Author: Marco Manoppo

Source: substack

DAO stands for Decentralized Autonomous Organization.

A bottom-up organizational entity rather than the traditional top-down hierarchy. With no central authority, decisions are made as a collective. Token holders participate in governance by voting on proposals that could change certain parameters in the protocol associated with the DAO. Smart contracts, as originally written, lay the groundwork for what can and cannot be changed.

Inspired by the original decentralized crypto ethos, The DAO aims to create a crypto-native structure that lives up to this ideology. It also reduces regulatory risk, as a functioning DAO means it can be self-sustaining without a penultimate owner or decision maker. There is no CEO to dictate the trajectory of the DAO, and no board of directors to oversee governance.

At first glance, this organizational structure sounds like a good idea. It is in keeping with the original crypto spirit and includes additional benefits. Imagine if Uber shareholders could change ride fares and surge pricing algorithms by voting on governance proposals. Imagine if there was no CEO, then Uber could continue to subsidize cheap rides by distributing more Uber stock as a liquidity-driven reward. Imagine if Uber CEO Dara Khosrowshahi never made the decision to launch UberEats and make the company profitable. Imagine how long it would have taken to achieve all this with a bottom-up approach. ...which doesn't sound so good now.

I know DAOs are still experimenting with various governance structures; but for now, it appears to be mimicking the benefits of shareholder voting rights without the same level of efficiency or oversight.

Achieving decentralization and autonomy with accountability is hard.

So, how can DAOs improve? In this post, we propose a framework for thinking about decentralized governance, and how to optimize good business decisions with it.

A quick overview of what this article is about:

Decentralizing too quickly or too early is the number one mistake.

DAO inspirations tend to create a "false narrative" that every decision is "the will of the community".

Having a hierarchical structure in a DAO is not a bad thing.

A full-fledged DAO may look a lot like a public company.

Accountability needs to be enforced on-chain.

false narrative

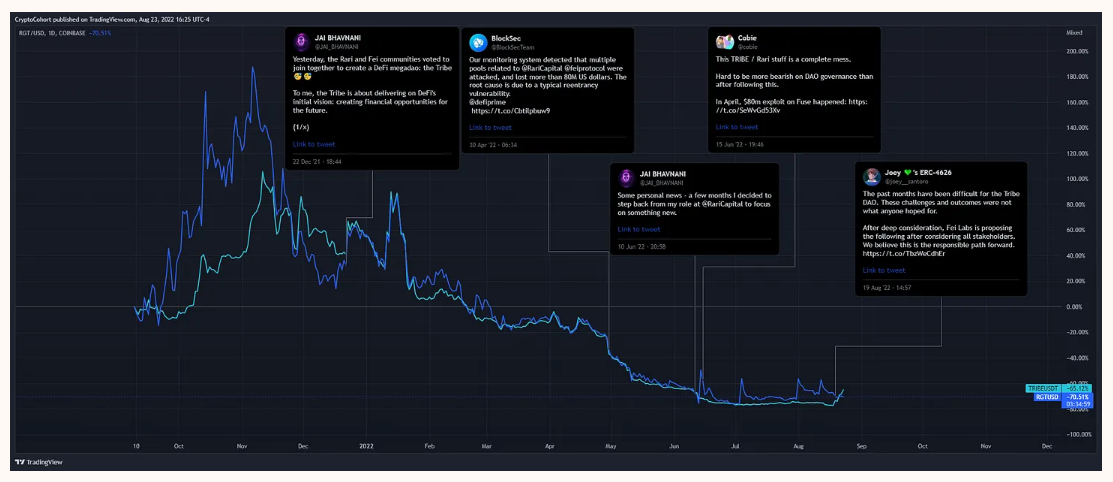

The reality is that most DAOs are not decentralized or even autonomous. Initial founders, core team members and early investors, as majority token holders, can make decisions according to their own preferences. The execution efficiency of a DAO is not measured by the participation of its community members, but mainly by the ability of the core team members. Check out the Tribe DAO event below.

In May, the compensation proposal for the $80 million Fuse hack was passed (Fuse is a currency market launched by Rari Capital, and Rari Capital merged with Fei Protocol to form Tribe DAO). Then, when the refund was about to be approved, someone filed a veto proposal to cancel that decision. Fei Labs, the main entity associated with the Tribe DAO, decided to abstain from the vote, indicating its opposition to refunds. All of this comes just days after Rari's original founder, Jai Bhavnani, decided to step down. Fast forward a few months later, Fei Labs original founder Joey Santoro has decided to exit the Tribe DAO.

If the last paragraph doesn't make sense to you, you should be thankful.

Again, it is very difficult to instill accountability in DAOs and their main operators, especially when voting power is concentrated in a few, creating a "false narrative" that every decision is "the will of the community" "—if it fails, put the blame on the token holders, but if it succeeds, get a lot of reputation.

You want the DAO to mature and operate like Apple, where Tim Cook has real responsibility and reports to the board — not like Facebook, where you can’t fire Mark Zuckerberg’s kid.

DAOs in their current form are also extremely inefficient. There is absolutely no reason for a crypto startup to be a DAO early on, other than to mitigate regulatory risk. The fact that it is often combined with anonymous founders is another hidden danger.

If a FAANG engineer could juggle 10 remote jobs , do you think the following wouldn't happen?

Large DAOs are also quite generous when it comes to budgets. Maker has generated $75 million in cumulative protocol revenue over the past 6 months, but its annual budget is around $54 million.

This means that the average annual salary is about $400,000 per person, which is higher than NASA.

The point is that DAOs need more accountability. In a later article, I will further explore how to do this, but we should learn from the already effective practices of listed companies, rather than behind closed doors.

However, accountability should be enforced on-chain.

For example, milestone-based compensation mechanisms for specific KPIs that cannot be gamed are a good example. Imagine a scenario where the initial founder token grant period is 8 years (approximately the average time for a startup to go public), and a certain percentage of the tokens will be unlocked when clear milestones are reached (such as net profit, daily active users, etc.) currency. There are many other possibilities we could explore here, but the design needs to be tight, enforceable on-chain, and unaffected by gamification patterns.

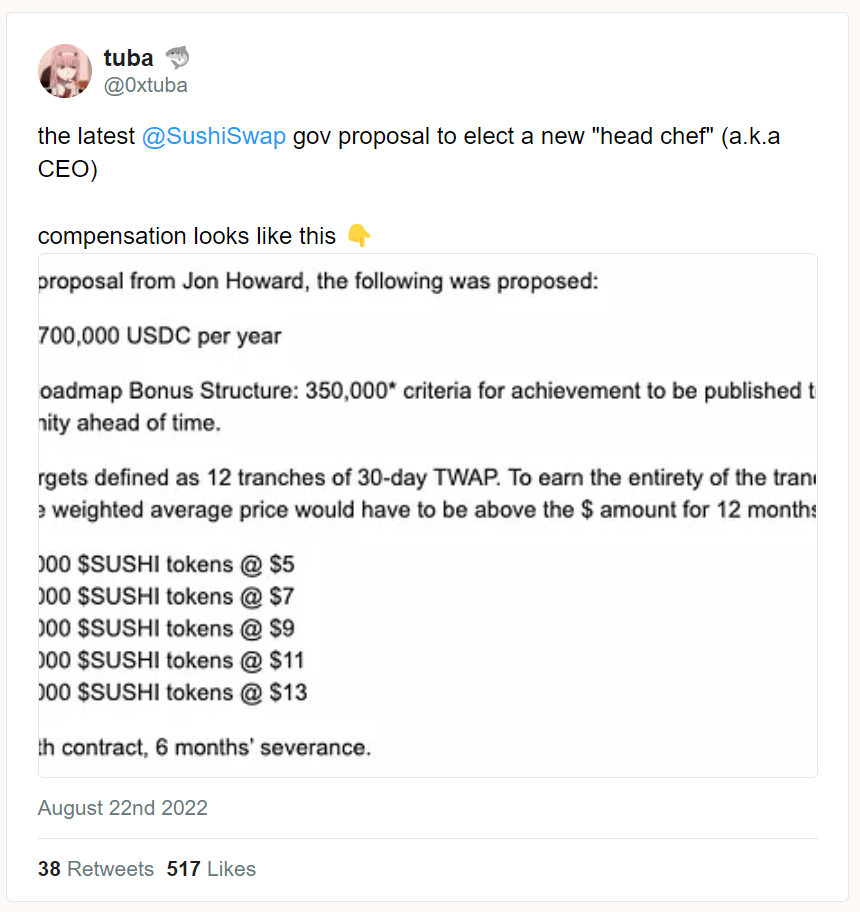

The SUSHI "chef" compensation below is a good starting point, but I'm not a fan of price-based token compensation, especially when most protocols are relatively young. Price-based compensation may be available to CEOs of public companies because of regulations and strict wash trading oversight. In the crypto space, this requires more careful thinking, as market manipulation occurs more frequently.

It also reminds us how generous the DAO is.

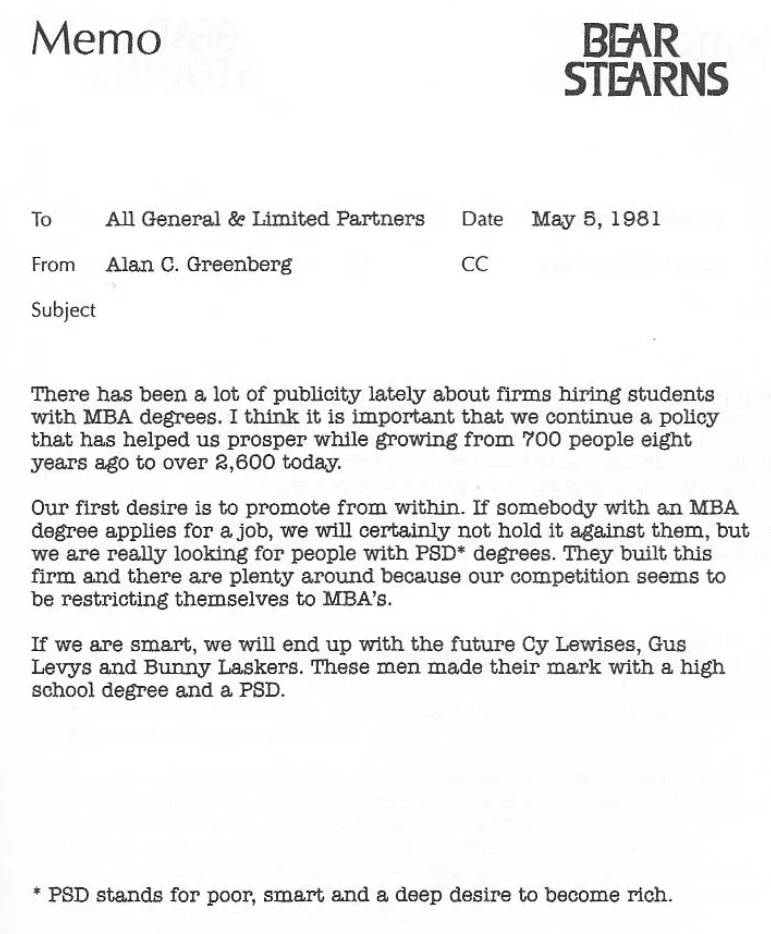

psd

In the past few years, a 1981 memo from Bear Stern has gone viral. It talks about creating a company culture that hires a PSD degree. Born poor (Poor), smart and capable (Smart), eager to get rich (Deep desire). The cryptocurrency space is full of people who want to "make it", but not many have the proper business acumen. Gamblers lose money on JPEG deals, while scam founders make money through short lock-up periods. The average tenure of a crypto founder is 18 months before turning to angel investing.

While developers and advancements in blockchain technology are important, the crypto space needs more business builders. Those who want to prove that web 3.0 can produce useful products, disrupt existing business models, and get rich in the process - rather than opting for nasty token economics strategies for short-term wealth.

Disclaimer: Not financial advice, all information provided in this publication and its affiliates is for educational purposes only and should not be construed or viewed as financial, legal, investment or any other form of advice.

Catherine

Catherine