Author: Bridget Harris, Founders Fund Investor; Translation: Golden Finance xiaozou

Chain abstraction has become a hot topic right now, and for obvious reasons - everyone in the crypto space should be interested in tools that make it easier for consumers to participate in on-chain activities.

But a lot of this discussion overlooks the question of how we got to this point in the first place? I have always believed that developers are consumers - now they have to choose between different ecosystems, technology stacks, and communities. This creates a lock-in mechanism, and sometimes developers are distracted from the problems they need to focus on because of unreasonable and unsustainable incentive mechanisms. Developers are also users, and they should not be forced to choose where to develop and build.

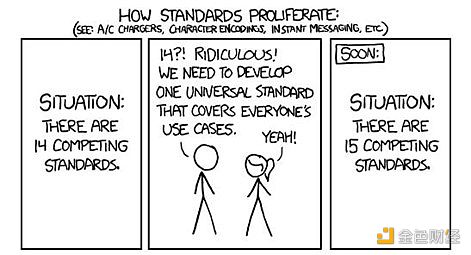

A core challenge facing developers is trying to integrate their applications with a bunch of different technology stacks and infrastructures - or build infrastructure across applications - and dealing with community loyalty issues across ecosystems. There seems to be a myriad of standards in the crypto space, which simply doesn't help.

Historically, this has often forced developers to “pick just one” ecosystem to build on — ecosystem creators know this, and actively compete for developer attention, leading to further lock-in and unsustainability. As a result, projects either choose halfhearted multi-chain expansion or aggressively pursue isolated single ecosystems. Both have problems, which chain abstraction (hopefully) is addressing.

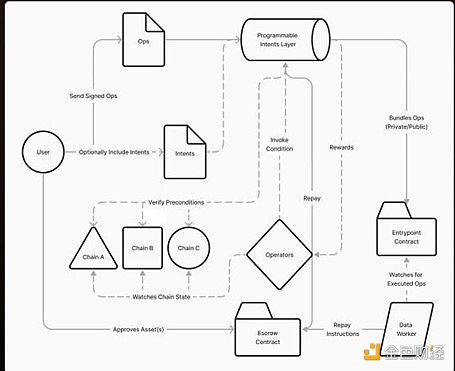

The end goal of chain abstraction is simple: developers can deploy anywhere — because user engagement is no longer important — and users can interact seamlessly across ecosystems (any chain, any liquidity). Convenience is welcome, and the biggest beneficiaries are likely to be the (increasingly integrated) interfaces that allow users to submit order flows.

Chain abstraction is a broad concept with no strict definition, and some even consider it a completely false concept. Chain abstraction is nothing more than a set of primitives, infrastructure, and tools that can simplify the work of users and developers - a lot of work can fall into the scope of "chain abstraction". I agree with the latter view, and at the same time, I think these advances are generally necessary steps for the positive development of the industry.

Below, I will briefly introduce several companies that are working on chain abstraction solutions and share some of my predictions for the future.

1, CEX

The most commonly used "chain abstraction" platform is probably Coinbase - although it offers a limited number of assets and is still a centralized exchange. Users can buy and sell various tokens across different chains through a single interface, albeit in a custodial manner. This is one of the main reasons why Coinbase has such a large adoption rate and huge revenue, which is a good sign for the entire chain abstraction field. It proves that convenience is popular and users value and are willing to pay for the functionality and simplicity of an interface.

This theme has permeated many different decentralized protocols, each of which is committed to simplifying one or more on-chain steps for users and developers.

2Core Layer Infrastructure

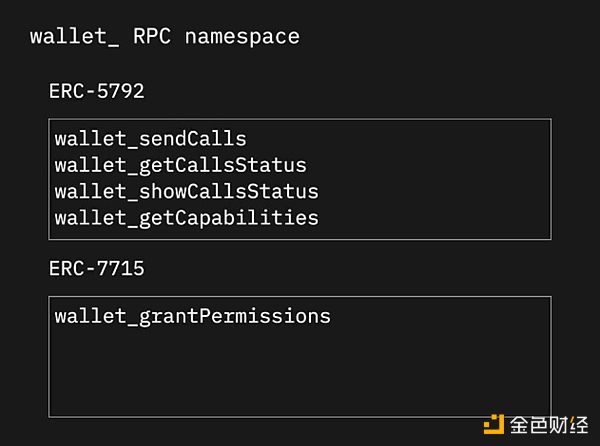

In order for chain abstraction to truly prevail, some believe that fundamental changes to established standards in the crypto space are needed. One example is OneBalance, which is enhancing the existing JSON RPC (crypto industry standard) standard in a native way so that the new standard allows applications to interact directly with wallets. Their new API is inherently backward compatible with Ethereum, Bitcoin, Solana, and all assets and smart contracts on these chains. In addition to trading across the three major main chains, this architecture - the CAKE framework - also includes gas abstraction, social recovery, and identity authentication. Users can benefit from fast state transitions because the solver can request state transitions on the target chain without waiting for the finalization of the source chain. The ultimate goal is to allow wallets, especially Metamask, to integrate their account model so that users can directly benefit from this new architecture. Specifically, this means that users can theoretically use ETH to buy WIF at the speed of Solana (relative to Ethereum).

Another company, Orb Labs, aims to be a chain abstraction provider, solving the chain abstraction problem at the node level rather than the account level. Their system consists of OrbyEngine (a smart RPC endpoint that wallets can use to aggregate and coordinate account states across all chains) and OrbyKit (a dapp SDK that provides the same functionality for application frontends). OrbyEngine uses a general intent protocol and special nodes called account unification nodes to aggregate and coordinate account states.

In short, they allow any wallet or dapp to implement chain abstraction, gas abstraction, etc. with as little as five lines of code. This fundamentally changes how users interact with wallets, applications, and chains, so they no longer need to worry about issues such as bridging across ecosystems and manually transferring assets. The "chain" just disappears, because all accounts and assets on other chains can be used for transactions regardless of where the user is. This fundamentally changes the idea of wallets as a medium to connect to a specific chain, turning it into a chain-agnostic connection mechanism that only focuses on managing the relationship between users, assets, and dapps.

NEAR is also on the core infrastructure side, which natively integrates chain abstraction into NEAR L1. Through its chain abstraction, developers can:

Immediately choose to subsidize user gas fees - this includes cross-chain transactions through NEAR's multi-chain Gas Relayer.

With NEAR's multi-chain signature service, users can use NEAR accounts to transact on other chains.

With FastAuth, users can register (or restore) a NEAR account using their email address, giving them a familiar web2 experience.

These primitives are key to providing a more seamless experience for developers, which is then actively extended to the user side through content created by these types of technology stacks.

3Unification through Bridges

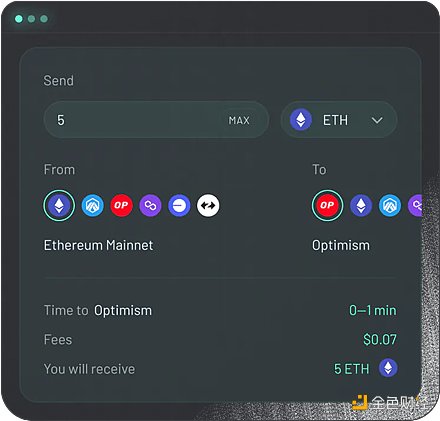

One level up, there are many bridge providers also working on chain abstraction - the most famous of which is Across. The protocol has a mature (shipped) intent engine, and relayers compete to complete user orders through the best execution path.

Today, Across is the only live, cross-chain intent-driven bridge protocol that actually works for bridges big and small. The market has responded: Across has processed nearly $10 billion in volume (6+ million transactions). Developers can also easily integrate their bridge abstraction framework Across+ into dapps to achieve native chain abstraction. This is an early proof-of-concept that demonstrates the power of chain abstraction and how the market values it.

Socket, the maker of Bungee (a bridge aggregator), is also developing a chain abstraction solution through modular order flow auctions (users submit intents for solvers to compete). With SocketPlugin, developers can add a widget to integrate Bungee (Socket's bridge aggregator that supports cross-chain asset transfers) directly into their projects. Most of the time, Bungee is routed through Across, and as of the end of June, Across's traffic share reached 50%. Compared with Socket's other aggregators, Across is considered the cheapest bridge most of the time.

4、Integrate swap

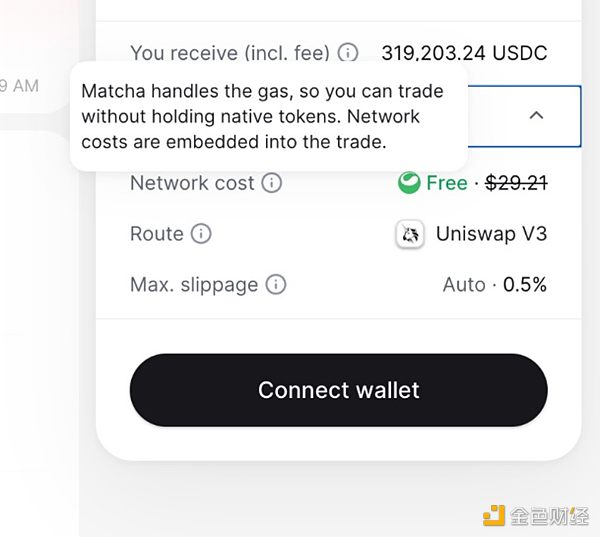

Swap exchange is the most popular action performed by users on the chain, exceeding bridging (as well as staking, mining, lending, etc.), and therefore the largest TAM that projects can tap into. Platforms such as UniswapX and Matcha focus on swap business, aiming to abstract gas, aggregate liquidity sources for cheaper transactions, and enable efficient cross-chain transactions. Typically, this involves a class of solvers competing to satisfy order flow in the most efficient way. Solver pays gas on behalf of swapper, improving efficiency by bundling orders together to compete for better prices, without users having to worry about gas token issues.

5, middleware framework+ interface

Some teams are building support layers for these protocols - for example, Light can be located at a layer below other cross-chain interoperability protocols (possibly including Across, UniswapX, etc.), acting as a middleware to provide support for the chain abstraction that users interact with. Interestingly, Light supports any configuration, across multiple chains expressed within the EVM, while most intent-based protocols only support limit orders, at least initially. In addition, Light uses an order flow auction mechanism, and users can programmatically define the conditions, security, and settlement of cross-chain transactions, which helps ensure best execution.

6、Intent as a subset of chain abstraction

Intent is particularly focused on swap exchanges, and its ultimate goal is to support users to trade any assets on any chain without bridging. The following projects have recently caught my attention:

Slingshot is an intent-based on-chain application that allows users to trade on different chains in a non-bridged, non-custodial manner. By creating an amazingly simple user experience — no gas tokens, no wallet-linking buttons, no bridges, login on any device, and one-click buys and sells — users are more likely to participate on-chain. The downside is that users are ultimately limited by the amount of funds held in the vaults of each supported chain, but regardless, this architecture encourages more activity across more chains.

Blackwing is developing a decentralized trading abstraction layer powered by Initia. Their advantage is providing traders with no-liquidation leverage by using Uniswap LP positions to secure margin positions. This greatly reduces the downside risk of major losses while increasing returns.

Essential is developing their own intention-oriented optimistic L2, where solvers directly propose their solutions in the form of new states. Here, fraud proofs are concise because incorrectness can be proven by showing that a constraint is not satisfied, which is then published to L1. Developers can directly leverage Essential’s DSL to write applications with a built-in intent framework, which enables a wider and more complex set of applications to exist and interoperate on L2.

7, Mass Adoption Through Abstraction

Just as you can access any website regardless of what browser or operating system you are running, you should also be able to access any crypto ecosystem regardless of what chain that ecosystem is built on. Regardless of the technology developers build on, they should not be at a disadvantage because they target certain users in different ecosystems. Achieving this is certainly easier said than done, but once it is achieved, I believe it will be a greater catalyst for mass crypto adoption.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance