandard() that check whether various aspects of the transaction meet the standards. If a transaction does not meet the criteria, the transaction received by the node will be quickly discarded.

In other words, although Ordinals transactions can eventually be added to the blockchain, most nodes will not add this type of data to the transaction pool, which will increase the number of mining pools willing to package Ordinals data onto the chain. Receive delay. However, if a mining pool broadcasts a block containing a BRC-20 transaction, other nodes will still recognize it.

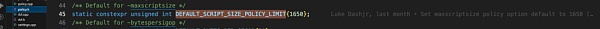

Luke has rolled out changes to the policy filter (policy) in the Bitcoin Knots client, and plans to introduce similar changes in the Bitcoin Core client. In this revision, he introduced a new parameter called g_script_size_policy_limit, which is used to limit the size of scripts in several different places. This change means there will be additional limitations on script size when processing transactions, affecting how transactions are accepted and processed.

Currently, the default value of this parameter It is 1650Bytes. Any node client can set it through the parameter -maxscriptsize at startup:

However, even if the code is updated, it will still be a long time before all miner nodes are updated to the new version. , during this time, innovators in the Inscription community should be able to create more secure protocols.

Metatrust Labs has scored and monitored Inscription investment risks on the metaScore platform through on-chain data and asset tracking. At the same time, it has also launched a Bitcoin network monitoring rule engine on the metaScout platform to help investment The author monitors real-time data from Bitcoin Inscription.

In this issue, we explore the technical principles and possible safety issues of the popular inscription ecology. In the next issue, we will bring you the more complex Taproot circuit etching technology—— bitVM, stay tuned.

16% of Web3 companies use .io. ccTLDs have been removed five times in history.

JinseFinance

JinseFinanceAI startups can use these idle graphics cards to bring profits to those who have graphics cards while at a lower price than traditional quotations. If there is now a platform that connects these demands and resources, a classic platform business model will be born.

JinseFinance

JinseFinanceOn June 6, 2024, Binance issued an announcement stating that Binance’s new coin mining has now launched the 55th project IO.NET (IO), a decentralized artificial intelligence computing and cloud platform.

JinseFinance

JinseFinanceIO.net announces IO token launch post-Bitcoin halving, aiming to enhance network capabilities, decentralize power, and foster community engagement.

Weiliang

WeiliangAmid strong price gains for many cryptocurrencies, a major recent development has been undervalued. The tokenization of “real world assets” is also booming.

JinseFinance

JinseFinanceBitcoin rally boosts Binance, with $10B+ volume. Institutional trade sizes rise. Legal challenges loom, new CEO aims to rebuild trust. BNB token remains resilient.

Huang Bo

Huang BoCompared with PoW, PoS is a better blockchain security mechanism.

链向资讯

链向资讯Compared with PoW, PoS is a better blockchain security mechanism.

Ftftx

Ftftx Bitcoinist

BitcoinistPanelists discussed whether DAOs could have sufficient legal power not only to replace corporate structures, but also to challenge governance models.

Cointelegraph

Cointelegraph