Hong Kong's RWA is not a "regression", but a "return to normalcy".

In the past month or two, many people have misread Hong Kong's "cooling down" as "pausing". But if we zoom out, it's more like rebuilding the power grid: moving from the early "bubble frenzy" back to the financial right track of "asset on-chaining." We call this path "getting back on track." The core change can be summed up in one sentence—embedding RWA tokens into real finance and industry, instead of letting it drift outside of regulation.

(AI raw image)

I. "Digital Asset Manifesto 2.0": Restoring Tokenization to Assets and Instruments

The key words of Manifesto 2.0 are not coins, but ratherfunds, trusts, gold, Hong Kong stocks, tax system, and secondary market. Behind this string of keywords lies Hong Kong's redefinition of tokenization using familiar financial language: Funds/Trusts: Money market funds, structured notes, and REITs are put on the blockchain through trust structures, with tokens corresponding to clear beneficial rights and information disclosure, avoiding "shell companies" and "hollow companies." Tax Alignment: From the Era of Subscription and Redemption to the Era of Transfer, the transfer arrangements for tokenized funds, and the exemption of stamp duty and profits tax, will gradually be modeled after traditional funds, directly opening the floodgates to a compliant on-chain secondary market. Returning to the scenario of warehousing and delivery: The LME (London Metal Exchange) has incorporated Hong Kong into its global warehouse network, and officially encourages the application of tokenization and on-chain traceability in warehousing and physical tracking. Gold tokenization is no longer just a symbol, but a combination of "warehouse receipts + clearing + delivery".

Broader Assets and Instruments: From gold, non-ferrous metals, and agricultural products to the tokenization of trusts, indices, and Hong Kong stocks, it shows that Hong Kong treats RWA tokenization as a toolbox rather than a speculative playground.

In short: Manifesto 2.0 transforms "on-chain performance" into "financial engineering," making RWA the new underlying infrastructure of Hong Kong's financial market.

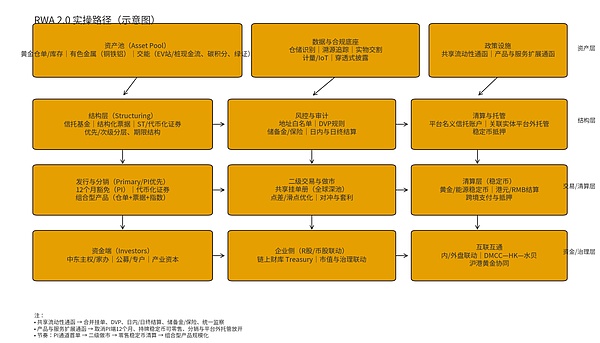

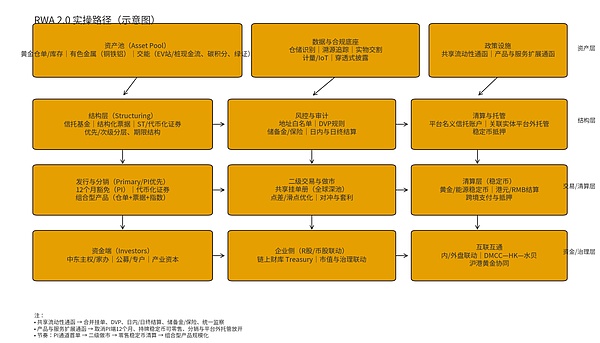

II. Huaxia Digital Capital's RWA 2.0: Financial Structure × Industrial Flywheel × Global Funds

Hong Kong's RWA 2.0 is not just about "moving assets onto the blockchain," but about simultaneously "engineering" financial structure, industrial ecosystem, and cross-border funds.

Financial Structure: Multi-Form Carrier: Trust Fund + Structured Notes + Security Tokens (ST), with the same underlying asset corresponding to different risk/maturity layers to suit investor preferences. Hong Kong Stock Tokenization + Stablecoin: Turning Hong Kong stocks into compliant products that can be transferred on-chain, and combining them with Hong Kong dollar/RMB stablecoins for settlement and collateral, thus bridging the gap between "on-chain transactions — traditional price discovery — cross-border clearing".

RShare-Token-Share Linkage (Digital Treasury): Enables enterprises to link "shares - tokens - proprietary stablecoins / treasury assets", migrating governance and market capitalization management to an on-chain auditable Treasury framework.

Industry Flywheel

Gold Tri-Region Linkage: Dubai pricing and certification, Hong Kong clearing and delivery, Shenzhen Shuibei processing, retail and recycling, forming a closed loop of "mining — warehousing — refining — investment — trading — retail — recycling".

Industry Flywheel

Three. Gold is the best "demonstration field": policy-driven + industry-penetrating + financial clearing

Hong Kong's gold RWA narrative no longer stops at "buying gold bars" but "building a market".

Warehousing and Delivery: The LME has incorporated Hong Kong into its warehouse network, and the government encourages tokenization as a warehouse identification and traceability label to improve the auditability and turnover efficiency of inventory financing. Clearing System and Interoperability: The proposal to build a central gold clearing system, inviting the Shanghai Gold Exchange to participate, paves the way for "Shanghai-Hong Kong Gold Cooperation"; the international board has already established an offshore delivery warehouse in Hong Kong and launched delivery contracts in Hong Kong.

Capacity and Industrial Chain: Promote refining in Hong Kong and "processing with supplied materials" with the mainland, and connect "mining end - refining end - warehousing end - delivery end - retail end - recycling end" into a quantifiable cash flow network. Product and Investor Access: Supports tokenized gold investment products and public gold funds, improving investment tools for individuals and institutions. Gold is suitable as a tool for RWA (Responsible Investment Strategies) because it combines global pricing, strong liquidity, and strong regulatory integration, enabling the rapid transformation of the "RWA concept" into a "tradable market."

IV. Stablecoins: Upgrading from "Payment Instruments" to "Industry Clearing Layers"

The next growth in Hong Kong's economy is likely to come from asset-backed stablecoins—especially gold stablecoins and energy/electricity stablecoins.

The next growth in Hong Kong's economy is likely to come from asset-backed stablecoins—especially gold stablecoins and energy/electricity stablecoins.The next growth in Hong Kong's economy is likely to come from asset-backed stablecoins—especially gold stablecoins and energy/electricity stablecoins.

Usage Upgrade: Upgraded from "Currency Alternatives in Wallets" to "Cross-border Clearing and Collateral Layer". When RWA assets are collateralizable, on-chain asset management and secondary trading have a "Unified Unit of Measurement".

RMB Scenario: RMB-denominated RWA and Hong Kong stock tokenization offer greater operational flexibility in Hong Kong. It can both attract Chinese capital and supply chains, and also serve cross-border settlements related to the "Belt and Road Initiative".

RMB Scenario: RMB-denominated RWA and Hong Kong stock tokenization offer greater operational flexibility in Hong Kong. It can both facilitate Chinese capital and industrial chains, and also serve cross-border settlements related to the "Belt and Road Initiative".

Trading and Settlement Mechanism (Core is "Settled Liquidity")

Establish Shared Order Book Rules: Includes pre- and post-trade processes, prepayment, instructions, settlement, liability management, and the rights and responsibilities of participating parties. These rules are binding on related parties and the designated custodian and can be enforced.

Full Prepayment + Pre-Trade Verification: Only accepts instructions where settlement assets have been frozen with the designated custodian.

Full Prepayment + Pre-Trade Verification: Only accepts instructions where settlement assets have been frozen with the designated custodian.

Expanding the Scope of Distribution and Custody

Explicitly allows platforms to distribute digital asset-related products and tokenized securities; for distribution, the platform may open trust/client accounts with custodians in the name of the platform to hold related products.

Allows platforms to provide custody for digital assets not traded on the platform through affiliated entities (license conditions need to be revised); in individual cases, tokenized securities may be custodied before the completion of the second phase assessment (provided that asset protection and whitelist transfer restrictions are in place). ...>

Shared liquidity allows Hong Kong price discovery to be directly linked to global deep pools; international price differences for gold/non-ferrous metals/Hong Kong stock tokens are absorbed more quickly, and RMB/Hong Kong dollar stablecoin settlement scenarios are smoother. The platform is authorized to distribute tokenized securities and related products, and can provide custody for assets outside the platform; combined products (warehouse receipts + notes + indices) can be completed through a single entry point, matching the compliant allocation of Middle Eastern funds/US Treasury bond repatriation. The "Gold RWA Flywheel" → "Clearing-Level Template" provides a system for gold warehouse receipts and tokenized clearing; it is naturally coupled with the vision of a central gold clearing system, which helps to make Hong Kong a blockchain model for global warehousing and delivery. Summary: The “Corresponding Relationship” between the Two Circulars and the RWA Industry Closed Loop The purpose of this diagram is not to be all-encompassing, but to grasp the main thread: the four steps of "asset—facilities—liquidation—funds" are integrated to form a closed loop that is auditable, financeable, and tradable. The practical implementation path requires the following key elements: Product rhythm: First, implement the "12-month exemption" and tokenized securities through the PI channel, creating a structured first order + secondary market making for gold/non-ferrous metals/EV cash flow, and then gradually open up retail licensed stablecoin scenarios. Liquidity engineering: Apply for shared order placement, and implement a unified monitoring + DVP + reserve fund and intraday settlement process, institutionalizing cross-pool market making parameters into a standard operating procedure (SOP). Clearing and Custody: Using a combination of "platform-named trust account + off-platform custody of related entities" to facilitate the off-balance-sheet and on-balance-sheet conversion of warehouse receipts, bills, indices, and stablecoins. Funding Organization: Linking Middle Eastern funds and mainland industrial capital, the fund is structured in a three-tiered manner: "Asset Pool (Warehouse Receipt/Contract Cash Flow) → Structure Layer (Priority/Subordinate) → Liquidation Layer (Stablecoin/HKD/RMB)". Eight Action Recommendations: Turn “Returning to Profitability” into “Advantage”. Continue to promote the clarification of the tax system and cross-border mutual recognition for the transfer of tokenized funds, and improve the predictability of the secondary market. Accelerate the standardization of the central gold clearing system and warehousing tokenization, making the "genuine" infrastructure an international model. Implement a "whitelist + full disclosure + custody audit" framework for stablecoins, providing a clear licensing path for industry stablecoins.

For institutions and platforms

Using the three-tier structure of trust/structured/stablecoins as a starting point, prioritize categories with clear cash flow and verifiable inventory (gold, non-ferrous metals, charging stations).

Promote market capitalization management and digital treasury governance through coin-equity linkage/R-equity linkage, and make "auditable on-chain treasury" a standard feature of enterprise digital finance.

Connecting Middle Eastern funds with mainland industries, using real assets and compliant structures to secure "high-quality liquidity." For industry stakeholders, treat "on-chain" as a tool for financing and operational transparency, not as mere conceptual packaging. Prioritize putting traceable measurement processes on the blockchain (warehouse receipts, electricity volume, inventory, settlement) and turn cash flow vouchers into tradable assets. Hong Kong's True Leap Forward: From a "City of Exchanges" to a "Port of Asset Digitization" As RWA tokenization becomes the new interface layer for real assets and real cash flow, and as stablecoins become the new underlying layer for cross-border clearing and collateralization, Hong Kong's role will naturally change: no longer just a bustling city of exchanges, but a global hub, clearinghouse, and standard-setting port for RWA. This is not a regression, but a return to its proper place; it is also an upgrade and shift in both institutional and industrial tracks. Huaxia Digital Capital's judgment is clear: Whoever delves deeply into and thoroughly understands "returning to normalcy" will hold the reins of the next round of international digital finance.

JinseFinance

JinseFinance