Author: Jack Inabinet, Bankless; Compiler: Tao Zhu, Golden Finance

Renzo’s ezETH Liquidity Restaking Token (LRT) Depegged by 80%! What caused this problem and how did the token price react?

Yesterday afternoon, Renzo Protocol announced the final plan for its airdrop, saying that 5% of the total supply of REZ will be distributed to early users who participated in the first season of ezPoints. It was revealed that the snapshot of the first distribution will take place this Friday, April 26.

After the announcement, ezETH was able to maintain its peg for a few hours, but the token began to gradually decouple from the peg at 10 pm EST, discounting as low as 0.22 ETH during the crazy peak, which lasted for about an hour.

Despite a market cap of $3.2 billion, there was only $27 million of ETH paired with ezETH in the mainnet swap pool before the decoupling; this thin liquidity combined with the lack of withdrawals made such a huge mess for ezETH.

The price of ezETH has since rebounded sharply from the bottom, but still remains at a small discount, which may reflect the risk of future decoupling, considering that the liquidity of paired ETH is now even thinner, falling to $10 million after yesterday's event.

Renzo’s ezETH is one of the most widely integrated LRTs in DeFi, second only to ether.fi’s eETH. As prices began to plummet yesterday, these protocols were forced into liquidations, exacerbating the decoupling phenomenon.

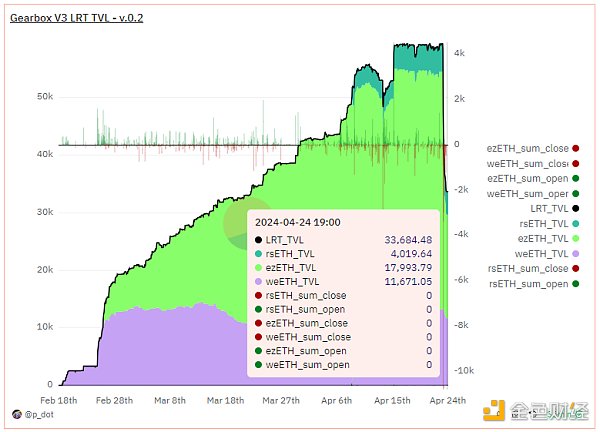

For example, Gearbox lost 55% of its ezETH TVL, while lending platform Morpho had more than 150 liquidations of over $25 million in ezETH collateral.

While the emergence of the second season of the ezPoints event should discourage withdrawals after the April 26 snapshot, given the increasingly thin liquidity of the token, there is certainly a non-trivial risk of another ezETH depeg if more depositors wish to exit.

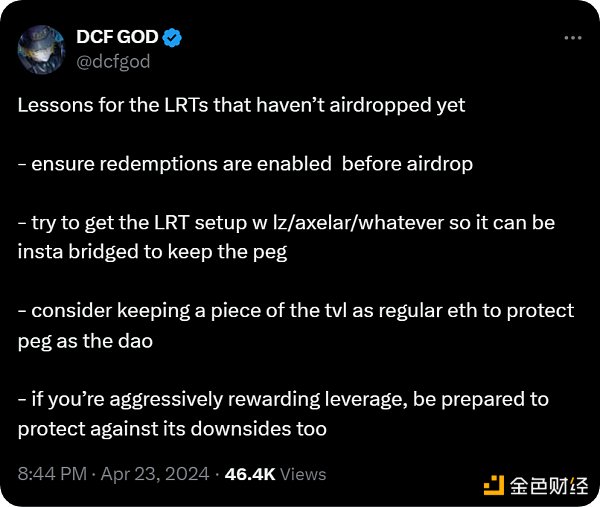

Other LRT protocols should be careful to learn from the ezETH depeg and should consider enabling withdrawals, providing multi-chain liquidity solutions (similar to Renzo's approach via Connext), and maintaining ETH reserves to defend their pegs before announcing airdrop distributions, which may prompt some depositors to exit.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance Max Ng

Max Ng Brian

Brian JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph