Author: Arthur Hayes, founder of BitMEX; Translator: Deng Tong, Golden Finance

There was water everywhere,

All the boards shrunk;

There was water everywhere,

There was not a drop of water to drink.

——Coleridge, The Rime of the Ancient Mariner

I love specialty coffee, but my home-brewed coffee is simply terrible. I spend a lot of money on coffee beans, but the coffee I brew at home always tastes worse than the coffee I drink in cafes. In order to improve my coffee, I started to take details more seriously. I realized that one detail I had been neglecting was the quality of the water.

Now I understand how important water is to the quality of the coffee I brew. I was really struck by an article recently published in Standart issue 35.

A similar phenomenon occurred during my time as a barista, when I learned that over 98% of a cup of coffee and around 90% of espresso is water.

This realization often comes later in people’s coffee journey, probably because it’s so much easier to spend money on a new machine with the goal of making better coffee. ‘Ah, you have a conical grinder! That’s why your pour-over is cloudy. Switch to a flat burr grinder!’ But what if that 2% isn’t the problem? What if focusing on the solvent itself could solve our coffee problems?

– Lance Hedrick, On Water Chemistry

My next step is to digest the author’s advice and order a home distiller. I know of a local coffee shop that sells mineral concentrates that can be added to your water that will create the perfect base to bring out the intended flavors of their roasts. By this winter, my morning cup of coffee will be delicious… I hope.

Good quality water is essential to brewing great coffee. Turning to investments, water or liquidity is important for accumulating Sats. This is a recurring theme in my articles. But we often forget its importance and focus on the little things we think will impact our ability to make money.

It’s hard to lose money investing if you can recognize how, where, why and when fiat liquidity is generated.Unless you’re Zhusu or Kyle Davis, founder of Three Arrows Capital. If financial assets are denominated in dollars, rather than in U.S. Treasuries (UST), it makes sense that the amount of global money and dollar debt is the most critical variable.

We should not focus on the Federal Reserve (Fed), but on the U.S. Treasury. This is how we determine specifically how Pax Americana increases and decreases fiat liquidity.

We need to recall the concept of “fiscal dominance” to understand why U.S. Treasury Secretary Janet Yellen views Fed Chairman Jay Powell as her beta cuck towel bitch boy. During periods of fiscal dominance, the need to fund the country overrides any central bank concerns about inflation. This means that bank credit, and thus nominal GDP growth, must be maintained at high levels, even if it leads to persistently above-target inflation.

Time and compounding determine when power shifts from the central bank to the Treasury. When debt-to-GDP ratios exceed 100%, debt mathematically grows much faster than the economy. After this event horizon, the institution that controls the supply of debt is crowned emperor. This is because the Treasury decides when, how much, and for what tenors to issue debt. Moreover, since the government is now addicted to debt-driven growth for survival, it will eventually instruct the central bank to use the printing press to cash the Treasury's checks. Central bank independence be damned! The COVID outbreak and the U.S. government's response of locking people in their homes and paying them into obedience with stimulus checks caused the debt-to-GDP ratio to rise dramatically to over 100%. It was only a matter of time before Yellen made the transition from grandma to bad girl.

There is a simple way that Yellen could have created more credit and stimulated asset markets before the U.S. fell into outright hyperinflation. There are two sanitized pools of money on the Fed’s balance sheet that, if released into the wild, would generate bank credit growth and raise asset prices. The first pool is the reverse repurchase program (RRP). I have discussed this pool in detail, where money market funds (MMFs) park their cash at the Fed overnight and earn interest. The second pool is bank reserves, which the Fed program pays interest on in a similar manner.

While the money is on the Fed’s balance sheet, it cannot be rehypothecated into financial markets to generate broad money or credit growth. By bribing banks and money market funds with interest on reserves and RRPs, respectively, the Fed’s quantitative easing (QE) program has created financial asset price inflation rather than a surge in bank credit. If QE had not been done in this way, bank credit would have flowed into the real economy, increasing output and goods/services inflation. Given the amount of debt the U.S. currently has under its belt, strong nominal GDP growth coupled with goods/services/wage inflation is exactly what the government needs to increase taxes and deleverage. So Bad Gurl Yellen takes steps to correct that mistake.

Bad Gurl Yellen doesn't give a shit about inflation. Her goal is to create nominal economic growth so that tax revenues increase and the U.S. debt-to-GDP ratio decreases. Given that no political party or its supporters are committed to cutting spending, deficits will persist for the foreseeable future. Moreover, because the federal deficit is so large, a record high in peacetime, she must use all the tools at her disposal to fund the government. Specifically, that means taking as much money as possible off the Fed's balance sheet and pumping it into the real economy.

Yellen needs to give the banks and money market funds something they want. They want a yielding cash-like instrument with no credit, minimal interest rate risk, to replace the yielding cash they hold at the Fed. Treasury bills (T-bills) with maturities of less than one year and yields slightly more than the interest on reserve balances (IORB) and/or RRP are perfect substitutes. T-bills are an asset that can be exploited in the wild and will generate credit and asset price growth.

Does Yellen have the ability to issue $3.6 trillion worth of T-bills? Of course she does. The federal government runs a $2 trillion deficit each year that must be financed through debt securities issued by the Treasury.

Yellen or whoever replaces her in January 2025, however, does not have to issue T-bills to fund the government. She can sell longer-term T-bills that are less liquid and carry more interest rate risk. These securities are not cash equivalents. Furthermore, due to the shape of the yield curve, longer-term debt securities have lower yields than T-bills. The profit motive of banks and money market funds prevents them from converting the funds they hold at the Fed into anything other than T-bills.

Why should we crypto traders care about the flow of money between the Fed's balance sheet and the broader financial system? Enjoy this beautiful chart.

As RRP (white) pulls back from its highs, Bitcoin (gold) pulls back from its lows. As you can see, it's a very tight relationship. As money leaves the Fed's balance sheet, it increases liquidity, which causes finite financial assets like Bitcoin to soar.

Why does this happen? Let's ask the Treasury Borrowing Advisory Committee (TBAC). In its latest report, TBAC clearly illustrates the relationship between increased Treasury issuance and the amount of money market funds hold in the RRP.

The large ON RRP balance may indicate unmet demand for Treasuries. During 2023-24, ON RRPs dried up as money funds shifted almost one-to-one to Treasuries. This rotation facilitated a seamless digestion of record Treasury issuance.

– Slide 17, TBAC July 31, 2024

As long as Treasury yields are slightly above RRP, money market funds will move cash into Treasuries – currently, the 1-month Treasury bill yields about 0.05% more than the money in the RRP.

The next question is whether Yellen can coax the remaining $300 billion to $400 billion in RRP into Treasuries. If you doubt bad girl Yellen, you are being sanctioned! Ask those poor souls from the “junk countries” what happens when you can’t get dollars to buy essentials like food, energy, and medicine.

In its recent Q3 2024 Quarterly Refinancing Announcement (QRA), the Treasury said it will issue $271 billion in Treasuries between now and the end of the year. That’s great, but there’s still money left in the RRP. Can she do more?

Let me quickly talk about the Treasury Repurchase Program. Through the program, the Treasury buys back illiquid non-Treasury debt securities. The Treasury can fund the purchases by drawing on its general account (TGA) or issuing Treasuries. If the Treasury increases the supply of Treasuries and decreases the supply of other types of debt, it creates a net increase in liquidity. Money will leave the RRP, which is good for USD liquidity, and as the supply of other types of Treasuries decreases, these holders will move up the risk curve to replace these financial assets.

The newly announced repo program will purchase up to $30 billion worth of non-marketable securities between now and November 2024. This is equivalent to issuing another $30 billion in Treasuries, bringing outflows from the RRP to $301 billion.

This is a solid liquidity injection. But how good is Yellen? How much does she want minority U.S. presidential candidate Momalla Harris to win? I say "minority" because Harris changes her phenotypic affiliation depending on the demographic she is targeting. This is a very unique ability she possesses. I support her!

The Treasury can inject a huge liquidity injection by reducing the TGA from about $750 billion to zero. They can do this because the debt ceiling goes into effect on January 1, 2025, and by law the Treasury can reduce TGA spending to avoid or prevent a shutdown.

Between now and the end of the year, bad girl Yellen will inject at least $301 billion and up to $1.05 trillion. Wow! That will create a glorious bull market for all risk assets, including cryptocurrencies, before the election. If Harris still can't beat the orange man, then I think she needs to become a white male. I believe she has that superpower.

More Potential Liquidity Waiting to Be Unleashed

Injecting $2.5 trillion into financial markets by draining RRPs over the past 18 months is pretty impressive. But there is more potential liquidity waiting to be unleashed. Can Yellen's successor (starting in 2025) create a situation where money is pulled out of bank reserves held by the Fed and injected into the broader economy?

In a fiscally dominant period, everything is possible. But how?

As long as regulators treat capital adequacy the same and the latter offers a higher yield, for-profit banks will swap one yielding cash-like instrument for another. Currently, T-bills yield less than the reserve balances held by the Fed, so banks won’t bid for T-bills.

But what happens starting next year when the RRP approaches zero and the Treasury continues to dump large amounts of T-bills into the market? Ample supply and the inability of money market funds to buy T-bills with the money parked at the RRP mean that prices must fall and yields rise. As long as T-bills yields rise to a few basis points above the rate paid on excess reserves, banks will use their reserves to buy T-bills in large quantities.

Yellen’s successor—my bet is Jamie Dimon—will be unable to resist the ability to stimulate the market for the political benefit of the ruling party and continue to flood the market with T-bills. An additional $3.3 trillion of bank reserve liquidity is waiting to be injected into financial markets. Join me in chanting: Bills, Baby, Bills!

I believe TBAC is quietly hinting at this possibility. Here is another excerpt from the same previous report, with my comments in [bold]:

Looking forward, a number of factors may be worth further examination when considering the future share of Treasury issuance:

[TBAC wants the Treasury to consider the future and how large Treasury issuance should be. Throughout the presentation, they advocated that Treasury issuance should hover around 20% of total net debt issuance. I believe they were trying to explain what would cause this share to increase and why banks would buy these Treasury bills. ]

– The evolution and ongoing assessment of the bank regulatory landscape (covering liquidity and capital reforms, among other things) and the implications for banks and dealers to meaningfully participate in the primary Treasury market to intermediate and warehouse (in anticipation of) future Treasury maturities and supply

[Banks don’t want to hold more longer-dated notes or bonds because they attract tighter collateral requirements from regulators. They quietly say, we won’t buy longer-dated debt anymore because it hurts their profitability and it’s too risky. If the primary dealers go on strike, the Treasury is screwed because whose balance sheet can absorb the massive debt auctions.]

– The evolution of market structure and its implications for Treasury market resilience initiatives, including:

> The SEC’s central clearing rule, which requires a significant increase in margin posted to regulated clearing houses

[If the Treasury market moves on exchanges, dealers will need to post billions of dollars worth of additional collateral. They can’t afford to do so and the result will be reduced participation. ]

> Future (expected) Treasury auction sizes and predictability of cash management and benchmark Treasury issuance

[If deficits continue to be so large, the amount of debt issued is likely to increase significantly. Therefore, the role of Treasurys as a “shock absorber” will only become more important. This means more Treasury issuance will be needed. ]

> Future MMF reforms and potential incremental structural demand for Treasurys

[If money market funds return to the market after RRPs are completely exhausted, Treasury issuance will exceed 20%. ]

– Slide 26, TBAC July 31, 2024

The banks have effectively gone on strike buying longer-dated Treasuries. Yellen and Powell nearly caused the banking industry to collapse by stuffing banks with Treasuries and then jacking up rates between 2022 and 2023… RIP Silvergate, Silicon Valley Bank, and Signature Bank. The remaining banks will no longer be messing around or wondering what will happen if they start buying high-priced Treasuries in large quantities again.

One example: US commercial banks have only bought 15% of non-Treasury Treasuries since October 2023.2 This is not good for Yellen because she needs the banks to step up as the Fed and foreigners exit the stage. I think as long as banks buy Treasuries, they will be happy to do their duty because Treasuries have a similar risk profile to bank reserves but with a higher yield.

Yellen is in the spotlight again

The fall in USD/JPY from 160 to 142 sent shockwaves through global financial markets. Many were hit last week and told to sell what they could. A moment ago, it was a textbook correlation. USD/JPY will hit 100, but the next wave of shocks will be driven by capital repatriation from Japanese companies’ overseas assets, not just the unwinding of yen carry trades by hedge fund puppets. 3 They will sell US Treasuries and US stocks (mostly big tech stocks like NVIDIA, Microsoft, Google).

The BoJ tried to raise rates and global markets went haywire. They caved and announced that rate hikes were out of the question. The worst-case scenario from a fiat liquidity perspective is a sideways yen with no net new positions funded with cheap yen. With the threat of the yen carry trade unwinding over, bad girl Yellen’s market manipulation is back in the spotlight.

No Liquidity = Bankruptcy

Without water, you die. Without liquidity, you go bankrupt.

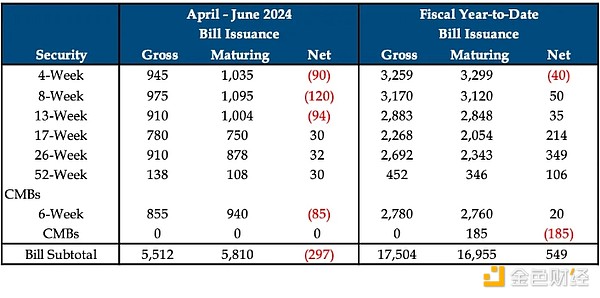

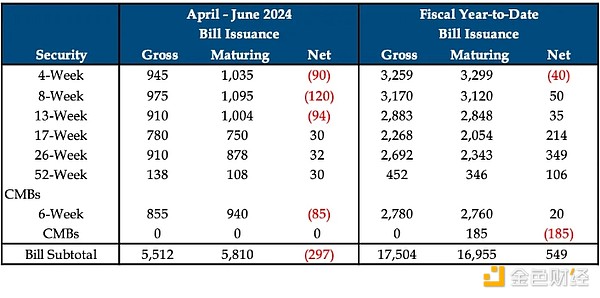

Why have crypto risk markets been moving sideways to down since April this year? Most tax revenues occur in April, which requires the Treasury to borrow less. We can observe this in the amount of Treasury bills issued from April to June.

As a result of the net reduction in outstanding Treasuries, liquidity is removed from the system. Even if the government as a whole borrows more, the net reduction in cash-like instruments provided by the Treasury removes liquidity from the market. As a result, cash remains trapped on the Fed's balance sheet RRP and cannot generate financial asset price growth.

This chart of Bitcoin (gold) vs. RRP (white) clearly shows that from January to April, when Treasuries were net issuing, RRP fell and Bitcoin rose. From April to July, when Treasuries were net withdrawn from the market, RRP rose and Bitcoin moved sideways, with a few big dips in between. I stopped on July 1st because I wanted to show the interaction before USDJPY rose from 162 to 142, which led to a broad sell-off in risk assets.

So, according to Yellen, we know that net issuance of U.S. Treasury bills will reach $301 billion between now and the end of the year. If this relationship holds, Bitcoin will quickly give back the sell-off caused by the appreciation of the yen. Bitcoin's next stop is $100,000.

When will the altcoin season come?

Altcoins are cryptocurrencies with higher beta values than Bitcoin. But during this cycle, Bitcoin and now Ethereum have seen structural buying in the form of net inflows into U.S.-listed exchange-traded funds (ETFs). Although Bitcoin and Ethereum have corrected since April, they have escaped the carnage experienced by the altcoin market. Only after Bitcoin and Ethereum break through $70,000 and $4,000, respectively, will the altcoins return. Solana will also climb above $250, but considering the relative market capitalization, the wealth effect of Solana's surge on the entire crypto market is nowhere near as strong as that of Bitcoin and Ethereum. A year-end rally in Bitcoin and Ethereum fueled by USD liquidity will lay a solid foundation for the return of the sexy altcoin party.

Later Trading Recommendations

With the Treasury issuance and buyback program running in the background, liquidity conditions will improve. If Harris wavers and needs more firepower with the stock market's firepower, Yellen will cut the TGA. Regardless, I expect crypto to exit a sideways to downside trajectory starting in September. Therefore, I will use the late northern hemisphere summer weakness to add crypto exposure.

The US election is in early November. Yellen will reach peak manipulation in October. There is no better time to get liquidity this year than now. Therefore, I will take advantage of the momentum to sell. Instead of liquidating my entire crypto portfolio, I will take profits on my more speculative momentum trades and park the funds in staked Ethena USD (sUSDe). Crypto markets are rising, increasing the odds of a Trump win. Trump's odds are peaking after the assassination attempt and Biden's poor debate performance, Kamala Harris is a top-notch political puppet, but she's not an octogenarian vegetable. That's all she needs to beat Trump. The election is a coin toss, I'd rather watch the chaos from the sidelines and return to the market after the US debt ceiling is raised. I expect that to happen sometime in January or February.

Once the US debt ceiling farce is over, liquidity will pour out from the Treasury and the Fed to get the market back on track. Then, the bull run will truly begin. $1 million Bitcoin remains my base case.

P.S.: China will finally unleash its long-awaited bazooka fiscal stimulus once bad girl Yellen and towel boy Powell team up. The 2025 US-China crypto bull run will be brilliant.

Yachtzee!

Notes

1. This is the total bank reserves held by the Fed and RRPs.

2. According to the H.8 Fed report, from the week ending September 27, 2023 to July 17, 2024, commercial banks purchased $187.1 billion worth of U.S. Treasuries. I am assuming that during the same period, money market funds purchased 100% of all Treasuries issued. During the same period, the Treasury issued $1,778 billion worth of debt securities other than Treasuries. Banks accounted for 15% of that.

3. Japanese companies include Japanese insurance companies, pension funds, corporations, households, and the Bank of Japan.

JinseFinance

JinseFinance