A comprehensive comparison: What are zk-SNARKs and zk-STARKs?

What are zk-SNARKs and zk-STARKs? They are both zero-knowledge proofs, but what are their properties and how do they compare to each other?

JinseFinance

JinseFinance

Author: Jennifer Obem & AJC, Messari Research Analyst; Translation: Golden Finance xiaozou

Abstract of this article:

· zkLink solves the challenges of blockchain liquidity and technology stack fragmentation by unifying Layer-2 (L2) networks and Layer-1 (L1) networks.

· zkLink provides two core solutions: zkLink Nova and zkLink X. Both solutions leverage zero-knowledge proof (ZKP) technology to provide users and developers with unified access to linked networks.

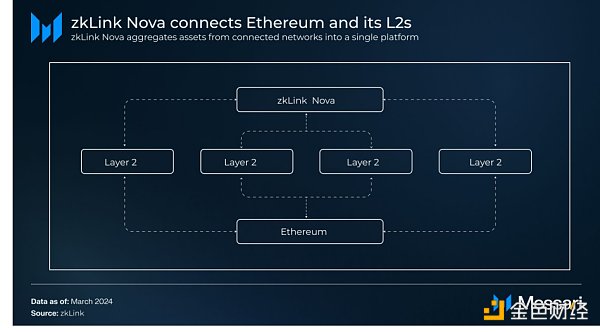

· zkLink Nova is a general-purpose Layer-3 (L3) network that integrates Ethereum L2s assets, liquidity, and dApps into a single, secure, efficient, EVM-compatible platform.

· zkLink X is an application-specific scaling engine for multi-chain dApp deployment, liquidity aggregation, and performance improvements across a variety of blockchain networks, including L1s and L2s.

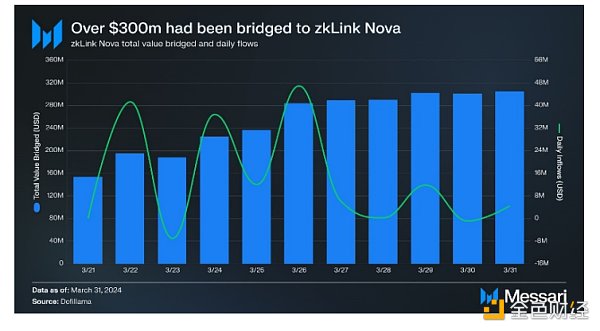

· Over $300 million in funds have been bridged to zkLink Nova, making it the L3 network with the largest total bridge value.

The cost of Layer-2s scaling Ethereum is to operate as an isolated sub-ecosystem, which weakens Ethereum's network effect. L2s vary widely from one another, leveraging different technology stacks (e.g., OP Stack or ZK Stack) and different proof techniques (e.g., fraud or validity proofs). As a result, L2s may have the disadvantage of further fragmenting Ethereum liquidity and complicating dApp development. They also weaken the user experience because cross-L2 transfers are time-consuming and expensive. Today's blockchain landscape is characterized by isolated and independent L1s, with little ability to communicate value except for asset transfers and cross-chain messaging through bridges. zkLink aims to unify L2s and L1s, enhance user experience through zero-knowledge proofs (ZKPs), and promote secure dApp development. zkLink provides two core solutions: · zkLink Nova: This is a general-purpose L3 focused on solving Ethereum's liquidity and asset fragmentation challenges.

·zkLink X: An application-specific extension engine that supports customized multi-chain dApp development, connecting L2s and L1s.

zkLink began to emerge as a multi-chain trading solution in 2021. It leverages ZKPs to provide users with reliable access to aggregated liquidity and enables developers to quickly deploy customizable and secure financial applications such as DEXs and AMMs. Over the years, zkLink has evolved into a technology stack-agnostic aggregator of assets, liquidity, and applications across L1 and Ethereum L2, forming an interconnected blockchain landscape. zkLink Labs (zkLink's development team), led by Vince Yang, has raised $23.1 million in funding from private investors and completed a community sale to fund the development of zkLink.

On March 11, 2024, zkLink Nova's Layer-3 public mainnet was launched, supporting 9 networks including Ethereum. It provides users and developers with an interoperable platform that can integrate liquidity and assets from Ethereum L2s. Users can deposit assets only once on zkLink Nova to interact with assets and dApps of all associated L2s, and these networks will no longer have duplicate dApp interactions, but the fees have become lower. Similarly, developers can quickly deploy more capital-efficient applications on L3, leveraging the liquidity of associated L2s without deploying multiple dApps. Since its launch in early March 2024, zkLink Nova has attracted more than $300 million in total locked value (TVL), demonstrating the potential demand for a unified universal L3 platform. ZKEX is the first application-specific decentralized exchange (DEX) built with zkLink X. As of March 2024, ZKEX is running on the V2 Alpha mainnet with a trading volume of more than $42 million.

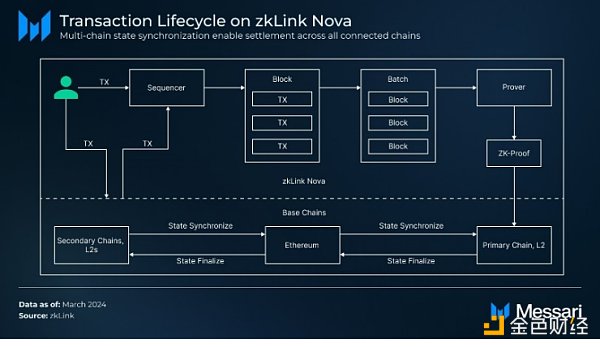

zkLink Nova is a zero-knowledge rollup (ZK-rollup) that runs as a general-purpose L3 built on Ethereum and its L2s. It leverages ZK Stack and zkLink Nexus technologies to aggregate liquidity and assets on the associated network. Due to its modular design, it also provides a customizable and scalable dApp deployment environment. The modular architecture of zkLink Nova includes the following four layers:

Sorting

The main task of the sorting layer is to monitor on-chain deposits in L3 smart contracts, maintain the state of L3, and organize transactions for processing and proof generation. Users can interact with zkLink Nova by depositing assets into smart contracts deployed on all associated chains or directly into L3’s sorter through an RPC service. zkLink Nova’s sorter records incoming transactions according to the requirements of L3’s proof system while removing ineligible transactions. Approved transactions are grouped into small blocks that are processed every two seconds in L3’s zkEVM. Blocks are further compiled into transaction packages to minimize the costs associated with interacting with the settlement layer. At the time of writing, the protocol’s sorter is centrally managed by the project team, but the long-term goal is to adopt decentralized sorter solutions such as Espresso, Astria, and Fairblock.

Execution

Transactions that update L3 state are executed at this layer. zkLink Nova leverages the ZK Stack’s zero-knowledge Ethereum Virtual Machine (zkEVM) to execute transactions. The zkEVM provides a secure execution environment for zkLink Nova’s smart contracts, using ZKPs to verify each step of program execution. As a result, this L3 can execute transactions verified using ZKP computations in an EVM-compatible environment, enabling developers to easily deploy dApps on Ethereum and other L2s to this L3.

Settlement

zkLink Nova’s dedicated settlement framework, zkLink Nexus, can settle across multiple L2s and Ethereum, unlike traditional ZK-rollups that settle on Ethereum. This allows the L3 to efficiently aggregate all user deposits into smart contracts on other L2s without recalculating proofs. Due to its technology stack-agnostic nature, zkLink Nova can connect to all Ethereum L2s, regardless of the technology stack (e.g., ZK or OP L2s). To settle transactions across multiple chains, zkLink Nexus leverages a multi-chain state synchronization mechanism, a settlement framework that delegates the responsibility of verifying proofs to one chain and communicates chain state to other chains.

· Choose one associated L2 as the "main chain" for verifying and enforcing ZKPs and ensuring the consistency of transactions on the chain.

· Other associated L2s as "auxiliary chains" only need to synchronously communicate the state calculated by the validator contract of this L3 to the main chain without calculating any ZKPs.

At the time of writing, Linea is the main chain of zkLink Nova due to its ability to execute zk-SNARK proofs and quickly settle on Ethereum. This L3 also supports Ethereum as an auxiliary chain, and also supports the following L2s: Manta, Mantle, zkSync Era, Arbitrum, Blast, Optimism, and Base.

The settlement process begins when the sorter submits a transaction package and zk proof to the main chain for verification. Using zkLink Nexus’ multi-chain state synchronization, the auxiliary chain sends the synchronization hash to the main chain through a canonical rollup bridge to ensure the consistency of the proof, thus completing the verification process.

Building multi-chain rollups brings the risk of deposit fraud. Malicious sequencers may report false deposits on the auxiliary chain to the main chain, resulting in user funds loss.

To mitigate this, the state synchronization phase includes an additional transaction verification layer in addition to the standard ZKP verification process used by a typical ZK-rollup. This additional verification layer confirms that the real-time data submitted by the sequencer to the main chain corresponds to the synchronization hash value periodically transmitted by the auxiliary chain. Once validation is complete, the main chain allows settlement, resulting in a soft settlement. The transaction package root is then distributed to the auxiliary chain for withdrawal processing, thus protecting the network from fraud risks.

Data Availability

Transaction and state transition data can be accessed on the Data Availability (DA) layer. As of the time of writing, zkLink operates as a Validum, storing transaction data off-chain through the Data Availability Committee (DAC). The DAC maintains a copy of the transaction data and its state history for this L3, storing transaction data in a cost-effective manner, especially for ZK-rollups that also incur proof verification costs. However, DACs provide less security than external DA solutions secured by a dedicated DA network. Therefore, zkLink Nova plans to leverage external DA solutions such as Celestia and EigenDA in the future.

Asset aggregation on zkLink Nova

To access zkLink Nova, users must first bridge assets from Ethereum and other associated L2s to this L3 through a canonical rollup bridge. Once assets are bridged to zkLink Nova, they can be aggregated into interoperable transactions. Tokens of the same value from different networks can be merged into a single token to unify liquidity. zkLink Nova leverages zk-SNARKs and zkLink Nexus (multi-rollup state synchronization) to securely aggregate assets from all associated networks. These features allow users to make deposits and bridge: · ETH is transferred from each linked network to this L3. The unified native asset allows withdrawals without third-party bridging, similar to withdrawals from a centralized exchange, but without counterparty risk. · Native assets from other L2s (e.g., ARB from Arbitrum) are transferred to this L3. This allows interoperable trading of native L2 assets on Nova, improving capital efficiency and supporting new DeFi use cases. · Stablecoins issued on different networks become the same stablecoin on this L3, simplifying the use of stablecoins while minimizing gas fees. · Consolidation of tokens on zkLink Nova Assets of the same value and type have different token addresses on multiple L2s. For example, the ETH bridged from Arbtrum and Optimism to zkLink Nova has two unique addresses. In order for users to interact with the ETH bridged from these two networks as one asset on this L3, the assets from the two different unique addresses must be merged into one asset.

To solve this problem of asset non-unification, zkLink Nova adopts an upgradeable token merger contract, which is managed by the Governance Committee and the Security Council. The contract allows zkLink Nova to merge tokens of the same value into one token. Users who bridge similar tokens from different addresses of multiple networks can lock the source tokens through the token merger contract on the source chain to receive derivatives equivalent to the locked assets on zkLink Nova. Users can also redeem locked tokens by burning derivative equivalents through the token merger contract. However, the protocol imposes a deposit cap on the supported assets, and the source token can be locked as a safeguard through governance.

Changes to the token merger contract are proposed and implemented through its governing bodies (Governance Committee and Security Council). These changes may include, but are not limited to: · Upgrading the token merger contract · Adding support for merging one source token · Changing the deposit limit for supported assets · Locking or unlocking source tokens on the source chain Although the Governance Committee initiates and bids on the token merger contract upgrade proposal through 2/3 multi-signature, the Security Council reserves the right to veto such proposals. The Security Council ultimately monitors the actions of the Management Committee and reserves the right to implement low-risk upgrades to the token merger contract. (2) zkLink X zkLink X is a specific application engine for deploying high-performance applications (e.g., financial applications like AMMs and DEXs) across multiple networks. Interoperability between L1 and Ethereum L2 continues to improve with the emergence of cross-chain bridging solutions that attempt to connect these networks. However, users are still faced with the challenge of transferring and managing assets between different networks with different technology stacks and tools. Similarly, developers must deploy applications on multiple networks with different execution environments, which sometimes requires technical knowledge of various programming languages and tool infrastructure.

zkLink X simplifies the dApp development process and provides developers with a unified point to deploy applications and access a wide range of liquidity across multiple networks. It enables dApp users to easily access, trade, and manage their assets across L2s and L1s through a single, capital-efficient platform. zkLink X is a modular deployment solution that allows developers to easily customize App Rollups across execution, settlement, DA, and sorting layers to meet different application needs. As a result, developers can deploy high-performance applications and customize the above components in the following ways:

· Leverage decentralized sorters such as Espresso, Astria, and Fairblock.

· Execute transactions using zkLink’s dedicated transaction-specific zkVM, which is designed for high-performance financial products such as CLOBs, AMMs, and DEXs.

· Settle transactions to zkLink X’s dedicated settlement framework: Nexus or Origin. With Nexus, transactions can be settled on Ethereum and its L2s, while Origin can be settled on Alt L1s such as Avalanche or Solana. In addition, Nexus verifies the transaction status of all associated L2s through a multi-chain state synchronization mechanism, while Origin verifies the transaction status of all associated L1s and L2s through a lightweight Oracle network.

· Utilize external DA solutions such as Celestia and Eigen DA to store transaction and status data.

One notable specific rollup built with zkLink X is ZKEX, a decentralized exchange with aggregated liquidity from Alt L1s such as BNB Smart Chain and L2s such as Starknet. Users can trade multi-chain assets from supported networks on the application without bridging multiple assets. Users can also enjoy a simple and smooth user experience as they can deposit these multi-chain assets into the DEX from a self-custodial wallet such as MetaMask.

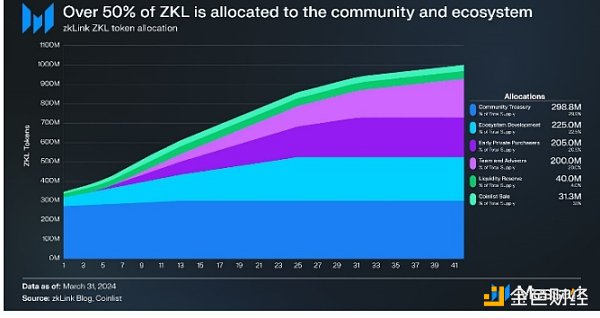

zkLink's native token ZKL is scheduled to be released in 2024, but the exact release date has not yet been announced. ZKL will grant users access to zkLink rollup infrastructure services and grant token holders governance rights over the zkLink project. Planned features for the asset include: · Staking: Provers will stake ZKL to access zkLink’s proof generation marketplace, where dApps request proof generation services. Provers can then be rewarded with ZKL for completing tasks. · Payments: ZKL will become the primary payment token for the zkLink proof generation marketplace. dApps leveraging the zkLink rollup infrastructure will pay ZKL tokens to provers that provide ZKP generation services. Additionally, specific application rollups built using the zkLink rollup infrastructure will pay ZKL to the zkLink DAO, the project’s proposed governance organization. These dApps may also adopt ZKL to pay for specific in-application products. · Governance: Through the future zkLink DAO, ZKL token holders will exercise governance over zkLink’s direction and development decisions.

ZKL will launch with a maximum supply of 1 billion tokens without inflation. The distribution of tokens is as follows:

· Community Treasury (~29.88%): The community treasury managed by the zkLink DAO will control the most significant portion of the total token supply. Approximately 20.75% of this allocation will be released through the TGE and distributed as rewards to early adopters, as well as community development bonuses and bug bounties to developers who have made contributions. Another 9.37% will be used as bug bounties, which will be paid out monthly over a period of one year. The remaining 79.25% will be allocated in the future at the discretion of the DAO.

· Ecosystem Development (22.5%): This allocation is dedicated to ecosystem development and will be used to fund growth initiatives and development plans. 20% of this will be distributed via the TGE, and the remaining 80% will be distributed monthly over a two-year period.

· Early Private Purchasers (20.55%): This allocation will be distributed to private purchasers across all rounds. Approximately 38.93% of this allocation will be reserved for pre-seed investors, with a 5-month lockup period and distributed according to a 27-month linear distribution plan. Approximately 37.98% will be reserved for seed round investors, with a 4-month lockup period and distributed according to a 27-month linear distribution plan. The remaining approximately 22.87% will be reserved for private purchasers, with a 3-month lockup period and distributed according to a 27-month linear distribution plan.

· Team & Advisors (20.00%): This portion will be allocated to the zkLink Labs team and project advisors. This distribution has a 6-month lockup period and will be distributed monthly according to a 3-year linear distribution plan.

· Liquidity Reserve (4.00%): This portion will be locked in the TGE liquidity pool. 50.00% of this allocation will be issued in the TGE and distributed linearly monthly for one year.

· CoinList Sale (~3.13%): This portion will be allocated to zkLink's CoinList community sale participants. 30.00% of this allocation will be unlocked during the TGE and then follow a 9-month linear distribution plan.

Shortly after the mainnet launch in March 2024, zkLink Nova launched the Aggregation Parade in collaboration with multiple Ethereum L2s (Arbitrum, zkSync, Manta, Mantle, and Linea). The program aims to increase ecological participation on zkLink Nova, and participants who perform the following operations on this L3 will receive Nova points (NP) rewards:

· Bridge: Users must deposit at least 0.1 ETH from supported L2s to this L3 to accumulate NP points and receive Soul Bound Tokens (SBT). Early deposits can earn additional points.

· Participate in zkLink's NFT referral program: Users can recommend three other users to this L3 to receive one of four different trademarked NFTs. After acquiring all four different trademark NFTs, users can upgrade the SBT rewards initially earned into Nova Lynks NFTs. Nova Lynks NFT holders are eligible to share part of the 10 million ZKL community pool.

· Staking: Users can stake supported assets such as ETH, wBTC, USDC, and other L2 tokens, liquidity staking tokens, and liquidity re-staking tokens on the network to accumulate NP points. Staking points are based on token classification multiplication plans, group staking milestones, and early bird reward multiplication plans for early staking participants.

Since the mainnet launch in early March 2024, zkLink Nova has attracted more than $300 million in TVL, marking the growing demand for a unified universal L3 platform.

As of the time of writing, there are more than 60 projects in the zkLink Nova ecosystem, covering DeFi, tools, social, games, and NFT fields. zkLink Nova continues to promote ecosystem participation through reward and funding programs and initiatives that support developers, users, and L2s deployed on this L3.

After the TGE, early ecosystem participants will receive ZKL token rewards based on the loyalty points system launched in August 2023. zkLink Labs also launched a liquidity alliance program in December 2023, working with market makers such as Skynet, Asymmetries, EF, Keyrock, Wintermute, Selini and Flowdesk to provide liquidity for DeFi applications on zkLink Nova. In return for providing liquidity, market makers will also share an undisclosed portion of the total ZKL token supply.

On March 8, 2024, zkLink Labs announced its developer grant program. The project will support the development of applications on this L3, focusing on DEX-AMMs, lending platforms, data indexers, oracles, bridges, and yield optimizers. zkLink Labs has reserved 20 million ZKL (2% of the total token supply) for the grant program, and each successful applicant will receive a grant reward of up to 50,000 ZKL.

To encourage continued research that advances L3 development, zkLink also regularly hosts L3 Summit events that bring together L2s and other blockchain infrastructure projects within the Ethereum ecosystem. As of the time of writing, zkLink has successfully hosted two L3 Summits, the first in November 2023 and the most recent in February 2024. These summits have been supported by participation from prominent L2 and infrastructure teams such as Arbitrum, Celestia, EigenLayer, Kakarot, Linea, Polygon zkEVM, Manta, Mantle, Polygon, QED, Scroll, Starknet, Taiko, and zkSync.

On March 14, 2024, zkLink Nova launched the points activity Aggregation Parade, issuing points rewards to users who bridge various tokens to zkLink Nova. Various tokens (including ETH, ETH staking tokens, USDC and USDT) are eligible for NOVA points. The event was a great success. As of March, zkLink Nova has received $305.5 million in bridge funds. According to DefiLlama, zkLink Nova is the largest L3 network by total bridged value (TVB).

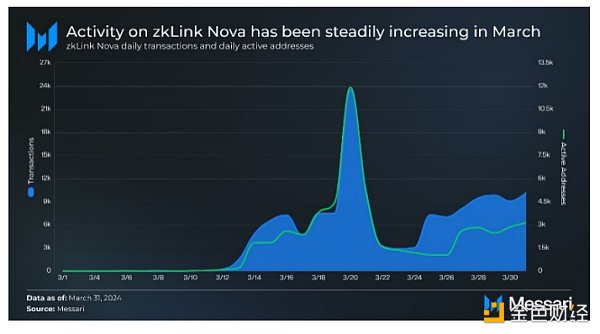

Activity on zkLink Nova has been steadily increasing since the mainnet launch on March 11, 2024. Both daily transactions and daily active addresses peaked on March 20, 2024, at 23,500 and 11,900 respectively. Throughout March, zkLink Nova averaged 4,800 transactions per day and 1,800 daily active addresses.

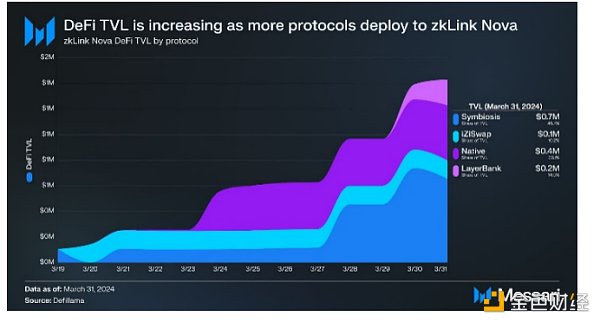

Due to the recent launch of zkLink Nova, DeFi TVL is still low. However, it should continue to grow as more protocols are deployed. There are currently four protocols with significant TVL share: Symbiosis, Native, LayerBank, and iZiSwap. Overall, the four protocols have a total TVL of $1.4 million. The largest protocol is Symbiosis, with a 46% share of the total TVL ($652,200). LayerBank, the only lending protocol to date, has $200,500 in TVL, accounting for 14% of DeFi TVL on zkLink. As more and more protocols are deployed on zkLink, it is expected that more and more value bridged to zkLink will play a role in DeFi.

Popular L2s like Arbitrum, Optimism, Taiko and zkSync are building interoperable expansion solutions to solve Ethereum's fragmentation challenges. For example, Arbitrum's Orbit development stack allows developers to deploy customizable interoperable L2s or L3s, called Orbit chains. Optimism's Superchain goal is to create a unified network of interoperable OP chains, sharing standardized tools and development stacks (OP Stack). zkSync's HyperChain approach connects interoperable but parallel zkEVM stack instances with shared bridge contracts and unified settlements on Ethereum through proof aggregation. However, the diversity of its underlying technology stack limits the interoperability between the Arbitrum and Optimism ecosystems. Taiko is building a Type 1 zkEVM for deploying L2s and L3s, which can seamlessly execute Ethereum code without any changes. Although EVM's compatibility with Ethereum is expected to increase, developers may need to be motivated enough to switch from existing L2 ecosystems such as Arbitrum or Optimism to Taiko.

zkLink takes a universal approach, integrating all L2s and L1s onto a single platform, regardless of the underlying technology. zkLink Nova's L3 simplifies liquidity and development access for all L2s onto a single platform. Meanwhile, zkLink X allows for the deployment of customizable application-specific rollups that support L2s and Alt-L1s. Omni Network is another project that aims to unify Ethereum's L2s. But unlike zkLink, Omni Network is an independent L1 that relies on ETH re-staking as its security. While both zkLink Nova and Omni Network are set to launch in March 2024, analyzing each protocol's approach to aggregating L2s can help determine whether one L3 is well-positioned to address Ethereum's fragmentation challenges.

Critics argue that L3s do not necessarily provide much value in scaling Ethereum, citing security risks as most L3s are settled on L2s and still need to be interoperable. However, others argue that L3s can scale Ethereum by supporting custom application development, which may not be possible on L2s. In addition to scaling Ethereum, L3s like zkLink Nova provide a unified execution environment for developing applications on Ethereum, as zkLink Nova is ultimately settled on Ethereum and its L2s. As a result, users and developers can enjoy an optimized user and developer experience without leaving Ethereum for other L1s.

zkLink Nova's alpha mainnet was launched in March 2024, and the new upgrade of this L3 will include support for external DA solutions and decentralized proof auction markets, as well as the release of a new proof system. For zkLink’s centrally managed ordering service, the team plans to integrate decentralized solutions like Espresso, Astria, and Fairblock in the future to mitigate centralization risks. Another expected upgrade is the ZK Oracle, a light node oracle network that verifies cross-chain state and is part of zkLink X’s specific application engine.

At the time of writing, zkLink operates as a Validum, storing transaction data off-chain through the Data Availability Committee (DAC), but the ultimate goal is to support external DA solutions such as Celestia and EigenDA in the future.

With the gradual release of new L2s, the Ethereum ecosystem will become increasingly complex, and solutions like zkLink and its L3 will be crucial to succinctly optimize the user and developer experience on this L1. In addition, the rise of Alt-L1s will further disrupt the blockchain landscape, highlighting the need for capital-efficient multi-chain applications. zkLink aims to solve these fragmentation challenges with zkLink Nova (universal L3) and zkLink X (custom application-specific scaling engine). Since its launch in early March 2024, zkLink Nova has attracted over $300 million in TVL, demonstrating interest in a unified, universal L3 platform. ZKEX, also deployed on the V2 Alpha mainnet, is the first application-specific DEX built with zkLink X. While other projects race to solve Ethereum's fragmentation challenges, zkLink's development roadmap is focused on building a leading hub for unified user and developer experiences between Ethereum L2s and Alt-L1s.

What are zk-SNARKs and zk-STARKs? They are both zero-knowledge proofs, but what are their properties and how do they compare to each other?

JinseFinance

JinseFinanceThe difference between Based Rollup and traditional Rollup.

JinseFinance

JinseFinanceZK Stack, dedicated vs. general-purpose ZK: Which one is the future? Golden Finance, the line between dedicated and general-purpose ZK is blurring.

JinseFinance

JinseFinanceMany people still confuse FHE with ZK and MPC encryption technologies, so this article will compare these three technologies in detail.

JinseFinance

JinseFinanceIn this article, I try to outline the development history of a cryptographic technology, which is different from the various technological changes in the crypto industry.

JinseFinance

JinseFinanceAOVM is an AI layer protocol built on top of @aoTheComputer, combining AO's hyper-parallelism with AI large models.

JinseFinance

JinseFinanceDencun includes 9 EIPs that enhance everything from security to the staking experience.

JinseFinance

JinseFinanceTechnology,zkEVM,Layer1,Vitalik: What will happen if ZK-EVM is packaged into Ethereum L1? Golden Finance, why not let ZK-EVM be used for rollup natively?

JinseFinance

JinseFinanceAs a product of its times, Dogecoin has its own set of problems. DogeLayer is here to fix just that.

Max Ng

Max Ng Cointelegraph

Cointelegraph