Author: Ciaran Lyons, CoinTelegraph; Compiler: Tao Zhu, Golden Finance

Despite 19 consecutive days of record inflows into U.S. spot Bitcoin exchange-traded funds (ETFs), many are still wondering why the price of Bitcoin has failed to break through the all-time high of $73,679 set in March. Analysts say they have the answer.

As of June 6, global spot Bitcoin ETFs held about 1.3 million Bitcoins, or 5.2% of the circulating supply of BTC, according to data from HODL15Capital, with a large portion of that held by U.S.-listed ETFs.

However, analysts say many other factors also affect prices, and ETFs are not influential enough.

"ETF liquidity is great, but not enough to exceed the selling volume of the entire ecosystem (for now)," noted Charles Edwards, founder of Capriole Investments.

“You know the market is made up of spot, futures, ETFs, and options, right? The price at any point in time is a product of all of them, not just one of them,” wrote crypto trader Christopher Inks in a June 7 X post.

“ETFs are important, but BTC’s price is more influenced by macroeconomic factors and geopolitical events,”crypto exchange co-founder Radar Bear explained.

Bitcoin ETFs may need to open up in more markets first

Net inflows into Bitcoin ETFs totaled $217.7 million on June 6, according to Farside.

Spot Bitcoin ETFs have seen inflows of more than $15.5 billion since their launch — though some traders believe that amount is still too small to have a significant impact on prices until other markets open.

Timothy Peterson, founder of Cane Island Alternative Advisors, pointed out: "There is still no spot Bitcoin ETF in the two major markets of the UK and Japan. There is still a lot of room for growth."

In the past 30 days, the price of Bitcoin has risen by 12.57%. Source: CoinMarketCap

After the spot Bitcoin ETF was approved on January 10, Bitcoin surged nearly 53%, reaching an all-time high of $73,679 on March 13.

However, in the nearly three months since then, Bitcoin has failed to rise further, trading mainly within the high and the $60,000 support level.

Long-term holder flow is an important factor

Edwards said that For another significant price increase to occur, one of the following three main factors needs to be confirmed:

"Increase in average ETF purchases, decrease in long-term holder selling, and growth in U.S. or global liquidity,"he explained.

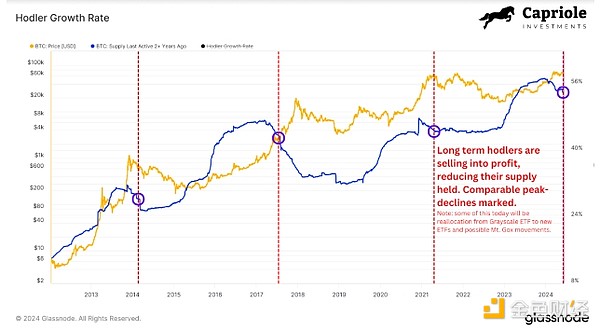

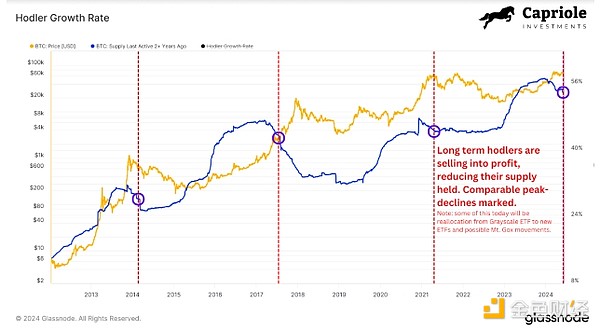

Edwards stressed that selling by long-term holders was an important factor, noting that those who held Bitcoin for more than two years sold more frequently in 2024.

Edwards said that this group's share of the total Bitcoin supply has fallen slightly in the past six months, to 54%, which has a much bigger impact on Bitcoin than it sounds.

"While 3% doesn't sound like a lot, it's equivalent to about 630,000 Bitcoins, or about 3 times the total purchases of all Bitcoin ETFs in the United States," he explained.

Holder growth has fallen by 3% since December 2023. Source: Charles Edwards

He further pointed out that the impact of Bitcoin's halving has not yet appeared:

"We may not have seen the impact of the halving yet, with Bitcoin daily issuance falling by 50% in March. We may see the gap between ETF demand and Bitcoin mining widen significantly over the next 12 months."

JinseFinance

JinseFinance