Source: Liu Jiaolian

As BTC (Bitcoin) resurfaces, the market has become more spring-like. It’s just that this BTC seems to be swimming breaststroke in the water. Sometimes it lifts its head out of the water to inhale, and sometimes it buries its head in the water to exhale. It fluctuates up and down in the previous high resistance zone, which makes people who are looking forward to an increase and those who are looking forward to a fall feel pinched in the palms of their hands. Sweating.

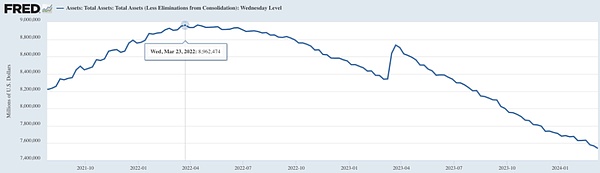

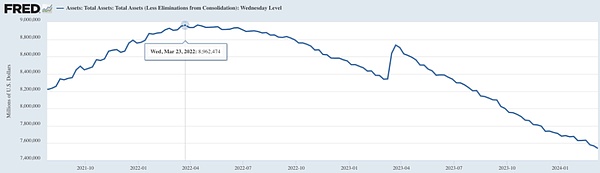

The Federal Reserve has been shrinking its balance sheet for two years, from a record high of nearly US$9 trillion to today's US$7.5 trillion. A reduction of US$1.5 trillion in two years.

Two years ago, the Fed’s balance sheet peaked in April 2022 , BTC 40,000. Now, two years after shrinking the balance sheet, in March 2024, BTC has reached nearly $70,000.

The stars on the K line crossed the dark sky, drawing a big check mark: from 40,000 to 20,000 in more than half a year, and from 20,000 to 70,000 in more than a year. Ten thousand.

Shrinking the table makes me feel lonely.

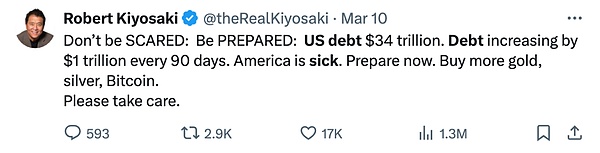

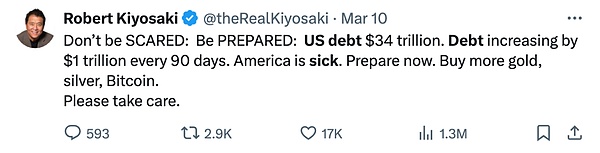

「Don’t be afraid: Get ready: US debt is $34 trillion. Debt is increasing by $1 trillion every 90 days. America is sick. Get ready now. Buy more gold, Silver, Bitcoin. Please take care." - Robert Kiyosaki, author of "Rich Dad Poor Dad"

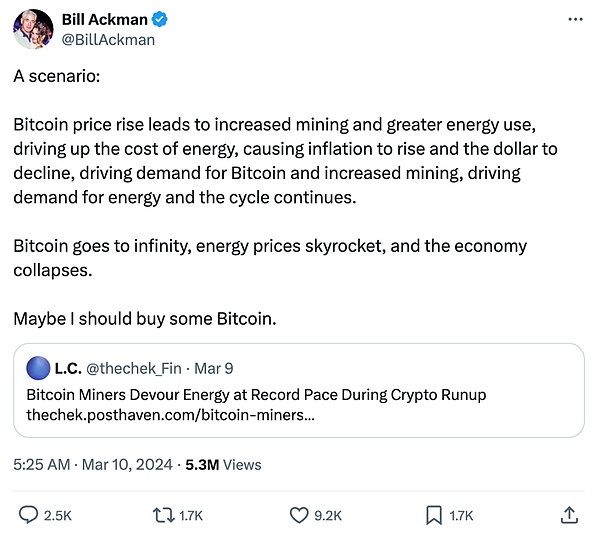

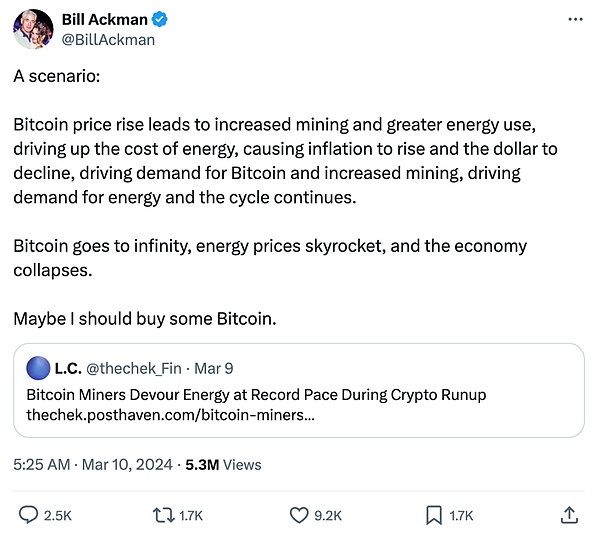

Hedge fund tycoon Bill Ackman deduced that there is a positive feedback loop that drives BTC prices toward infinity: BTC prices rise, energy utilization rates rise, energy prices rise, the U.S. dollar falls, and more funds leave the U.S. dollar. , entering BTC, pushing BTC to rise further, motivating miners to further expand production, energy utilization to further rise, energy prices to rise further, and the US dollar to fall further, pushing more funds to leave the US dollar and enter BTC... This cycle repeats, pushing the price of BTC God. Finally he said: "Maybe I should buy some Bitcoin."

p>

Buffett, who has never been optimistic about BTC, is a famous long-term investor. He has been shorting the US dollar and longing stocks for decades, and has gained huge wealth.

99% of Buffett’s wealth was earned after the age of 50. And until he was 60 years old, he had only earned 3% of his current wealth! Up to 97% of wealth is earned after the age of 60.

The wealth accumulation of long-term investors is different from that of short-term speculators. Short-term speculators pursue young success. What long-term investors pursue is accumulation.

There is such an interesting statistical chart of Buffett’s 66-year investment career on the Internet:

The figure divides Buffett’s investment career into his early debut period, 27 to 45 years old, with an average annual return of 22%; his middle-aged peak period, from 46 to 68 years old, with an average annual return of 22%. 42.42%; in the final stage of old age, between the ages of 69 and 92, the average annual rate of return is 9.58%.

It can be seen that the age of 46-68 is his golden period as a long-term investor.

However, Buffett began to get involved in investing at the age of 27, and it was only after 20 years of hard work that he reached his peak.

For most people, it may not be until they are 37 years old that they have a certain amount of primitive accumulation and their minds are enlightened before they start to seriously invest.

So, according to Buffett's speed, it will take him 56 years old to find the door and enter the fast lane of wealth growth.

Assuming that the development speed of the encryption market is twice that of the traditional market, then our lives may be accelerated, and we can enter the peak state after 10 years of debut.

In this way, even if his debut age of 37 is 10 years later than Buffett, he is still expected to reach his peak at the age of 46.

Jiaolian has been deeply involved in the encryption industry for 6 years, and the compound annualized rate of return of the investment portfolio is 27.6% (calculated based on today’s BTC 68k, ETH 3.8k, UNI 14), of which BTC’s compound annualized rate of return (CAGR) ) is 30.4%. There is still some distance to go before Buffett's peak speed.

However, there are still 4 years left for the teaching chain, which is enough time for another encryption cycle. I hope that when the bulls and bears meet again, the CAGR can reach more than 40%, in line with Buffett. Keep up the good work!

JinseFinance

JinseFinance