Source: Lawyer Liu Honglin

I found that many friends would think that Meme coin almost occupies the "top stream" position in this round of bull market. Why? Because it has several unique characteristics.

The first is the low threshold. Meme coin does not require complex technical background and substantive application support like mainstream currencies, and even does not need to read the project white paper. As long as the name is attractive, the story is interesting enough, and some network hot packaging is added, it can easily enter the market. For many novice investors, this "everyone can understand" logic makes them more willing to participate.

The second is high spreadability. The core gameplay of Meme coin is "entertainment-driven", and it quickly goes out of the circle with the help of viral spread of social media. Whether it is the "Doge" stalk on Twitter or the fancy relay in the Telegram group, the spread of Meme coin does not rely on traditional marketing methods, but more on the spontaneous promotion of the community. Low cost, but explosive effect.

Finally, there is the emotional amplification effect. Meme coin is not just a synonym for speculation, it is more like an "amplifier" of market sentiment. When the market is bullish, Meme coins are often crazily sought after by investors; and when the market is sluggish, it can also use "playing with memes" to ease investors' anxiety, giving people a reason to stay in the market and wait for the next bull market.

In general, the popularity of Meme coins is a track that is driven by emotions, communication and community in addition to technology. Because of this, it has become the undisputed "top stream" in this round of bull market.

Where there is demand, there is a market. In order to make it more convenient for cryptocurrency players to trade Meme coins, Memecoin full-chain trading platforms such as DEXX are born. According to relevant information, DEXX supports multi-chain asset transactions such as SOL, ETH, TRX, BASE, BSC, and provides on-chain mobile stop-profit and stop-loss, hot spot push, copy trading and other functions. Compared with mature full-chain trading platforms such as Banana Gun and Unibot, DEXX's main differentiation is smoothness, and it even has the reputation of "Binance on the chain".

However, I found that everyone generally has a wrong understanding that decentralized projects like DEXX are a "technology-driven" market, and do not need to pay too much attention to legal and compliance issues, but the ideal is full, but the reality is very skinny.

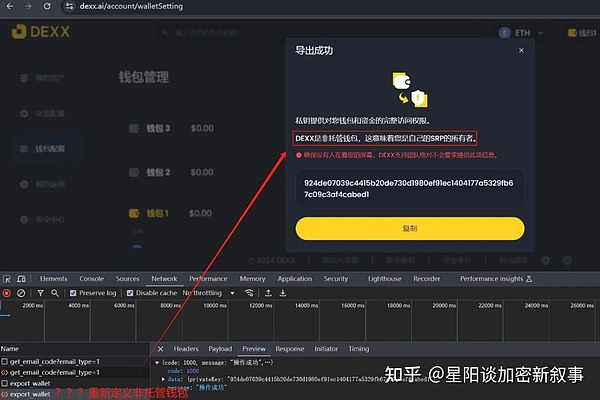

Some time ago, DEXX suffered a serious attack, resulting in large-scale theft of user assets. According to investigations by blockchain security companies such as SlowMist, the main reason for this incident is that the platform improperly manages users' private keys. User private keys are stored in plain text on official servers, and there is a lack of sufficient encryption protection during transmission. This means that attackers may intercept user private keys during transmission and obtain asset access rights. This private key management method obviously does not meet the industry's basic requirements for decentralized security, and greatly increases the risk of user asset theft.

Similar cases are not uncommon in the Web3 field, but the scale and influence of the DEXX incident are particularly huge. Although DEXX does not directly handle legal currency transactions or user identity information, its management loopholes in user assets will inevitably arouse the doubts and attention of regulators. In fact, regulators in many countries are turning their attention to the DEX field, and the legal constraints on these platforms will only become stricter in the future.

When Honglin Lawyer and industry friends discussed the DEXX incident, there was a particularly interesting technical detail that we have been discussing: Why would a service provider like DEXX choose to master the user's private key instead of using decentralized wallet contract authorization to complete the transaction?

After all, from the perspective of decentralization, wallet contract authorization is obviously more in line with the concept and can greatly reduce the risk of private key leakage. But after careful consideration, there are actually several "have to" reasons behind this.

The first is operational convenience. For many users, especially those who have just entered the circle, understanding operations such as wallet authorization and transaction signature is equivalent to understanding blockchain technology. In contrast, it is much easier for users to trust the private key to the platform and complete all the transaction logic in the background. Service providers certainly hope that the user experience is as simple as possible, and lowering the operation threshold naturally becomes a priority.

The second is flexibility and intervention capabilities. Centralized management of user private keys allows the platform to take measures more quickly when transactions are abnormal, such as revoking an erroneous transaction, freezing suspicious assets, and even "rescuing" user funds in the event of a hacker attack. Although this is somewhat contrary to the concept of decentralization, from an operational perspective, this "quick response" is actually a risk hedging for service providers.

Finally, there is difficulty in technical implementation. Although the wallet contract authorization method is good, it is not easy to implement, especially in a multi-chain environment, the complexity of contract compatibility and authorization logic will increase sharply. The centralized hosting solution is much more direct, reducing the cost of development and maintenance for service providers.

Ultimately, these choices are trade-offs made by service providers between user experience, platform flexibility and technical costs. Although it may be more efficient in the short term, it also poses hidden dangers to security and compliance. The DEXX incident undoubtedly proves that once these hidden dangers break out, the cost will be extremely heavy. This contradiction between technology and industry choice is not only a problem exposed by the DEXX incident, but also a development pain point in the entire Web3 field. How to find a balance between user experience and decentralization is the key that entrepreneurs and technical teams need to think deeply about.

Compliance advice from Mankiw lawyers

Based on the DEXX incident and the current state of the industry, as a lawyer in the Web3 field, Mankiw lawyers hope to provide entrepreneurs with more specific and practical advice to help everyone find a balance between technology, compliance and security:

First, clarify legal responsibilities and design a compliance architecture. When launching a project, entrepreneurs need to develop a clear compliance strategy for the regulatory environment of the target market. For example, if a project plans to enter the US market, it is necessary to pay attention to whether the trading tokens will be classified as securities and whether they involve the requirements of the Securities Exchange Act. At the same time, in terms of platform design, the trading function can be separated from the user data by setting up an independent technical service company to reduce the risk of directly touching the user's assets. This not only protects entrepreneurs from regulatory accountability, but also establishes a good compliance image for the platform. In addition, the platform should clarify the legal responsibilities of all parties in the user agreement, especially the solution mechanism when the asset is lost or the transaction is abnormal. Through these architectural designs, the uncertainty caused by policy adjustments or market fluctuations can be minimized.

Secondly, decentralized solutions should be used first in security design. One of the biggest lessons of the DEXX incident is the vulnerability of its centralized private key custody. If the platform can adopt decentralized technologies, such as multi-signature wallets or smart contract authorization, it can not only improve the security of user assets, but also reduce the systemic risk of single point failures. At the same time, the platform should also focus on the security management of the system architecture, including: regularly inviting third-party authoritative institutions to conduct a comprehensive audit of smart contracts and technical architecture; establishing a reporting and response mechanism for security vulnerabilities to promptly fix potential problems; designing redundant security measures, such as a multi-level transaction verification system, to prevent large-scale attacks. In addition, with the popularity of cross-chain transactions, entrepreneurs also need to pay special attention to the design and security testing of cross-chain bridges, because cross-chain bridges have become one of the main targets of attackers in recent years.

Again, balance transaction freedom and compliance transparency. Although the attraction of decentralized trading platforms lies in the high degree of freedom of users, completely laissez-faire management may also bring huge legal risks to the platform. Entrepreneurs can introduce on-chain intelligent analysis tools to avoid regulatory issues by monitoring high-risk transaction behaviors in real time. For example, abnormal accounts or large transfer behaviors that may involve money laundering and terrorist financing can be identified and marked, and the platform's response measures to illegal behaviors can be clearly stated in the user agreement. In addition, introducing a moderate KYC mechanism in high-risk user usage scenarios, especially identity verification for large-value transaction users, can strike a balance between protecting user privacy and meeting regulatory requirements.

Finally, create a user trust and brand protection mechanism. Entrepreneurs should realize that compliance and security are not only the bottom line of the law, but also the cornerstone of user trust. Regularly disclosing the platform's security audit results and compliance practices to users can enhance users' trust in the platform. At the same time, by cooperating with industry associations or technology alliances and participating in the formulation of industry standards, the platform's market position can be further enhanced.

Conclusion

Through these suggestions, I hope entrepreneurs can learn lessons from the DEXX incident. In a technology-driven market, legal compliance and security are not only the cornerstones of success, but also the key to avoiding risks and achieving long-term development. Attorney Mankiw is willing to escort every Web3 entrepreneur and jointly create a healthier and more sustainable industry ecosystem.

JinseFinance

JinseFinance

JinseFinance

JinseFinance Chris

Chris JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Olive

Olive