Author: Marlon; Compiler: Yangz, Techub News

With the Bitcoin "halving" approaching, speculators are eagerly looking forward to the launch of Runes. While attracting a lot of attention on CT, there has also been a lot of confusion and misleading around this new token standard. Even unrelated protocols use "Rune" in their names and tokens, exacerbating the confusion.

To avoid misleading, we have made a simple combing.

What are Runes?

As a developer of Ordinal Theory, Casey Rodarmor is building a homogeneous token standard for Bitcoin, the Runes protocol. As a meta-protocol, the Runes protocol itself is not a token. As Casey said in the podcast, this is "where people create shitcoin on Bitcoin."

Tokens created using this token standard are called Runes. Unlike BRC-20, Runes is a homogeneous token standard, that is, each Rune is interchangeable. The Runes token standard is similar to the ERC-20 token on Ethereum, but simpler.

Overview

The Runes protocol adopts Bitcoin's security framework and extends UTXO to store Bitcoin and Rune balances. Therefore, users can create and trade Runes through regular Bitcoin transactions.

This is an important nuance. Many protocols are scrambling to launch their own Rune tokens, some through creative gamification models, others through tantalizing promises of airdrops. Be cautious of false marketing claims that they are the first Runecoin project; at best they can only secure and etch an 11th rune.

The Genesis Rune, Rune 0, will be available for minting, starting with this halving and ending at the next halving in about 4 years. Each mint receives one Genesis Rune, with zero divisibility.

Approximately every 4 months, the rune name will be reduced by one character. The maximum length of the name is 28 characters. In addition, to prevent "jumping the gun", the protocol adopts a "submit first, then disclose" scheme. The unlock schedule of token names can be found here. In conclusion, be prepared for crazy token names:

This makes each Rune name unique. In addition, each token will have a single Unicode code point as the currency symbol.

Can Runes replace BRC-20?

With a total market value of $2.65 billion, BRC-20 tokens have a considerable market size in the Bitcoin market. The narrative around Runes is driven primarily by speculators who believe that Runes will replace BRC-20 as the new widely used token standard on Bitcoin.

Are Runes a Better Token Standard?

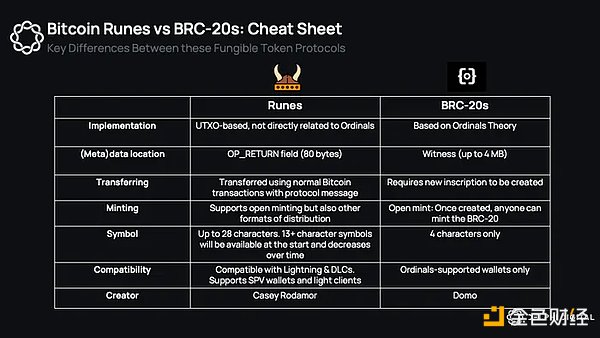

As we highlighted in our deep dive into Ordinals and Runes, the differences between the two are stark:

Runes do not use witness data, but instead utilize the OP_RETURN field to simplify the process of creating tokens. Runes can be etched (deployed), minted, and transferred through Runestones, making regular Bitcoin transactions possible.

Runestones are rune protocol messages that store transfer instructions in Bitcoin's unspent transaction outputs (UTXOs). These transfer instructions determine how to transfer runes in the output, such as the destination address and the transfer amount. By default, the rune balance on the input UTXO is destroyed when it is transferred to a new UTXO.

This approach is more network-friendly than the BRC-20 standard, which currently generates a large number of unused UTXOs, making the network cluttered. Another disadvantage of BRC-20 is that new inscriptions must be created for each token transfer.

In addition, runes are more flexible in creation. They can be open minted, fairly distributed, and users can also choose to mint the entire supply into a single address (just like ERC-20). BRC-20 is limited to open minting.

More importantly, BRC-20 inscriptions are more susceptible to "front running". This is because anyone can see the inscription transaction in the mempool and then execute it in advance by paying a higher transaction fee, which is bound to be troublesome for trying to deploy new tokens. In contrast, Runes attempts to prevent front running using a "commit first, then disclose" scheme. At a higher level, it is also possible for users to commit to transactions privately. Disclosing the details only shortly before confirmation can greatly reduce the time window for front running.

Finally, Runes supports compatibility with SPV wallets and Bitcoin L2, which uses the UTXO model. Therefore, in theory, it is possible to use lightweight wallets and integrate with the Lightning Network for faster and cheaper transactions. The reason for the emphasis on "in theory" is that although interoperability already exists, the infrastructure must be developed first.

Some FUD

In theory, Runes solves many of the issues that BRC-20 has with user experience and compatibility. However, I am cautious about the view that Runes will indisputably replace BRC-20.

To enable protocol upgrades and ensure clients stay in sync, Casey incorporated what he calls the Cenotaph model into the Runes protocol. Cenotaphs are malformed rune stones created by bad inputs. When included in a transaction, the runes associated with the Cenotaphs are destroyed or unusable.

This is one of the controversial points because it introduces the risk of accidentally losing runes. For example, if you interact with an application that creates rune transactions and it accidentally generates a Cenotaph, then you could lose all runes stored in the same UTXO.

So is this a big risk or a small risk? It's hard to say until the protocol goes live, but it's something users need to keep in mind. Casey mentioned these issues in this thread - TLDR: In his opinion, the risk is negligible. Regardless of its importance, avoiding untested third-party services after Runes is launched is a good way to minimize the risk.

In addition, there have been recent rumors on Twitter that BRC-20 may be updated soon. It is said that the BRC-20 indexer will be able to calculate EVM smart contract code on token balances. If the rumor is true, many of the current design problems will be solved, making BRC-20 more competitive than Runes. However, it should be noted that this is just a rumor and should be treated with caution.

Ultimately, the success of Runes depends on the user experience. If Runes can be quickly integrated and take advantage of its wide compatibility, it has the potential to replace BRC-20.

If you’re interested in getting a taste of Runes before they go live, check out Haze’s brilliant analysis of $PUPs. For more information on the technology, I highly recommend checking out the official documentation and listening to Casey’s podcast on the product launch.

Redphone’s Overview

Finally, a special thanks to Redphone, who first proposed the BRC-20 concept, for sharing his thoughts on Runes below:

Unless BRC-20 continues to evolve, Runes will likely become the dominant token standard for Bitcoin.

Runes are more efficient.

Runes store token balances in UTXOs, shifting trust from the Indexer level back to the Bitcoin blockchain. This in itself is a huge win.

Because Runes are in UTXO, they are easier to integrate with L2, cross-chain bridges, and other DeFi applications.

If Runes can be integrated into the Lightning Network, the Lightning Network will also be completely new. Can you imagine a Runes-based stablecoin running on the Lightning Network? Coinbase is already working on supporting the Lightning Network. Maybe one day we can directly withdraw shitcoin from Bitcoin to the Lightning wallet.

Runes expand the issuance mechanism of tokens. Unlike BRC-20, it is not limited to fair launch. And this helps drive more adoption, because fair launches are difficult to keep contributors consistent for a certain period of time.

Casey Rodarmor is an absolute master of gamifying protocol launches. For example, when launching ordinals, he gave each numerical Satoshi an alphabetic counterpart (learn more about naming Sats). He also created rarity tiers for each Sats (leading to the “Sat Gold Rush” craze among Sat collectors). Similarly, he gamified the launch of runes by gradually allowing shorter names. Initially, each token name had to be 13 characters or longer. About every four months, new rune names could be one character shorter. This is the magical incremental evolution of the Runes protocol that continues to attract attention. All protocol designers in the world could learn from this approach.

Coupling the launch of Runes with the Bitcoin halving is another brilliant marketing move/gamification by Rodarmor. Normally, I look forward to the Bitcoin halving itself. Now, I almost only look forward to the Runes.

Many BRC-20s will be bridged to Runes (perhaps via teleburns?)

BRC-20 has a fervent fan base and its ecosystem will grow. But in which direction, I am not sure. As we mentioned above, there are rumors that BRC-20 indexers may soon be able to calculate EVM smart contract code on token balances. This will greatly improve their performance and be comparable to Runes, and may even surpass any innovation on Bitcoin Core.

It is completely fine for multiple token standards to coexist. What matters more is what you can do with these tokens. Many BRC-20 tokens have already entered centralized exchanges. In my opinion, this has proven its sustainability.

Bitcoin is moving too slowly for the native shitcoin. This means that the Bitcoin L2 war will be one of the biggest opportunities in the cryptocurrency space. I would love to see ordinals (and BRC-20) indexers win this battle by launching tokenized L2 networks. Regardless, we will see a groundbreaking L2 ecosystem in the coming months and years, and I think Runes will be a key part of that story.

In the end, I, and Redphone, are fans of both Runes and BRC-20. Both will likely continue to thrive in the short term, but BRC-20 will have to evolve to stay relevant.

Beyond Runes, I love Rodarmor’s creativity. From the moment I first came across ordinals, I saw him as an innovator in the cryptosphere, one of those visionaries who went down in history… like Hal Finney, the first Bitcoin contributor, Vitalik Buterin, co-founder of Ethereum, Hayden Adams, founder of Uniswap, etc. The successful launch of Runes will only be the icing on the cake for Rodarmor. He has changed the fate of the orange coin, and Runes looks ready to change it again.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance