Summary

Orion via Liquidity Aggregation, virtual order book, and integrated high-security cross-chain bridge integrate the decentralized DEXs and CEXs liquidity into a single access point, greatly simplifying the user's transaction process and bringing a seamless user experience.

Recently, Orion The launch of the Refer&Earn activity encourages influential figures and loyal protocol users to recommend new users to join, and provides corresponding $ORN and transaction fee reductions as incentives. This reward-based recommendation mechanism can not only quickly increase the user base of the platform, but also It can also spread Orion's brand through the natural social network of community members and achieve organic growth.

Orion recently The BRC20 cross-chain bridge was launched, which greatly expanded the functionality of the Orion protocol, enabling it to support the creation and exchange of tokens on the Bitcoin network, laying a key foundation for the expansion of the Bitcoin Finance (BTCFi) ecosystem. This development not only enriches the application scenarios and value of Bitcoin, but also provides Orion with a unique opportunity to connect BTCFi with the broader decentralized finance (DeFi) ecosystem. Given the rapid expansion of the Bitcoin ecosystem over the last year, we expect BTCFi to be a high-growth area, and Orion, through its cross-chain bridge solution, is poised to achieve significant growth in this area.

Orion Protocol was founded in 2018 and was originally designed to provide a unified, decentralized trading solution connected to all major cryptocurrency centers through a liquidity aggregator Exchanges (CEXs) and decentralized exchanges (DEXs) allow users to access the entire market’s liquidity on their decentralized platforms to obtain the best price for any token in the market.

Orion Protocol also aims to improve transaction efficiency, reduce costs and provide a seamless user experience by integrating high-security cross-chain bridges and virtual order books. The core of the platform is that it integrates decentralized market liquidity into a single access point, thereby simplifying the user's transaction process while maintaining the characteristics of Defi such as high transparency, high security and no reliance on intermediaries.

In November 2023, Orion Protocol announced that it would rebrand 'Orion Protocol' to 'Orion' to reinvigorate the protocol and provide a clearer and more targeted value proposition while expanding the utility and potential of the ORN token.

Alexey Koloskov (Founder & CEO )

Alexey was the chief architect of Waves before serving as CEO of Orion Protocol, during which time he successfully led the decentralization of Waves The architecture design and development of the exchange. Since June 2017, Alexey has been the founder and CEO of Orion Protocol and has led the project for more than 6 years. During this period, he was responsible for formulating company strategy, overseeing product development, and promoting Orion Protocol. Innovation and growth in the blockchain industry.

Kal Ali (Co-Founder & COO)

As an early strategic advisor and co-founder of Orion Protocol, Kal Ali currently also serves as a limited partner of Dominance Ventures, a venture capital institution that has participated in early investments in projects such as Cosmos, Gunzilla Games, and Avalanche.

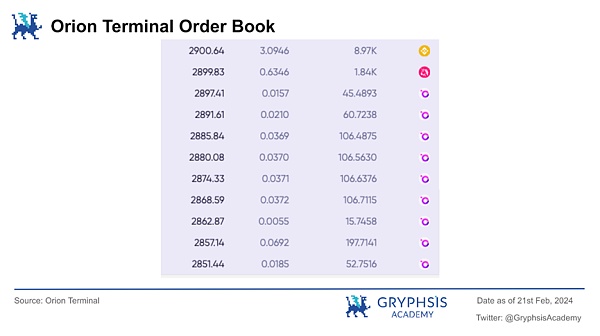

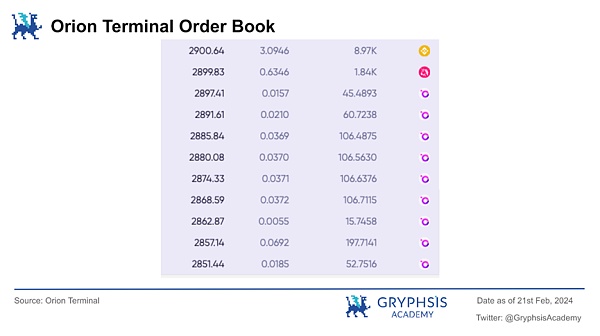

Orion Terminal, As the core product of Orion Protocol, it accesses and integrates the order books of multiple exchanges in real time through its unique liquidity aggregation mechanism. This mechanism covers a wide range of exchanges, including centralized and decentralized platforms, ensuring that users can obtain the best trading prices and depth in the entire market in a single interface.

This innovation not only provides users with optimized transaction execution and pricing strategies, but also effectively reduces transaction costs and improves the overall efficiency of the market. The following is the implementation path of this mechanism.

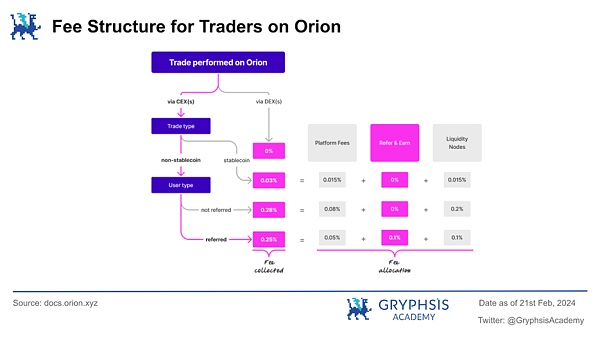

Through Orion Terminal, users do not need to create personal accounts in centralized exchanges, eliminating cumbersome procedures such as personal KYC. Through the account established by Orion in CEX, also known as a liquidity node or liquidity provider, when a user initiates a transaction, they will complete all aspects of the transaction in one step through a smart contract to ensure that the transaction is either completely successful or does not occur at all. There is no intermediate state) is sent to the liquidity node, and the node executes the transaction on CEX, and then receives the tokens immediately. Unlike traditional DEXs that use the AMM mechanism, deCEX provides real-time order books, providing more accurate and real-time trading data.

Safety deviation mechanism (SD):

Although atomic Transactions may ensure that users can send transaction requests at the ideal price while ensuring the safety of funds. How does Orion ensure that users can complete transactions at the best price? In this regard, Orion sets a safety deviation SD (Safe Deviation) for transactions.

To understand simply, SD is an automatically preset transaction slippage. In the USDT trading pairs in CEX, since most trading pairs have sufficient liquidity, SD is 0; for CEX's non-USDT trading pairs (such as ETH/BTC), 0.4% SD is applied; for single swaps in DEX, 0.15% SD is applied, and for multi-step swaps, 0.15% is multiplied by the number of corresponding steps. Orion does not charge additional fees during this process other than actual commissions and network fees calculated based on order volume.

Different from users setting their own slippage, although both SD and user-set slippage affect the transaction price, SD is a fixed, predefined mechanism that provides users with a level of transparency and predictability of price movements.

Even under extreme market conditions, the system will automatically take steps to facilitate transactions. At the same time, the SD mechanism may adopt different coefficients according to different market conditions (such as the liquidity and volatility of the trading pair, etc.). This flexibility and adaptability exceeds the scope that users can provide by manually setting slippage, especially in the market. When prices fluctuate greatly in a short period of time.

However, the SD mechanism itself also has certain shortcomings. For example, a large transaction in a trading pool with insufficient liquidity reserves may significantly affect the generation of the pool. Coin price, the preset slippage of 0.15% is not enough to cope with this change, causing the transaction to fail.

Liquidity Node/Liquidity Provider:

During trade execution, Orion dispatches orders to specific liquidity nodes through its virtual order book. To maintain the decentralized nature of the network and improve efficiency, Orion introduced the Delegated Proof of Liquidity (DPoL) mechanism.

Through this mechanism, liquidity nodes need to pledge ORN tokens to participate, and nodes with higher pledge amounts are more likely to be selected to execute transactions. But this selection process not only considers the amount of pledges, but also evaluates the type of tokens provided by the node, the blockchain network in which it is located, and its reserves to ensure that transactions can be executed smoothly.

DPoL also allows users to participate in decision-making by delegating ORN tokens to specific liquidity nodes, thereby influencing node selection. This process is designed to balance the interests of users and nodes, enhancing the decentralization of the network and user engagement by allowing nodes to set transaction fees and share revenue with users.

Asset security and autonomy:

In asset security In terms of user control, Orion Terminal provides a mode of conducting transactions directly from the user’s wallet. Through the liquidity aggregator, the user is actually the order commissioner. After creating the order through Orion, the aggregator interacts with the liquidity node for acceptance. Information such as the order address, trading platform and order quantity of each order are publicly viewable and verifiable.

This model strengthens the security of assets, ensures that users’ funds are always under their direct control, and reduces the theft of funds that exists in traditional centralized exchanges. and risk of abuse. Even if Orion Terminal fails, the liquidity node network and smart contracts continue to operate normally, allowing users to continue to participate in transactions through Orion’s liquidity and economic services.

This design embodies the core of the decentralization concept, that is, users can conduct transactions safely and freely without trusting any third party.

Traditionally, decentralized exchanges (DEXs) such as Uniswap V3 use an automatic market maker (AMM) mechanism and use its price curve to determine prices, which is different from the order book trading used by centralized exchanges (CEXs). Orders are clearly listed for easy comparison and trading in different ways. The AMM price curve makes it difficult to directly compare its liquidity with the order books of centralized exchanges.

Orion's innovation is that it converts the price curve of AMM into a traditional order book form. AMM liquidity like Uniswap V3 can be Display and compare like centralized exchanges like Binance or OKX.

This switch not only makes price comparison easier, it also allows limit orders to be placed on AMM, enhancing trading space. Additionally, by converting AMM price curves into order books, Orion ensures that AMM liquidity can be seamlessly integrated and compared with CEXs, creating a unified trading platform for users.

Virtual order books (VOBs) combine traditional order books (OOB)'s direct trading method and the automated market maker (AMM) liquidity model create a unified trading platform. VOBs not only reveal information about direct transactions, but also reveal potential liquidity that is more advantageous through multi-step swaps.

For example, a transaction that exchanges Token A for Token C through an intermediate token (Token B). Continuously calculating complex swaps means it can constantly update and optimize trading opportunities, providing traders with new and competitive prices, as well as arbitrage opportunities that may have been undiscovered before.

Based on the above three key technologies, Orion Terminal has undoubtedly become the initial ideal form of liquidity aggregation trading products. Of course, its specific reliability and value discovery capabilities It still needs to be verified by the market.

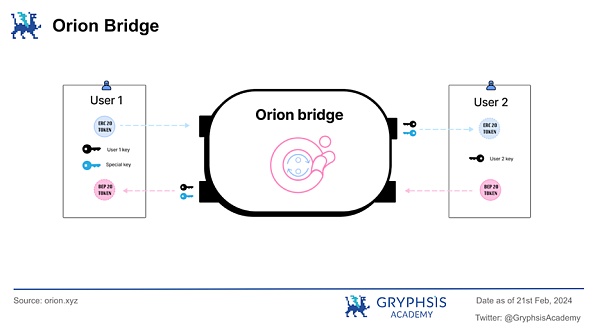

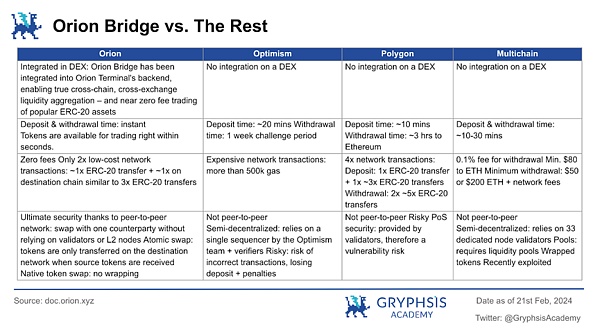

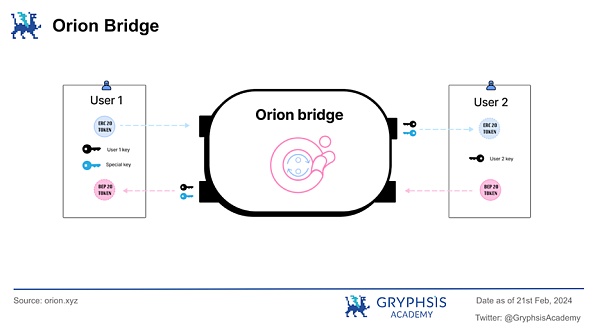

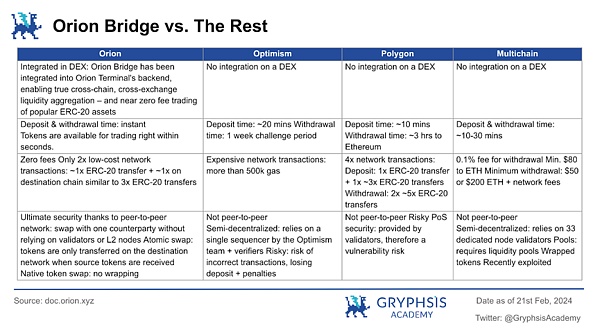

Orion Bridge solves the challenges of cross-chain transactions in the cryptocurrency market to a certain extent and realizes a truly efficient decentralized cross-chain bridge. The core of this technology lies in its integration method. For the first time, cross-chain and cross-exchange liquidity aggregation is directly embedded into the back-end of Orion Terminal, thus providing users with a seamless, fast and secure trading environment. . Compared with the existing Bridge, Orion Bridge provides a trading experience with no restrictions, no delays, no order rejections, no fund locking and no risk of exploitation, which largely solves the problem of other cross-chains in the market. There are many problems with the bridge.

Orion Bridge is supported by three core technologies: Atomic Swaps, P2P Network and Broker Network. Atomic swaps allow two assets on different blockchains to be exchanged instantly, without wrapping the assets or delays. P2P technology achieves true decentralization, that is, assets are exchanged directly between individuals without the intervention of a central organization. And the broker network ensures the immediacy and smoothness of transactions, regardless of the size of the transaction.

In the first iteration of Orion Bridge, the seamless connection between Ethereum and BSC has been achieved, and the BRC20 cross-platform will be launched in the near future. The chain bridge enables BRC20 tokens to be traded with EVM-compatible chains such as MATIC and BSC. It is worth noting that ORN is the only token with the BTCfi concept among the tokens listed on Binance.

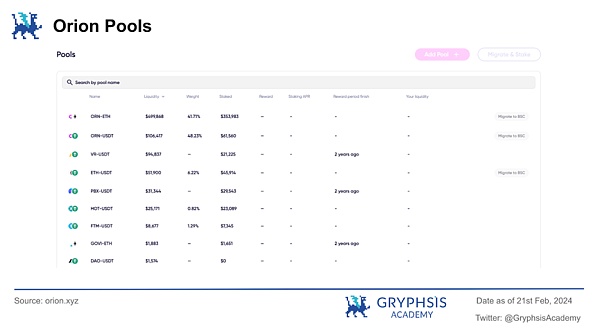

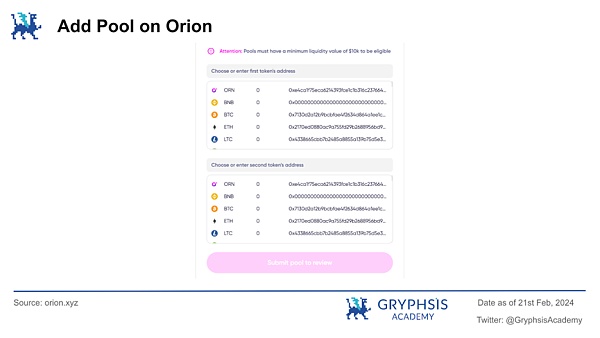

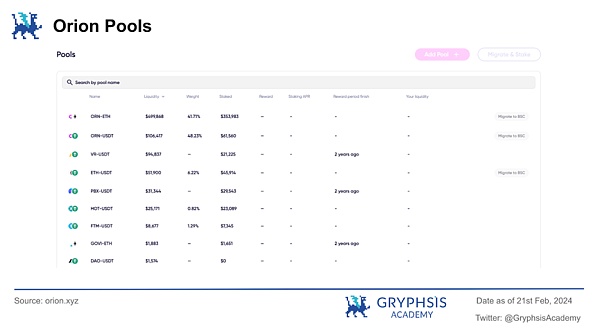

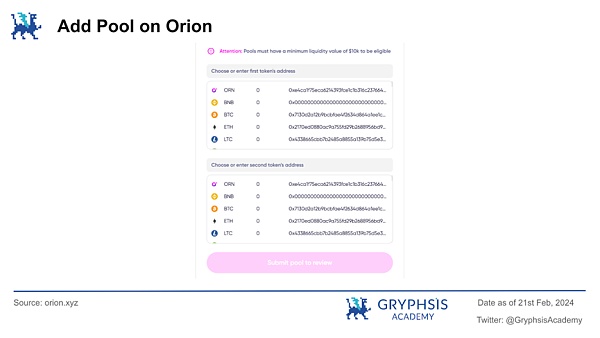

Orion Pools is based on Uniswap V2 A decentralized liquidity pool platform for model building. The platform allows users to not only contribute liquidity and create new liquidity pools, but also personalize their experience by adding custom logos, ensuring an active and vibrant trading environment.

The design concept of Orion Pools reflects the emphasis on user empowerment, empowering users to create, contribute and customize liquidity pools through simplified user interfaces and processes. Ability.

In terms of operational processes, Orion Pools provides intuitive guidance, allowing users to easily create new pools or add liquidity to existing pools. The process of creating a new pool includes selecting or adding a new token, proposing a pairing with USDT to ensure integration across the Orion platform, uploading a token icon (for new tokens), and completing a transaction to confirm the creation of the new pool. The process of contributing liquidity involves selecting a preferred pool, entering the amount of contributed assets, and confirming the transaction through the wallet. These processes are not only user-friendly, but also enhance the platform’s liquidity and trading efficiency.

By contributing assets to the liquidity pool, users can not only promote seamless transactions on the platform, but also receive a portion of the transaction fees as rewards, forming a mutually beneficial relationship. Orion Pools not only provides opportunities to earn profits, but also enables users to become part of a wider trading ecosystem, enhancing users’ sense of participation and belonging.

With the new governance and liquidity mining system taking effect, Orion Pools is transitioning to a more sustainable and growth-oriented model. The new system, effective from December 5, 2023, emphasizes support for the growth and sustainability of the protocol while ensuring alignment with user interests. This shift not only increases the appeal of the platform, but also is expected to attract more users to participate in the Orion ecosystem.

Orion Widget launched by Orion Protocol is an innovative application designed for cryptocurrency trading platforms and decentralized application (dApp) developers to quickly implement any web page or application through a simplified integration process. Token trading function on. The tool leverages Orion’s centralized and decentralized exchange (CEX and DEX) liquidity and allows users to trade directly by connecting their own wallets, thereby improving the convenience of trading and user experience.

The core advantage of Orion Widget is its high degree of customizability and ease of integration. Developers can customize the appearance and functionality of the Widget through a series of predefined parameters, including theme style, default trading assets, list of tradable assets, initial transaction amount and fee assets, etc., to meet the specific needs of different platforms and user groups. This flexibility ensures that widgets can fit seamlessly into various web and app environments while maintaining brand consistency and user-friendliness.

In addition, the integration process of Orion Widget is extremely simple, supporting integration through scripts and iframes, and requires almost no complex coding work. This greatly lowers the technical threshold, allowing even developers with non-technical backgrounds to easily deploy trading functions on their platforms. This move not only speeds up the development cycle, but also reduces development costs and provides the project with greater flexibility and scalability.

When it comes to token listings, Orion Widget supports hundreds of tokens listed by Orion Protocol and ensures unlisted tokens through its extensive liquidity sources Token support further expands users’ trading options. This feature is particularly suitable for projects that want to offer trading services for specific tokens on their platform without having to worry about lack of liquidity or token support issues.

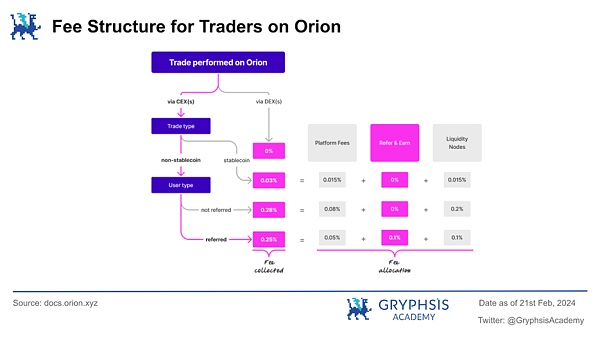

Orion Protocol’s Refer & Earn activity is a Plans to expand its user base. Through this program, Orion encourages influencers and loyal users to refer new users to join, incentivized with $ORN tokens as rewards. Participants can apply to join the program by contacting @TradeOnOrion via Telegram.

By sharing the referral link, the recommended user can enjoy a 10% discount on transaction fees when trading @TradeOnOrion, and the referrer can generate Earn up to 70% more rewards on trading fees. Rewards are distributed in real time via BNB Chain’s $ORN token. As the plan progresses, more opportunities will be opened up for users who want to become recommenders.

In addition, recommenders with active referral networks and high trading volumes will not only receive basic rewards, but also have the opportunity to receive additional $ORN token rewards for ranking on the leaderboard . Ranking of the leaderboard is based on the network’s transaction volume and the amount of ORN tokens in wallets over a 14-day period. Orion adjusts the ranking budget every month to temporarily increase recommendation rewards. The rewards are distributed every hour and can be claimed on the BNB chain.

This reward-based recommendation mechanism can not only quickly increase the user base of the platform, but also spread Orion's brand through the natural social network of community members, achieving organic growth. . Community members directly benefit from their recommendation behavior, and this mutually beneficial relationship enhances user loyalty and enthusiasm for the platform.

At the same time, the "Refer & Earn" activity incentivizes users who trade through recommended links through transaction fee discounts, which not only directly reduces users' transactions cost, may also attract more trading activities to move to the Orion platform. As the trading volume increases, the liquidity of the platform will also be improved, thereby attracting more users and traders, forming a positive cycle. In addition, increased transaction activity can also improve the market competitiveness of the platform and attract more project parties and partners to pay attention to and join the Orion ecosystem.

By implementing a multi-level reward system, Orion encourages chain recommendations among users and promotes community activity and participation in the long term. Real-time distribution of rewards and additional incentive mechanisms based on leaderboards further increase the appeal of the event and inspire active participation from users. This long-term user engagement and community building is critical to the platform's stable growth and continued development.

According to OrdSpace data, BRC20 currently has tens of thousands of tokens and a total market value of more than two billion US dollars. The market has proven its popularity and users' high demand for such assets. As a cross-chain bridge connecting Bitcoin and other blockchain networks (such as Ethereum, BNB Smart Chain, etc.), Orion is one of the few infrastructures that supports the BRC20 standard. This provides Orion with the advantage of being the first mover in the market and helps attract Early adopters and investors.

In addition, by supporting the BRC20 cross-chain bridge, Orion can attract users and developers who want to explore new financial products and services on the Bitcoin network. This cross-chain functionality will significantly increase liquidity and trading volume on the Orion platform.

The introduction of the BRC20 cross-chain bridge enables Orion to support the creation and transfer of fungible tokens on the Bitcoin network, thus providing support for the BTCFi ecosystem provides an important foundation for its development. Not only does this increase the use cases and value of Bitcoin, it also gives Orion a unique opportunity to connect BTCFi with the broader DeFi ecosystem.

With the rapid development of the BTC ecosystem last year, we expect that BTCfi will be a fast-developing track, and Orion may also develop accordingly. There is strong room for growth through its cross-chain bridge products.

In September 2020, Uniswap announced an airdrop of its governance token UNI. All Ethereum addresses that interacted with Uniswap V1 or V2 before the airdrop deadline are eligible to receive an airdrop of at least 400 UNI.

Combined with Uniswap’s airdrop history and successful experience, if Orion Protocol considers implementing a similar airdrop strategy, we can foresee several potential growth points and positive effects. Including but not limited to attracting new users to join, promoting community governance and old user participation, increasing project exposure, acquiring new partners, obtaining effective user feedback and promoting its own technical improvements, etc.

Orion Protocol Governance 2.0 represents a fundamental change in its governance mechanism, aiming to build a resilient future that rewards commitment and ensures that every participant can contribute to Orion's long-term success by enhancing community interaction and influence. The core of Governance 2.0 is the introduction of veORN (Vote-Escrowed ORN), a non-transferable token that represents users’ locked ORN, equivalent to their voting rights and influence within Orion.

In the initial stage, veORN is mainly used for voting in liquidity pools, but its design is flexible and may be expanded to new governance as the Orion ecosystem develops. ability. The veORN mechanism encourages users to increase their participation and influence in Orion governance by locking ORN long-term, thereby strengthening community members’ control over the development direction of the platform.

Users further participate in Orion's governance process by staking ORN and selecting a locking period to obtain veORN. The choice of the locking period reflects the depth of the user's commitment to Orion governance. A longer locking period can bring more veORN, thereby increasing the user's influence in governance decisions. This mechanism is designed to reward users with long-term commitment to the Orion ecosystem, through a carefully designed reward system that ensures rewards are proportional to the user's level of participation and depth of commitment.

At the same time, the veORN decay mechanism introduced in Governance 2.0 is designed to motivate users to continue to participate in Orion governance. Over time, veORN without additional staking or extended locking periods will gradually decrease, requiring users to maintain or increase their influence in governance by increasing ORN staking or extending the locking period. This design ensures the vitality and fairness of the Orion governance ecosystem, encouraging new users to participate while rewarding existing users who have long-term and active participation.

As incentives in the Refer & Earn plan: fee generation from the referrer (70% weight) and user's ORN balance (30% weight). A larger ORN balance can significantly increase the rewards received.

Cross-chain bridge projects have a high presence in the DeFi field risks, including security vulnerabilities and operational risks. As a cross-chain bridge project, Orion needs to attach great importance to these risks and adopt corresponding security measures and risk management strategies to protect user assets and enhance community trust.

Orion Protocol provides its unique liquidity aggregation service by integrating multiple decentralized and centralized exchanges, a process that involves complex system integration work. While this integration provides users with broad liquidity access and an optimized trading experience, it also introduces system integration risks.

These risks may include technical compatibility issues, that is, the API and data formats of different platforms may be different, requiring fine adjustments and adaptations to ensure seamless integration. . In addition, maintaining the stability and reliability of this integration is also a challenge, because updates or failures of any one platform may affect the operation of the entire system. This strategy of relying heavily on external platforms may be affected by policy changes or service outages on these platforms.

Therefore,Although system integration brings significant advantages to Orion, such as richer liquidity and better user experience, it also Orion is required to invest continuous efforts to manage and mitigate these integration risks, ensure the stability and security of the platform, and protect the interests of users from being affected.

Reference materials

[1] https://docs.orion.xyz/overview/mission-and-vision

[2]https://trade.orion.xyz/dashboard/overvie

JinseFinance

JinseFinance