Source: Lawyer Shao Shiwei

Introduction:

Due to the traffic advantages of big Vs and KOLs in the currency circle, many virtual currency exchanges will choose to cooperate with In this type of group cooperation, big Vs and KOLs in the currency circle serve as order leaders, leading novice users to follow orders. Order leaders can receive commissions from the platform.

As we all know, virtual currency-related businesses are classified as illegal financial activities in our country. So, will the above-mentioned business cooperation model have relevant legal risks for the order operators?

0 1 Illegal business crime

Contract trading in virtual currency exchanges is similar to traditional futures contracts. Traditional futures trading requires a relevant futures license. Therefore, operating futures business without permission from the regulatory authorities constitutes an illegal business crime. If the order agent leads the user to conduct contract order transactions, does the exchange's behavior constitute an illegal operation, and is there any relevant legal risk for the order agent?

Lawyer Shao believes thatthe contract trading business model of the virtual currency exchange does not constitute an illegal business crime. According to Article 225 of the Criminal Law, "Anyone who illegally operates securities, futures, or insurance businesses without the approval of the relevant national competent authorities, or illegally engages in fund payment and settlement business" constitutes the crime of illegal business operations. Although contract trading is similar to futures in principle, it is not a traditional futures business. "Illegal business" corresponds to the concept of "legal business". In other words, you must have a legal business, so correspondingly, there will be no futures business. Those who obtain relevant licenses are classified as illegal businesses. Since virtual currency-related businesses have been characterized as illegal financial activities, it is impossible for relevant specific businesses to have relevant licensing qualifications. Although the crime of illegal business operations has a catch-all clause of "other illegal business activities that seriously disrupt market order" (hence it is called "pocket crime"), more detailed provisions in laws, regulations, judicial interpretations, etc. are also needed. Otherwise, the law cannot It is expressly stipulated that it is not a crime.

However, even if the contract ordering and other business of a virtual currency exchange does not constitute an illegal business crime, if the following circumstances exist, the ordering officer may be at legal risk of being suspected of the following types of crimes.

02 Crime of organizing and leading pyramid schemes

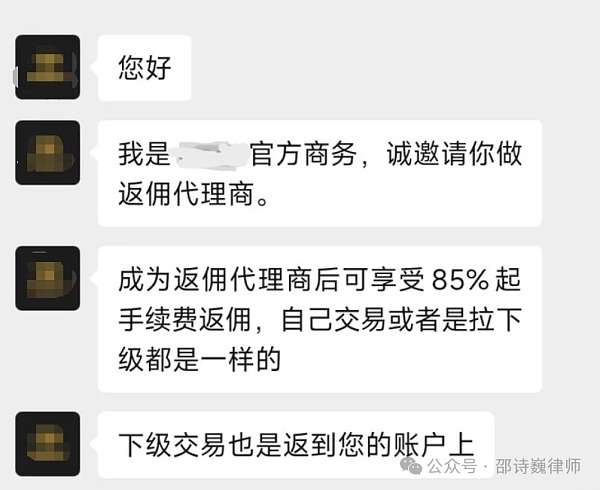

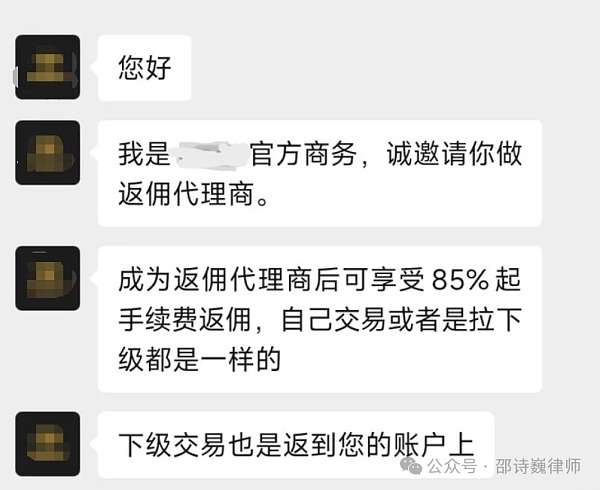

Invitations shared by users through KOL Code to register an exchange account. In the future, the user's transaction fees on the exchange can be given to the KOL in a corresponding proportion of commissions. This proportion may reach 40% or even higher.

If the order leader requires the user to pay a certain membership fee in order to obtain the qualification to follow orders, the payment will be based on headcount, and the development staff reaches the "30 people and level 3 development staff" in the crime of organizing and leading pyramid selling activities. "Above", the risk of criminal involvement is higher.

For example (2018) Sichuan 06 Criminal Case No. 56, the business content of Wu and others was to use Litecoin as a payment tool to handle the "mining machine rental" business from a website in order to increase the scale of funds. , Wu gradually developed an 11-level membership model with more than 100 people, and used the collected membership fees to make larger investments. Businesses involving virtual currencies and mining machines are prohibited in our country, but the court ultimately found that Wu and others were guilty of organizing and leading pyramid schemes because their behavior was consistent with the characteristics of recruiting people, paying membership fees, and grading. In the same way, regardless of whether the virtual currency copy trading model itself violates the prohibitive provisions of the law, KOL must guard against pyramid schemes risks at the level of attracting new users.

03 The crime of opening a casino

Contract business in virtual currency exchanges, Is it suspected of opening a casino? Lawyer Shao’s previous article “Does operating a virtual currency exchange constitute the crime of opening a casino? 》 has also been analyzed.

There were previous news reports (1) that the “bitwell” virtual currency trading platform was suspected of fraud, and the company’s personnel involved were arrested. Afterwards, the procuratorate changed the charges in this case and transferred the case to the court for the crime of opening a casino. The key reason for changing the crime to the crime of opening a casino is the perpetual contract business in the exchange.

If the judicial authorities determine that the contract business of a virtual currency exchange is equivalent to gambling, and the platform is suspected of opening a casino, then the new recruit rebate model mentioned in the second point of this article will be similar to The exchange (online gambling platform) has opened agency accounts for KOLs (agents) who help develop members. The commission received by the superior agent is determined based on the amount of bets, wins and losses of the user (gambler).

04 Fraud

From the perspective of users, especially rights defenders It seems that the exchanges and order agents are all "colluding" together to cut off the leeks of users. However, the order leader is not an employee of the exchange, and the two parties only have a cooperative relationship. If there are black-box operations within the exchange, manipulating the backend, causing users to lose money, or even run away with the "coins", the platform will be suspected of fraud. Whether the traders also have criminal risks should be determined based on the profit situation, the degree of subjective knowledge, etc. Comprehensive judgment.

05 Written at the end

February 2023, Fengxian District, Shanghai The People's Procuratorate released a case in which two futures intermediaries were sentenced for "calling orders" and "bringing orders" online. This case is the first case in the country of a futures intermediary illegally operating futures trading consulting business. Although this article mentioned that the business related to virtual currency exchanges may be difficult to identify as an illegal business crime, it can still be seen from this case that not only institutions have legal risks, Orders and other transaction consulting services strong>In judicial practice, there is also the possibility of being regulated by criminal law.

[1] Local Public Security Bureau: The "bitwell" virtual currency trading platform was suspected of fraud, and 21 suspects were arrested and 5,000 cash was seized. More than 10,000 yuan_ifeng.com

Cheng Yuan

Cheng Yuan