Author: thedefinvestor Source: thedefinvestor Translation: Shan Ouba, Golden Finance

It has been a tough few months for cryptocurrencies.

While the price of BTC has not fallen too much from its all-time high, there are many altcoins that have seen their prices fall by more than 60-70% in the past few months.

Why did this happen?

I think there are a few reasons for this:

US and German governments are selling BTC

Mt. Gox’s BTC repayments will begin this month (billions of dollars worth of BTC will be distributed to its users)

Summer is a historically poor season for crypto in terms of price performance

Upcoming Ethereum spot ETFs (although their launch is bullish in the long run)Will unlock $9 billion worth of ETH from the Grayscale Ethereum Trust

Historically, the halving has been a sell-the-news event in the short term—last cycle, BTC Sideways for 5 months after the halving

The list could go on and on…

But I think the main reason so many people keep selling and there seem to be no buyers is that crypto has no major catalysts in the short term.

Does this mean the bull run is over? I think not.

In Q4’24 we have many bullish catalysts including the Fed rate cut, the US Presidential Election (historically positive for crypto) and FTX cash repayments.

I think FTX’s repayment is particularly bullish because $16 billion in cash will be distributed to former FTX users — and many of them will likely reinvest that money in crypto.

Don’t forget, FTX collapsed when BTC was worth about $20,000. Most of the people who invested in crypto on FTX at the time were crypto natives who were optimistic about the industry’s long-term prospects.

However, there are still several months until FTX’s repayment.

As I said, in the short term, I don’t see any major bullish catalysts.

I expect volatility to continue this summer, with the uptrend resuming sometime in late summer or fall.

That doesn’t mean it’s a good idea to sell all your crypto now and try to buy it back at a lower price.

I do believe we are closer to the bottom than the top.

But when the bottom will be reached is unknown. Although the false gurus like to sell the dream that it is entirely possible to predict it.

Personally, I think now is a good time to accumulate high-conviction coins, which is what I am doing now.

In the end, patience and faith will be rewarded as always.

On-chain Alpha

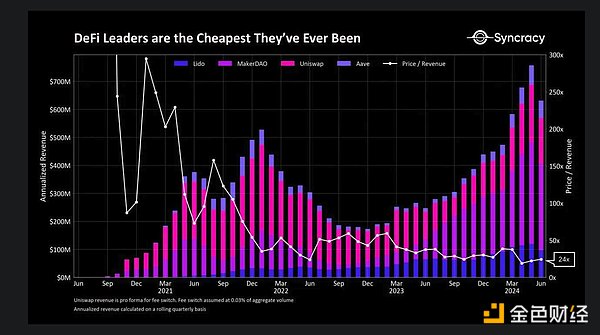

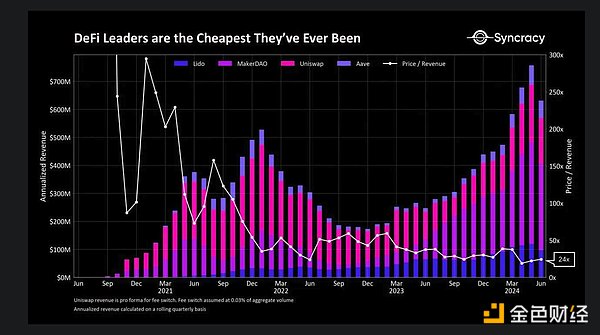

Ethereum DeFi leaders hit new highs

DeFi leaders including Lido, MakerDAO, Uniswap and AAVE are now generating more revenue than ever before.

But despite this, their market value/revenue ratio is at a multi-year low.

One reason could be that, despite the significant revenue generated by protocols like Uniswap and Lido, their revenue is not shared with token holders.

However, this could change in the future if US regulators allow it after the US presidential election.

DeFi Latest Developments

VanEck and 21Shares apply for Solana spot ETF

Arbitrum DAO proposes to launch ARB staking. 50% of the remaining sorter fees will be used to reward ARB stakers

Marginfi announces plans to launch mrgnswap, allowing traders to go long/short newly created meme coins with leverage

Fluid launches Refund, a one-click feature for importing positions from existing protocols into Fluid. Fluid users enjoy the best rates, highest LTV, and lowest liquidation penalties on the market

Solana introduces ZK Compression, a primitive that could bring huge network scalability improvements

pSTAKE’s BTC Liquid Staking solution has over 32,000 users on the Babylon Testnet. Early depositors will receive a points boost when the mainnet launches

Bluefin has launched its $BLUE token, scheduled for launch in July. Bluefin is the most popular derivatives DEX on Sui

Solana has released Blinks, a blockchain link that converts on-chain operations into shareable links on the internet (including X)

ZKsync has launched Elastic Chain - an expanding ZK Rollup network with native interoperability

NATIX Network has released its token $NATIX . Natix is the first AI-powered dynamic map powered by DePIN and a community of drivers

Jupiter Exchange launches Jupiter Swap V3 with instant routing, smart token filtering, and other features

SEC alleges Lido and Rocket Pool staking schemes are securities

Aptos Foundation proposes to deploy AAVE on its first non-EVM network, Aptos

JinseFinance

JinseFinance