Source: Grayscale; Compiled by: Deng Tong, Golden Finance

February , the price of Bitcoin rose 45%, surpassing $60,000 for the first time since the fourth quarter of 2021, and was only 9% below its historical high at the end of the month. We believe the price increase may reflect significant inflows into new US-listed ETFs and expectations of the Bitcoin issuance halving in April.

From a crypto industry perspective, the utilities and services crypto industry dominates other market segments. This area includes many projects that may create synergies with artificial intelligence technology, including Filecoin. The decentralized file storage service has expanded into computing capabilities and announced an integration with Solana.

Macro factors may be the main obstacle to increasing cryptocurrency valuations in the short term. Inflation accelerated in February, casting some doubt on the possibility of the Federal Reserve cutting interest rates.

In a mixed month for traditional assets, the cryptocurrency market produced solid returns in February 2024, helped by steady inflows into the new spot Bitcoin ETF and various positive fundamental developments. At the moment, the main risk to digital asset valuations may be the Federal Reserve’s monetary policy: inflation picked up again in February, and any further acceleration is likely Delay interest rate cuts until later this year or longer.

In both absolute and risk-adjusted terms (returns relative to volatility), Bitcoin and Ethereum were the top performers in cryptocurrencies and traditional finance in February. One of the best performing assets (Chart 1). Global bond markets have fallen this month as rising inflation dented hopes of interest rate cuts from the U.S. and European Central Banks. Stocks were mostly higher, led by shares in China and other emerging markets. While cryptocurrencies have become increasingly correlated with traditional markets in recent years, the performance of major coins in February once again highlighted the diversification benefits of the crypto asset class.

Chart 1: Bitcoin and Ethereum outperform many other major assets

For Bitcoin, the solid returns may reflect, at least in part, the new U.S.-listed spot Bitcoin Steady inflows into ETFs. From their launch on January 11 to the end of that month, the ten spot Bitcoin ETFs saw net inflows totaling $1.46 billion. [1] In February, net inflows accelerated significantly, totaling $6 billion for the entire month. Across cryptocurrency exchange-traded products (ETPs), we estimate net inflows totaled $6.2 billion in February, more than double monthly records dating back to October 2021 (Chart 2). Notably, since the launch of the Bitcoin ETF, U.S.-listed gold ETFs have experienced net outflows, with investors switching from one “store of value” asset to another. [2]

Chart 2: Net inflow record of cryptocurrency ETP

From the perspective of spot Bitcoin ETF inflow, according to the current block reward rate, the Bitcoin network will Approximately 900 new Bitcoins are produced, which is approximately $54 million worth of Bitcoins (assuming an average price per coin of $60,000). By April 2024, Bitcoin issuance will be cut in half (occurring every four years, known as the “halving”), when daily issuance will drop to 450 Bitcoins. Net inflows into U.S.-listed spot Bitcoin ETFs averaged $208 million per day in February, well outpacing the pace of new supply even before the halving. We believe that an imbalance between new demand and limited new issuance may have contributed to the increase in valuations.

While Bitcoin delivered solid returns in February, it was beaten by the second-largest crypto asset by market capitalization, Ethereum (ETH), which rose during the month 47%. [3] The market appears to be anticipating a major upgrade to the Ethereum network scheduled for March 13. Ethereum is pursuing a modular design concept, and over time, more activities will occur on the Layer 2 blockchain connected to the Layer 1 mainnet. The upcoming upgrade will accommodate this growth by providing Layer 2 with designated storage space on Ethereum, aiming to reduce its data costs and thereby increase its operating profits. Ethereum may also benefit from other favorable factors, including attention to "re-staking" technology[4 ] — Eigenlayer, a leader in the space, raised $100 million from venture capital firm a16z this month[5] — as well as regulatory approval for the ETH Denver conference (February 29-March 3), and ETH ETF Prospects.

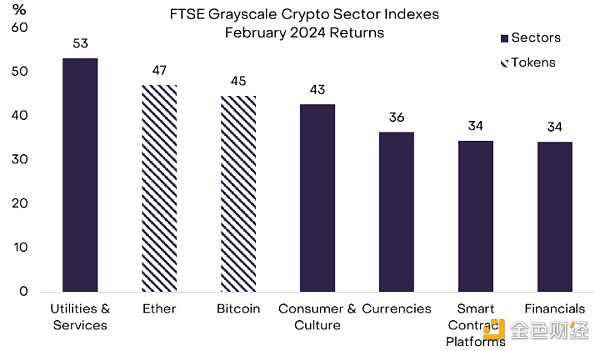

The best-performing segment in February was Utilities and Services cryptocurrencies – up 53% (Chart 3). This product category includes tokens related to artificial intelligence (AI) technologies some of which have received Huge gains. [6] Although not originally designed with artificial intelligence applications in mind, we expect Filecoin (FIL) to have benefited from market interest in this topic. The project initially focused on decentralized storage but now includes smart contracts and computing infrastructure, which could lead to synergies with blockchain-based artificial intelligence applications. On February 16, Filecoin announced an integration with Solana to provide a decentralized block history for the network. [7] Filecoin currently holds the dominant market share (approximately 99%) in decentralized data storage. [8]

Exhibit 3: Utilities and services crypto industries outperform in artificial intelligence

The crypto-finance category has a growth rate of 34%. [9] Part of the growth is driven by the governance token of decentralized exchange (DEX) Uniswap surge. The platform generates revenue through transaction fees, a portion of which is transferred to the Uniswap Foundation when users visit the front-end website. However, no revenue currently flows directly to holders of the UNI governance token. On February 23, the head of governance at the Uniswap Foundation proposed distributing fee revenue directly to UNI holders who stake tokens and delegate voting rights on the platform. [10] If implemented, the UNI token would receive a portion of transaction fees from one of the largest decentralized finance applications by transaction volume.

The increase in valuations in February was accompanied by an increase in transaction volume and a rise in various on-chain indicators, especially It's Ethereum. For example, average daily ETH spot trading volume reached $5.8 billion in February, the highest level since September 2021, according to Coin Metrics data. The value of all transfers on the Ethereum network also increased to its highest level since June 2022 (Chart 4). Finally, the total stablecoin market capitalization increased by another $5.5 billion this month. [11] In related news, stablecoin issuer Circle announced that it will stop supporting USDC on the Tron blockchain. [12] About 80% of USDC in circulation is on the Ethereum network, and only about 1% is on Tron (of which Tether is the main stablecoin). [13]

Chart 4: Ethereum’s on-chain transfers continue to increase

inbits The cryptocurrency market has had a strong year, supported by ETF inflows and a variety of fundamental positive factors. However, an important lesson from the last crypto cycle is that macro factors such as Federal Reserve monetary policy and economic conditions can significantly affect crypto asset valuations. If the macro market outlook remains positive, many aspects of the industry, including Bitcoin’s halving and Ethereum’s upgrade, could point to further gains in coin prices over the course of the year. Now, the price of Bitcoin is only 9% above its all-time high, so a new record may be reached later this year.

In contrast, A less favorable macro outlook could dampen valuations. In Q4 2023, Bitcoin may benefit from the Fed's move from tax rate reduction to tax rate cuts. If the central bank does cut interest rates in the coming months, it could weaken the dollar and support the valuations of assets that compete with the greenback, including Bitcoin. But during January (with February data reported), the steady decline in US inflation appeared to be slowing or stalling by some measures [14] and markets began to discount the outlook for higher inflation (Figure 5) . If inflation remains stubborn, Fed officials may consider lowering the delay to the second half of this year or until 2025. In general,higher U.S. interest rates[15] can be positive for the value of the U.S. dollar and can be negative for Bitcoin.

We believe that the most likely outcome is U.S. consumer price inflation will continue to decline, prompting the Federal Reserve to eventually cut interest rates. But crypto investors should keep an eye on upcoming inflation reports (specifically the CPI report on March 12 and the PPI report on March 14) as well as updated policy rate guidance from the Federal Reserve at its next meeting on March 20.

Chart 5: US inflation priced higher by the market

References:

[1] Source: Grayscale Research estimates based on Bloomberg data.

[2] Source: Bloomberg, "Gold's Pain is Bitcoin ETF's Gain in Store of Value Smackdown,” Eric Balchunas and James Seyffart, February 26, 2024.

[3] Source: Bloomberg, as of February 29, 2024.

[4] Re-staking allows the repurposing of staked tokens for other Application provides security.

[5] Source: CoinDesk.

[6] For example, token prices of Worldcoin, Bittensor, Akash and Render The rise may be partly related to the focus on artificial intelligence topics.

[7] Source: Crypto.news.

[8] Source: Filecoin.

[9] Source: Bloomberg, as of February 29, 2024.

[10] Source: Blockworks.

[11] Source: DeFi Llama, as of February 29, 2024 .

[12] Source: Circle.

[13] Source: DeFi Llama, as of February 29, 2024 .

[14] For example, in January, the annual CPI of 3 million excluding food and energy The rate was +4.0%, compared with +3.3% in December. Source: Bloomberg.

[15] Especially "real" interest rates or interest rates adjusted for inflation .

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Huang Bo

Huang Bo JinseFinance

JinseFinance Brian

Brian Xu Lin

Xu Lin Espresso

Espresso Nulltx

Nulltx