Original: Liu Jiaolian

Overnight, BTC recovered below the 5-day line to around 69k. In the early morning, UNI (Uniswap) suddenly rose by more than 15 points, breaking through $10 and approaching $11. From the market point of view, the bottom of this wave of triple bottoms built on 4/14-5/15 is about $6.6. From $6.6 to $10.7, the increase in the past ten days has exceeded 60%.

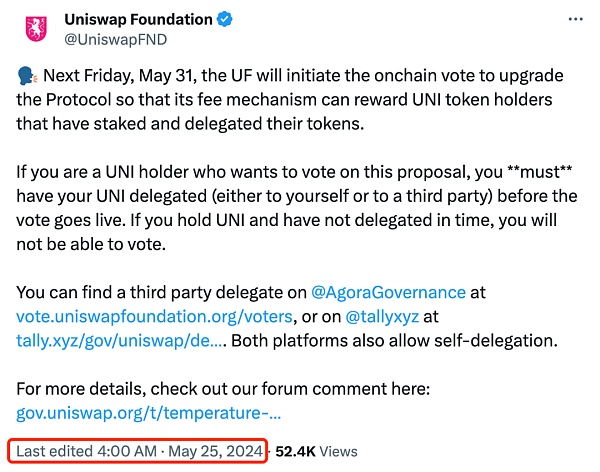

This sudden rush in the early morning is most likely related to the Uniswap Foundation’s announcement that it will vote on governance dividends on May 31.

Jiaolian looked at the time-sharing line, and the secondary market started to run ahead at 1 a.m. This is definitely a case of insider information and mouse trading! The news was released at 4 o'clock, and the good news landed. The previous runners obviously shipped once, which led to a retracement at the 10-dollar position from 4 to 5 o'clock, but the spread of the good news attracted the secondary buyers, and continued to pull up the price.

The market is a dream of getting rich for some people, but it is an ATM for some people.

Regarding this governance dividend proposal, Jiaolian had a detailed introduction in the article "Uniswap (UNI) surged by more than 50%" 3 months ago on February 24. Readers who don't know can click in to review it. I won't repeat it here.

One point that needs to be explained is that the Uniswap governance dividend proposal distributes the handling fees collected by the protocol, that is, the various tokens paid by traders, rather than issuing additional UNI for incentives. This is different from many PoS staking mining, such as staking ETH to obtain additional ETH, or DeFi farming, such as Compound lending to obtain platform currency COMP subsidies. Mining and farming are both releasing platform tokens for incentives, and the consequence is the continuous dilution of the value of the platform currency. However, Uniswap's dividends will not lead to over-issuance and dilution of UNI.

Following the 2.24 pull-up and callback, the bottom was built at $6.6, which is significantly higher than the $4 at the bottom of the 2022-2023 bear market (the lowest even reached $3.3 at one point). This is a good sign. You must know that the fate of most altcoins is to go down all the way throughout their lives, and few can cross the bull and bear markets and bottom out and rebound.

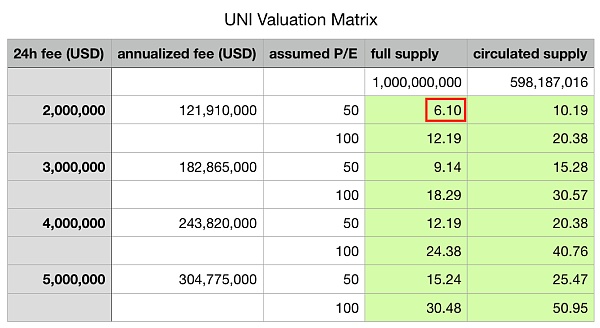

The triple bottom of $6.6 built in this wave also confirms the bottom line number in the valuation matrix given by Jiaolian in the 2.25 article "After the Uniswap team shipped $1 million at high prices...":

Note that the $6.1 calculated by Jiaolian is based on the full circulation market value, the so-called FDV (Full Diluted Value). UNI's token model is very simple, with a total of 1 billion in the first four years, and the contract is hard-coded and cannot be issued. After that, a fixed 2% increase will be issued each year, and the additional part will be put into the community treasury and controlled by governance.

This year, 40% of the team and investors should have been unlocked. About 20% of the 60% community treasury has been spent, and less than 40% is left. The chain shows that there are about 380 million coins. So the circulating supply is 1 billion minus 380 million, which is about 600 million coins. Comparing with cmc, the circulating supply is 599 million coins. Well, it is very close to our estimate.

In the valuation matrix, if the fundamentals are still 6.1 dollars, and the circulating market value is calculated instead of FDV, then the valuation is 10.19 dollars, which is exactly the same as the current price after the increase.

So it seems that the range of 6-10 is probably the more solid bottom of UNI. The fundamentals use real data from the bear market, and it can't be any worse. The P/E multiple of 50x may be much higher than stocks, but the crypto market is an emerging market. The market-to-dream ratio bubble here is more colorful. After all, the market-to-dream ratio of air coins and meme coins is infinite. Does anyone care when they are hot?

Some time ago, there was a whirlwind of criticism in the circle about high FDV and low circulating market value, saying that these VC coins are just waiting to be cut, and the leeks in the market are not stupid, and they are unwilling to put their necks into the knife, so they would rather speculate on meme coins that are like air than take over the so-called value coins that VC holds heavily.

After all, VCs are not doing charity in the crypto market. To release the high FDV in their hands to the market and turn it into circulating market value, they need enough and brave leeks to take over for them at high positions.

Among these VC coins, UNI is considered to be very close to the circulating market value and FDV, especially considering that the non-circulating part is still controlled by the community rather than VC.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Davin

Davin Aaron

Aaron decrypt

decrypt Beincrypto

Beincrypto Bitcoinist

Bitcoinist Nulltx

Nulltx