Author: Zheng Jie, Data Researcher at Artemis; Cosmo Jiang, Portfolio Manager at Pantera Capital. Translated by: Shaw, Golden Finance. Abstract: Currently, cryptocurrency data providers display widely varying supply metrics for the same token, significantly impacting market capitalization or valuation multiples (e.g., market cap/revenue). Artemis and Pantera Capital propose a simple framework called "Outstanding Supply," which measures total supply minus the total number of shares held by the protocol. This is analogous to "Outstanding Shares" in the stock market, which measures total issued shares minus total treasury shares. Our goal is to provide investors with a clearer valuation comparison between tokens and stocks.

Introduction

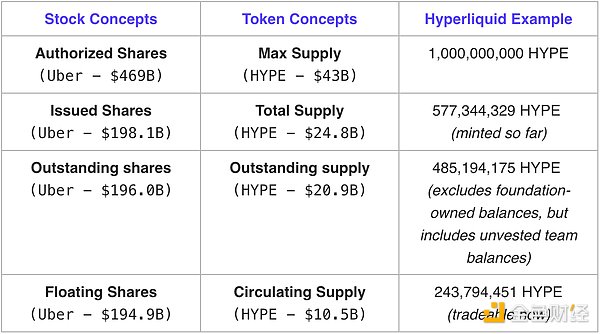

When investors purchase stocks, they typically focus on the following key figures to understand the stock's issuance:

Authorized Shares: The total number of shares a company is legally permitted to issue.

Issued Shares: The number of shares a company has actually issued since its inception.

Outstanding Shares: The number of shares currently held by all investors. This figure does not include treasury shares held by the company itself.

Free Float: The number of shares actually available for public trading.

Why is it important?

This data is crucial for investors in the following ways:

Ownership Definition: Investors can use this data to clearly understand the economic stake they have acquired in a company.

Supply Risk Assessment: This helps investors predict the potential for new stock supply to the market.

Liquidity Considerations: This helps investors gauge the ease with which a stock can be traded in the market, that is, the likelihood of trading without significantly affecting the stock price. Let’s look at Uber.

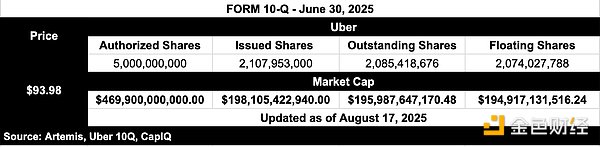

Source: Artemis

Let’s look at Uber.

Authorized Shares: 5 billion → The maximum number of shares Uber is authorized to issue. Public market investors almost never mention authorized shares.

Shares Issued: Approximately 2.1 billion shares → The number of shares Uber has actually issued

Shares Float: Approximately 2.09 billion shares → The number of shares Uber investors currently hold. This is the number of shares public market investors really care about.

Shares Free Float: Approximately 2.07 billion shares → The number of shares that can actually be traded on the market.

Now, imagine if Uber were valued based on its authorized shares. It would look like a company with a market capitalization of $469 billion and a price-to-earnings ratio of 70, which doesn't seem reasonable. Authorized shares are not a number that any investor should use to value a company, as authorized shares multiplied by the stock price has no economic significance.

However, in reality, investors value Uber based on its outstanding shares (approximately 2.09 billion shares), giving it a market capitalization of nearly $195.9 billion (as of August 17, 2025) and a forward price-to-earnings ratio of 30. Shares outstanding reflect the economic reality of who owns a share of a company's value.

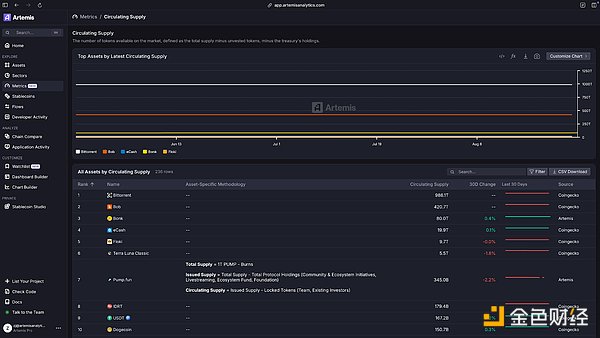

The Problem with Current Token Supply Metrics

In the cryptocurrency space, most investors focus solely on the token's circulating supply. Circulating supply = tokens available for public trading. However, the definition of circulating supply varies widely: Some projects count locked tokens, some don’t. Some include reserve wallets, some don’t. Some ignore burned tokens. Some projects quietly release tokens without any clear disclosure. On the other hand, investors often see FDV (fully diluted valuation). FDV (Fully Diluted Valuation) = Token Price × Total Supply

This is like valuing Uber as if all of its existing shares could be traded tomorrow, or as mentioned above with a $469 billion market cap, which is also economically incorrect.

Thus, investors are left with a choice between FDV (all issued tokens) or circulating supply (which is confusingly and inconsistently defined and, crucially, often excludes unvested and uncirculated tokens).

Why “Issued Supply” Is a Useful Middle Value

This is where “Issued Supply” comes in. “Issued Supply” counts all tokens ever created while excluding any tokens held by the protocol that are not actually in circulation, such as those held by foundations, reserves, or labs. Think of it as the cryptocurrency equivalent of "shares outstanding." "Issued supply" is more relevant than fully diluted valuations; compared to circulating supply, "issued supply" offers a clearer definition and more consistent standards. "Issued supply" is a middle ground based on economic reality and is trustworthy to investors.

Real Token Example - Hyperliquid

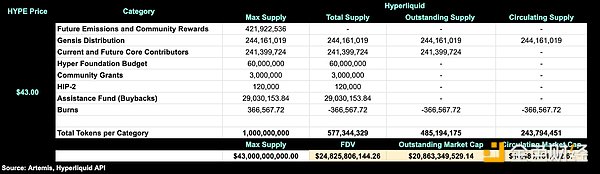

Source: Artemis

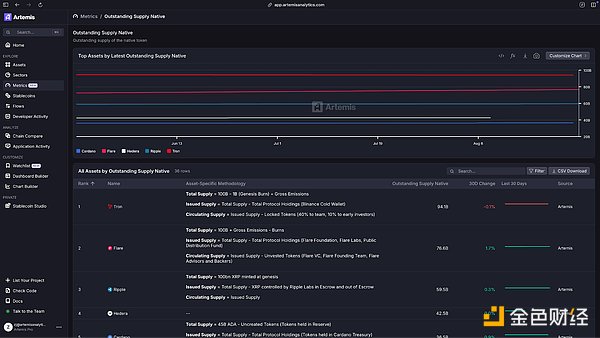

Total Supply as a metric, but this still overestimates valuations because it includes protocol holdings. For example, of Hyperliquid's 1 billion HYPE tokens issued, 6% (or 60 million tokens) are held by the Hyper Foundation. These tokens belong to the protocol and can be used for protocol operations, project funding, or team compensation. From an economic perspective, they are fundamentally different from tokens held by investors. Based on this, Hyperliquid's issued supply (approximately $20.8 billion) provides the closest perspective to its "true" market capitalization. This concept is similar to the concept of outstanding shares in the stock market, which includes all tokens held by investors and excludes treasury shares. In contrast, Hyperliquid's circulating supply valuation (approximately $10.5 billion) more accurately reflects the liquidity and tradability of the HYPE token in the real market, similar to the concept of free float in the stock market. These supply metrics are important. When we calculate valuation multiples like the price-to-earnings (P/E) or price-to-sales (P/S) ratio based on fully diluted valuation (FDV), these multiples often become artificially inflated. This phenomenon is particularly evident in comparative analysis, where projects like Hyperliquid with a significant amount of uncirculated supply are penalized in terms of valuation compared to their peers. Note: Our definition of "total supply" differs from Coingecko's. Coingecko includes all tokens in its calculations regardless of ownership. Our calculations differ by deducting permanently destroyed and unmined tokens to ensure that "total supply" accurately reflects the number of tokens in existence that could impact a project's valuation. Reasons for Discrepancies in Existing Data: Currently, most investors looking at the $HYPE token will find significant discrepancies between the data sources they receive: DefiLlama's Outstanding FDV (Fully Diluted Flow Valuation) data indicates Hyperliquid's market capitalization at $27.8 billion. Assuming a token price of $43, a simple calculation indicates that their stated circulating supply is approximately 647 million. However, the actual number of Hyperliquid tokens minted to date is only 577 million. This suggests that DefiLlama's data is a significant overestimation. CoinGecko's circulating supply estimate is $14.5 billion. Based on this valuation and current token prices, they extrapolate approximately 337 million tokens to circulation. However, this figure is likely an overestimate. This is because Coingecko's calculations do not fully exclude all wallets held by protocols, such as those held by the Hyper Foundation, community grants, and aid fund wallets. In the real world, many tokens held in these wallets have yet to enter public trading, so the "true" number of circulating tokens is likely lower than Coingecko's figures. The challenge is that these discrepancies can lead to valuation discrepancies of up to billions of dollars. In the absence of a unified, clear standard, different researchers or investors analyzing the same token are likely to have wildly different perceptions of its true size. All of this highlights the urgent need to clarify "issued supply" and develop a more accurate and reasonable concept of "circulating supply." The concept of "issued supply" provides a transparent standard for cryptocurrency research and analysis, comparable to traditional stock markets, helping to improve accuracy and comparability. Artemis Solution: Issued Supply and Optimized Circulating Supply Total Supply Definition: Total supply refers to the total number of tokens created (minted), minus the number of tokens destroyed. It can be roughly compared to issued shares in the stock market.

Total Supply as a metric, but this still overestimates valuations because it includes protocol holdings. For example, of Hyperliquid's 1 billion HYPE tokens issued, 6% (or 60 million tokens) are held by the Hyper Foundation. These tokens belong to the protocol and can be used for protocol operations, project funding, or team compensation. From an economic perspective, they are fundamentally different from tokens held by investors. Based on this, Hyperliquid's issued supply (approximately $20.8 billion) provides the closest perspective to its "true" market capitalization. This concept is similar to the concept of outstanding shares in the stock market, which includes all tokens held by investors and excludes treasury shares. In contrast, Hyperliquid's circulating supply valuation (approximately $10.5 billion) more accurately reflects the liquidity and tradability of the HYPE token in the real market, similar to the concept of free float in the stock market. These supply metrics are important. When we calculate valuation multiples like the price-to-earnings (P/E) or price-to-sales (P/S) ratio based on fully diluted valuation (FDV), these multiples often become artificially inflated. This phenomenon is particularly evident in comparative analysis, where projects like Hyperliquid with a significant amount of uncirculated supply are penalized in terms of valuation compared to their peers. Note: Our definition of "total supply" differs from Coingecko's. Coingecko includes all tokens in its calculations regardless of ownership. Our calculations differ by deducting permanently destroyed and unmined tokens to ensure that "total supply" accurately reflects the number of tokens in existence that could impact a project's valuation. Reasons for Discrepancies in Existing Data: Currently, most investors looking at the $HYPE token will find significant discrepancies between the data sources they receive: DefiLlama's Outstanding FDV (Fully Diluted Flow Valuation) data indicates Hyperliquid's market capitalization at $27.8 billion. Assuming a token price of $43, a simple calculation indicates that their stated circulating supply is approximately 647 million. However, the actual number of Hyperliquid tokens minted to date is only 577 million. This suggests that DefiLlama's data is a significant overestimation. CoinGecko's circulating supply estimate is $14.5 billion. Based on this valuation and current token prices, they extrapolate approximately 337 million tokens to circulation. However, this figure is likely an overestimate. This is because Coingecko's calculations do not fully exclude all wallets held by protocols, such as those held by the Hyper Foundation, community grants, and aid fund wallets. In the real world, many tokens held in these wallets have yet to enter public trading, so the "true" number of circulating tokens is likely lower than Coingecko's figures. The challenge is that these discrepancies can lead to valuation discrepancies of up to billions of dollars. In the absence of a unified, clear standard, different researchers or investors analyzing the same token are likely to have wildly different perceptions of its true size. All of this highlights the urgent need to clarify "issued supply" and develop a more accurate and reasonable concept of "circulating supply." The concept of "issued supply" provides a transparent standard for cryptocurrency research and analysis, comparable to traditional stock markets, helping to improve accuracy and comparability. Artemis Solution: Issued Supply and Optimized Circulating Supply Total Supply Definition: Total supply refers to the total number of tokens created (minted), minus the number of tokens destroyed. It can be roughly compared to issued shares in the stock market.

The total supply is calculated as: Total Supply = Maximum Supply - Number of Tokens Not Created - Number of Tokens Destroyed

Source: Artemis

Issued Supply (New Metric)

Source: Artemis

The formula for calculating circulating supply is: Circulating supply = Issued supply - Number of locked tokens

Why are these two indicators needed?

Alex

Alex

Alex

Alex JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Edmund

Edmund JinseFinance

JinseFinance JinseFinance

JinseFinance Future

Future Cointelegraph

Cointelegraph