Before Christmas, MicroStrategy gave a shot in the arm to the cryptocurrency market, which had recently pulled back.

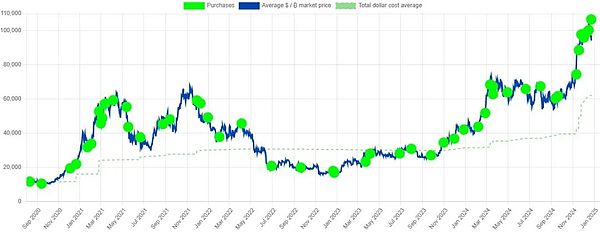

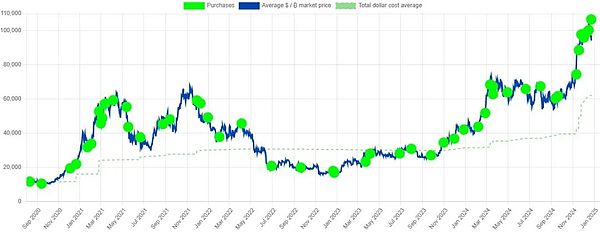

On the evening of December 23rd, Beijing time, MicroStrategy announced that it had purchased an additional 5,262 bitcoins, continuing to increase its holdings of bitcoin for the seventh consecutive week. According to a document submitted to the U.S. Securities and Exchange Commission (SEC) on Monday, the company sold about $561 million worth of shares in the stock issuance market, and then used the proceeds to increase its bitcoin reserves. The average price of bitcoin purchased last week was about $106,613, slightly lower than the historical high of about $108,500. Now, MicroStrategy holds a total of 444,262 bitcoins, spending $27.7 billion at an average price of $62,257, which also means that the company has become the largest corporate holder of bitcoin.

So, what wealth codes are implied in the MicroStrategy Digital Asset Framework? Bitkoala Finance will analyze and interpret them with you in this article.

Michael Saylor Releases Digital Asset Framework Including Strategic Bitcoin Reserves

This week, MicroStrategy CEO Michael Saylor released a digital asset framework that includes strategic Bitcoin reserves. The framework divides digital assets into six categories: non-issuer digital goods (such as Bitcoin) supported by computing power, digital securities with issuers, digital currencies, digital functional tokens, digital NFTs, and digital asset-backed tokens (such as gold and oil-backed tokens). Michael Saylor said that strategic digital asset policies can strengthen the dollar, eliminate national debt, and make the United States a global leader in the digital economy in the 21st century.

In practice, Michael Saylor suggested limiting the compliance costs of asset issuance to less than 1% of the size of managed assets, and the annual maintenance costs to no more than 0.1%. At the same time, he proposed to expand the capital market access threshold from the current 4,000 listed companies to 40 million companies by reducing the issuance costs (from tens of millions of dollars to hundreds of thousands of dollars). He specifically suggested the establishment of a Bitcoin reserve, believing that this could create $16-81 trillion in wealth for the U.S. Treasury and provide a new way to offset national debt.

In fact, the digital asset framework proposed by MicroStrategy is an ambitious macro plan that aims to deeply integrate digital assets with the traditional financial system and provide a clear regulatory framework for the development of the digital asset industry. The framework will clearly define digital assets, distinguish different types of digital assets to provide a basis for supervision, and by formulating unified industry standards, improve the transparency and credibility of the digital asset market, reduce investment risks, and encourage innovation while regulating supervision, and promote the healthy and orderly development of the digital asset industry.

What wealth codes are implied in the MicroStrategy Digital Asset Framework?

The digital asset framework proposed by MicroStrategy aims to promote the legalization and regulation of digital assets. Once the policy is implemented, it will bring huge development opportunities to the entire industry. The framework emphasizes the integration of digital assets and traditional finance, and is expected to give birth to more innovative financial products and services. As an industry pioneer, MicroStrategy is expected to occupy a favorable position in policy dividends and industrial changes.

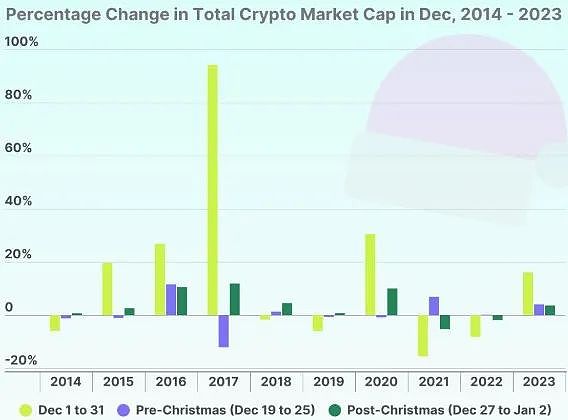

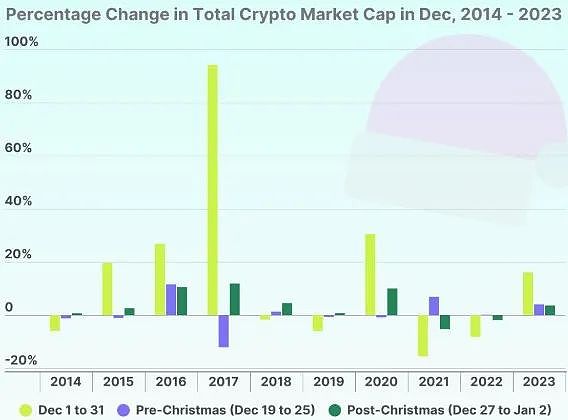

In fact, MicroStrategy chose to launch the digital asset framework during the Christmas period. This timing seems to be mysterious, because according to CoinGecko data, from 2014 to 2023, the cryptocurrency market experienced a Christmas rebound 8 out of 10 times after Christmas. In the week from December 27 to January 2, the total market value of cryptocurrencies jumped by 0.7% to 11.8%.

Although there was no Christmas rebound after the peak of the 2021 cycle, BTC had fallen by about 26% from its high of $69,000 by Christmas and continued to fall throughout 2022. The difference is that 2021 was the peak year of the cycle, while 2025 is expected to be the peak year of this cycle, following the four-year pattern since the birth of Bitcoin.

Not only that, cryptocurrency trader "Mister Crypto" also pointed out after comparing Bitcoin's performance in previous years that there were sharp increases between Christmas and New Year in 2016 and 2020 (i.e., a few years before the peak of the market cycle).

Of course, the crypto market is highly volatile, and investors also need to be cautious.

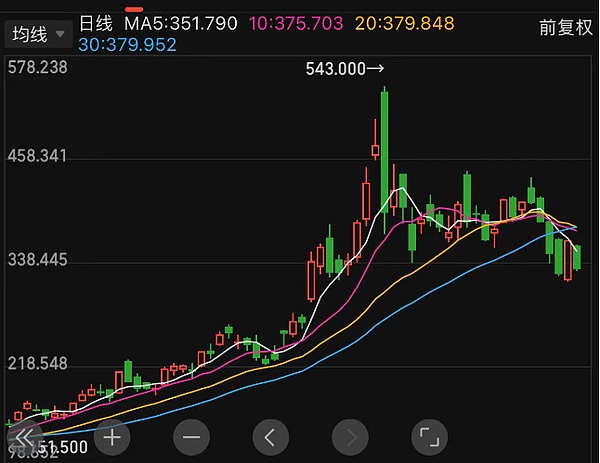

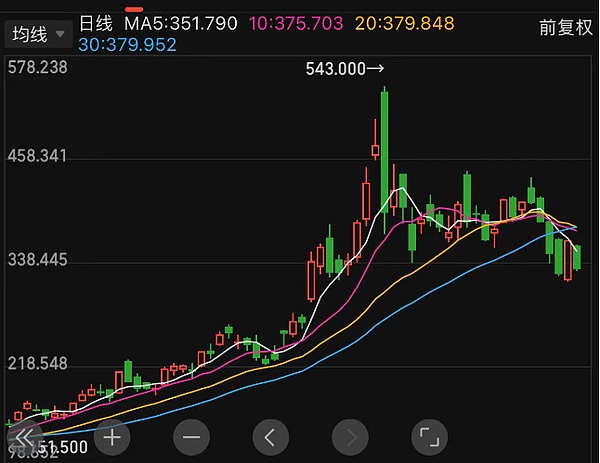

MicroStrategy Stock's Bitcoin Premium Shrinks

MicroStrategy's Bitcoin premium (measured by the ratio of enterprise value - market value plus net debt - to the value of the company's Bitcoin holdings) continues to shrink. The company is currently valued at about twice the value of its Bitcoin holdings, which are about 439,000 Bitcoins. The ratio has fallen from a peak of 3.5 times in November to twice the current level, indicating that MicroStrategy's stock price has failed to keep up with the recent rally in Bitcoin's price after it broke through $100,000.

Given that there is still a high Bitcoin premium in the stock, MicroStrategy's stock price may face more downside. The current market value of MicroStrategy is about $79 billion, of which Bitcoin holdings are worth about $43 billion. The company also has $7 billion in debt. The high premium may make MicroStrategy's stock price easy to pull back when the premium further shrinks.

However, analysts remain optimistic about MicroStrategy's performance, mainly based on the company's strategy of continuing to purchase Bitcoin through equity and debt financing. MicroStrategy has raised about $17 billion since the end of October, mainly through equity financing, and used the proceeds to purchase Bitcoin. Benchmark analyst Mark Palmer gave the stock a "buy" rating and proposed a target price of $650 based on an estimate of the company's Bitcoin holdings in 2026. He expects the price of Bitcoin to reach $225,000 by the end of 2026.

Analysts are also willing to assign a price-to-earnings multiple to the theoretical gains that MicroStrategy could create by issuing shares or bonds to buy Bitcoin. MicroStrategy mentions a so-called Bitcoin "yield" (the ratio of the change in Bitcoin holdings to the number of outstanding shares), which has exceeded 70% this year. But this "yield" relies on the company selling shares at a premium to the value of its Bitcoin holdings, which is not certain.

MicroStrategy's high premium in 2024 is a special phenomenon. In 2022 and 2023, the company's stock price was almost the same as the value of its Bitcoin holdings, and the premium was about 20% at the end of 2023. If the Bitcoin premium continues to decrease and the Bitcoin price falls sharply, MicroStrategy's stock price may face further downside risks.

Summary

As a hard asset, Bitcoin is seen as an effective tool to resist inflation. MicroStrategy believes that Bitcoin has a value-preserving function similar to gold. With the development of the digital economy, Bitcoin's position as an underlying asset continues to consolidate.

MicroStrategy's digital asset framework is a forward-looking strategy that also provides investors with a new perspective, but the digital asset market is still in its early stages of development and is full of opportunities and challenges. When investing, investors should remain rational, conduct in-depth research, and develop an investment strategy that suits them based on their own risk tolerance.

JinseFinance

JinseFinance