Author: IGNAS, DEFI RESEARCH; Compiler: Joyce, BlockBeats

Recently, the re-staking track has attracted community attention since RSTK, and strong players such as Eigenlayer, ether.fi, and Puffer Finance have emerged, attracting a large amount of liquidity from the community. Among the many players, who has more development potential? In this blog post, encryption researcher Ignas starts from the potential of the LRT track, panoramicly analyzes the "LRT war" carried out by the re-staking protocol from the perspectives of points mechanism, income method, token economics, etc., and finally gives his own opinion Strategy manual. The compilation is as follows:

Did you know? Rocket Pool began preparing for ETH staking in 2017, and although Lido only debuted a month before the launch of Ethereum PoS in 2020, it quickly occupied 70% of the market share, while Rocket Pool’s rETH market share was only 4.6%.

Lido has taken the lead in Liquidity Collateralized Tokens (LST), but the competition for Liquidity Recollateralized Tokens (LRT) is just getting started ! This heralds a challenging battle ahead for the cryptocurrency industry’s most promising sector.

In this blog, I will share why I am optimistic about LRTs, explore the main differences between them, and interview the five major LRT protocols to gain a deeper understanding of their View.

The optimistic future of LRT

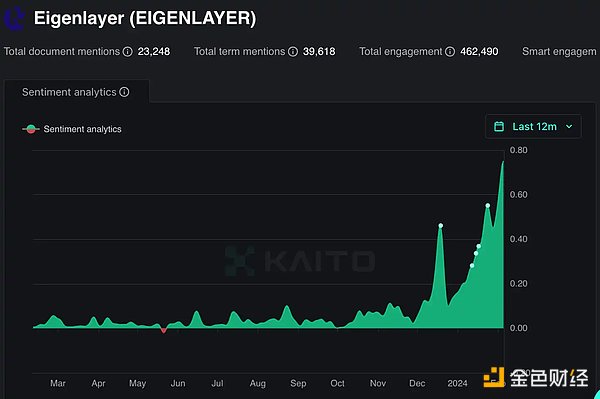

This is the second article about re-staking navigation. In the first article, I discussed the use cases for Eigenlayer’s Active Validation Service so that we could better understand each of the building blocks of restaking (and their risks). I also discussed my bullish stance on the September 2023 re-squatting + LRT, and my bullish thesis has not changed one bit. It actually gets stronger. Sentiment analysis shows that bullish sentiment is exploding.

I'm bullish on the re-hypothecation + LRT narrative because it has 3 key elements I look for in an ecosystem: 1) Innovative technology 2) Money printing opportunities 3) Compelling narrative.

I even believe that re-staking and implementing LRT will make ETH an attractive asset worth buying and holding. This, in turn, will cause ETH to catch up with BTC and altcoins. But it’s important to note that this is not a risk-free return. You must understand that you are layering one asset onto another, so your risk increases proportionately.

What is LRT and why do we need it?

Let’s step back a little and understand the LRT (Liquidity Recollateralized Token) meta-trend that I shared here before.

EigenLayer's re-staking model has a significant disadvantage for DeFi: once your liquidity staked tokens (LSTs) are locked on EigenLayer, they become Lack of liquidity. You can’t trade it, use it as collateral, or use it anywhere else in DeFi.

LRTs unlock this liquidity again by adding a layer to unlock it again. You can choose to deposit your LSTs directly into EigenLayer via the Liquidity Redemption Protocol. Since I first introduced restaking, LRT-integrated TVL has grown to $1.8 billion. Just a week ago, when I shared this article on AVS, the number was $1.8 billion...

Bullish elements:

LRT provides a higher ETH yield. With LRT, we can get Ethereum staking yield (~5%) + Eigenlayer re-staking rewards (~10%) + LRT protocol token emissions (~10% and more). When Eigenlayer is fully live, we expect ETH gains to be around 25%. You've already earned 40% APY on Pendle.

Airdrop: Eigenlayer+ AVS + LRT protocol token airdrop, AltLayer is just the first one.

Simplicity: Holding LRT (liquidity re-staking token) can simplify management. You don’t need to directly deal with delegation to operators, compound interest returns, and pay attention to all related developments while only paying about 10% of the fee.

I believe that the liquidity unlocked by LRTs (which was originally locked in EigenLayer) will create greater leverage in the DeFi field, which may Pushing TVL and ETH prices higher like DeFi Summer 2020 did. This could ultimately lead to new market volatility.

Currently we are still in the early stages, and EigenLayer is still in the second phase of the test network. I believe that when EigenLayer is fully launched, the real excitement has just begun.

LRT War

Points, points, points...

This war will be divided into several stages. Currently, the first phase is underway. Since few people understand the difference between these LRT protocols (can you?), points become the main weapon at this stage.

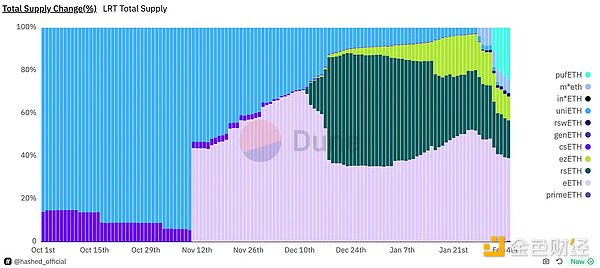

Currently, EtherFi (eETH) occupies the leading position in the LRT (liquidity re-staking token) market, with a market share (MS) of 39%. In fact, eETH’s total value locked (TVL) in Eigenlayer even exceeds stETH.

The dominance of market share largely depends on who launches first, but Puffer (pufETH), as a latecomer, quickly climbed to second place in the market The share reached 22%. Why is this? The answer is: points!

The Puffer protocol, which recently announced an investment from Binance, is offering 3x stakers who withdraw stETH from Eigenlayer and deposit it into Puffer. integral. This incentive could be a key factor in Puffer gaining market share quickly. By offering higher point rewards, Puffer successfully attracted investors looking to maximize returns, resulting in rapid market share growth in a short period of time.

Although Eigenpie joined late, it quickly accumulated a total value locked (TVL) of US$184 million and a market share of 6%.

Eigenpie is offering the following incentives:

In the first 15 days (as of February 12 Day), users can get 2 times the points bonus.

Points will be used to airdrop EGP tokens, accounting for 10% of the total supply.

Points are required to participate in the EGP Token Initial Offering (IDO), which has a fixed market capitalization (FDV) of $5 million.

First movers have a natural advantage in attracting ETH, which makes new entrants face challenges in attracting funds. However, Puffer's success shows that there are still uncertainties in the market. I think we may be heading into a “vampire attack” period where emerging protocols will offer generous points or token rewards to users who withdraw funds from existing LRTs and deposit into their platforms. Although we haven’t reached this stage yet, EtherFi has started a deVamp campaign to encourage users to switch from Eigenlayer’s native restaking to EtherFi.

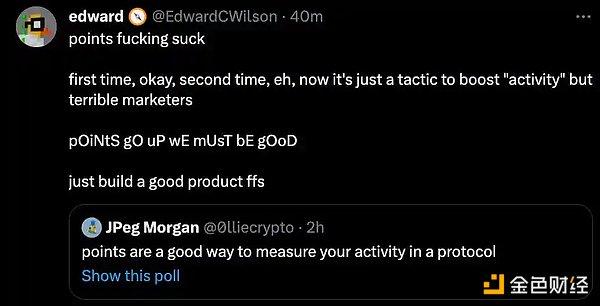

Since points are off-chain and supply is not restricted, teams are undertaking multiple activities to maintain the inflow of ETH. I believe we have now reached a point where users should not be tempted to stake ETH unless there is an attractive reward campaign.

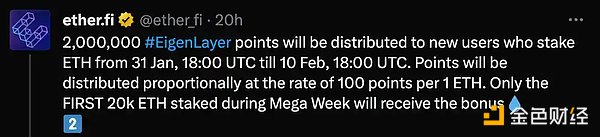

Eigenpie, for example, is offering an additional 1.2 million Eigenlayer points to ETHx depositors until February 9th. At the same time, EtherFi is also offering 2 million Eigenlayer Points (on top of EtherFi Points) from its treasury to new depositors until February 10th.

Notice the importance of integration

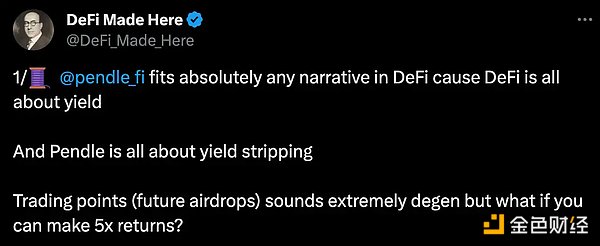

Given that stETH is the most liquid and deeply integrated asset in the DeFi ecosystem, the new It won’t be easy for LST (liquidity staked token) to surpass it. For example, eETH (EtherFi), rsETH (KelpDAO) and ezETH (Renzo) have been integrated into Pendle, and the "benefits" of LRT are divided into two parts:

YT: Provides you with exposure to earnings, points, and airdrops from the LRT protocol and Eigenlayer.

PT: Provides you with a fixed annual rate of return (with lock-in period), up to 41% of ezETH.

LRT protocols typically invest a large amount of points (POINTS) in integration in order to take the lead in liquidity. Therefore, observing a protocol’s integration beyond TVL is an important indicator of its market dominance.

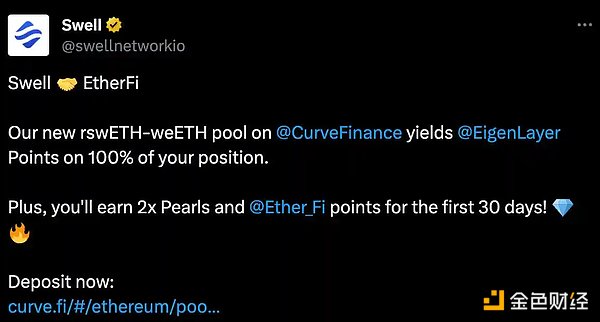

Swell x EtherFi seems to have realized this and they have adopted a non-competitive strategy. Working together rather than against each other, they launched a shared rswETH/weETH pool on Curve that rewards users with double Pearls and EtherFi points. This strategy helps them build broader partnerships in the rehyping space, potentially gaining an advantage over the competition.

Token issuance and protocol differentiation

I believe that when Eigenlayer is fully online and provides multiple AVS (active verification services) to re-stake ETH, The real excitement has just begun. That’s when the differences between different LRT (Liquidity Recollateralized Token) protocols will start to make real sense.

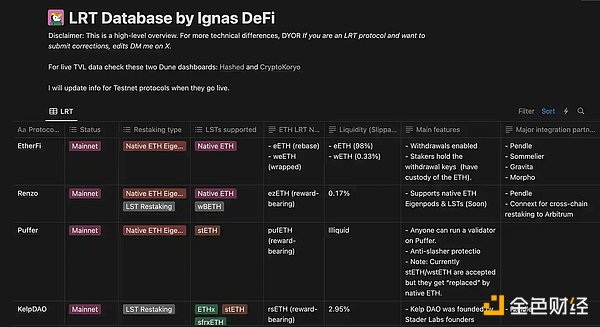

Initially, I planned to cover all LRT protocols in this article. However, including all protocols would make the article too lengthy. So, I created a Notion dashboard that highlights the key differentiators. For example, it includes liquidity information by checking slippage when trading 1k LRT ETH to ETH. You can check it out here.

In short, the main differences are as follows:

-Re-staking type: Re-staking native ETH to Eigenpods, or LST (such as stETH, rETH etc.) to re-pledge.

-Withdrawal: Currently only EtherFi supports withdrawal.

-Liquidity: LRT ETH derivatives need to remain liquid in the secondary market. Currently, KelpDAO, Renzo, and EtherFi are the only ones maintaining liquidity.

-Integrated into DeFi 1.0 platforms: Pendle is a major platform. (I exclude permissionless deployments like decentralized exchanges (DEXes). These integrations fall under the "liquidity" section.)

-Security, Decentralization and other factors.

Since the LRT war has just begun, I decided to ask the team directly how they see this war developing:

“We expect this to be similar to the evolution of the LST wars, with protocols differentiating themselves through innovation, ease of use, and revenue.” - Kizen, Chief Marketing Officer of Swell. Puffer's community manager said: "We believe that the ultimate winners will be those who excel in liquidity, DeFi integration and best AVS risk management."

Consensus seems to be focused on three key elements: Which protocol offers higher yields? Which protocol does a better job at risk management? Which protocol offers better token economics to continue attracting users/maintaining liquidity?

Nearly all the protocols I interviewed emphasized the security of their protocols, but each team emphasized the security aspects differently. For Swell, it’s its integration with Chainlink Proof of Reserves, audits from Sigma Prime, and additional risk management work from top DeFi advisors and slash-proof experts.

Puffer community manager emphasized their commitment to decentralization strategy from the beginning: Puffer chose a long-term path and built a Decentralized protocol. Doing so reduces the tail risk currently prevalent in the LST market. […] In the future, there will certainly be some aggressive LRTs who choose to engage in too many high-risk AVS and eventually collapse, although this will appeal to some users. However, as the re-hypothecation market matures, ETH stakers will begin to look for more secure LRT to park their funds.

Rok Kopp, co-founder of EtherFi, believes that security comes from users holding withdrawal keys and control of decentralized nodes: "We are currently the only A protocol that lets stakers hold withdrawal keys and directly control ETH." He also pointed out that other LRT protocols delegate all staking tasks to professional node operators. Some or even all other LRTs run their nodes through a single validator, which is effectively centralized.

Kratik from the Renzo team said that they believe the most valuable LRTs are those that provide users with the optimal risk-adjusted portfolio: Renzo aims to provide users with the most optimal The safest and most convenient way to re-pledge risk adjustment exposure while enjoying the benefits of an institutional-level node operator.

So, how do you and I choose the best re-pledge agreement?

Indeed, choosing a suitable LRT protocol for re-staking is not an easy task, especially as the market changes every day, which is better than mine It's much more complicated than initially imagined. Currently, I have adopted a strategy of re-staking in multiple LRT protocols at the same time while constantly researching. I believe that when the LRT governance token actually launches, there will be more differentiation in the market. I expect these tokens may be launched when the Eigenlayer mainnet goes live or when the EIGEN token is released, to take advantage of the market heat.

Also, I think they need to launch a token because points fatigue is starting to show. I would be very disappointed if they don't launch with the EIGEN token.

Eventually, tokens will be launched because the LRT protocol needs to hand decision-making power (and perhaps responsibility) to the DAO, letting the community decide which operators and AVS should re-pledge funds.

LRT Protocol Token Economics

Back in September, I doubted that most LRT wars (in the form of tokens rather than points) will be similar to how Curve wars evolved.

When new AVS launch on Eigenlayer’s Pool Security, they will require additional incentives to attract re-staking ETH. AVS, which launches first, may have an easier time attracting liquidity because there are fewer options for us to consider. However, deciding in which protocol to re-stake is a time-consuming task that requires expertise. Most users will tend to choose the AVS that offers the highest returns. easy to understand.

At this time, the LRT protocol governance token comes in handy.

The new AVS (Active Verification Service) may find that rather than attracting users and TVL (Total Value Locked) directly, it is better to direct deposits towards them by influencing the LRT protocol More economical and effective. Voting on token issuance by acquiring LRT tokens may be more efficient than providing native token rewards.

For example, AltLayer will require ETH to enable the Restaked Rollup service for its three AVS. They can attract Eigenlayer’s large-scale stakers and retail investors by offering them their own token rewards. However, it may be simpler and less expensive to lobby LRT protocols that already have large amounts of re-staking ETH.

This dynamic, in turn, increases demand for LRT tokens, especially those that successfully attract significant re-staking of ETH. As we saw with the “Curve Wars,” competition among AVS for DAO votes may become fierce as more AVS are launched. Probably not at first, but as more AVS are launched, competition will be inevitable.

There is actually little to no information about the LRT protocol's native token, but some teams have agreed to share some alpha with Ignas' blog readers:

Swell will adopt veTokenomics (voting token economics): Swell will implement a Curve-like voting escrow and metering flywheel system within its ecosystem. In this way, SWELL will be used to reward the most loyal community members, giving them the ability to direct the flow of rewards.

While other teams did not share exact details, they all mentioned that the tokens will be used to vote for operators/AVS. "PUFI holders ultimately decide which [re-staking operators] are whitelisted and how the protocol's re-staking ETH is deployed to them." - Puffer Community Manager

So, I would be very surprised if the token is not launched when Eigenlayer is fully launched.

While votes for AVS may not be directly specific to multiple protocols, each protocol's governance model may differ. For example, the co-founder of EtherFi mentioned that stakers do not need to pick specific AVS, but can choose based on their own risk appetite. KelpDAO plans to establish an active risk committee and governance process.

Risk and Strategy Manual

In short, our valuable ETH assets and DeFi ecosystem stability. For stakers like us, as well as the DeFi protocol and the entire ecosystem, the risks are huge.

In conversations with the LRT protocol team, some teams revealed their plans to charge a 10% commission that will accrue to the DAO. Considering that billions of dollars of ETH will be re-staking in the future, such a revenue stream will help increase the value of their native token.

In the fields of DeFi and Ethereum, re-pledge can significantly increase overall returns. As more lending protocols adopt LRTs, the yield on lending will rise. At the same time, as TVL grows, we can foresee a new wave of innovative dApps emerging, all thanks to the contributions of AVSes.

However, risks are also growing simultaneously. The risks of decoupling, smart contract vulnerabilities, and hacks are accumulating, and we could be in for some bad days. Let’s hope these risks don’t turn into fatal blows. For us, it is crucial to protect the security of ETH assets while pursuing maximization of points. With so many extra points going on, I’m running low on ETH…

So, here’s an updated version of the strategy I shared back in September. Here’s how I do it:

Due diligence: I test every LRT protocol by depositing a small amount of ETH. I would check in with their backers, investors, and join Discord as an anonymous account, asking questions to make sure I understood how they worked.

Market dynamics: Pay attention to which LRT protocols have gained the most TVL, successfully integrated into existing DeFi infrastructure, and their liquidity in the secondary market . I initially thought the LRT market would be closely similar to the LST market, with 70% dominance, but as more AVS are launched and LRT protocol design differences start to emerge, there may only be a handful of LRTs sharing the majority of ETH.

Risk management: Protect my ETH principal through conservative mining. I originally planned to only invest 5% of my total ETH holdings per protocol, but have now increased that to 10% per protocol... a bit risky.

Token strategy: I am betting on those LRT governance tokens with attractive "Ponzi token economics" that can build a Self-sustaining flywheel. These tokens should offer attractive staking yields, real yield rewards, and voting rights on which AVS receive re-staking ETH. Additionally, they need to have an inflation rate low enough to offset any selling pressure.

Exit strategy: During the market boom, when everyone is talking about how LRT and LRT governance tokens are generating new "meta" of "generational wealth" , I would cash out and put back into ETH. It is best to sell in batches and gradually sell as the price rises.

Review and adapt: Hopefully the market will offer something new that we haven’t seen yet. If you see a WTF moment that confuses everyone but is discussed endlessly on CT (even if it's negative), watch, learn, and adapt. Those are the best investment opportunities.

I will conclude with a quote from Rok Kopp, and I agree with him:

“The LRT market is still in such a nascent stage, which is why it’s so exciting! We’ve just seen the first AVS enter the market. We think there will be a number of different ways to re-stake over time .Ultimately, we think restaking may become the most important thing on Ethereum, because Ethereum itself is."

Why Lido can succeed despite coming later Win? Mainly because of timing and incentives. So, don’t be too quick to give up points.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Huang Bo

Huang Bo JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance decrypt

decrypt