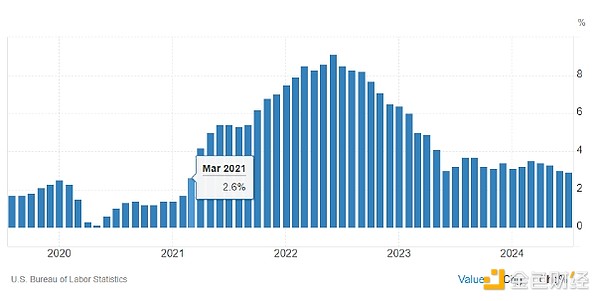

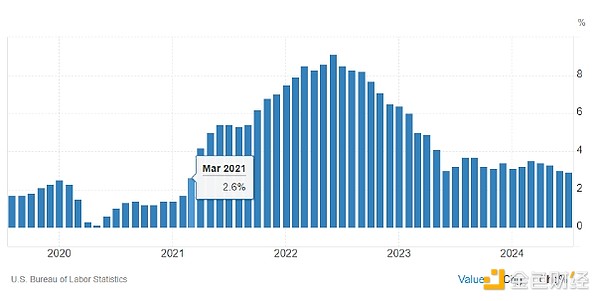

The United States released the Consumer Price Index (CPI) last night, which has attracted much attention from the market. The report showed that the U.S. CPI rose 2.9% year-on-year in July, falling for the fourth consecutive month and returning to the "2-digit" for the first time since March 2021. The inflation data was in line with market expectations. Although it strengthened the market's expectations for the Fed's interest rate cut in September, it also reduced the possibility of a previous sharp interest rate cut of 50 basis points.

After the data was released, the market reacted in a series of ways. The U.S. dollar index fell first and then rose, and finally closed up slightly by 0.01%; the pound fell 0.25% against the U.S. dollar; and the U.S. dollar rose 0.33% against the yen. The euro strengthened to an eight-month high as the market bet that the Federal Reserve will cut interest rates more than the European Central Bank this year. The three major U.S. stock indexes all turned lower in early trading after opening higher, but eventually closed slightly higher, with the Dow up 0.61%, the S&P 500 up 0.38%, and the Nasdaq up 0.03%.

In the international market, oil prices fell across the board, mainly due to an unexpected increase in crude oil inventories. However, geopolitics remains the focus of the market. A new round of Gaza ceasefire negotiations will be held in Doha on the 15th, and Hamas refused to participate. Affected by this, U.S. oil fell 1.44% and Brent fell 1.03%. The precious metals market was also under pressure. The spot gold price once rose to $2,480 in the short term, less than $4 away from the record high set last month, but then gave up the gains and closed down 0.72%. Silver prices also fell 1.03%.

The cryptocurrency market has experienced sharp fluctuations after the release of the CPI data. Bitcoin and Ethereum rose briefly after the data was released, but then quickly fell back. Bitcoin once hit $61,839, but due to the surge in selling pressure, it quickly fell below $60,000 and is currently trading at $58,440, down 4.55% in 24 hours. Ethereum has a similar trend, reaching a high of $2,784 before falling rapidly. It is currently trading at $2,653, down 2.55% in 24 hours.

The abnormal performance of the crypto market may have multiple reasons. On the one hand, the market has already expected the Fed to cut interest rates, and the announcement of the news failed to bring new stimulus, but instead triggered profit-taking by some investors. Some large position holders may take advantage of this good news and sell assets at high levels, causing prices to fall sharply. On the other hand, the U.S. government transferred 10,000 bitcoins from a wallet address related to Silk Road to Coinbase late last night, which triggered market concerns that bitcoin may be sold in large quantities, further suppressing market sentiment.

The July CPI data continued the trend of a sharp decline in inflation, making it almost certain that the Federal Reserve will start cutting interest rates in September. As for whether the rate cut will be 25 basis points or 50 basis points, the market still needs to observe the number of first-time unemployment claims each week and the August non-farm payrolls report to be released on September 6. According to CME's Fed Watch tool, the market currently believes that the probability of the Federal Reserve cutting interest rates by 25 basis points in September is 56.5%, and the probability of cutting interest rates by 50 basis points is 43.5%.

The release of the CPI data and the market reaction once again reflect the complexity and variability of the market. Although macroeconomic data and policy expectations have an important impact on the market, factors such as investor behavior, market psychology and external events cannot be ignored. While investors are cautious, they may reduce overall risk through diversified investments. For example, do not concentrate all funds in a single industry. You can trade foreign exchange, buy US stocks/indexes, invest in bulk gold and other assets with different risk levels on a one-stop trading platform like 4E. 4E has launched more than 600 asset trading pairs and supports long and short transactions with a thousand times leverage. Through such diversified investments, even if some assets perform poorly, the good performance of other assets can balance the overall risk and return to a certain extent.

JinseFinance

JinseFinance