Author: Cycle Capital Research

Mentougou Bankruptcy Case

MtGox was founded in July 2010 and is a Japanese exchange. It is the earliest and largest exchange in the cryptocurrency circle, and its trading volume once accounted for more than 80%. In 2013, 850,000 bitcoins were stolen from Mentougou, and the exchange went bankrupt. Subsequently, about 200,000 tokens were recovered. Since 2014, investors and court-appointed trustees have launched a lengthy compensation lawsuit for these 200,000 coins. About 60,000 BTC were used to pay various fees, and about 140,000 BTC remained.

Debt Transaction

After the incident, during the long period of waiting for the results, institutions have been acquiring Mentougou's debts. At the same time, debt transactions between individuals are also common. For example, in 2019, Fortress Investment Group sent extensive inquiry emails to creditors, offering to purchase BTC at $900, which was twice the price of Bitcoin when Mentougou went bankrupt. The price of debt transactions will fluctuate with market conditions. If the original creditors are worried about not being repaid, they can sell their debts to get back part of the principal.

Compensation plan

In 2021, Mentougou passed a compensation plan, and creditors can get back the remaining value of the exchange.

According to the compensation plan, since the stolen assets can no longer be recovered, the Mentougou Exchange can only compensate creditors for approximately 23.6% of their original debts. If creditors choose to accept early lump-sum compensation, there will be a discount, and the compensation rate will be only 21%; if they do not accept it, creditors may have to wait for a long time, and the final compensation may be more or less. At present, the proportion of creditors who have not been compensated in advance has not been found.

The composition of the compensation assets is divided into two parts, one is cash, which comes from the proceeds of BTC sold by the Japanese government during the high point of 2017, and the other is BTC. Cash is 5%-10%, and BTC is 95%-90%. The specific ratio can be selected. It can be seen that more than 90% of the compensation is BTC.

Regarding the claim time (which is also the time when BTC enters the market), it may take two to three months. A total of 5 exchanges will accept the BTC used by Mentougou for repayment and then distribute it to the creditor's account. The timetable for each exchange is different. Kraken needs 90 days, Bitstamp needs 60 days, BitGo needs 20 days, SBI VC Trade and Bitbank will complete the payment within 14 days. This time is the longest time and may be advanced.

In addition, the deadline for early lump-sum compensation is October 31, 2024. This time will not be modified unless approved by the court.

Current progress

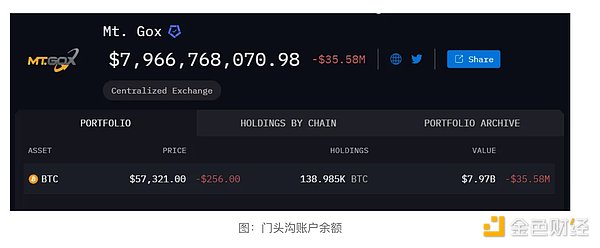

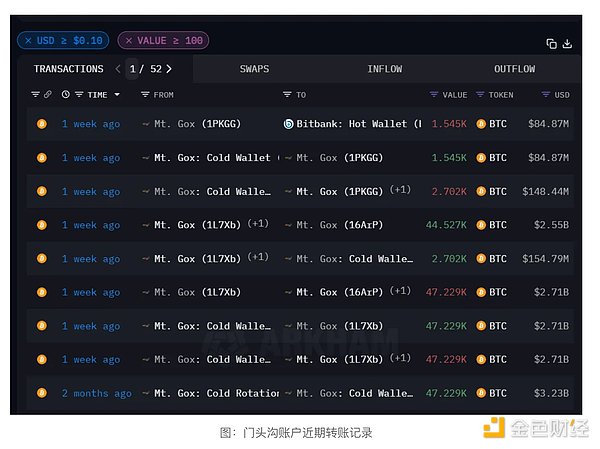

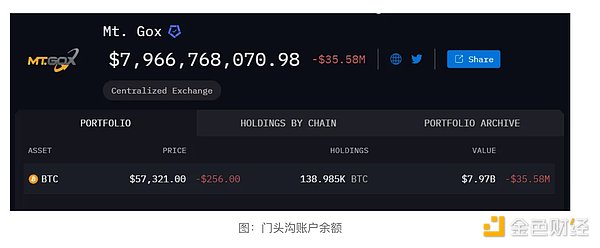

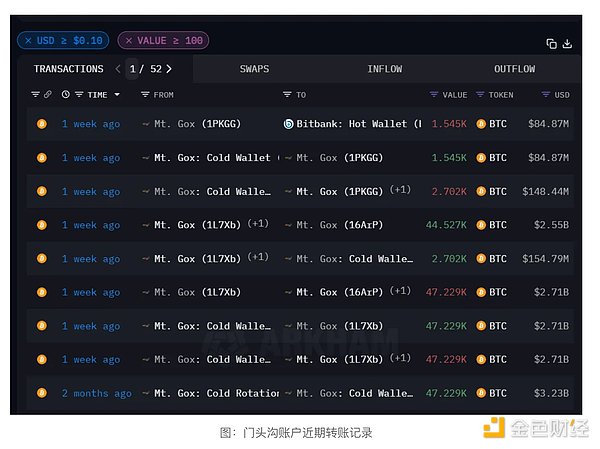

In May 2024, the BTC in the cold wallet of Mentougou moved for the first time since 2018, causing panic in the market. On July 5, 2024, 47,000 tokens were moved from the Mentougou account address, of which 1,545 BTC were transferred to bitbank and began to be paid. On the same day, the German government sold BTC, and the maximum daily decline exceeded 8%.

As of July 12, 138,000 BTC were still in the account address of Mentougou, and it can be considered that the selling pressure of Mentougou has not actually entered the market. The decline on July 5 was part of the realization of the expected decline in the selling pressure of Mentougou.

Selling Pressure Analysis

Mentougou creditors will sell part of the BTC, but they should not sell all of it.

From the perspective of profitability, according to cost calculation, when Mentougou went bankrupt, the BTC price was $485. If it is the original creditor, according to the current price, the BTC increase is 120 times; the amount of BTC paid by Mentougou is about 20% of the original holdings, so the profit is about 24 times. Even if it is a debt acquisition, there is more than 10 times the profit. In addition, the debt acquisition agency may hold more BTC, and it will not sell all of it if it is optimistic about BTC in the long term.

From the perspective of holders, during the long litigation process, the widespread debt trading market has given paper hand creditors ample exit opportunities. Those who are willing to buy debts should be more long-term BTC holders.

Assuming that the proportion of early lump-sum repayment is 75%, the total number of BTC repaid is 105,750, the discount is 11%, and the actual number of BTC used for repayment is 94,117; and assuming a 30%, 50%, and 70% selling ratio, and a selling time of 1 to 3 months, the number of BTC sold in different situations can be calculated. As shown in the following table:

How much impact does such a supply have on the market? You can refer to the recent BTC supply caused by the German government and the demand for BTC ETFs during this period for further analysis.

Comparison of the market impact of the German government's BTC sales

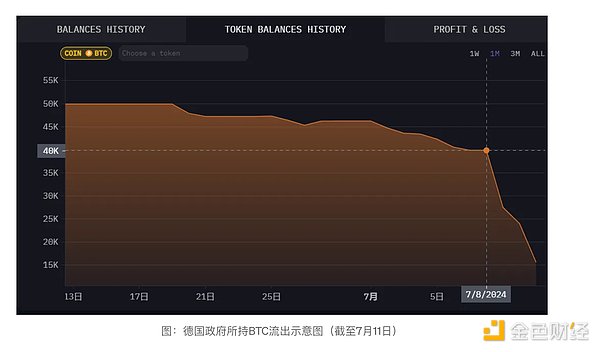

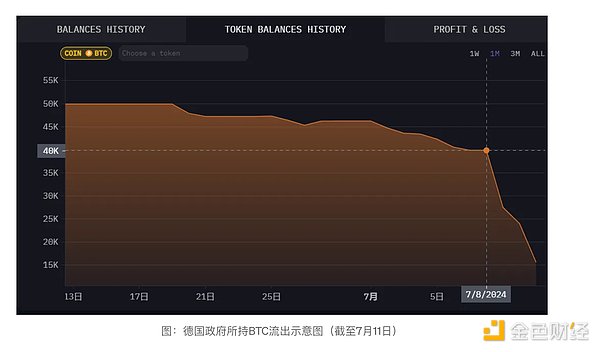

Since June 19, the German government has sold its 50,000 BTC through centralized exchanges. As of July 12, there were 6,394 BTC left in its address, which means that about 43,700 BTC were sold in 23 days, which is worth about $2.4 billion based on $55,000.

During this period, the maximum drop in the daily pin was about 19% (from 66,400 to 53,500), and the daily real column dropped by about 14% (from 64,800 to 55,900). The largest single-day decline occurred on July 5, when Mentougou transferred 47,000 tokens (of which only 1,500 entered the exchange). Under the double pressure, BTC plunged to 53.5K on July 5, with a single-day decline of 8.5%, the lowest point of this round of decline. After July 6, BTC rebounded, reaching a maximum of around 59,500.

Combined with the transfer of tokens by the German government, it can be clearly seen that the market's expectations for the decline in token sales must precede the actual sale time of the tokens. When the German government began to continuously transfer out BTC in small amounts, the market continued to fall. From June 19 to July 7, a total of 18 days, the German government sold about 10,000 BTC, with an average daily sale of 556 tokens. On July 5, after the double pressure of the German government + Mentougou, the actual selling pressure of the German government increased, but the market's ability to bear was also strengthened. On July 8, the German government sold nearly 13,000 BTC. The market did not break the previous low and the daily closing rose. From July 8 to July 12, the German government outflowed about 33,700 tokens, and BTC has been fluctuating between 54K and 60K.

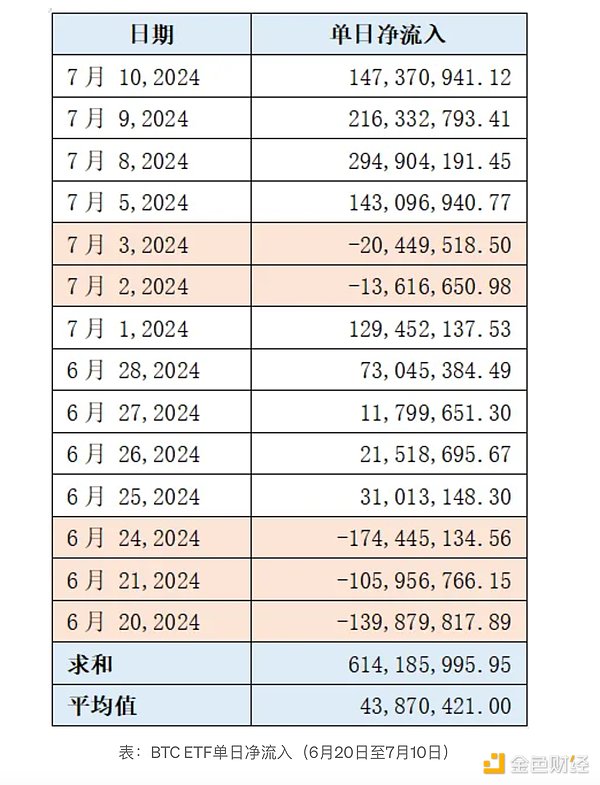

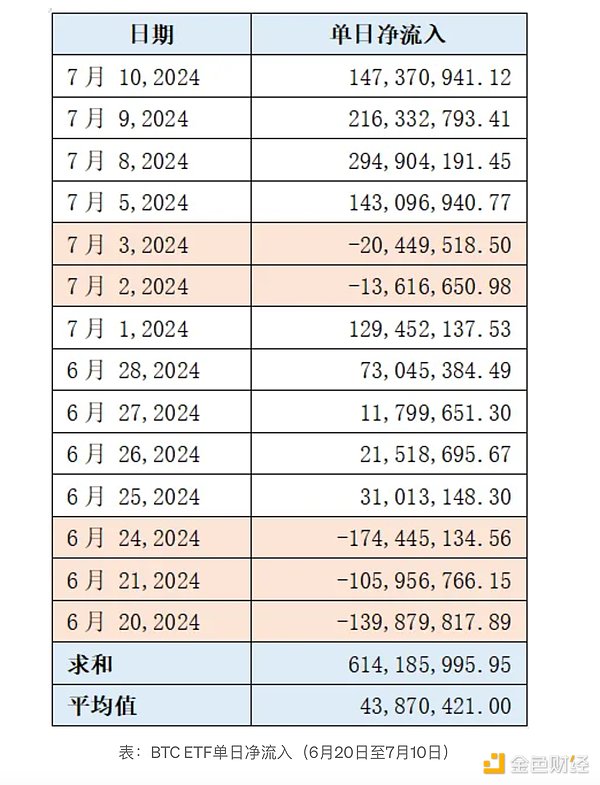

BTC ETF demand analysis

BTC ETF is a relatively stable buying order in the current market. During the period when the German government sold tokens, from June 19 to July 10, there were 15 working days. During the 15 days, the ETF had 6 days of net selling, selling $470 million; and 9 days of net buying, buying $1.07 billion, with a net inflow of $600 million and a daily average of $43 million. The main purchases occurred after July 5, totaling more than $800 million.

According to the above, the German government sold a total of 40,000 tokens to the market during this period, about $2.4 billion. Therefore, the demand for BTC ETF was not enough to provide sufficient support, and the market price fell.

Conclusion

If the compensation of Mentougou is sold out within a month, the selling pressure faced by the market will be highly similar to the German government's selling, and the amount and time of selling will be similar. According to the current demand for ETFs, it cannot provide sufficient carrying capacity, and the price of BTC may fall further.

If the compensation of Mentougou lasts longer (2-3 months), the amount of BTC entering the market every day will not be particularly large, and it will not cause a one-time decline. However, due to the continued expectation of selling pressure, there may be a period of volatility to digest the selling through volatility. This also means that it is difficult for the main upward trend to come in the short term.

Currently, only 1,545 tokens of Mentougou have been transferred to the exchange, and the rest are still in Mentougou's account. It can be considered that the actual selling pressure has not yet entered the market. When the BTC held by Mentougou is distributed to several exchange addresses on a large scale, it may cause a large panic drop, thus forming a plunge. When specific individuals sell, due to dispersion and difficulty in tracking and observation, it may not necessarily cause a significant drop in prices.

JinseFinance

JinseFinance