Author: UkuriaOC, CryptoVizArt, Glassnode; Compiler: Deng Tong, Golden Finance

Summary

Most Bitcoin investors are holding unrealized profits, and speculative interest has returned to the market for the first time after two months of sideways trading.

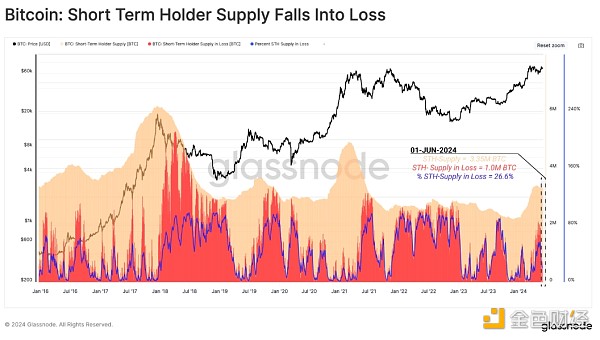

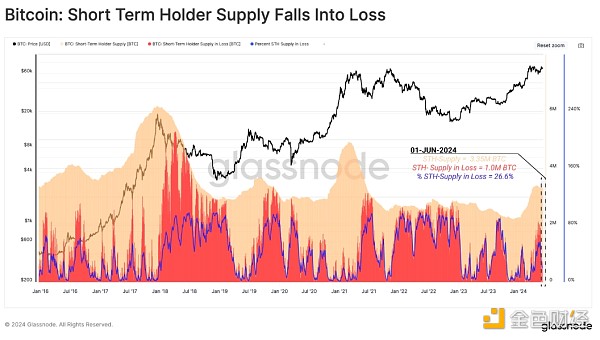

The short-term holder group has borne the vast majority of market losses, which usually occurs when a bull market adjusts from a new high.

The sell-side risk ratio of both long-term and short-term holders has experienced a reset, indicating that a new balance has been found. The market is ready to act, and near-term volatility expectations should increase.

Mt Gox Progress

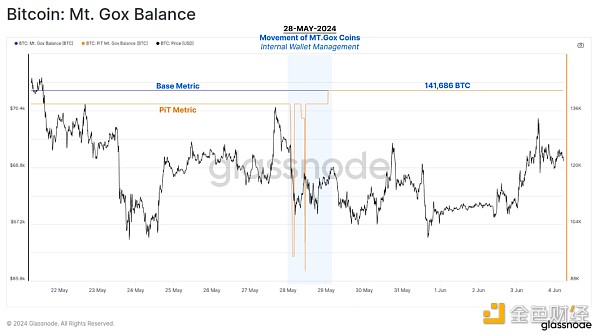

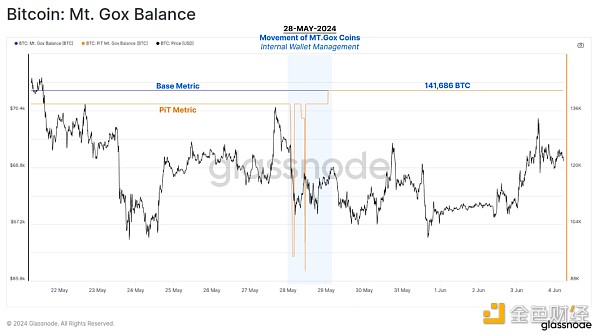

On May 28, 2024, the market reacted to the internal wallet consolidation of the Mt.Gox trustee (the legal entity responsible for the safekeeping of the bankrupt exchange's 141,000 BTC). More than a decade later, this is the first indication that the long-awaited Mt.Gox distribution event is imminent.

Former Mt.Gox CEO Mark Karpeles confirmed that the nature of the token movement is due to internal wallet management in preparation for the distribution to creditors. The distribution is expected to be completed in October this year.

By evaluating Mt.Gox balances, we can visualize this event using the Glassnodes Point in Time (PiT) metric. The PiT metric is immutable and uses a cluster of all known wallets at the time of observation to reflect the state of each metric. Standard MtGox balance metrics are variable and reflect best estimates at all points in time.

Here we can see internal wallet management, where over 141k BTC were moved in several parts throughout the day on May 28th.

Capital Flows and Composition

The main impact of such a large amount of long-idle coins being used is that unfiltered metrics such as Realized Cap, SOPR, and Coindays Destroyed will show a large spike associated with these Mt Gox coins. In theory, these coins have been revalued to a higher cost basis during the wallet management transactions.

We can use the entity-adjusted variation of realized cap to filter out these uneconomical fund transfers to maintain a clear view of Bitcoin capital inflows. Realized cap is currently at an ATH valuation of $580 billion. However, we can see that the rate of new inflows has slowed since late April as the market consolidates.

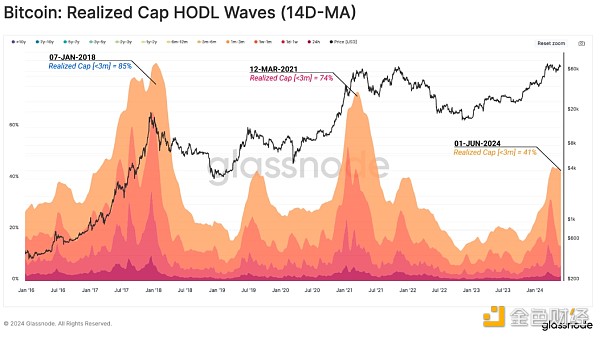

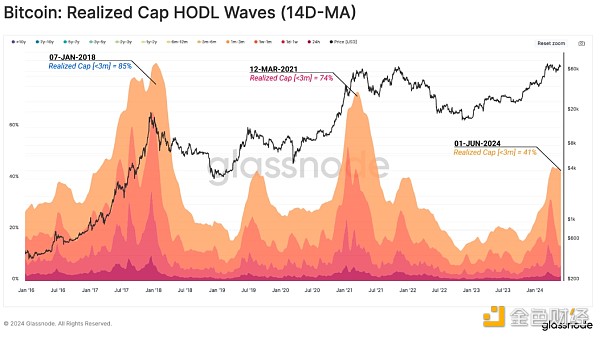

The Realized Cap HODL Waves indicator can then be used to examine the overall wealth composition over time. By isolating tokens under 3 months old, we are able to assess the proportion of liquidity held by "new demand".

This group currently accounts for 41% of the network's wealth, proving that wealth distribution is moving in the direction of new demand. Relative to the historical end values of each cycle, this wealth transfer usually reaches a saturation of more than 70% with new demand, which indicates that long-term investors are consuming and selling relatively small amounts of supply.

While inflows of liquidity and speculative appetite have weakened over the past two months, the return to the $68,000 level has prompted most short-term holders to re-hold unrealized profits.

This suggests that despite the recent sideways price action, the cost basis of most recent buyers is now more favorable and below the current spot price.

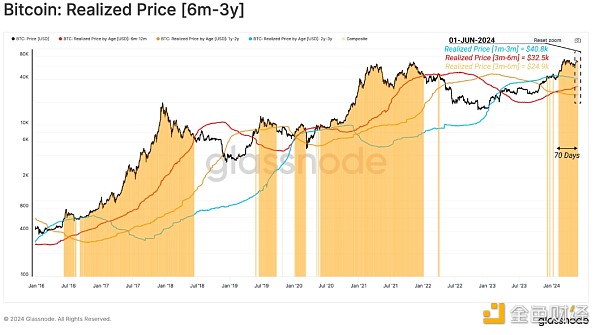

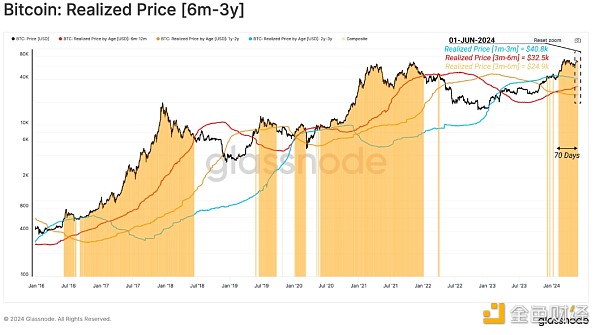

We can study the average buying price in different time periods. Another group worth paying attention to is the single-period holders (coin age is 6 months to 3 years). We noticed that all members of this group have held a large amount of unrealized profits since the price broke through the $40,000 area.

As the price rose to a high of $73,000, the market absorbed a large amount of selling from this group. We can expect that if the price rises, the incentive for this group to sell more supply will increase and further increase their unrealized profits.

Long Term Holder Market

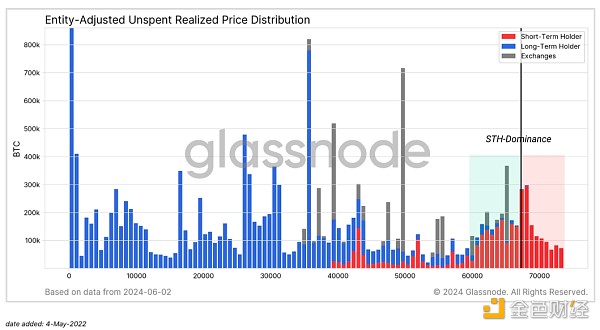

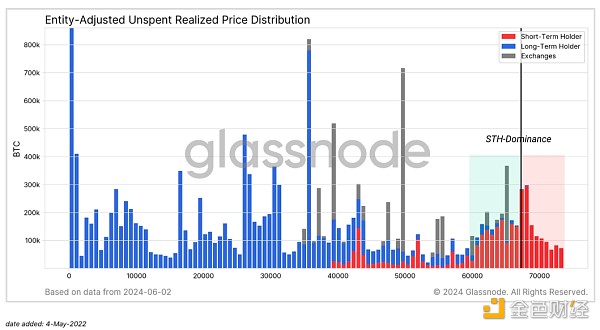

As the market consolidates near its ATH, we can use the URPD indicator to visualize the supply of BTC based on its acquisition cost basis.

There are a large number of short term holders accumulating coins near the current spot price. This suggests that there is a lot of investment taking place in this price area. However, this carries the risk of increased investor sensitivity to price moves in either direction.

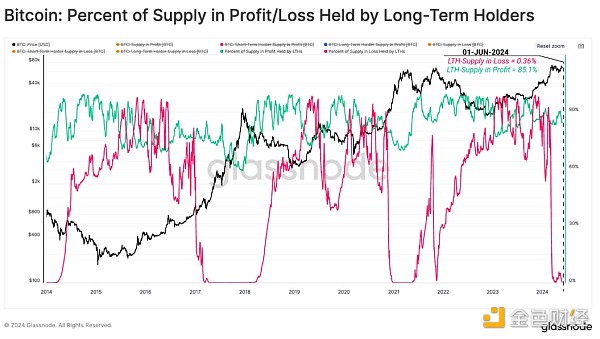

Almost all of the tokens with unrealized losses belong to the short-term holder group, which makes sense given the proximity to ATHs from previous cycles.

The chart below is a tool that depicts the proportion of short-term holders losing money. This tool can be used to observe when this group exhibits high sensitivity to changes in price action, especially when a large amount of supply goes into losses in a short period of time.

The market's recent pullback to $58,000 reflects a -21% correction, and the largest drop since the FTX crash. At the low point of this move, a staggering 56% (1.9 million BTC) of STH supply went into losses.

However, while the massive supply is technically at a low, the magnitude of unrealized losses is still consistent with a typical bull market correction and is starting to abate as the market stabilizes.

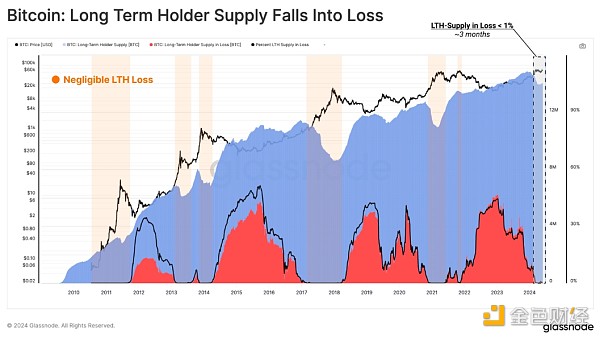

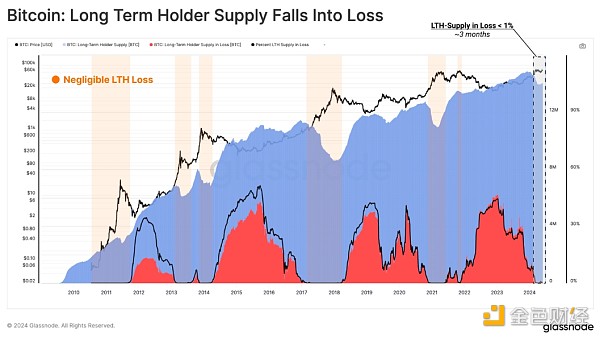

Turning to long-term holders, we can see that the total amount of losing LTH supply is negligible, with only 49,000 BTC (0.03% of LTH supply) above the spot price. Given that the new ATH was only set in March (less than 155 days ago), these losing LTH tokens are the few holders who bought at the top of the 2021 cycle and have been holding on.

Another way to visualize this is by the proportion of all lost supply that is in the LTH cohort. At the bottom of a bear market, LTH tends to bear the majority of unrealized losses as speculators are driven out of the market and the final capitulation results in a massive transfer of token ownership to committed holders.

Conversely, during the manic phase of a bull market, LTH's contribution to lost supply tends to zero. Meanwhile, STH bears the vast majority of market losses as new demand buys tokens near local and global price peaks.

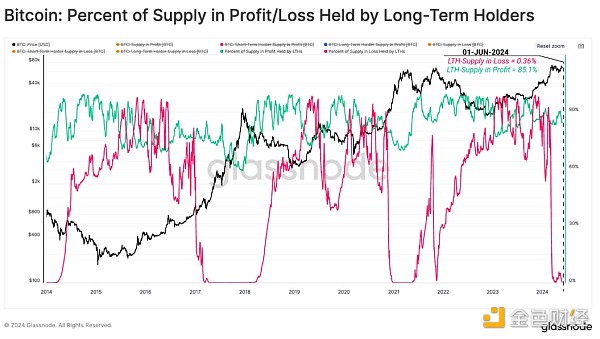

Currently, LTH holds just 0.3% of lost supply, while subsequent profits account for over 85% of supply.

Room to grow

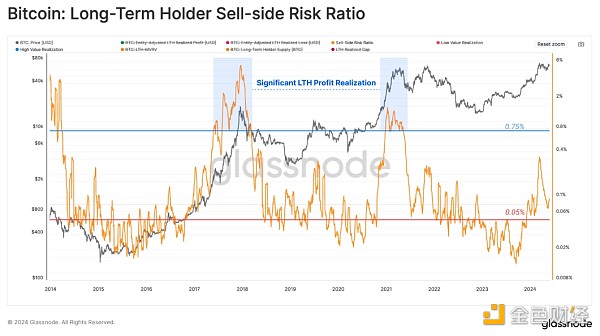

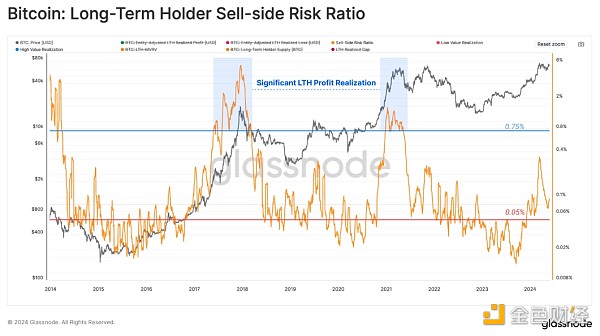

We can investigate the activities of long-term and short-term holders by analyzing their spending behavior. To do this, we can use the sell-side risk ratio, which assesses the absolute value of the profits plus losses locked by investors in relation to the size of the asset (measured in terms of real market capitalization). We can think of this metric under the following framework:

High values indicate that investors are making large profits or losses relative to their cost basis when spending tokens. This situation indicates that the market may need to re-find equilibrium and usually occurs in the context of large price fluctuations.

The low values indicate that most tokens are being spent relatively close to their breakeven cost basis, indicating that a degree of equilibrium has been reached. This situation typically indicates that the "profit and loss" within the current price range has been exhausted, typically describing a low volatility environment.

Notably, both the profit and loss of the STH group have reset, indicating that a degree of equilibrium has been established during the recent sideways price consolidation.

For the long-term holder group, their sell-side risk ratio increased significantly as profit taking took place until reaching the ATH of $73,000.

However, from a historical perspective, their sell-side risk ratio is still at a low level compared to the previous ATH breakout. This means that the relative magnitude of profit taking by the LTH group is smaller relative to previous market cycles. This may indicate that the group is waiting for higher prices before increasing its distribution pressure.

Summary

After months of price consolidation, the dawn of market speculation seems to be returning. New buyers and single-cycle investors are mainly holding unrealized profits. This observation is supported by the fact that only 0.03% of long term holders are in the red, which is typical of the early stages of a bull market.

Over the past 2 months, the seller risk ratio for long and short term holders has reset and returned to equilibrium. This suggests that most of the profits and losses that could have been made in this price range have already been realized and suggests an increased risk of significant volatility in the near term.

JinseFinance

JinseFinance