Author: Matthew Hougan, Bitwise Asset Management; Translator: Baishui, Golden Finance

In last week’s CIO memo, I argued that Ethereum ETPs will have $15 billion in net flows by the end of 2025. This would be a huge gain, putting Ethereum ETPs near the top of the list of the most successful ETP launches in history.

However, it cannot match the success of Bitcoin ETPs.

Less than six months after listing, Bitcoin ETPs have already attracted $14 billion in net flows. I expect this to grow to over $50 billion by the end of 2025 as Bitcoin ETPs gain approval on large platforms like Morgan Stanley and Merrill Lynch.

Bitcoin is 3x the size of Ethereum by market cap and has more name recognition, so it makes sense that Bitcoin ETPs would attract 3x the traffic of Ethereum products.

But something has been bothering me ever since I wrote that CIO memo. If things play out a certain way, I think Ethereum ETPs could perform significantly better than I expect.

Here’s why.

High-Growth “Tech Stocks”

Naive investors (and parts of the media) conflate Bitcoin and Ethereum. Here’s why: They are the two largest crypto assets. But readers of this memo know that they are as different as gold and oil.

By design, Bitcoin is structured as a new monetary asset. Its goal is to compete with gold, the U.S. dollar, and other fiat currencies both as a store of value and (eventually) as a medium of exchange.

This is an exciting arena. Gold is a $10 trillion-plus market, and this “money” market is the largest in the world. If Bitcoin successfully penetrates these markets, its value could easily jump 10x or more.

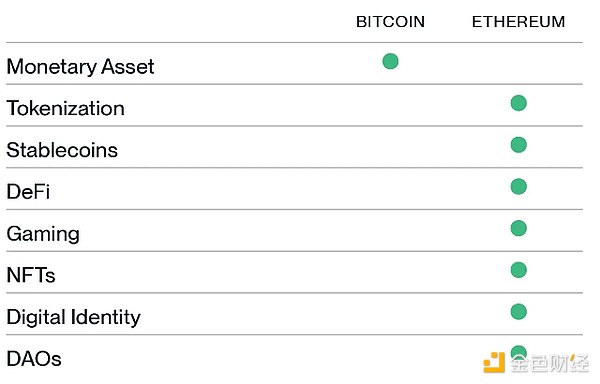

Ethereum is something completely different. Ethereum is structured as a technology platform: it is a fully programmable blockchain that serves as the backbone for new crypto-based applications, such as tokenization, stablecoins, and decentralized finance.

The economics of Ethereum are simple: all else being equal, the value of Ethereum (the asset that powers the Ethereum blockchain) grows as more people use these applications. This is because you have to pay ETH fees to use the platform.

Leading blockchains by use case

Source: Bitwise Asset Management

Why Ethereum ETPs may outperform expectations

This is where I have a sneaking suspicion that Ethereum ETPs may surprise on the upside. After all, investors love tech stocks. Almost all investors invest in high-growth tech companies like Nvidia and Meta, while relatively few invest in monetary assets like gold.

It’s easy for me to imagine investors selling a small number of their tech investments and buying ETH. I think that’s easier than imagining investors making an entirely separate portfolio for a new monetary asset.

For that to happen, we need the core idea — that ETH is a tech investment — to gain mainstream traction. For that to happen, you need to see two things: 1) more people need to understand how Ethereum is different from Bitcoin, and 2) some applications built on Ethereum need to gain mainstream traction.

What would that look like? Imagine stablecoins increasing from $160 billion in assets to $1.6 trillion as more people embrace the speed and transparency of blockchain payments. Or consider decentralized finance opening up new ways to borrow and lend as regulatory clarity emerges. Or imagine more companies following BlackRock’s lead and building tokenized funds on the Ethereum platform. Sure bet? Of course not. But you don’t have to try that hard to imagine it.

Maybe someone needs to launch a new ETF where 10% is ETH and 90% is tech stocks.

Bernice

Bernice