The Art of Token Economics: A Deep Dive from FDV to Airdrops

A deep dive into the different factors of a project’s token economics and their impact on token valuation and on-chain activity.

JinseFinance

JinseFinance

Author: Dewhales Source: Dewhales Capital Translation: Shan Ouba, Golden Finance

Dewhales in the recent The research points out that projects have recently been moving in a truly modular direction similar to Web2. Over the past decade of Web2, the number of external libraries, frameworks, and containers has exploded. Previously, modules in Web3 could be likened to frameworks that were difficult to integrate, requiring ad hoc solutions to bring them together. Now, it's more like Web2 with libraries, and one program can call many different libraries. In Web2, the abundance of libraries often leads to significant bloat in application size, a banking application should ideally be 20-50 MB but can end up being 500-800 MB due to libraries. However, in Web3, the current situation is slightly different.

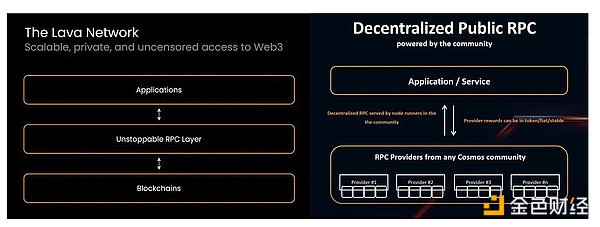

Web3 is moving away from the Fat Protocols paradigm of providing developers with numerous SDKs. These comprehensive offerings often result in developers getting “a little bit” of something rather than a tool with truly broad capabilities. Furthermore, looking at trends over the past few years, the cryptocurrency pendulum has swung from centralized to decentralized solutions, with the current main development direction being truly decentralized due to the expansion of Web3 development capabilities. Lava Network is one of the cornerstones laying the foundation for a truly distributed and decentralized Web3.

In order to understand Lava and To get an overview of its goals, consider the following analogy:

Lava is a Postal systemwhile other providers are independent postmen. If a city only has one postal carrier, they may get sick, leaving no one available to deliver the mail. If there are many postmen from different companies, competition will arise and it will be difficult for consumers to choose a specific postman. In Lava, anyone can join the “Lava” collective of postmen and deliver mail any way – by bike, car or on foot. You pay once and the Lava algorithm selects the best postman based on your needs to help you deliver your letters. You don't have to choose your own mail carrier or maintain relationships with several different providers at the same time.

Lava is a marketplace, while other providers are individual stores. Currently, in Web3, there is no infrastructure aggregation service, and as new blockchains and combinations are launched, this part of the stack is becoming increasingly fragmented. For each rollup deployment on Celestia, developers must use a new provider or set up a node to use it. Lava eliminates the need for developers to manually select a single provider. When developers connect their applications to Lava, the protocol not only connects them to the most efficient node available to get responses, but also routes their requests to the correct provider - through chain, protocol, and API interfaces.

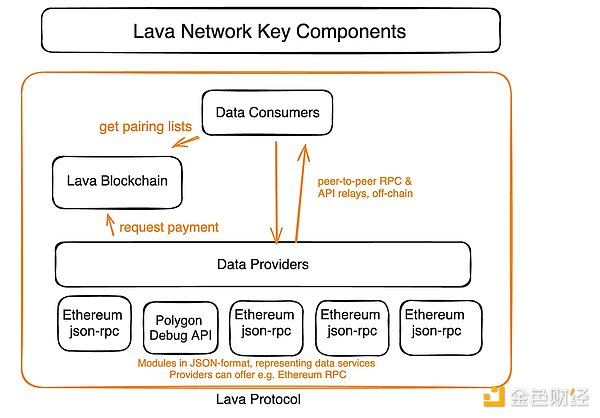

Lava protocol aims to provide decentralized and scalable blockchain data access. Lava is a fast, reliable and decentralized RPC network for all blockchains that solves the problems inherent with centralized blockchain data providers (Infura, Alchemy, etc.). In addition, there are incentive pools on Lava that blockchains can create to guide infrastructure development. This is used to pay the provider, while users/developers get the RPC for free. Learn more about the shortcomings of current solutions in the Competitors section. In addition to this, the team also emphasized that Lava will support more features and modules in the future.

Currently, the first service module on Lava is RPC, and the network supports more than 30 chains. In the future, modules such as subgraphs, oracles, and anti-MEV APIs can be added without permission.

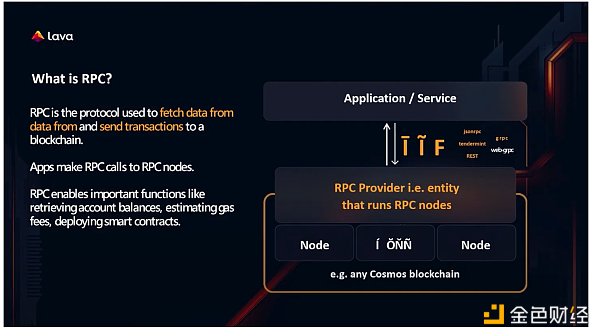

What is RPC:RPC (Remote Procedure Call) is a A method that allows a program to call a procedure (function) in another program. In a blockchain environment, they are full nodes that facilitate other network participants to connect to the blockchain for read/write access. RPC nodes are typically used by those who do not have or are unable to run their own full nodes or light clients, which greatly reduces friction when accessing the blockchain. Any user connecting to an RPC provider implicitly trusts the integrity of the provider because no self-checking effort is done.

Purpose of RPC:Users need to use RPC to connect to any blockchain and perform any basic Operations: mint, trade, transact, send, deploy smart contracts. For Dapps, RPC allows Dapps to interact with any blockchain network. For example, a Dapp can use RPC to send transactions, read data from the blockchain (gas prices, account balances, etc.) or subscribe to certain events on the network. RPC also allows Dapps to interact with the blockchain network without revealing their private keys.

On one hand, Lava's description seems similar to something like a router or repeater. But in reality, Lava as RPC permeates every aspect and component of web3: different ISPs, services, dApps, many different processes invisible to users. So next we need to dig deeper into how exactly Lava works.

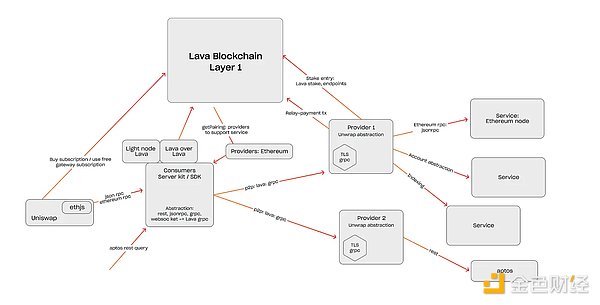

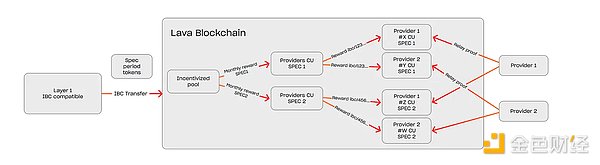

1 . Chains and Rollup create an incentive pool on Lava, consisting of its native tokens or stablecoins or even memecoin

2. Chains and Rollup by writing simple specifications ("specs") to define the required infrastructure services and add them to Lava so that providers can serve the infrastructure

3. Suppliers join Lava to provide services to specification-defined infrastructure and receive rewards from an incentive pool. This is especially beneficial for newly launched or pre-launched chains that are not yet supported by a few major vendors

4. Lava aggregates providers and organizes them based on geography and provider The quality of service routes requests in the best possible way. Users don’t need to manually research and pick the best provider; Lava can highly dynamically serve user needs on a per-request basis

5. Users and developers get free Infrastructure

6. Vendors are paid monthly based on the computing power and quality of service they provide

7. Developers can purchase subscriptions to higher rate limiting services (such as more RPC requests). Subscription fees are also paid to the provider on a monthly basis.

The problem with current on-chain data providers is that such solutions are very fragmented and no one can provide everything in one place - each provider is missing something functionality or support for a specific network. Therefore, multiple solutions need to be used simultaneously to cover the necessary data stack. Lava also highlighted the issue of centralized infrastructure failures.

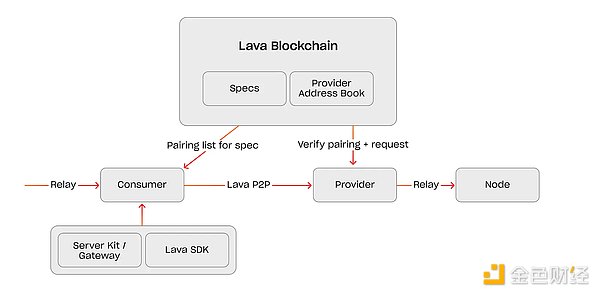

Lava acts as a marketplace and settlement layer for accessing blockchain data with dynamic market-driven pricing. Payment settlement, conflict resolution and pairing are all done on-chain. To ensure competitiveness, communication between suppliers and consumers takes place directly, with data and requests taken offline (i.e. not through the Lava network). Lava is designed to allow users to access not just RPC, but RPC in different locations around the world for better speed and user experience.

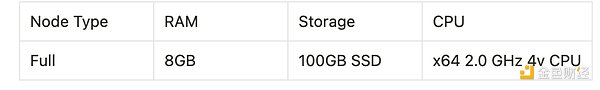

Technically, Lava offers a PoS-based blockchain solution developed using the Cosmos SDK and Tendermint core. This seems logical in the context of Cosmos being positioned as a hub that allows different networks to connect to each other. But this raises the question that Cosmos is actually a rather expensive solution for connecting different networks via IBC technology. The fact is that the current IBC transport layer requires pairs of lightweight clients between each chain. On most EVM-based chains, the cost of running a full lightweight client is prohibitive, limiting IBC access to high-bandwidth, low-cost chains. The validator requirements are the standard requirements of Cosmos:

Cosmos is highlighted in the single page, but in reality, if we visit Gateway Lava, we will see quite a few Supported chains (including some that offer RPC in testnet). As of mid-June, only 16 chains were available; as of July 7, 24 chains were available:

Lava also provides an SDK, which is designed for developers A powerful JavaScript/TypeScript library designed to allow developers to integrate plug-and-play RPC multi-chaining by adding a simple js library to their code. It provides decentralized access to all chains supported by the Lava ecosystem and can be used in both server and browser environments. By importing Lava-SDK into their projects, developers can easily interact with different blockchains and create decentralized applications with ease.

Gateway - Easy-to-access web UI for online project management and URL-based API access on all supported chains and APIs.

SDK with badge server and integrationSDK with innovative badge system for hiding and private keys that protect front-end dApps. The SDK also supports native integration with viem, web3.js, ethers.js, CosmJS, and more.

Server Kit - Concurrent, high-throughput binaries that can be used to build gateways or in enterprise environments Provide services to multiple consumers.

Consensus-based data accuracy. Clients are free to use a threshold algorithm to sample API endpoints and minimize response collisions in a probabilistic manner. Consensus is built around the data in the network, with future plans to launch simple clients to further remove assumptions about trust. Developers don’t have to worry about outdated or inaccurate data.

Network redundancy scales with traffic spikes - Applications interact with provider lists to Increase uptime and service coverage. The network can also quickly run its RPC nodes, creating new Lava Network specifications for providers to connect and deliver services.

Connect to many providers = high uptime - Customers are paired with a list of providers, and Ratings based on latency, freshness, and availability in a peer-to-peer system to determine provider rewards. Providers are rewarded based on their per-session QoS, meaning users get the best experience possible with no downtime.

Specification that can support any chain, any API - Using Lava as a provider, developers can Change its configuration to access any chain and any API currently provided by the network. DAOs and contributors can use open source to quickly implement new support for the network, so developers don't have to spend time looking for new providers that meet their needs. All the RPC a developer needs is available through an open source license.

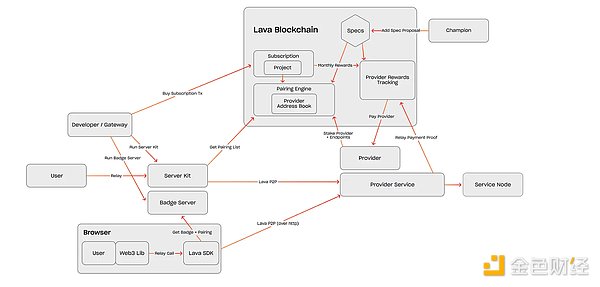

But if we don't look under the hood through the small glass window, where we can only see part of the engine, but open the hood - everything will look bigger and more complex:

< p style="text-align:center">

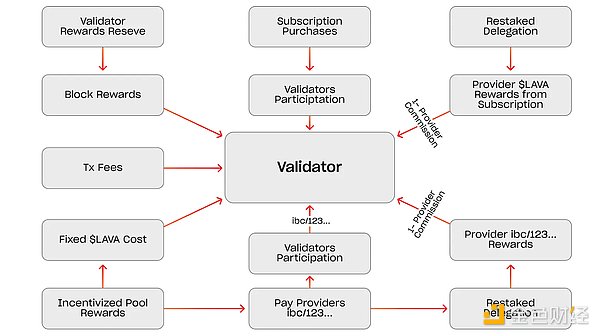

Validators protect the chain and earn LAVA by protecting the chain. Validator nodes are responsible for securing the Lava blockchain by providing blocks, voting on blocks, and validating status. The formation of validator rewards is discussed further in the “Token Economics” section.

Delegators stake LAVA to providers and validators on the network. This makes the network more secure and allows delegators to share risk with providers and validators in exchange for rewards

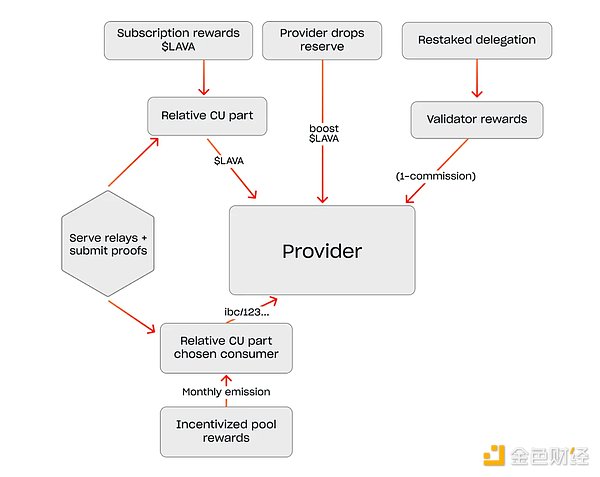

for consumption Provider of or management services. Providers fulfill retransmission requests by staking on the network and running RPC nodes in the retransmission chain of consumer requests (e.g. Cosmos, Etherium, Osmosis, Polygon, etc.). In many cases (but not all), the provider will also be the node operator for a specific blockchain. They receive payment from consumers for service requests in the form of LAVA. Depending on the performance of the RPC service, providers may be rewarded, penalized, or excluded from the chain. However, in contrast to validators, providers are rewarded from:

1)Subscription payments from service consumers,

2)Service ipRPC Specification of ipRPC Rewards - As mentioned above, in the ipRPC pool

3)Delegation rewards - As mentioned in Re-staking below

4)Reward boost

provided Merchant payments come from CU and are paid in LAVA. Each provider receives a portion of the service consumer's subscription price. The share received for a subscription is calculated by dividing the number of CUs offered by the provider to that consumer by the total number of CUs used by the consumer in the subscription. This gives the exact percentage of service CUs attributed to the provider in question.

ChampionsEarn LAVA by creating, maintaining, servicing, and supporting specifications on the Lava network. Many champions create specifications and propose them on-chain, maintain existing specifications with necessary updates or changes, or write software that serves the specifications (node clients, API clients/indexers, or other innovations). Part of the reward is reserved for the champion.

Consumer is anyone who consumes the web3 API using the Lava protocol. Examples include developers, wallets, dApps, exchanges, indexers, and more. They use LavaSDK, ipRPC endpoints, gateway endpoints, or server suites to retrieve data. The consumer initiates a relay request. They interact with the relay chain and participate in the Lava network to make reliable RPC calls. Lava facilitates decentralized interactions with the blockchain, enabling consumers to maximize privacy, transaction speed, data reliability, auditing, and node availability. Consumers on the Lava network are divided into developers and the applications they create.

Enterprise customers who can use Lava Server Kit - This is a GO language reference implementation that can A solution that provides self-hosted gateway access to blockchain APIs and is designed to run as a backend server. It is able to accept raw RPC queries, wrap them with protocol layers, and send them directly to providers on our network in a decentralized manner. Lava Server Kit is more concurrent and performant than Lava SDK, and can be used for enterprise-level applications that require high throughput and high scaling efficiency.

Specification is the basic component that provides multi-chain support for Lava, presented in JSON format. These so-called specifications define the minimum requirements required for a specific chain’s API to run effectively on Lava. Using these specifications, Lava determines supported chains and methods, and sets corresponding costs, prerequisites, and checks.

Lava Gateway is a web platform for developers that provides instant access to blockchain data. The gateway leverages the Lava Server Kit to provide a managed entry point for developers who need to RPC over the Lava network. This setting allows users to manage and customize the Web3 API using convenient controls directly from the browser.

The topic of re-staking has been on everyone's lips for a long time, but in the case of Lava, it has moved from an unexpected direction to a more complicated approach. But in the case of Lava, this approach differs from the usual re-staking of LST and AVS native tokens. By re-staking in the Lava Network, token holders can delegate their tokens to provider-provided specifications to claim a portion of the rewards awarded to the selected provider. All re-stakeholders are eligible to receive a portion of the provider’s profits.

LAVA is delegated to the verifier and can be pledged again. LAVA tokens can be re-staking to providers without introducing additional collateral, resulting in greater returns at the expense of greater risk. Instead, every time a provider stakes a token, an equal amount of tokens is staked back to the validator. In other words, provider staking is both self-delegation (delegating to oneself as a provider) and standard delegation (delegating to a validator).

Purpose of re-staking:

- Provide a way for delegators to help select the best provider and earn rewards

- For validators Delegators provide additional benefits

- Reduce network security costs

In fact, there are quite a few RPC providers out there - 29, according to Alchemy. The main ones are Infura, QuickNode, and Alchemy. But compared to them, Lava Network offers a completely different product.

What are the disadvantages of a centralized RPC provider:

Wallets can censor countries, providers can block transactions for certain dapps, and gateways can return inaccurate data and sometimes be malicious.

Due to earlier this year An error occurred during the test network launch, and the Solana Foundation RPC endpoint went offline. While this does not affect the network's ability to create new blocks, it means that users must rely entirely on private RPC providers, and publicly available RPC is no longer available.

RPC providers often face catastrophic configuration issues , for example providers in the Ledgerwatch Erigon project recently experienced issues with their endpoints going down and the HTTP endpoint URL being permanently shut down, as documented in the project logs.

Optimsim Airdrop Revealed The failed airdrop resulted in a 60% loss in token value due to preemptive traffic that overloaded its public RPC.

In addition, large providers serve a handful of chains. Lava enables any chain to provide fast and reliable RPC to its users/developers without permission. Through incentive pools (incentivized public RPCs). Additionally, RPC endpoints may go offline under high load for which the centralized provider is not responsible - this is also an aspect of GTM's strategy Lava Network.

In other words, We see considerable differences in many parameters. And it's still worth seeing how Lava performs. Feedback shows that using RPC Lava can improve application performance by about 10x, even on Arbitrum, due to no downtime with other RPCs. The team stated that in general - CUs/prices are defined by the ecosystem and due to the novelty of Specs, Lava will be able to offer an unlimited number of CUs/prices - on-demand modules are defined based on supply and demand.

Looking at it from a different perspective, another competitor could be EigenLayer. This is not only because of the idea of restaking being used (albeit from a different perspective), but also because of the architecture and principles of the protocol. The problem is that while EigenLayer supports network bootstrapping (AVS), Lava Network provides bootstrapping for creating your own RPC infrastructure through a mechanism called Incentivized Public RPC. Similar to how EigenLayer uses LST and native ETH to extend cryptoeconomic security, in Lava Network, chains and aggregations create an incentive pool on Lava consisting of its own tokens, stablecoins, and even meme coins.

Lava tokens have direct utility through a subscription model and staking provider nodes (norms), ensuring the integrity and continuity of their services. In addition, Lava Network’s validators also stake tokens. Token holders can delegate their tokens to providers and validators and participate in governance.

There are other aspects to shaping the flow of funds: the chain contributes incentive tokens to Lava, which rewards providers and stakers for providing specifications to its developers and users, while developers (champions) can contribute by creating, developing and Earn rewards for maintaining RPC and API specifications and software.

In addition, Lava tokens are an integral part of protocol expansion. This is because it is used to incentivize public RPC pools where tokens from other platforms implementing Lava RPC can also be used with Lava tokens. The ipRPC pool can accommodate native Lava tokens (LAVA) and IBC wrapped tokens from any blockchain.

For access and connections, the incentive pool relies on the server suite/gateway interface. Selected consumers with special subscriptions act as sponsors for end users. These special subscriptions enable consumers to distribute rewards from the ipRPC pool to providers when data is consumed by end users. As a result, providers that serve the ipRPC specification receive incentives above and beyond regular network service incentives.

With other blocks Like the chain, validators are rewarded for staking. Staking validators receive rewards from four sources:

1) Block rewards from the reward reserve

2) Block rewards from subscription commissions

3) Block fees from network transactions

4) Delegation rewards (as described in the "Re-staking section above")

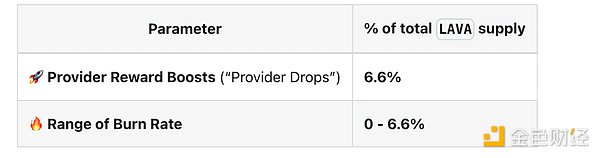

LAVA’s supply is fixed and no more tokens will be minted. In addition, Lava has developed a new deflation mechanism to attract offers during the initial phase of the mainnet 6.6% of supply is allocated to “Provider Drops”, a monthly reward distribution mechanism designed to incentivize provider participation. Monthly rewards vary based on paid demand for services on Lava; higher paid demand. , the greater the reward for providers who join early. As the network attracts more consumers, the need for Drops will decrease as providers will benefit from subscription payments at the end of each month. , all unallocated validator rewards will be burned.

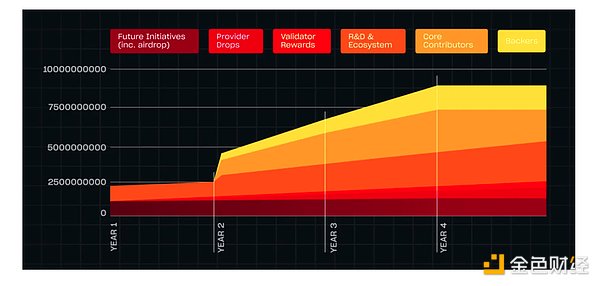

Lava will have 1,000,000,000 tokens at Genesis and there will be no inflation

25% - Public Allocation, future plans and reward reserves (provider airdrops and validator rewards) . Fully unlocked at launch. Except for reward reserves: 31% continuously unlocked from launch to year 4 - R&D and Ecosystem; for providers, Program for validators and champions. 25% unlocked at launch, remaining 75% unlocked continuously from year 1 to 4

17% - Investors, 33%. Unlocked in the first year. The remaining 67% is unlocked continuously from year one to year three.

27% - Contributors, early contributors, core team, advisors, etc. 33 % unlocked in the first year. The remaining 67% is unlocked continuously from year one to year three.

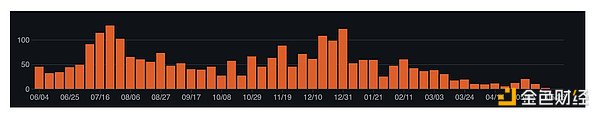

GitHub is very active and can even be considered an example of a truly active GitHub. In this study, we wanted to highlight the activity in the Lava Network repository alone, as this clearly shows a lot of activity in the project work, especially since July 2023.

https://github.com/lavanet/lava - is the main repository. There are 44 contributors (23 as of July 2023) working on the repository, written in Go as the primary language, along with Shell, Phyton, and other languages. Commit frequency is very high since June 2022, all pull requests are in the case, and the activity is not artificial. New versions are active, the first version is in November 2022, and in less than 1.5 years there have been 115 versions (33 as of July 2023), which is a very good number: < /p>

< /p>

There is currently an open issue titled Contribution - Provider rewards persistence on shutdown. The existence of problems indicates that the maintainers are responsive to problems and actively working to resolve them. As far as the code is concerned, the repository looks good and the code is written using well-known tools and libraries (Cobra).

https://github.com/lavanet/lava/tree/main /ecosystem/lava-sdk - Lava SDK repository, also quite active, this repository has fewer contributors (6) and has a lower commit rate, but still better than most crypto projects in the main repository Much more active (as of July 2023, this repository is currently included in the main lava repository). The SDK (Software Development Kit) is designed to allow developers to access the Web3 API through the Lava network. It is implemented in JavaScript/TypeScript and is designed to run in the browser, providing multi-chain peer-to-peer access to blockchain APIs.

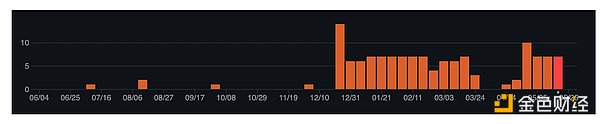

https://github.com/lavanet/docs - Documentation repository, also actively updated , and has a large number of contributors (43 as of the end of May 2024, 6 as of the end of July 2023):

https://github.com/lavanet/lava-providers - Another interesting one The repository has been actively developed in recent months. It contains a resource for the Lava Access SDK to discover the first provider to connect to to access initial pairing data. That is, this repository contains the json used by Lava to provide a decentralized solution for connecting new consumers to the network through provider nodes, thus providing reliable and controlled network connectivity.

Lava also announced backers for the 2024 round, including: Haskey, Tribe Capital, Jump, Quiet, Node.capital, Finality, MH Ventures, Alpha Lab, Chorus One, YTWO, kommune, Protocol Labs, Alliance, Kepler, Dispersion Capital, Chainlayer, Compa, Galileo, Anagram, Caladan, Dispersion Capital and Interop Ventures.

Lava Foundation has raised $11 million to develop the Lava ecosystem and fund Protocol development. In addition, Lava also completed a $15 million seed round of financing, led by Tribe, Jump and Hashkey.

In addition, Lava has partnered with NEAR, Evmos, and Axelar on incentivized RPC campaigns and distributed hundreds of thousands of rewards in the form of node operator rewards to provide reliable infrastructure. Other partners include (or projects using Lava):

Learn web3DAO- Conducted educational projects and conducted hands-on workshops for developers on the Lava SDK.

In addition to Learn web3DAO, Lava is also at Solana Hacker House Presentations were given and the center was positioned as an environment for developers and learning.

Caddi - By using Lava, Caddi users can get more accurate gas prices across multiple networks. Caddi allows for optimized exchange pricing and, in addition to DEXs, connection to centralized exchanges via APIs. But judging by available social media metrics, the app isn't very popular yet.

ZyberSwap is a DEX on Arbitrum. Further launches are planned on Optimism and zkSynk, which has a smaller TVL of $4.18 million, according to DeFiLama.

Arcadeum - Online Casino, on its website A large number of different gambling games are available.

Chorus One - At the launch of the Lava core network Provide users with Stake-as-a-Service (SaaS) solutions.

Another unique aspect of Lava’s approach to partnership building is the launch of incentivized public RPC campaigns. Specifically, during the event, Lava partnered with Union Labs to incentivize public remote procedure calls (ipRPC) and has a token reward pool worth $100,000. Union Labs is an independent compatibility layer that uses zero-knowledge proofs to provide a secure bridge to connect any application chain, L1 and L2. After the planned launch of the Union mainnet in summer 2024, node operators will have the opportunity to become Union RPC providers through Lava, streamlining the process for developers by consolidating providers into a single access point. Event participants will receive a portion of the reward pool within three months of the expected initial launch date.

Additionally, Axelar's involvement in the program was mentioned on the Axelar Community Forum. Their incentivized public RPC endpoint has become the primary RPC on Axelar. At launch, Axelar’s main and test networks have processed over 7 billion RPC requests, with over 31,000 AXL tokens distributed among premium Axelar node operators. Support for archived data and the CosmWasm API has also been added, significantly improving performance through enhanced caching capabilities. In April, Axelar's CUs reached 11.4 billion compute units, demonstrating the immediate usage and demand for Lava RPC.

A deep dive into the different factors of a project’s token economics and their impact on token valuation and on-chain activity.

JinseFinance

JinseFinanceSky Strife, a full-chain game developed by the Lattice team, was launched on the Redstone mainnet yesterday.

JinseFinance

JinseFinanceI think it’s time for Web3 Degens to pay attention to this kind of exploitation. Through unremitting efforts, we have taken back the ownership of the network and avoided the ruthless monitoring and exploitation of Web2 oligarchs. Don’t lose what Web3 is proud of. fundamental.

JinseFinance

JinseFinanceLava Network is a modular data network that provides developers with scalable access to any rollup or blockchain.

JinseFinance

JinseFinanceThe modular track has just begun, and RPC nodes are also a hard requirement. When the two are combined, I believe this project will be very promising.

JinseFinance

JinseFinanceDo governments have a legitimate reason for fighting crypto with CBDCs?

Clement

ClementTraditional finance is resilient- but crypto can be made resilient as well, and global institutions are the key.

Clement

ClementWhere do stablecoins get their stability from, and how can they be made more stable?

Clement

Clement Coinlive

Coinlive Aptos has teething problems hours after mainnet deployment. VCs and team control majority of token supply.

Beincrypto

Beincrypto