The US economy in 2025 shows signs of weakness, consumer spending continues to decline, and labor market alarms are ringing. The Beveridge curve reveals a trend of fewer job vacancies and rising layoff risks, while the sluggish air passenger market reflects the shrinking consumer confidence. This article combines data from the International Air Transport Association (IATA), the US Census Bureau, and the Consumer Confidence Index (CCI) to analyze the relationship between consumer behavior and the job market, revealing the potential risks of economic downturn.

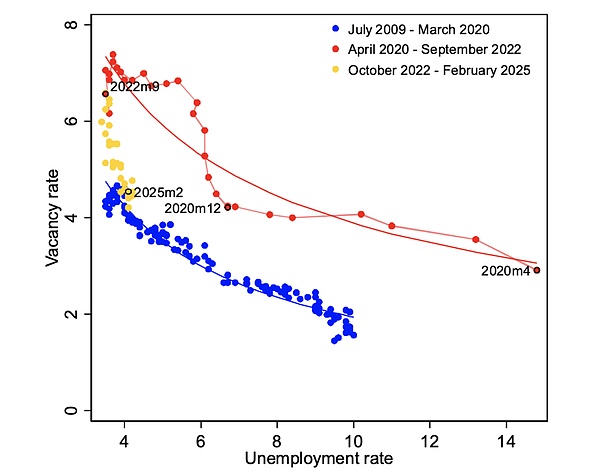

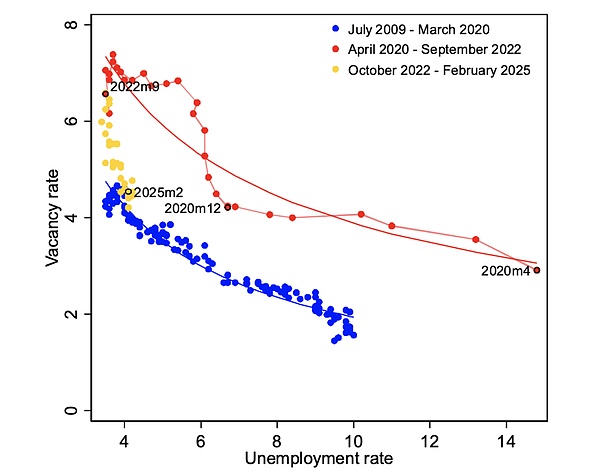

Beveridge Curve: Turning Point in the Labor Market

The Beveridge curve depicts the inverse relationship between job vacancy rate and unemployment rate: when the economy is booming, there are more job vacancies and the unemployment rate is low; when the economy is weak, vacancies decrease and the risk of layoffs increases. According to the JOLTS report of the U.S. Bureau of Labor Statistics (BLS), the job vacancy rate has dropped from a peak of 7.0% in 2022 to 5.8% in 2024, and further declined to 5.5% in the first quarter of 2025. This shows that corporate recruitment demand continues to shrink, and the Beveridge curve has moved significantly downward, approaching the post-epidemic low.

Over the past three years, stagnant recruitment activities have become the norm. For example, the average monthly number of job vacancies in 2024 was 8.7 million, a 17% decrease from 10.5 million in 2022. In 2025, companies further cut their recruitment plans, and some industries (such as aviation and retail) have shown signs of layoffs. The key question is whether the economy is shifting from "no recruitment" to "layoffs". If layoffs expand, consumers' concerns about job stability will further suppress spending, forming a vicious cycle.

Air passenger market: a barometer of consumer confidence

The air passenger market is an important indicator of consumer discretionary spending. IATA's 2025 outlook shows that the global airline industry is expected to achieve a net profit of US$36 billion, an increase of 11% from US$32.4 billion in 2024, but mainly due to a 13% drop in jet fuel prices (average US$85 per barrel in 2025, down from US$98 in 2024), rather than demand-driven. Total revenue is expected to reach US$979 billion, a year-on-year increase of 1.3%, but lower than the previous expectation of US$1 trillion. The number of passengers is expected to be 4.99 billion, a year-on-year increase of 4%, a 4.4% decrease from the previous forecast of 5.22 billion. Air cargo volume was revised down from 72.5 million tons to 69 million tons, an increase of only 1.5%, reflecting weak global trade.

In the United States, the "staycation" phenomenon is prominent. IATA data shows that demand for domestic routes in the United States will grow by only 2.8% in 2025, lower than the global average. Consumers tend to choose short trips or give up travel. For example, Philadelphia resident Brad Russell chose to drive on weekends instead of flying because tariffs pushed up the cost of living. American airlines (such as Delta and United Airlines) canceled their financial forecasts in early 2025, warning of a "demand shock." IATA head Willie Walsh pointed out that the profit per passenger per flight segment is only $7.2, and cost pressures (such as a 5% increase in airport fees) may force airlines to cut flights and employees, and the risk of layoffs in 2025 will increase by 30%.

Consumer spending falls back: Concerns behind the data

According to the U.S. Census Bureau, nominal retail sales fell 0.9% month-on-month in May 2025, and fell 0.1% (revised) in April, falling for two consecutive months. In the first five months of 2025, retail sales increased by 1.2% only in March due to tariff forward purchases, while the remaining four months (January -0.7%, February 0%, April -0.1%, May -0.9%) were weak. Excluding automobiles and parts, retail sales still fell 0.3% in May, lower than the expected 0.2% growth, and remained unchanged in April. Core retail sales (excluding automobiles, gasoline and building materials) fell 0.4%, the largest drop since 2023.

Spending at bars and restaurants was particularly sluggish, falling 1.2% in May, the worst performance since early 2023, reflecting consumers' concerns about their financial situation. A Bloomberg survey in May showed that 63% of respondents cut spending due to the risk of recession, 70% reduced dining out, 57% reduced entertainment spending, and 33% of those planning summer travel reduced their trips. The Consumer Confidence Index (CCI) fell from 70.4 in December 2024 to 65.8 in May 2025, close to the post-epidemic low, indicating increasing pessimism.

External pressure: the dual threat of oil prices and trade wars

Oil prices and trade wars further exacerbate economic pressures. In May 2025, Brent crude oil prices rose to $90 per barrel, up 10% from the average price in 2024, pushing up gasoline prices to $4.2 per gallon. The Energy Information Administration (EIA) predicts that if oil prices remain high, household transportation costs will increase by 15% in 2025, further squeezing disposable income. In terms of tariffs, the 25% tariff on China will take full effect in the first quarter of 2025, pushing up the prices of imported goods, but weak demand will curb inflation. CPI data showed that from March to May 2025, the cumulative increase was 0.25% (annualized 1%), and after excluding housing, it fell by 0.22%, reflecting insufficient demand rather than price-driven.

The Beveridge curve and the vicious cycle of consumption

The downward shift of the Beveridge curve echoes the decline in consumer spending. The reduction in job vacancies indicates the risk of layoffs. The aviation industry has planned to cut 10% of flights and lay off 5%-8% of employees. The retail industry is also under pressure, with the number of store closures in the first quarter of 2025 increasing by 12% year-on-year. Consumers' concerns about employment prospects have translated into reduced spending: the decline in retail sales, air travel and entertainment spending shows that pessimism has turned from emotion to action. In April 2025, Federal Reserve Chairman Jay Powell pointed out that the relationship between consumer sentiment and spending is complex, but employment concerns are the core driver. If layoffs intensify and consumption shrinks further, the economy may fall into recession.

2025 Outlook: Economic Downside Risks Increase

In 2025, the US economy faces multiple challenges. The Beveridge curve predicts that the labor market may enter a "layoff phase", and the downturn in the aviation and retail industries confirms this trend. Low consumer confidence, rising oil prices and trade wars will continue to suppress demand. Morgan Stanley predicts that GDP growth in 2025 will be only 1.2%, lower than 1.8% in 2024; the unemployment rate may rise from 4.0% in May 2025 to 4.5% by the end of the year. If oil prices break through $100 or tariffs expand, the probability of a recession will rise to 40%.

Through the perspective of the Beveridge curve and the air passenger market, the U.S. economy in 2025 is at a turning point. Consumers are spending less due to a weak job market, and this trend is confirmed by low demand in the airline industry, falling retail sales, and reduced entertainment spending. Fewer job vacancies indicate the risk of layoffs, and rising oil prices and trade wars exacerbate demand destruction, which may push the economy further downward. Consumers and the labor market will bear the brunt, and in 2025, we need to pay close attention to the interaction between employment and consumption to cope with potential recession risks.

Kikyo

Kikyo