Delphi: 比特币生态入门到精通

Crypto 最令人困惑的部分之一是行话 ,它确实是一个陌生俚语的迷宫。为了消除混淆,本文中的所有加密原生术语都以斜体书写并会即时给于解释,或在文末的词汇表中给予定义。

JinseFinance

JinseFinance

Authors/Contributors: Kyle Ellicott, Yan Ma, Darius Tan, Melody He; Translation: 0xNirvana, Deep Tide

"Bitcoin Ecological Layer: Pulling Back the Curtain of the Trustless Financial Era" is a A research report on the development of various aspects of the Bitcoin ecosystem. This report was co-authored by the Spartan Group team, Kyle Ellicott, and a number of experts who provided feedback and insights and generously gave their time to review the final version of this article. This report was drafted in December 2023, and the data contained in it are accurate as of the time of writing. This article is the second in a series of four articles. For the first article, please go to "Bitcoin Ecological Layer: Pulling Back the Curtain of the Trustless Financial Era (1)"

Since its inception in January 2009, Bitcoin’s role and potential have undergone significant evolution. Initially, many viewed Bitcoin as a hedge against inflation, a store of value (SoV), and a hope to democratize the financial system. Only recently, in its fifteenth year of existence, has there been a renewed focus on the role of the Bitcoin network as a platform for shaping the future of decentralized applications (dApps). This evolution is particularly dramatic at this stage, mainly due to: Ethereum’s obvious achievements in applications, Bitcoin’s dominance of Ethereum as an asset has not diminished, and it is growing day by day. It has undoubtedly affected people’s expectations of the Bitcoin network. Inspired by this, developers have successively introduced numerous infrastructure "layers" on top of the Bitcoin core network (Layer-1 or L1). These Bitcoin ecological layers make full use of the stability and security of Bitcoin, and at the same time, without changing L1, by improving scalability and programmability, they aim to unlock more than 850 billion US dollars and growing, yet to generate revenue. asset. Nowadays, we are all witnesses and participants of the major progress of the Bitcoin ecological layer. We expect these ecological layers to be able to act on BTC assets, fully inheriting the restructuring security and finality of Bitcoin, while overcoming its programmability and performance problems. limitations. Going forward, these unique infrastructure layers attached to the Bitcoin ecosystem will become the building blocks on which many app entrepreneurs rely.

Despite the above progress, much of the necessary infrastructure is still in the development and experimental stages. It is worth noting that the journey that the Bitcoin ecosystem is going through is not without precedent. In 2017, the influx of early NFT and token projects into the Ethereum network led to slowed transaction speeds and sharp increases in transaction fees. This phenomenon actually stimulated the developer community's ambition to build more powerful infrastructure, even if its efforts only To enable the Ethereum network to support a small part of the massive potential application needs, developers also hope to provide the necessary scalability and flexibility for the network. At that time, the Ethereum community discussed and experimented with various methods, and finally decided to adopt a layered approach to improve its performance and scalability, so that today we see the Ethereum Layer-2 (Layer-2 or L2) being widely used and Accepting it, the amount of assets locked on its chain (TVL) has reached billions of dollars. Therefore, Ethereum’s experience in expansion, ecological growth, decentralized applications and its underlying network can all be learned by Bitcoin.

Similar to Ethereum’s critical moment in 2017, the introduction of Ordinals in 2023 became a major cultural turning point for “building on the Bitcoin ecosystem”. This shift triggered a developer revolution to develop on top of the infrastructure and extension layers of Bitcoin L1. We are now not only seeing the emergence of new protocols and token standards (such as BRC-20, etc.), but also the development of new Bitcoin L2, which are beginning to unleash the potential of the Bitcoin economy and allow us to glimpse the value of more than 8,500 in advance. Hundreds of millions of dollars in dormant capital may be unlocked, and this capital relies on the most stable and tested technology in the industry to date. As a result, the Bitcoin thesis is being redefined: Bitcoin is no longer just a store of value or an asset, Bitcoin is fulfilling its role as infrastructure in an ever-expanding economy.

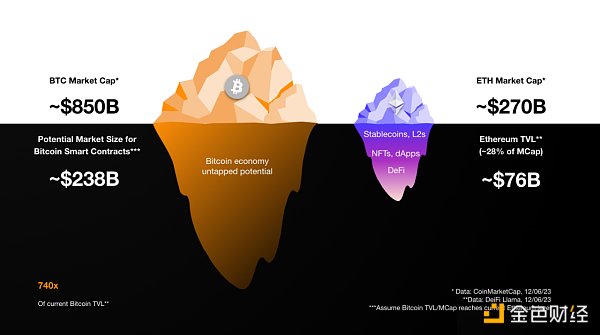

Like Ethereum’s growth trajectory, the Bitcoin ecosystem will likely experience a surge in user adoption driven by viral use cases that can kickstart the growth flywheel. This will in turn attract more developers and increase the TVL of ecosystem applications. Considering that the market value of Bitcoin is approximately US$850 billion, which is approximately 3.15 times the market value of Ethereum of US$270 billion, in comparison, the current TVL of Bitcoin application is only US$320 million, and the TVL of Ethereum application is US$76 billion. In other words, these data indicate that there may be a potential 740-fold growth opportunity for the Bitcoin ecosystem to reach a similar level of maturity as Ethereum at the application level. Beyond this, we also need to consider the potential influx of additional liquidity once the ecosystem gains momentum.

The huge market potential of Bitcoin smart contracts

To deeply understand the evolving new narrative , we need to distinguish between the two concepts of Bitcoin digital assets (BTC) and Bitcoin network (i.e. Bitcoin Core, Bitcoin L1, Bitcoin blockchain). Many people are confused about the meaning of the term "Bitcoin" because it can refer to both the network and the coin. Although the two are closely related, they are actually completely different. To avoid confusion, this report uses “Bitcoin” when referring to the network and “BTC” when referring to the token or digital asset.

Bitcoin the Network’s famous white paper (Bitcoin: A Peer-to-Peer Electronic Cash System, Satoshi Nakamoto) came out on October 31, 2008, introducing a peer-to-peer electronic cash system to the world, and soon after, the Bitcoin network came online. Its genesis block was mined on January 3, 2009. Since its release, the network has maintained stable operation, while other networks have experienced various problems such as downtime and attacks, which proves the feasibility of Bitcoin as the ultimate L1 network. Bitcoin has demonstrated its ability to provide trust without centralized intermediaries and serve as the ultimate decentralized settlement layer for transactions, assets, and future applications. However, developing applications on Bitcoin other than the BTC asset itself has been difficult due to Bitcoin's lack of flexible programmability and the inability to trustlessly write to the network from the outside. Compared with Ethereum, an important difference between Bitcoin and Bitcoin is that it does not natively support smart contracts. If smart contracts are not used, all development based on the Bitcoin network requires the development of more tools to complete functions similar to smart contracts. . Smart contracts are a key feature that enables decentralized applications to use BTC as an asset or settle transactions on Bitcoin L1.

BTC (digital asset) has traditionally been regarded as a store of value and as a hedge against inflation in volatile global financial markets. The advent of BTC provided the world with a digital, permissionless, censorship-resistant and scarce global asset for the first time. BTC’s status as the top crypto asset has never been shaken. Its market value currently exceeds US$850 billion, and the peak even reached US$1.25 trillion in November 2021. However, even today, more than ten years later, the general public still only regards BTC's function as a store of value as its main value. Unless BTC usher in further evolution and innovation, it will be difficult for us to see BTC gain more practicality, and it will be difficult for the public to judge its value beyond the current understanding.

The Bitcoin ecological layer provides a solution to this problem. BTC assets are the initial use case for Bitcoin L1. If the Bitcoin ecosystem layer, such as Bitcoin L2, can run smart contracts that can use BTC as an asset, then Bitcoin L1 can retain its key advantages (such as security, durability, and decentralization) while also allowing Unlimited experiments on other Bitcoin ecological layers. Applications can use BTC as their asset, run on L2 rails, and settle transactions on L1. These L2 rails will provide faster and more scalable transactions while gradually inheriting security from L1. This enables “Building on Bitcoin” and redefines the Bitcoin thesis as a true asset and infrastructure for the growing Bitcoin economy.

Over the past few years, the market has proven that “building on the Bitcoin blockchain” can bring unique opportunities and challenges. Unlike other blockchains, Bitcoin was originally created to be viewed as an asset or “currency” rather than as an application platform. Other blockchains have clearly entered everyone's field of vision as application platforms. In order to understand why Bitcoin is slower to mature than other ecosystems, it is particularly important to review its initial situation:

The Bitcoin network is open to everyone , regardless of their background or technical knowledge. The Bitcoin code is open source and can be copied and modified. This openness fosters a culture that encourages experimentation, and no single group or individual can have a decisive influence on the direction of blockchain development.

The interoperability of the Bitcoin network is limited, a feature that leads to its unique derivatives. Bitcoin's derivative network is completely independent, has its own assets, and has no "backward compatibility" with the original Bitcoin network. Therefore, in its current state, BTC assets are restricted to the Bitcoin network and cannot be directly removed or transferred to other blockchain networks.

Lack of programmability can create significant barriers to construction. Since Bitcoin does not support smart contracts, it does not have flexible programming capabilities, which restricts its use as an application development platform. Coupled with its severe performance limitations, this is a major challenge that has to be faced if Bitcoin is regarded as a platform for construction.

Bitcoin L1 still needs help with speed and scalability. The Bitcoin network is very limited in how quickly it can confirm transactions and its ability to process large amounts of transaction data in a short period of time. Due to the critical need to ensure decentralization, the size and frequency of records (also known as blocks) in the Bitcoin blockchain are limited. Since a block is generated every 10 minutes on average, and the original block size is 1 megabyte, the on-chain transaction processing capacity of the Bitcoin network is affected by this, with the average transaction confirmation time ranging from 10 to more than 30 minutes, which is far from Cannot meet the needs of most applications.

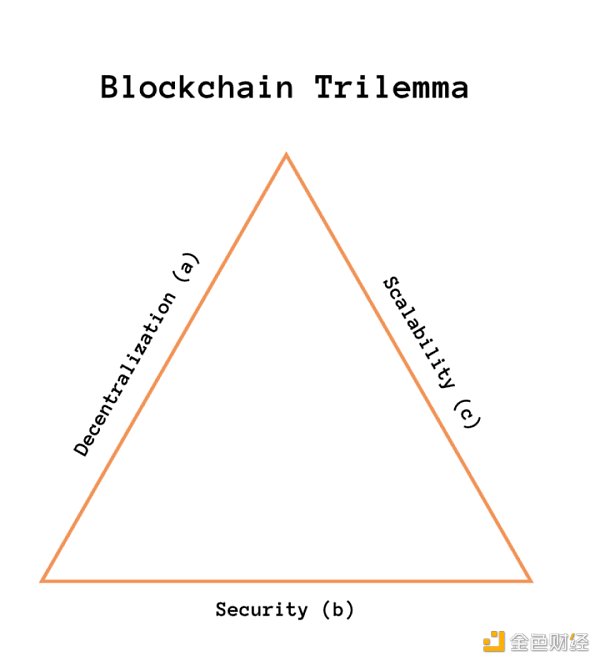

If you want to try to deal with or improve these characteristics of Bitcoin, you need to first understand the Blockchain Trilemma. Using this concept to look at Bitcoin L1, we can see that it is decentralized (a) and secure (b), but lacks scalability (c) and the transaction processing speed is only about 3 to 3 per second. 7.8 transactions. This limitation highlights the need to find alternatives or additional ecological layers to compensate for the inherent shortcomings of blockchain networks.

The urgent need for scalable solutions gave rise to the early creation of the Ethereum network . Although Ethereum lacks security and decentralization compared to Bitcoin, Ethereum provides scalability solutions required for application development, such as the second-layer network L2 (for example, Arbitrum, OP Mainnet, etc.) and subnetworks (e.g., Avalanche’s Evergreen), achieved significant growth. Throughout the industry, similar trade-off solutions are emerging one after another, and there has been a wave of development focused on scaling solutions, including Sharding, Nested Blockchains, and State Channels. ), Supernets (e.g., Polygon Edge), App-Chains, and second-layer networks (also known as sidechains).

For years, much of the focus has been on Ethereum and its compatible Ethereum Virtual Machine (EVM) ecosystem. However, by 2023, with the latest upgrade of Bitcoin L1 and the emergence of Ordinals, we are collectively witnessing a shift in the focus of the entire industry. Developers are turning their attention back to Bitcoin, especially to solve its scalability problem - an important part of Bitcoin's L1 impossible triangle problem (security, decentralization and scalability).

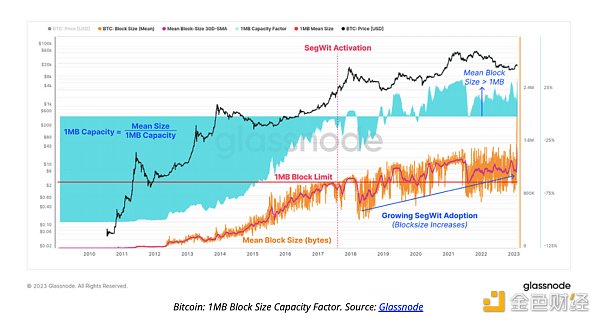

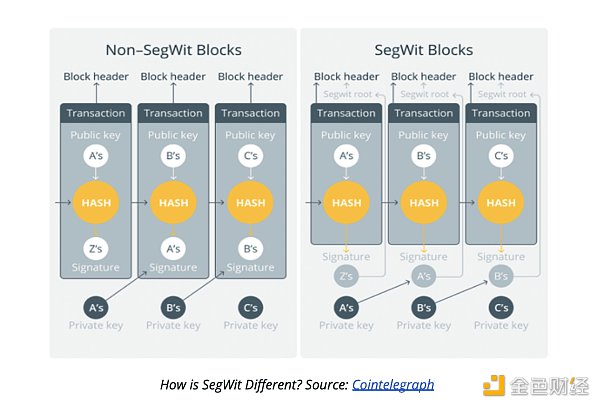

Bitcoin’s significant progress in scalability began with the Segregated Witness (SegWit) update in July 2017. The upgrade marks an important change that shortens transaction times and expands block sizes beyond the 1MB limit set by Satoshi Nakamoto in 2010 by separating the unlocking code into a dedicated section of each Bitcoin transaction.

SegWit introduced a revised block size measurement method using "Weight Units (wu), later known as vsize/vbyte, allowing up to 4M weight units (4wu) per block , effectively extending the block size to approximately 4MB. This change is designed to be backward compatible with all previous Bitcoin Core versions and greatly improve transaction efficiency.

Bitcoin: 1MB block size capacity factor. Source: Glassnode

SegWit achieves this by splitting the data structure, which separates the "witness data" (including signatures and scripts) from the transaction into a completely new part of the Bitcoin block section, the “transaction data”, which contains details of the sender, receiver, etc. The introduction of this structure divides the new 4wu (weighted unit) block size into the following two parts:

Each virtual byte (vbyte) of witness data is calculated as 1 weighting unit (wu), and Compared with transaction data, the weight of each virtual byte is only 25%.

Each virtual byte (vbyte) of transaction data is calculated as 4 weight units (wu), which is four times the weight of each virtual byte of witness data.

How is SegWit different? Source: Cointelegraph

Following SegWit, Taproot is another major upgrade for Bitcoin that will be activated in November 2021. Taproot is a soft fork that removes the maximum limit on witness data consumption per transaction, allowing for faster transaction speeds, enhanced privacy protection through Merkelized Alternative Script Trees (MAST), and more security through Schnorr signatures. Efficient key signing. Taproot also facilitates asset trading on Bitcoin L1, introducing protocols like Pay-to-Taproot (P2TR) and Taproot Asset Representation Overlay (Taro).

Taro is a protocol proposed based on Taproot technology that supports the issuance, sending and receiving of assets on Bitcoin L1 and Lightning Network. The protocol launches its mainnet Alpha version in October 2023.

Schnorr signatures enable key aggregation by introducing the ability to merge multiple public keys and signatures into one. In short, combining multiple signatures for verification rather than aggregating each signature individually increases transaction efficiency.

MAST increases privacy by hiding preset conditions related to transactions, and does not publish unused results on the chain. This not only improves privacy, but also reduces transaction volume, thus reducing Data usage.

P2TR introduces a new Bitcoin payment method through Taproot addresses.

These L1 upgrades laid the foundation for further development of the Bitcoin ecological layer, and these development activities have been quietly carried out behind the scenes. It was not until the release of Inscription that Bitcoin's construction work once again became the focus of attention. , marking a new era of Bitcoin’s scalability and functionality.

Despite the L1 upgrade, following the conservative outcome of the 2017 “Block Size War”, Bitcoin development activity It went through a period of stagnation that lasted until 2022. This relatively slow pace of development is largely due to the fact that most efforts are focused on maintaining Bitcoin Core L1 and less attention is paid to the development of the broader infrastructure required to build a broad ecosystem. The limited development activity in Bitcoin is mainly concentrated in emerging ecosystems like Stacks (175+ monthly active developers) and Lightning, and these ecosystems only account for a small portion of industry developers.

In December 2022, with the emergence of Inscription, the development landscape of Bitcoin has changed significantly. Ordinals allow for the creation of immutable digital art on-chain, not only re-energizing the Bitcoin developer community but also predicting that this will develop into a $4.5 billion market by 2025. More and more developers no longer focus solely on Ethereum, but are expanding their horizons to include Bitcoin L2 solutions. This key development signals a resurgence of engagement and innovative activity within the Bitcoin ecosystem, setting the stage for a new wave of growth and technological advancement.

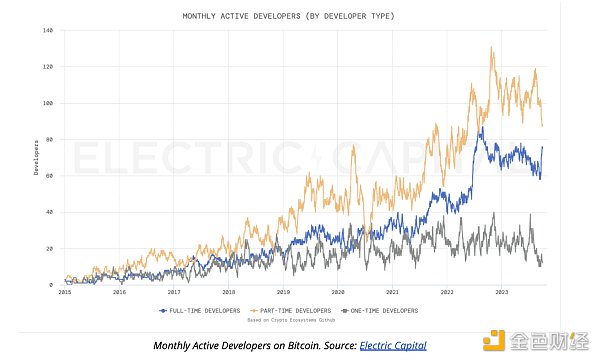

Number of active Bitcoin developers per month. Source: Electric Capital

Number of active Bitcoin developers per month. Source: Electric Capital

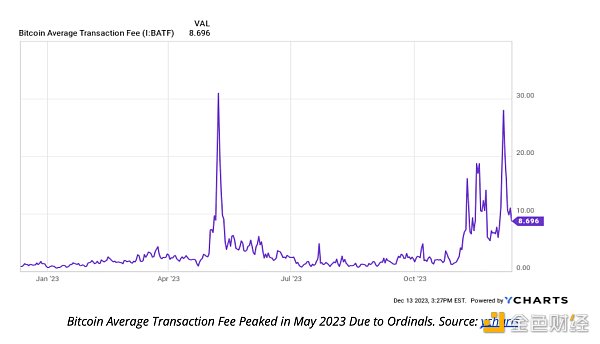

The introduction of Ordinals has had a profound impact on the Bitcoin network, especially the increase in transaction fees. Compared to relatively modest 1-3 sats/vB fee levels in 2022, when Ordinals began to come into focus in May 2023, transaction fees experienced a staggering 20x to 500x spike. By December 2023, its annual growth rate has reached as high as 280%. This surge in data significantly demonstrates the sharp increase in activity and interest in the Bitcoin network and plays a key role in revitalizing the Bitcoin builder culture and ecosystem. While higher fees help increase Bitcoin’s long-term security budget beyond current standards, they also reflect the growing demand for Bitcoin block space.

Bitcoin average transaction fees peaked in May 2023 due to Ordinals. Source: ycharts

The surge in usage of the Bitcoin network has put tremendous pressure on its infrastructure, especially in terms of rising transaction costs, but also in terms of its affordability and practicality. created new challenges. This development becomes particularly evident when users face high fees that are disproportionate to the amount of transactions. For example, a Bitcoin transaction worth $100 may require a fee of up to $50, significantly reducing its economic viability. The same situation extends to Lightning Network channels, as closing a channel with a similar transaction value becomes impractical due to exorbitant costs. If the transaction fee is too high, such as 1000 sats/vB, the network will face a more complicated situation. Therefore, there is an urgent need for scalability solutions within the Bitcoin ecosystem to meet growing demand while still maintaining its transaction viability.

The phenomenal inscription has reignited developers’ interest in Bitcoin, but it has also further amplified the limitations of Bitcoin. Particularly due to Inscription’s lack of support for fully expression smart contracts, developers have turned their attention to other platforms. This highlights the need for more sophisticated scaling solutions within the Bitcoin ecosystem to ensure its utility and relevance within the wider blockchain and financial landscape.

Therefore, L2 solutions are becoming increasingly important if the Bitcoin network is to achieve improved functionality and further success. L2 runs on top of L1, improving scalability and reducing transaction costs by facilitating off-chain transaction channels. Unlike Ethereum, where L1 independently supports smart contracts, Bitcoin's L1 needs to rely on L2 solutions to provide this functionality due to its initial design emphasis on security and decentralization. This reliance underscores the critical role of L2 solutions in expanding Bitcoin’s utility beyond basic transactions, enhancing its efficiency, scalability, and overall appeal in the digital asset space.

Although L2 solutions for Bitcoin are still in the early stages of development, they are poised for significant growth. In comparison, mature alternative L1 scaling options such as Ethereum and L2 solutions like Polygon have reached a higher level of maturity. Since 2017, due to the extensive efforts of developers, these networks have been equipped with advanced tools (such as Starknet, ZKSync, etc.) and features, which is clearly reflected in their TVL data, which accounts for approximately 9.0% of the market capitalization to 12.5%. As technology continues to advance and innovate, Bitcoin's L2 solution is expected to reach a similar level of maturity and may develop into an economic system that is comparable in scale to or even larger than existing L2 solutions. It is predicted that Bitcoin's L2 solution will be able to handle a large number of Bitcoin transactions in the future, possibly exceeding 25% of all Bitcoin transaction volume. This will be a huge leap compared to the current Bitcoin L1 usage.

Some recent developments in Bitcoin’s L1 infrastructure aim to simulate smart contract functionality without the need to build a dedicated smart contract layer. Innovations like Recursive Inscription (BRC-420) and OrdiFi, as well as discussions about re-enabling the “OP_CAT” feature via a soft fork, are all intended to facilitate DeFi-like complex transactions that bypass traditional smart contracts.

I would like to emphasize again that unlike the Ethereum Virtual Machine (EVM)-compatible chain that achieves composability through a general-purpose virtual machine, the Bitcoin framework lacks such a smart contract mechanism. This fundamental difference requires Bitcoin projects to deploy additional tooling and more sophisticated integration strategies to provide a user experience comparable to Ethereum. This may result in experiments on L1 facing similar scalability challenges as the base network. At this point, smart contract applications have begun to appear in the ecosystem to varying degrees, and are likely to expand further.

For example, the team behind BRC-420 recently launched Merlin Chain, a Bitcoin-native L2 solution designed to alleviate scalability issues. Additionally, Ordz Games launched its first-ever Bitcoin-based game last year, using the BRC-20 token $OG, which was offered on a decentralized exchange (IDO) on ALEX Lab’s Launchpad earlier this year. , was 81x oversubscribed in the form of $ORDG. In subsequent parts of this series, we will dive into these innovations in detail, outlining the ongoing evolution of the Bitcoin ecosystem.

Crypto 最令人困惑的部分之一是行话 ,它确实是一个陌生俚语的迷宫。为了消除混淆,本文中的所有加密原生术语都以斜体书写并会即时给于解释,或在文末的词汇表中给予定义。

JinseFinance

JinseFinanceLooking back at the whole year of 2023 at the beginning of 2024, the Bitcoin ecosystem has indeed blossomed with a hundred flowers, from the historic moment of "spot ETF passing" at the beginning of this year, to the BRC20 protocol, Bitcoin NFT, Layer 2, ecological infrastructure, etc.

JinseFinance

JinseFinanceIn the year 2023 that just ended, the Bitcoin ecosystem has undergone some weak but powerful and far-reaching changes.

JinseFinance

JinseFinanceThis article will discuss the current development direction of the Bitcoin ecosystem. It will only provide an overview of the current Bitcoin ecosystem and does not contain any investment advice.

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance