Source: Ethena Labs; Compiled by: Tao Zhu, Golden Finance

Today marks an important step in aligning the growth and use of USDe more closely with $ENA. Ethena will begin to gradually introduce more practical features for $ENA in the Ethena ecosystem, starting with the launch of universal staking for $ENA.

Table of Contents

i) Current use cases for $ENA in the Ethena ecosystem;

ii) Introducing universal re-staking for $ENA and $USDe;

iii) Potential rewards for the $ENA re-staking pool in Symbiotic;

iv) Immediate reduction of future $ENA inflation with lock-up requirements for users of unvested ENA starting in Season 1.

i) Current Use Cases of $ENA:

Currently, $ENA is used in the following ways:

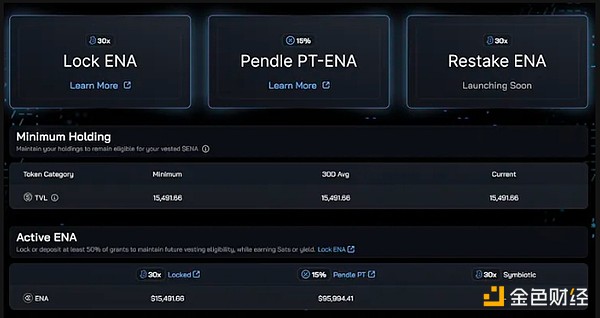

i) Locked in Ethena to increase potential future returns. This is intended to incentivize the transfer of value from more employed capital pools to users who are more aligned with the long-term growth of Ethena. The scale of this reallocation is linear with the amount of USDe held by the user. Therefore, as the USDe supply grows, the potential implicit $ENA holding requirements imposed on long-term consistent ecosystem members will also expand with this growth. Currently, the locked ENA pool holds approximately 290 million ENA.

ii) Locked in Pendle Finance PT-ENA, users can earn a fixed APY of currently ~75% in the form of PT-ENA, YT-ENA purchasers can earn point allocations, and are able to meet minimum ENA holdings relative to their USDe holdings by holding only 1 YT = 1 ENA. Currently, the PT-ENA pool holds ~160M ENA.

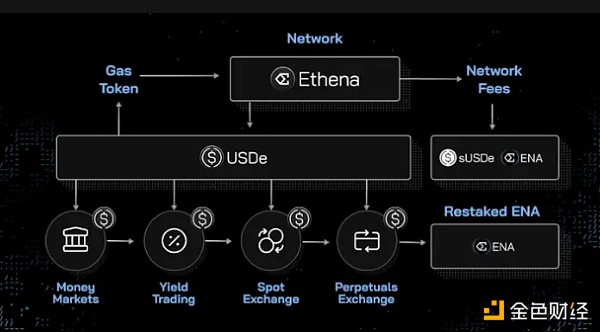

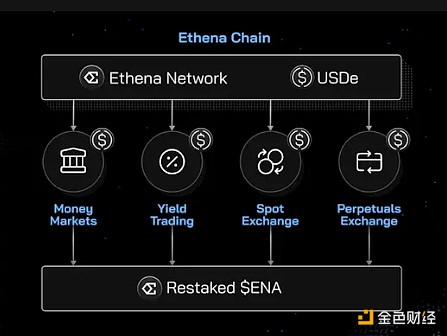

iii) The next phase of incorporating $ENA into the Ethena system and increasing utility will utilize a universal re-staking pool to stake $ENA. The first use case is to provide economic security for cross-chain transfers of USDe relying on a LayerZero DVN-based messaging system. This is the first of many layers of infrastructure associated with the upcoming Ethena Chain and financial applications built on top of it that will leverage and benefit from the re-staking $ENA module.

For more details on the chain, see the Ethena 2024 roadmap post detailed here.

The staked $ENA and $sUSDe will be the first new assets deposited in Symbiotic in the coming era, with the initial LST cap fully filled in under an hour.

The Dune dashboard for locked $ENA has been created here:

ii) Details of the $ENA re-staking module:

Ethena will initially pilot a universal re-staking framework with Symbiotic and LayerZero, seeking to secure cross-chain transfers of Ethena-based assets (including $USDe and $sUSDe). These transfers are validated via the LayerZero DVN network, which is secured via staked $ENA within Symbiotic.

This module will also include building a general framework to launch re-collateralized DVNs for LayerZero ecosystem partners that use a consistent token to provide economic security and DVN operator choice.

For more details on LayerZero DVNs, please refer to the documentation here.

While cross-chain transfers based on Ethena will be secured via staked $ENA, Ethena will provide a unique value proposition for general re-collateralization use cases via $USDe and $sUSDe for use as base assets by other systems and protocols.

$USDe/$sUSDe offer two distinct asset qualities that unlock unique potential use cases compared to leveraging $ETH as the underlying re-collateralized asset:

i) Uncorrelated: Relatively stable assets “pegged” to the USD are typically uncorrelated to volatile crypto assets, and USD stability relative to ETH is an important quality in times of stress during periods when haircuts need to occur — when you need the security of re-collateralization the most.

ii) Sustainable Real Returns: It is unclear how AVS can provide a true non-inflationary yield on billions of dollars of re-collateralized capital without having excessive token rewards be the majority of the yield. Using $sUSDe, which has a structurally higher real yield than any USD-based asset since inception, uniquely solves this problem by reducing the need for inflationary rewards to bridge the gap in capital costs between re-collateralizers and systems that consume security.

iii) $ENA Symbiotic Staking Rewards Details:

After the ETH LST cap is filled in a few days, $ENA and $sUSDe will become the next eligible assets to be staked in the next era.

$ENA staked in Symbiotic will receive the following rewards:

Highest Ethena multiplier, 30x per ENA per day;

Symbiotic Points;

Mellow Points;

Potential future LayerZero RFP allocation (if allocated to Ethena);

The $ENA pool will go live on Wednesday, June 26th.

$ENA Re-staked in Ethena Chain:

As outlined in the 2024 roadmap, Ethena Chain will focus on building financial applications and infrastructure on $USDe as the gas token and pivot asset within the system.

Our view is that crypto-native currencies are the holy grail and killer app, and the US dollar is the lifeblood of every financial application.

Recollateralized $ENA will provide universal security for these use cases for the following applications:

As well as on-chain infrastructure solutions such as:

In return, they may be eligible to benefit from potential future airdrops from these protocols at a later date at their discretion.

As the ecosystem and use cases around the USDe asset grow, $ENA’s utility will grow as an asset that helps secure the ecosystem.

iv) $ENA Locking and Vesting Update:

As of June 17th, any user who received $ENA via airdrops (e.g., the portion received from the Shard Campaign airdrop that was subject to vesting conditions) will need to lock up at least 50% of the available $ENA from one of the three options outlined in Section 1.

Failure to do so will result in all of a user’s unvested $ENA (attributed to the associated wallet) being redistributed to other users who have $ENA locked in i) Ethena locking, ii) PT-ENA on Pendle (any chain), or iii) Symbiotic Restaking. As more use cases for $ENA emerge in the ecosystem, the options for locking $ENA for this purpose may also expand.

To be clear: the purpose of the above is to incentivize $ENA holders to realign from employed capital to long-term aligned users.

The above will be made clear when users claim their next weekly ENA vesting on June 23rd. From that point on, at least 50% of the newly vested ENA needs to be locked in the above options, or the user will lose the unvested ENA.

$ENA forfeited due to not meeting the above conditions will not be retained by the foundation, team, or investors - it is only used to benefit ecosystem aligned users.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance Sanya

Sanya JinseFinance

JinseFinance Weiliang

Weiliang JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Joy

Joy Davin

Davin