In January 2024, the cryptocurrency and NFT markets ushered in an important turning point. Among them, the debut of the first batch of spot Bitcoin ETFs in the United States was particularly eye-catching. This financial integration milestone events have attracted the attention of many investors. At the same time, the NFT field has also achieved impressive growth, with transaction volume and user activity increasing significantly. In addition, this month also shows the transformation of the NFT market. The sudden rise of Polygon, the rise of platforms such as Mooar, and the emergence of culturally rich projects such as TinFun have all become the focus of the market. In contrast, OpenSea has expressed its openness to acquisitions amid a series of market changes.

This report is based on data provided by Footprint Analytics' NFT research page. This page is a comprehensive and easy-to-use dashboard that provides the latest statistics and metrics necessary to understand the pulse of the NFT industry, including transactions, projects, financings, and more.

Key points overview

Crypto market overview

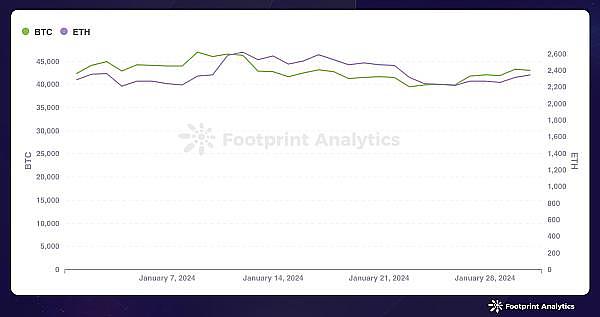

Bitcoin started at $42,303, rose slightly by 1.65%, and finally closed at $43,001; while Ethereum Starting at $2,283, it rose 2.77% to close at $2,346.

The broader crypto market has turned to exploring synergies between crypto and AI. Against the background of the Federal Reserve's decision to maintain interest rate stability, the market value of stablecoins has steadily increased.

NFT Market Overview

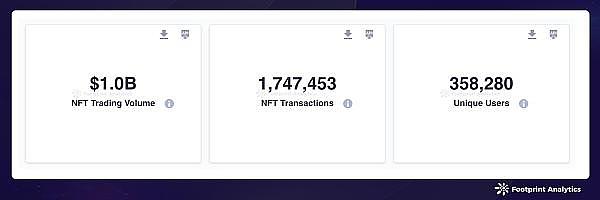

In January, the NFT market grew strongly, with transaction volume reaching US$1 billion, a month-on-month increase of 17.3%.

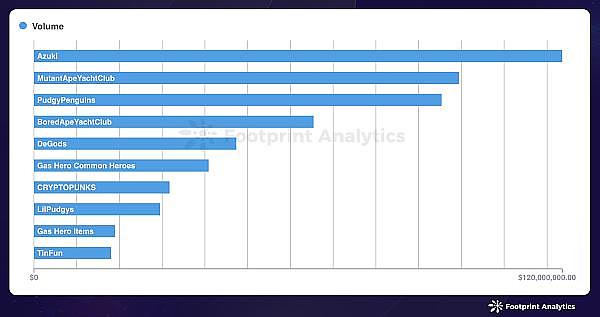

Pudgy Penguins continues to be popular, ranking third in the top ten rankings in terms of transaction volume, while its sister project Lil Pudgys Ranked eighth.

The NFT of the blockchain game Gas Hero, especially the Common Heros and Items series, saw a surge in transaction volume in January, ranking Among the top ten in terms of trading volume that month.

TinFun has ranked among the top ten in terms of transaction volume since its debut in January 2024.

Public chain and NFT trading market

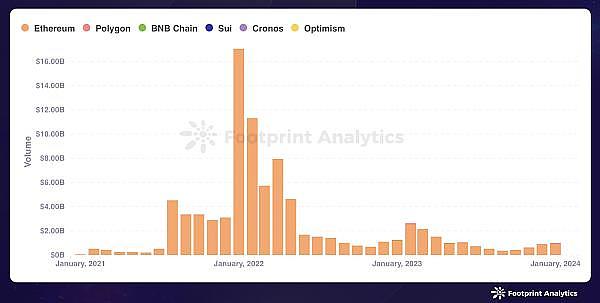

Ethereum leads the NFT market with a transaction volume of $900 million, with a market share of 89.1%, but this is the lowest level since 2021.

Polygon saw a significant increase in trading activity in January, with its trading volume reaching $110 million, a 97.2% increase from the previous month.

OpenSea's market share continued to decline, from 20.8% to 16.6%, and transaction volume also decreased by 10.1% to 170 million Dollar.

The popularity of blockchain game Gas Hero significantly contributed to the increase in transaction volume of Mooar and Polygon in January, highlighting the The impact of games on market dynamics.

NFT investment and financing situation

In January, the NFT investment and financing market remained stable, with a total of 5 rounds of financing, totaling US$26.4 million.

This month’s key news

OpenSea launches new feature to create crypto wallet using email.

Binance Labs announced its investment in Memeland’s native token Memecoin (MEME).

Tune.FM announces $20 million in funding.

OpenSea CEO: The company has received acquisition intentions and is open to acquisition transactions.

Crypto market overview

January 2024, Bitcoin and Ethereum continue to trend upward, albeit at a slower pace. Bitcoin started at $42,303 and edged up 1.65% to end at $43,001, while Ethereum started at $2,283 and climbed 2.77% to end at $2,346.

Data source: Bitcoin and Ethereum prices - Footprint Analytics

The debut of U.S. spot Bitcoin ETFs in January 2024 marked a key moment for the crypto market, with daily trading volumes of up to $210 million in these ETFs quickly attracting investors' attention, reflecting the Deeper integration within the traditional financial ecosystem. Despite the heightened excitement, Bitcoin and Ethereum prices have remained relatively stable, suggesting traders remain cautious following the ETF approval.

At the same time, the focus of the broader crypto market has turned to exploring synergies between the crypto industry and AI. Against the background of the Federal Reserve's decision to maintain interest rate stability, the market value of stablecoins has steadily increased. This period marks a subtle evolution that the crypto space is undergoing, both in terms of institutional adoption through the approval of a Bitcoin ETF and in balancing considerations with continued expectations for macroeconomic and technological developments.

NFT market overview

In January 2024, the NFT market grew strongly and transactions The sales volume reached US$1 billion, a month-on-month increase of 17.3%. The number of transactions surged by 26.2% to a total of 1,747,453, while the number of unique users (number of wallets) increased by 20.5% to 358,280. These statistics highlight a significant upward trend in both market activity and user engagement, further demonstrating the growing market influence of NFTs.

Data source: NFT Market Overview - Footprint Analytics

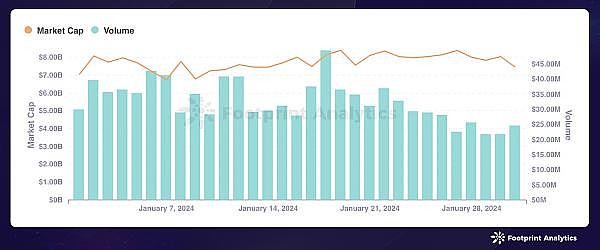

The market value of the NFT market started at approximately US$7.02 billion at the beginning of the month, an increase of 5.83%, and the market value at the end of the month was approximately US$7.43 billion.

Data source: NFT market value and trading volume - Footprint Analytics

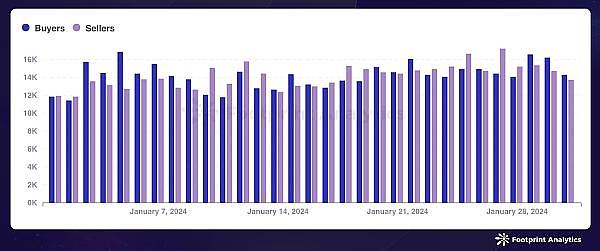

The buyer-seller ratio in the NFT market increased to 118.6%, the number of buyers increased to 228,509, an increase of 26.8% from December, and the number of sellers reached 192,718, an increase of 9.1%. This change indicates that buyer interest is continuing to grow faster than the increase in sellers.

Data source: NFT Daily Buyers & Sellers - Footprint Analytics

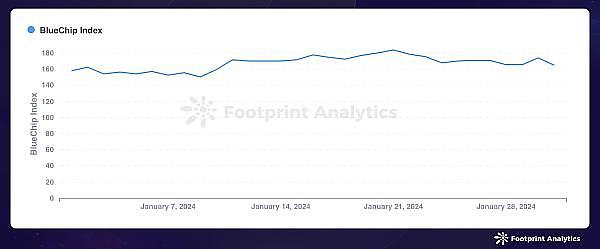

The blue chip index experienced slight growth in January, rising 4.4%, with some fluctuations during the month.

Data source: NFT Blue Chip Index - Footprint Analytics

In January, Pudgy Penguins continued to be popular, ranking third in the top ten rankings in terms of transaction volume, while its sister project Lil Pudgys ranked eighth.

Data source: Top ten NFT series by trading volume in January - Footprint Analytics

Gas Hero is a blockchain interactive strategy game focusing on social interaction. It was officially launched on January 3 and quickly gained widespread attention. The game runs within the Find Satoshi Lab ecosystem and uses GMT, the same native token as StepN. The game provides players with the opportunity to collect, customize, and enhance hero NFTs, which include a variety of weapons and pets, incentivizing players to collect in-game assets by completing missions. Notably, the game’s NFTs, particularly the Common Heros and Items series, saw a surge in trading volume in January, ranking among the top ten by volume for the month.

Gas Hero Common Heroes NFT Series

TinFun is a high-profile NFT project that has ranked among the top ten in terms of transaction volume since its debut in January 2024. The project is committed to inheriting Eastern cultural traditions by integrating high-quality artworks and innovative blockchain technology, leading people to in-depth exploration of Eastern aesthetics, stories and games. The project is led by “BitCloutCat”, the founder of LaserCat NFT, with core team members coming from well-known companies such as Tencent, OKX and Riot Games. TinFun’s successful launch has raised expectations that it will maintain momentum through continued user engagement and that the practical value of its NFT collectibles will exceed the market’s hype.

TinFun

Public chain and NFT trading market

In January, Ethereum led the NFT market with a trading volume of US$900 million, with a market share of 89.1%, but this is the first time since 2021 the lowest level. Conversely, Polygon saw a significant increase in trading activity in January, with its trading volume reaching $110 million, a 97.2% increase from the previous month. The significant growth boosted Polygon's market share to 10.4%, nearly double December's 6.0% share.

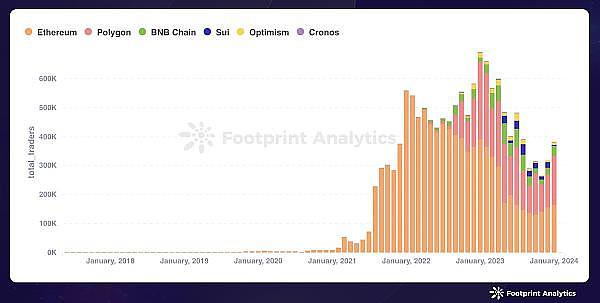

Data source: Public chain NFT monthly transaction volume - Footprint Analytics

The number of unique users of Ethereum continued to grow, reaching 163,000, an increase of 4.9% from December, but its share of total users dropped from 49.0% to 42.7%. In contrast, Polygon's user base has grown significantly, from 50.5% to 170,000, and its share has also increased from 35.5% to 44.5%, successfully sitting on the largest user base in January. Meanwhile, BNB’s user share increased slightly, from 7.5% to 8.6%.

Data source: Number of monthly unique users of public chain NFT - Footprint Analytics

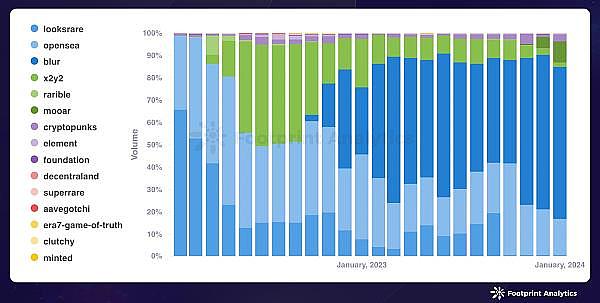

In terms of the NFT trading market, Blur's trading volume increased by 11.7% to $690 million, although its market share fell slightly to 68.3% from 69.2% in December. OpenSea's market share continued to decline, falling from 20.8% to 16.6%, and transaction volume also decreased by 10.1% to $170 million. On the contrary, Mooar has emerged as a force to be reckoned with, with its trading volume increasing significantly by 112.1% and its market share expanding from 5.0% to 9.5%.

Data source: Monthly transaction volume proportion of NFT trading market - Footprint Analytics

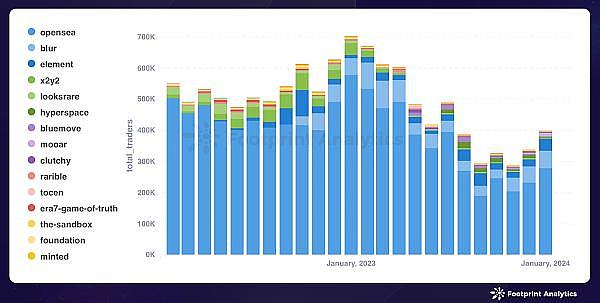

In addition, OpenSea, Blur, and Element attracted the most unique users in January, with 279,000, 55,000, and 40,000 users respectively.

Data source: NFT trading market monthly number of unique users - Footprint Analytics

The popularity of the blockchain game Gas Hero significantly drove the increase in trading volumes of Mooar and Polygon in January, highlighting the impact of the game on market dynamics.

In contrast, OpenSea has struggled to justify its previous $13.3 billion valuation amid the turmoil in the NFT market. On January 27, CEO Devin Finzer revealed that OpenSea had attracted acquisition interest, although he did not disclose the timing or potential acquirer. Finzer told the media that the company is open to the option of being acquired. While OpenSea was once the leader in the NFT market, its competitors have been growing even more rapidly since the second half of 2023.

NFT investment and financing situation

In January, the NFT investment and financing market remained stable Stable, with 5 rounds of financing totaling US$26.4 million.

NFT project financing situation in January 2024

Binance Labs, as the investment arm of Binance, has made a strategic investment in MEME Coin. MEME coin is the native token of Memeland, an independent Web3 startup studio created by the founder of 9GAG. Memeland is committed to cultivating SocialFi and the creator economy, leveraging the power of MEME culture to tightly connect creators and communities through its MEME coins and NFTs (The Captainz, The Potatoz and YOU THE REAL MVP). This investment demonstrates Binance Labs’ commitment to supporting innovative projects that strengthen the connection between digital content creators and their audiences in the evolving Web3 ecosystem.

Web3 music platform Tune.FM has successfully raised $20 million from LDA Capital to further its mission of enabling musicians to profit from their work Get more generous royalties. Leveraging advanced Hedera Hashgraph blockchain technology, Tune.FM offers artists the unique opportunity to earn revenue for streamers through its native JAM token and mint NFTs for their digital music and collectibles.

______________

The above research report data includes:

Public chains: Ethereum, Polygon, BNB Chain, Cronos, Optimism, Sui

Trading markets: OpenSea, LooksRare, Blur , X2Y2, Cryptopunks, Rarible, SuperRare, Foundation, Decentraland, Aavegotchi, Element, Era7, the Sandbox, Minted, Clutchy, BlueMove, Hyperspace, Tocen, Keepsake, Mooar

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Edmund

Edmund Catherine

Catherine dailyhodl

dailyhodl Others

Others Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph