Looking at the AltLayer airdrop announcement a few days ago, I noticed that the addresses that pledged TIA and EigenLayer are eligible for airdrops, but the details have not been announced.

After studying EigenLayer in the past two days, I found that it is still a very lively project, and the coins have not been issued. There may be surprises in the future.

AltLayer airdrops to EigenLayer pledge users

What is EigenLayer?

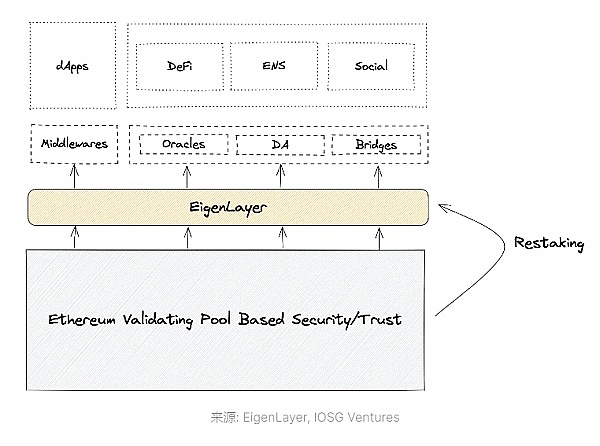

EigenLayer is an intermediary protocol based on Ethereum that introduces the concept of restake, allowing Ethereum nodes to re-pledge their pledged ETH or LSD tokens to other In protocols or services that require security and trust, you can gain dual benefits and governance rights.

Users who natively stake ETH or use Liquidity Staking Tokens (LST) can join the EigenLayer smart contract to re-stake their ETH or LST and extend cryptoeconomic security to other applications on the network, for extra rewards.

With EigenLayer, Ethereum stakers can earn rewards by re-staking their staked ETH.

For example, by staking ETH in Lido and obtaining stETH, stETH can be re-pledged to obtain income in the EigenLayer protocol; or by staking ETH in Rocket Pool to obtain rETH, the stETH can be re-pledged to obtain additional income.

Using the EigenLayer protocol, ETH can be reused, reducing staker participation costs and increasing trust protection for individual services. It leverages the collective security of ETH equity holders to provide permissionless innovation and Market governance creates a safe operating environment.

EigenLayer is a re-pledge agreement

How to participate in EigenLayer staking?

The EigenLayer mainnet was launched in June last year. Users can participate in two ways: Native Restaking and Liquid Restaking.

Native re-pledge requires independent operation of verification nodes, which has high technical and financial thresholds. 32 ETH needs to be deposited for verification and as an operating margin for the node.

Link the wallet, create EigenPod, and after depositing ETH, you can detect changes in re-staking rewards in real time.

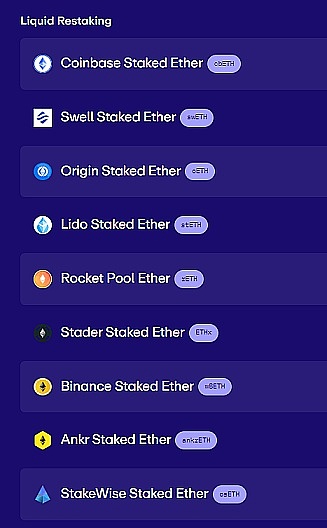

Liquidity re-pledge, that is, users can pledge the equivalent ETH obtained from Lido, Rocket Pool ETH and other platforms, and then pledge it in the EigenLayer protocol.

EigenLayer currently supports 9 liquid pledged derivative tokens, including Lido stETH (stETH), Rocket Pool ETH (rETH) and Origin Staked Ether (oETH).

EigenLayer supports 9 LSD

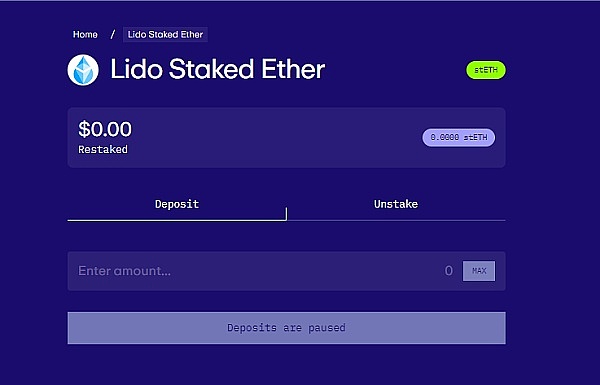

For example, to pledge stETH, click Lido stETH on the official website app.eigenlayer.xyz to jump to the corresponding re-pledge page;

Enter the re-pledged stETH amount, click "Next" to complete the authorization (you will be prompted with a "custom spending limit", just choose the largest one) and after confirming the two transactions, you will see "Deposit Successful" That means the re-pledge is successful.

The EigenLayer protocol is a new exploration of the Ethereum ecosystem. The first is to allow ETH pledgers to pledge ETH again, providing a layer of security and trust for other protocols; the second is to enable new software modules in the ETH ecosystem to use pledgers as verification nodes to improve security and efficiency.

EigenLayer supports a variety of modules, such as consensus protocol, data availability layer, virtual machine, guardian network, oracle network, cross-chain bridge, threshold encryption scheme and trusted execution environment, etc.

Ethereum’s updates are currently advancing slowly through robust off-chain democratic governance. EigenLayer allows innovation to be quickly deployed on Ethereum’s trusted layer, serving as a testnet for innovation on the Ethereum mainnet. Providing testing and experience avoids Ethereum’s trade-off between rapid innovation and democratic governance.

Re-pledge protocol EigenLayer

What are the future expectations of EigenLayer

Behind EigenLayer is a young block team The chain team has 30 members, more than 80% of whom are engineers.

EigenLayer has completed three rounds of financing, totaling more than $64 million.

The latest Series A financing was led by Blockchain Capital, with participation from Coinbase Ventures, Polychain Capital, IOSG Ventures, etc., with a valuation of up to US$500 million.

EigenLayer is a brand-new technological innovation protocol that lowers the threshold for project development, brings higher security and scalability to the Ethereum ecosystem, and enhances the trust network of Ethereum, making any system All can take advantage of the security of the Ethereum pool, increasing the value and influence of Ethereum.

The Restaking concept proposed for the first time has no competing products and is still in its infancy with few participants. This is also its future opportunity; judging from the amount of financing and the future prospects of the track, interactive users may There was an unexpected gain.

BTC fell below $39,000 after the adoption of the ETF

Of course, it is still impossible to predict the overall future development of the Ethereum ecosystem. Whether Ethereum will be in the next market cycle It has still become mainstream and is still waiting for market verification.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance