Author: Francesco, source author blog; Compiled by: Songxue, Golden Finance

Rehypothecation seems to be positioned as one of the main narratives driving 2024. However, while many people talk about how restaking works and its benefits, it’s not all rosy.

This article aims to take a step back and analyze restaking from a higher level, highlighting the risks and answering the question: Is it really worth it?

Let’s start with a quick introduction to this topic.

1. What is re-pledge?

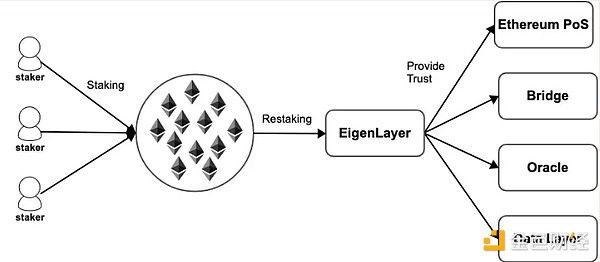

Ether The Proof of Stake (PoS) of Ethereum acts as a distributed trust mechanism, and participants use their rights and interests to ensure the security of the Ethereum network.

Re-staking means that the same stake used to secure Ethereum PoS can now be used to secure many other networks.

Re-staking can be interpreted as programmable staking, where users choose to participate in any positive or negative incentives that secure other infrastructure.

In practice, EigenLayer's re-stakeholders provide economic trust (in the form of staked ETH) so that slashing can be done against anything objectively verifiable.

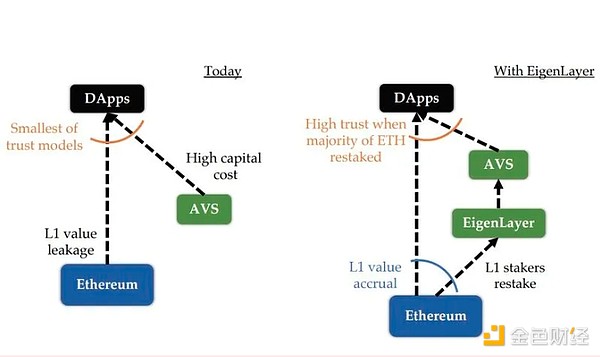

EigenLayer is “modularizing” Ethereum’s distributed trust so that AVS services can leverage it without needing to launch their validator sets, effectively lowering the barrier to entry into the market.

Typically, these modules require an active verification service with its own distributed verification semantics for verification. Typically, these Active Validation Services (“AVS”) are either secured by their own native token or are of a permissioned nature.

2. Why do some people Will do this?

Simply put, this isbecause of financial incentives and benefits.

If Ethereum’s staking returns average around 5% per year, re-staking may provide attractive additional returns. Estimates for these rewards cannot be provided at this time as they will depend on demand and supply dynamics on the Eigen Marketplace.

However, this creates additional risks for stakers.

In addition to the inherent risk of leveraging their staked ETH, when users choose to re-stake their tokens, they are essentially delegating power to the EigenLayer contract in the event of an error, In the case of double signature, the authority to reduce its rights and interests will be reduced.

Therefore, re-staking adds a layer of risk, as the re-stakeholder may be slashed on ETH, on the re-staking layer, or both.

Is the extra income worth staking again?

R(isk)-Staking

For stakers, re-staking means you can decide to join as many networks as possible and increase your returns< /strong>, so EigenLayer calls itself the "Airbnb of distributed trust."

Not everything is so rosy, however, as re-staking adds some significant risks:

ETH required staked (or LST - therefore not liquid);

EigenLayer smart contract risks;

Protocol-specific cuts Conditions;

Liquidity risk;

Centralization risk.

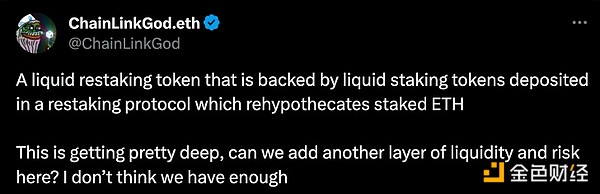

In effect, by re-staking, users are taking a token that is already at risk (due to staking) and adding additional risk on top of it, ultimately creating layers upon layers of risk that look like:

In addition, for these primitives Performing additional development adds more complexity and additional risks.

In addition to the risks to individual restakers, the Ethereum developer community has raised issues related to restaking, particularly in Vitalik’s famous article on not overloading the Ethereum consensus. The problem with re-staking is that it opens up new risk avenues for staked ETH to protect the mainnet, using part of it to protect other chains (chosen by the staker).

So if they misbehave according to other protocol rules (maybe have bugs or weak security), their stake will be slashed.

In this regard, developers and EigenLayer are trying their best to coordinate their efforts to ensure that Ethereum is not weakened by these technological advancements.

Re-adjustment of the most important "layer" to protect Ethereum is indeed not an easy task.

Furthermore, a key aspect in this regard is the level of risk management allowed to the rehypothecater.

Many re-staking projects leave the whitelisting process of AVS to their DAO. However, as a restaker, I would like to be able to personally review and decide which AVS to restake to avoid being slashed by malicious networks and reduce the possibility of new attack vectors.

Overall, restaking is an interesting new primitive worth investigating.

However, the concerns of Vitalik and others cannot be ignored. When talking about restaking, it is important to remember how this affects the security model of the Ethereum mainnet.

However, a fair look at restaking is that it provides an additional layer of risk on top of one of the most important mechanisms for protecting Ethereum.

Ultimately, whether re-staking is worth it is a personal choice.

Re-pledge risk:

Collusion risk: many operations Players may attack a group of AVS at the same time and compromise security;

Risk reduction: Users who re-stake may face reduction penalties from ETH and AVS;

Single point of failure: receiving withdrawal certificates from Ethereum certificates (system risk of the main network);

Centralization risk of validators;

Added additional risk to protect Ethereum staking.

3. Attraction to Institutions

Perhaps surprisingly, many institutions have expressed interest in re-staking as an additional option beyond staking ETH. Reward interest.

Nevertheless, they will likely re-hypothecate through their custodian rather than joining any other services that would expose them to additional risk of haircuts.

Given the risks mentioned previously, the highest interest in re-pledge will likely come from retail investors or institutions.

For those already involved, the additional benefits on top of native ETH staking are attractive, but for those who already understand the risks, they are not life-changing benefits. .

This opens up new use cases for Ethereum as a financial instrument.

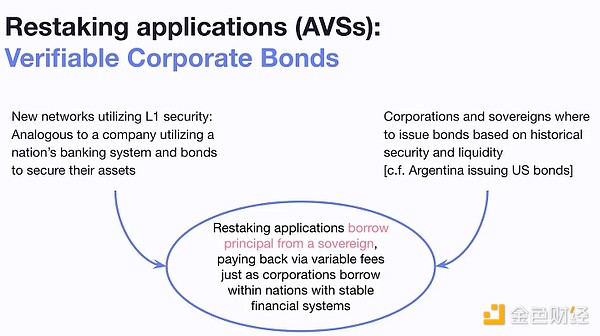

A particularly interesting comparison is comparing rehypothecation applications to "corporate bonds."

The new network hopes to achieve L1 security, similar to the way a company or country uses its financial system to create bonds and protect its assets.

In the crypto space, Ethereum is the most widespread and liquid network, probably the only one capable of sustaining such a market, and the most secure from a similar point of view as countries in traditional financial economies .

Currently, for Most of the interest in staking appears to be driven by speculation about the EigenLayer airdrop, which may just be the largest airdrop in crypto history.

What will happen after the airdrop?

Perhaps a realistic risk/reward analysis might nudge some to look for other avenues that might be more fruitful.

I would venture to say that a high percentage of capital put into re-staking may be capital that was hired and then potentially left after the airdrop.

Isolating the speculative component will be an essential factor in assessing the true interest of users in this new primitive.

Personally, I think the re-hypothecation narrative is a little overhyped and the risks involved need to be carefully evaluated.

Summary

Due to re-staking, AVS Ethereum's highly robust security layer can be leveraged at launch, lowering the cost barrier.

Users benefit from increased capital efficiency by selectively re-staking their ETH, thereby receiving more staking rewards.

Rehypothecation adds additional risk on top of other risks.

Restaking is an exciting primitive that inspires new use cases.

While full development of the Eigen market will be completed in about a year, there are already some interesting re-staking experiments being explored.

Some of the concerns raised by Vitalik involve the concentration of staking power, to the detriment of staking alone.

It will be interesting to observe how EigenLayer will work with the Ethereum Foundation to solve these problems.

But beyond that, there are other problems.

What steps can we take to mitigate these risks?

Some solutions to mitigate the risk of re-staking include optimizing the parameters of re-staking (such as TVL caps, penalty amounts, fee allocations, minimum TVL, etc.), as well as ensuring that funds are spread across AVS.

An immediate step that rehypothecation protocols could consider is allowing users to choose different risk profiles when making rehypothecation deposits.

Ideally, every user should be able to evaluate and choose which AVS to stake again, without having to delegate the process to a DAO.

This requires a joint effort between AVS and EigenLayer to ensure there is an ongoing roadmap to minimize these risks.

The EigenLayer team has worked with the Ethereum Foundation to further align and ensure that restaking does not add systemic risk to Ethereum, liquid staking tokens, or the AVS that utilize it.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance XingChi

XingChi JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Alex

Alex JinseFinance

JinseFinance