BTC staking has become a reality through the Bitcoin Layer 2 network - this privilege, which once belonged to assets on blockchains using the Proof of Stake (PoS) consensus mechanism, now directly benefits users who hold BTC.

Bitcoin, which operates using the Proof of Work (PoW) consensus mechanism, has always had relatively simple on-chain functions due to differences in founding concepts, and is not designed to support the operation of a large number of on-chain use cases like Ethereum's creation goal. Therefore, if users holding BTC want to participate in on-chain use cases (such as DeFi projects), they usually need to convert BTC into alternative assets (such as using Stable Coins) to cross-chain to participate in the Ethereum ecosystem.

At present, with the industry's increasing attention to the development of BTC's native ecosystem, BTC pledge projects have become a new focus of this type of ecological development. BTC holders have more opportunities to directly participate in on-chain use cases. Industry insiders also believe that: BTC pledge will be a new detonation point that will attract more users to the blockchain world in the future.

BTC pledge ecological classic project

Babylon pledge

On August 22, 2024, the first phase of the BTC pledge project Babylon, founded by Professor David Tse of Stanford University and Mingchao Yu, a senior engineer at Dolby Laboratories, was officially launched.

Babylon's pledge economic model is somewhat similar to Ethereum's re-staking project EigenLayer, which allows users to stake their BTC on a blockchain that uses a proof-of-stake (PoS) consensus mechanism to obtain pledge rewards without the need for cross-chain or third-party escrow operations.

BTC asset holders who participate in staking through Babylon can withdraw the pledged BTC after the pledge period ends, or they can withdraw the pledged BTC in advance. BTC staking users can get two rewards: one is the token income from Babylon, and the other is the fees paid by other blockchain chains to establish security using Babylon staking.

It is reported that Babylon will launch a complete BTC pledge protocol in 3 stages:

Phase 1: Users lock BTC in the escrow script through BTC transactions. In order to control risks, the number of BTC pledged in the first phase will be limited to 1,000 BTC. According to statistics, about 12,720 BTC holders participated in the pledge lock-up activity in the first phase.

Phase 2: Activate BTC pledge.

Phase 3: Implement BTC multi-staking, which allows users to stake the same BTC on multiple blockchains based on the Proof of Stake (PoS) consensus mechanism.

“

Learn More

After supporting the addition of more BTC accounts such as Taproot, the latest version of imToken has been further upgraded to support Babylon BTC staking to meet the staking needs of BTC holders.

You only need to go to the imToken "Wallet Management" page, click "Add Account" to add a new Bitcoin account, deposit BTC, and then visit the Babylon Staking DApp on the browsing page to start the staking operation.

For references to pledge operations, please refer to: https://support.token.im/hc/zh-cn/articles/36702982047257

SatLayer Re-Pledge

SatLayer is a BTC re-pledge platform developed based on Babylon. It has recently successfully completed an $8 million seed round of pre-financing and raised more than 100 BTC within 1 day of its launch on August 23, 2024, sparking heated discussions in the industry.

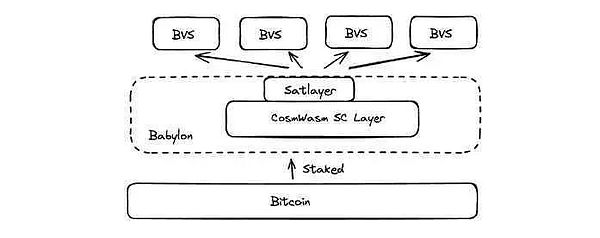

In SatLayer's re-pledge ecosystem, participating in re-pledge can provide security protection for any blockchain or decentralized application or protocol that adopts the Proof of Stake (PoS) consensus mechanism through the BTC-based Verification Service Platform (commonly referred to as BVS).

△ SatLayer ecological architecture diagram, source: Foresight News

The functions provided by SatLayer for BTC holders include: using the Babylon protocol to pledge BTC, participating in re-staking and obtaining re-staking rewards, and obtaining liquidity asset rewards from the SatLayer platform.

Thoughts on BTC Staking Ecosystem

Improving the security of blockchains that use the Proof of Stake (PoS) consensus mechanism is not an easy task. It is essentially a game—a game between the motivations of validators and digital asset holders to participate in staking and their expectations for staking rewards. It also tests the credibility and technical reliability of the blockchain itself.

To achieve security protection, not only a large number of assets that can participate in staking are required, but also continuous incentives to attract more users to join the staking. This is also the most realistic challenge of the staking ecosystem and the difficulty of sustainable development in the future. As the digital asset with the largest circulation and the largest market value, the industry is optimistic about the prospects of BTC staking, which has injected a shot in the arm for the depressed market sentiment in 2024. This may also mean that the blockchain world is quietly changing: newly launched assets and soaring market values are no longer enough to trigger user emotions. Everyone is looking forward to more innovations in blockchain native technologies and more flexible asset issuance methods, so as to build a safer, more innovative, more substantive use case, and further release liquidity blockchain world.

Zoey

Zoey

Zoey

Zoey Beincrypto

Beincrypto Bitcoinist

Bitcoinist Coinlive

Coinlive  Others

Others Beincrypto

Beincrypto Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph