Author: Stacy Muur, Web3 researcher; Translation: Jinse Finance xiaozou

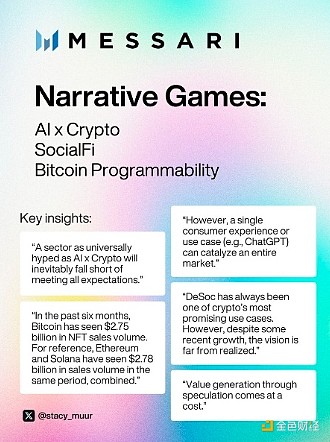

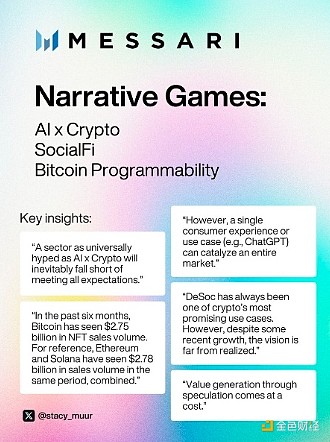

The main narratives brought to us by Messari’s latest crypto research report are: AI, SocialFi, and Bitcoin’s programmable layer.

Below, let’s take a look at the key insights into these areas, the noteworthy players, and the relevant investment considerations.

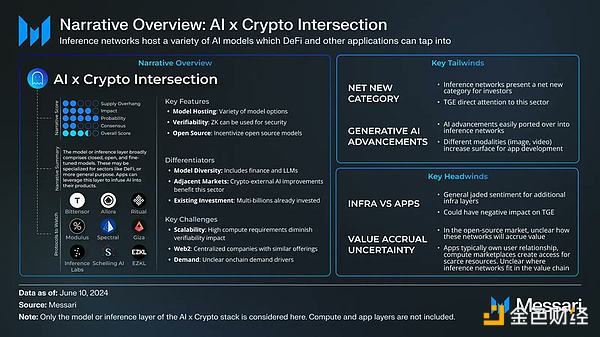

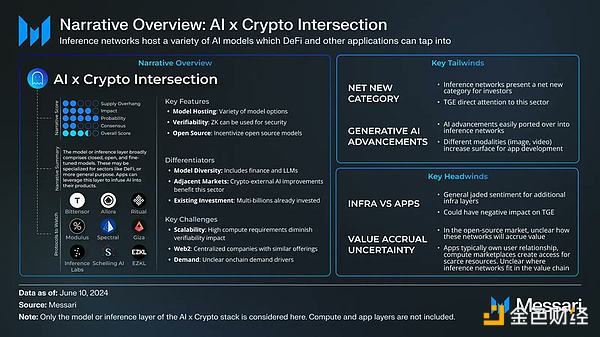

1. AI x Crypto

The three main layers that AI x Crypto development currently focuses on are:

Infrastructure layer (such as Akash Network, The Render Network, etc. for computing training AI models)

AI model layer (such as Allora, bittensor, Ritual, etc.)

Application layer (such as MyShell)

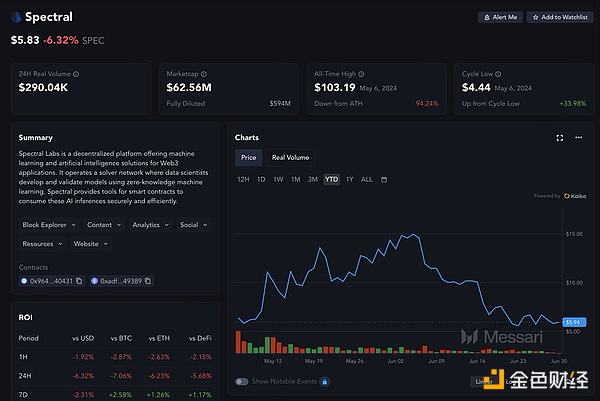

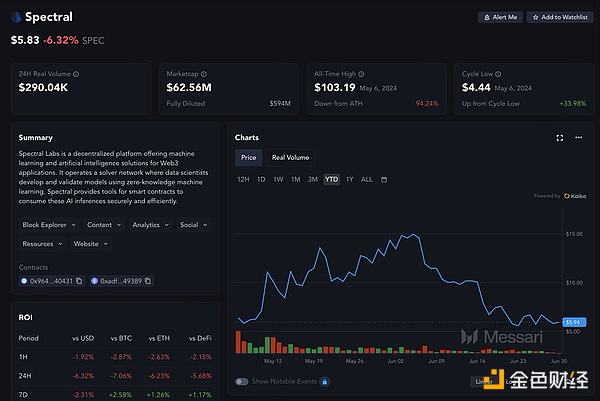

The infrastructure layer is now complete, and the next generation of AI x Crypto protocol waves is expected to rise at the model layer. Spectral Token (SPEC) is one of the only liquidity tokens in the category with a circulation level of about 11%.

Given the traditional financing of most model-layer protocols, Messari analysts expect that the circulation level of tokens issued by these protocols should generally be around 10-20%, which will lead to a large-scale oversupply in the coming months and even years.

Favorable factors:

Growing interest from institutions and retail investors.

Synergistic development with the field of generative AI.

Potential for integration with the SocialFi protocol.

Disadvantages:

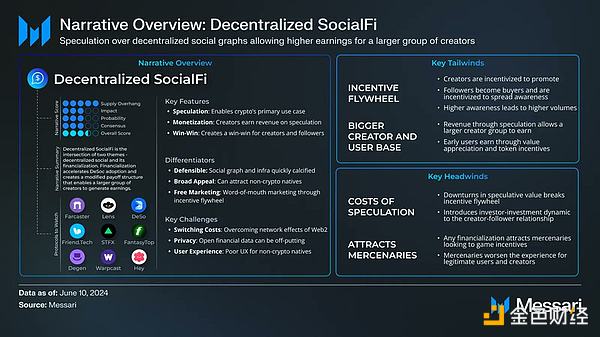

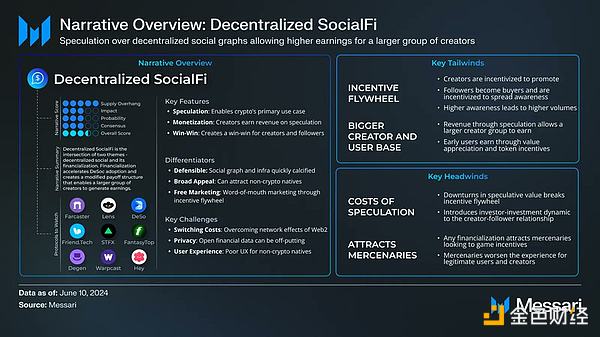

2. SocialFi (DeSoc)

Main Trends:

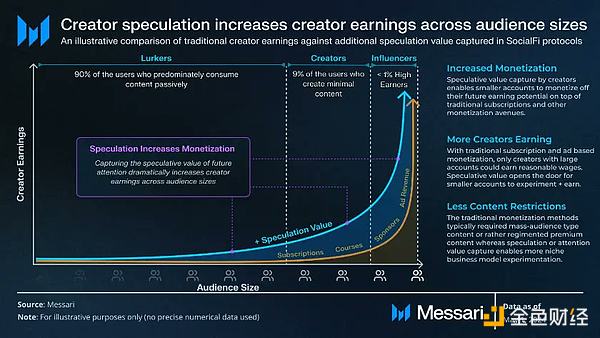

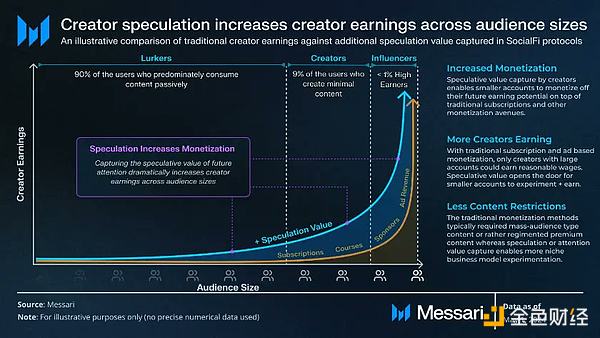

Incentive structure: Changing the monetization method of traditional social media by introducing speculation.

Attracting creators: Incentivizing creators to bring users, generating a speculative value cycle.

Investment Considerations:

Oversupply: Prices are generally lower as creators and users receive higher allocations.

Impact and Probability of Success: Moderate impact, with varying degrees of success probability.

Market Consensus: Mixed, with both high and low valuation views.

Farcaster has 50,000 DAUs and recently raised funding from Paradigm and a16z at $1 billion FDV (fully diluted valuation).

SocialFi, on the other hand, has a lower consensus. Degen is valued at $600 million, while friend.tech is valued much lower at $80 million.

Pros:

Cons:

The speculative value cycle may be interrupted, bringing instability to the market.

It may be exploited by profiteers or attackers.

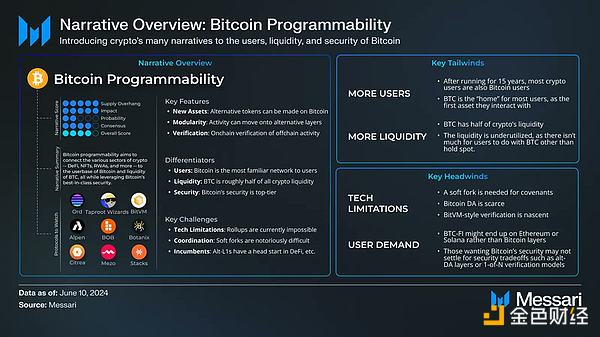

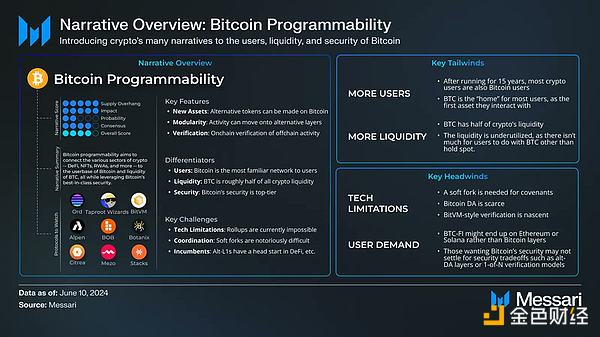

3. Bitcoin Programmability

Main Trends:

Investment Considerations:

Oversupply: Future protocols may face severe oversupply.

Technical Limitations: There are currently limitations in rollup capabilities and DA.

Market Acceptance: Uncertainty in market demand for a programmable Bitcoin layer.

Favorable Factors:

Disadvantages:

Wilfred

Wilfred