Author: Xinwei, Ian

TLDR

< li>We believe that the development of the AI x Crypto track is sustainable and not just a temporary craze. As AI technology develops and time passes, we expect to see more funding and attention continue to flow into this field, leading to multiple rounds of development opportunities. Therefore, laying out the AI x Crypto track is not only feasible, but also a necessary strategic choice.

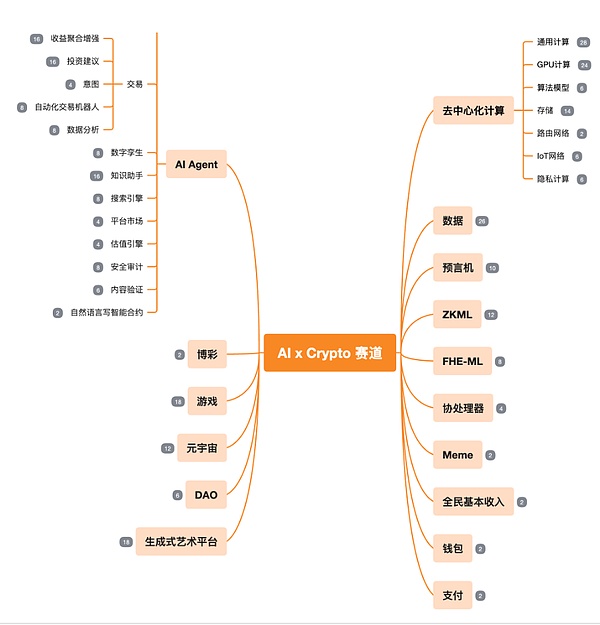

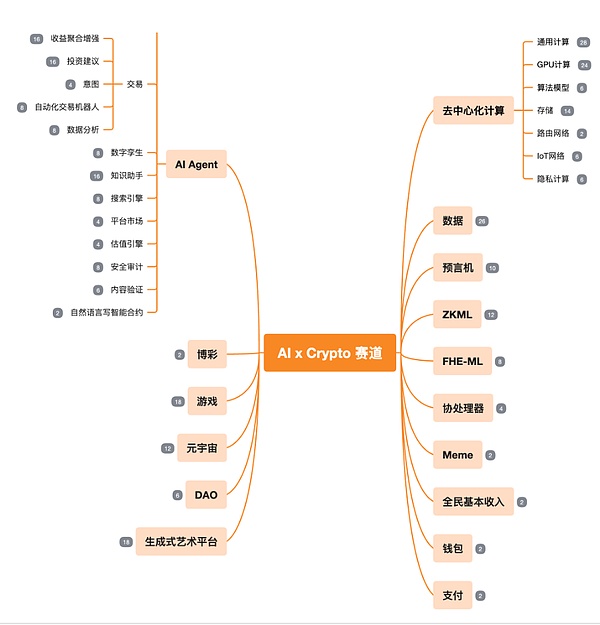

In the field of AI x Crypto, we can see multiple subdivisions, including AI Agent, decentralized computing, data, oracles, ZKML, FHEML, and collaboration Applications such as processors, memes, universal basic income, generative art platforms, and games. In these fields, decentralized computing is particularly eye-catching. Whether it is GPU computing or algorithm models, they represent huge space for innovation, and the demand for computing power is extremely high. Computing power has become a form of consensus, and its value potential It is comparable to the market value ceiling of public chains. At the same time, we are also optimistic about ZKML, FHEML and co-processors, which are still in early stages but have huge potential.

Taking into account the current market liquidity, project fundamentals and community influence, Worldcoin, Arkham, Render Network, Arweave, Akash Network, Bittensor and io.net are all in our opinion Major projects with leadership and development potential.

Introduction

In the past few years, the field of AI x Crypto has experienced unprecedented development and change. This emerging field combines two of the most transformative technologies: blockchain and artificial intelligence to explore how decentralized approaches can empower AI applications to increase transparency, security and user control. With the rapid progress of artificial intelligence technology, especially the rise of generative artificial intelligence, and the growing demand for decentralized solutions, AI x Crypto has become one of the most exciting innovation frontiers in the technology field.

The new landscape of assetization in the field of AI "Computing power assetization", "Model/Agent assetization", and "Data assetization" are the three major scenarios.

In the capitalization of computing power, there are two main directions: decentralized computing and decentralized reasoning of AI Agents. Decentralized computing focuses on using distributed networks to train AI models. AI Agent mainly uses the trained AI model to perform decentralized reasoning. These AI Agents can be deployed in decentralized networks to provide users with various intelligent services, such as automated transactions, knowledge assistants or security audits.

However, from a technical perspective, the current training of large AI models involves massive data processing and high-speed communication bandwidth requirements, which places extremely high demands on hardware facilities. Currently, training large Transformer models usually requires the configuration of high-end CPUs such as NVIDIA's H100 or A100, NVIDIA's NVLink technology for connecting GPUs, and professional fiber switches to achieve network connections above 100Gbps to support training across multiple data centers. These models contain billions to tens of billions of parameters and require powerful computing power and video memory to execute deep network algorithms. At the same time, in order to quickly supply data for processing, high-speed storage and network bandwidth are necessary to reduce I/O bottlenecks. Parallel computing strategies such as model parallelism and data parallelism require high-speed internal and external network bandwidth to achieve effective synchronization between multiple GPUs. These requirements indeed make decentralized AI training face huge challenges under current technology and cost conditions.

The AI inference performed by AI Agent has lower requirements for computing power and communication bandwidth, making the decentralized approach more feasible and practical. This is also the reason why many computing power-related projects currently on the market focus more on inference rather than training. Nonetheless, centralized solutions often still outperform decentralized solutions at this stage when considering cost-effectiveness and reliability.

The assetization of models/Agents is also an important direction, especially driven by large language models such as GPT, which has become an important trend. Users can interact with AI-based virtual characters. Converting these AI Agents into NFTs allows users to buy, sell, collect or exchange, similar to art transactions. However, projects in this direction often have low technical thresholds, insufficient innovation, and a low degree of integration of AI and Crypto. Many projects only convert AI models into NFTs without thinking deeply about the combination of AI and Crypto, which will lead to homogeneous competition in the market. In addition, Agents are basically stored on cloud servers, and only the ownership certificate is made into NFT and placed on the chain, and the degree of integration with Crypto is relatively shallow.

Data capitalization is also an important direction of the AI x Crypto track, focusing on using decentralized technology and incentive mechanisms to release and utilize large amounts of data resources that are usually limited to private domains, including personal data and corporate Internal data etc. Once these data are converted into resources that can be used for training or fine-tuning large models, it can significantly improve the professionalism and efficiency of AI models in different vertical fields. However, factors such as data diversity, quality, application scenarios, and privacy protection increase the complexity of data assetization, making standardization a challenge. Although it is possible to NFT data that cannot be standardized, it also highlights the difficulty of establishing a highly liquid and easy-to-trade market.

As a part of data capitalization, decentralized data annotation improves the availability and quality of data by motivating community members to participate in data annotation through the "Label to Earn" model or crowdsourcing platform. Cost and time are reduced. This method of decentralizing labor not only ensures the efficiency and quality of data annotation, but also ensures that participants receive fair rewards, providing a new path for data assetization.

Source: MT Capital

As can be seen from the above, the current scenarios for the actual establishment of the AI x Crypto track are relatively limited, and the thresholds in most directions are relatively high. Low, the recent market boom is mainly capital operation and emotional FOMO. The AI x Crypto track currently has several core pain points:

Immature business model: AI The advantages. With the involvement of teams with deep understanding of these two fields, it is expected that more solutions will be developed that not only demonstrate the power of AI technology but also deeply integrate Crypto features.

The dual challenge of cross-disciplinary expertise and practitioner preference: In AI x Crypto projects, teams often either have a deep background in the field of AI or a deep understanding of Web3 and cryptocurrency, but it is difficult to Do both. This not only limits the ability to innovate in technology and explore business models, but also reflects the preference of practitioners when choosing fields, that is, excellent AI talents are often reluctant to get involved in the encryption industry. This lack of interdisciplinary expertise, in conflict with practitioner preferences, has become a major obstacle to promoting innovation in this field. In the future, teams that can work across borders and have insights into AI and encryption technology will become a key force for innovation and progress in this field.

Technical challenges of internal empowerment: When Crypto tries to empower AI from within, such as through ZKML and FHEML, the main pain point faced is the poor scalability of these technologies, making them ineffective in practical applications. Encountered limitations. Likewise, when AI attempts to empower Crypto from within, it will need to address not only the complex engineering issues of how to integrate AI into existing systems, but also ensuring that this integration works effectively and does not hinder system performance. These two challenges together reflect that when deeply integrating AI and Crypto, not only innovative technical solutions are needed, but also the complexity and scalability issues in implementing these solutions need to be overcome.

Despite the current difficulties, we still believe that AI x Crypto is one of the most important tracks in this cycle. The combination of AI and Crypto not only shows strong technical potential and application prospects, but also occupies a unique and important position in the current technology and investment fields:

1. The technological revolutionary status of AI: AI is It is widely regarded as the key force driving the next round of technological revolution. Compared with the previous round of concepts with the Metaverse as the core, it requires more practical applications and there are challenges in user data verification. Especially as the stock prices of Metaverse concept companies like Roblox and Meta plummeted, the popularity of the Metaverse quickly receded. Unlisted high-tech companies like OpenAI do not need to prove their value through revenue at the current stage. Compared with the Yuanverse, AI has a wider influence in practical applications and technological innovation. It has penetrated into many fields such as medical care, education, transportation, and security, and has the ability to promote the improvement of the entire high-tech industry chain. Decentralized computing power further unleashes the potential of AI, providing necessary computing resources through distributed networks to support the training and reasoning of AI models, promoting the progress and widespread application of AI technology.

2. The importance of computing power: In the AI x Crypto project, the importance of computing power is self-evident. Computing power is not only directly related to the efficiency and effectiveness of AI model training, but is also an important indicator to measure the technical strength of the project and market consensus. The higher the computing power, the stronger the consensus and the higher the market value. As more companies and individuals participate in decentralized computing power contributions, not only can the optimal allocation of resources be achieved, but also the exploration of new economic models and value distribution methods can be promoted, such as through computing power mining and AI computing power hosting. etc.

Representative Project

Worldcoin

The reason why WLD has performed well recently is simple. On February 15, OpenAI released Sora, a large video generation model. Through text commands, Sora can generate high-definition videos of up to 60 seconds that contain highly realistic backgrounds, complex multi-angle shots, and emotionally charged multi-character narratives, demonstrating a deep understanding of real-world physics. Although people are looking forward to the release of GPT-5, the impact brought by Sora is comparable to that of a GPT-5 release.

This incident has once again ignited people’s enthusiasm for the field of AI. As we all know, Sam Altman, the founder of Worldcoin, is also the CEO of OpenAI. Under the operation of bookmakers, WLD quickly became the brightest focus in the market at the beginning of the year.

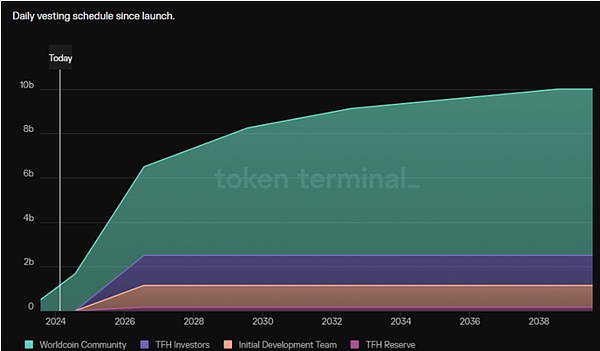

Worldcoin mainly involves two areas: identity authentication and issuance of digital currency. According to rumors, OpenAI is developing two types of agent robots that can deeply understand human instructions and act according to these instructions, which is regarded as the final step towards artificial general intelligence (AGI). After reaching this point, almost all jobs may be replaced, and the vast majority of people will face unemployment, but they cannot starve to death. At this time, OpenAI needs to issue basic income (UBI) through Worldcoin, and you can receive 6WLD every month just through iris recognition.

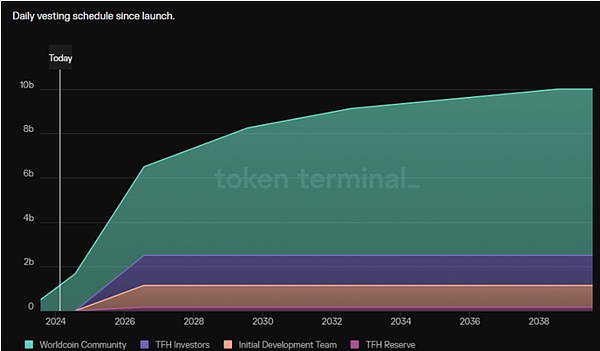

However, a detailed analysis will reveal that WLD has no substantial empowerment and exists more as a hyped air currency. If WLD is really used to issue basic income in the future, this form of non-stable currency may cause various problems. This is why Worldcoin’s white paper and founders are ambiguous when discussing the role of WLD.

WLD will probably always be a meme coin. Still, that doesn't mean WLD doesn't have investment value. From a market capitalization perspective, WLD has similarities with DOGE. If Ultraman's reputation can surpass that of Musk, WLD may have a chance to reach the market value of DOGE. However, its high unit price limits its potential as a top meme coin to a certain extent. If the price of Worldcoin is more affordable, it will undoubtedly greatly increase its appeal as a top meme coin. As a top figure in the AI field, every relevant public statement or major event in the AI field by Sam Altman will have a significant impact on the Worldcoin market, increasing the attractiveness and uncertainty of Worldcoin as an investment target.

If there is an operation to split the currency in the future, that is, to redefine the market positioning of Worldcoin with a lower unit price and higher circulation, such a strategy may trigger a rapid increase in price.

Although there is currently a certain degree of ambiguity in Worldcoin’s market positioning and practical applications, making it regarded as a meme coin by some, Altman’s influence and the rapid development of the AI field provide Worldcoin with a unique market dynamics. If reasonable market strategies are adopted in the future, such as currency splitting, Worldcoin has the potential to become a force that cannot be ignored in the market.

Source: https://foresightnews.pro/article/detail/53744

Arkham

Arkham was founded in In 2020, it is headquartered in the United States and is led by founder and CEO Miguel Morel. The team includes Zachary Lerangis, head of operations, Alexander Lerangis, head of BD, and John Kottlowski, institutional relations expert. Arkham has raised more than $12 million in funding, including a $2.5 million public offering from Binance Labs. The founders are veterans of the crypto industry, having previously founded Reserve, a stablecoin project designed for high-inflation economies, with investors including Peter Thiel, Sam Altman, Coinbase and Digital Currency Group.

Binance announced on July 10, 2023 that Arkham’s token $ARKM will be listed on its Launchpad. This is the first time Binance has launched a tool product, which aroused great interest.

Arkham is a platform that uses artificial intelligence algorithms to analyze blockchain data. It can associate blockchain addresses with real-world entities, providing users with a complete behavioral perspective behind them. Arkham recently launched a blockchain intelligence trading platform called Arkham Intel Exchange, which allows users to request required information through bounties, and information providers can receive rewards for providing information. Arkham also provides powerful tools that allow users to search, filter and sort any crypto transaction, revealing the entities and individuals behind market activity.

In addition to being listed on Binance, multiple exchanges such as Kraken, OKX, and Hotbit also support $ARKM transactions.

Arkham has launched a model called "Intel-to-Earn" to achieve an intelligence economy by matching buyers and sellers on the blockchain. Its platform token $ARKM is used to pay for analytics platform fees, governance voting and user incentives. The total supply of $ARKM is 1 billion, the listed circulation is 150 million (accounting for 15% of the total supply), and the test website has 200,000 registered users. After being listed on the exchange, the trading volume is expected to reach US$100 million.

Arkham mainly consists of two major components: blockchain analysis tools and intelligence trading market. The analysis tools provide users with comprehensive data insights through entity pages, token pages, network mapping, etc. Arkham uses its self-developed artificial intelligence engine Ultra to de-anonymize blockchain data and match addresses with real-world entities through algorithms. The intelligence trading market allows users to buy and sell information through bounties, auctions, and data sharing. Arkham maintains the long-term operation of the platform by charging a fee - a 2.5% manufacturing fee for listing and auction payments, and a 5% acceptance fee for bounty payments and successful auctions.

Compared with other data analysis platforms on the market, Arkham has several unique advantages, such as creating token usage scenarios, realizing on-chain data value transactions through intelligence exchanges, and providing data analysts with knowledge Channels for monetization; self-motivation of the platform through commissions and other means, which is conducive to the sustainable development of the platform; providing archiving functions for users to track historical investment portfolios; and visualizing data maps to reduce research costs. However, Arkham also faces some challenges, such as a small number of public chain supports, a functional gap with platforms such as Nansen, limited replicability of token scenarios, a user group dominated by professionals, and limited appeal to ordinary investors. , and its own data processing capabilities are weak, relying on external data teams, etc.

The Arkham project has first-mover advantages and a broad market space in the field of blockchain information analysis, but it is still in its early stages. The business model needs to be verified, and ecological construction and scale will take time to cultivate. In terms of risks, the popularization of on-chain information analysis takes time, user education costs are high, the replicability of the business model is limited, users are mainly professionals and rely on personnel for information processing, operating costs are high and risks are high, and the quality of information is uneven. There are reputational risks, as well as uncertainty about regulatory policy changes.

https://foresightnews.pro/article/detail/48222

Render Network

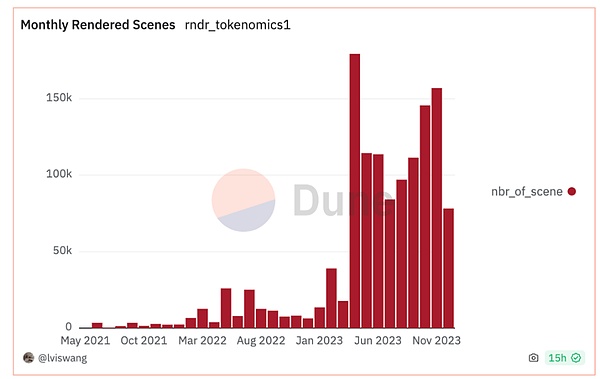

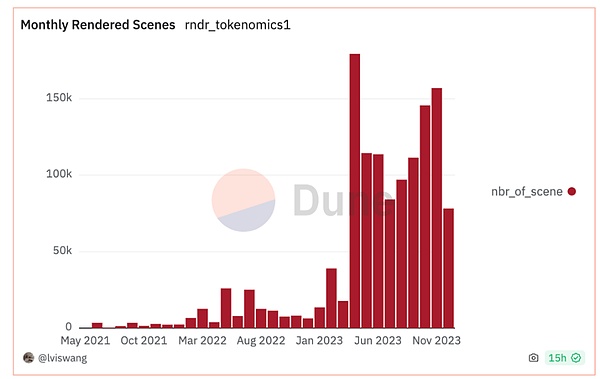

Render Network, since 2020 Since its launch in April, it has become a leading decentralized rendering platform, building a bridge between users who need GPU computing power and suppliers with spare computing resources. This platform mainly serves high-demand computing fields such as artificial intelligence, virtual reality and multimedia content creation. Through its unique dynamic pricing strategy, it provides all parties with a fair solution by taking into account the complexity, urgency and available resources of the task. and a competitive market environment. In this way, GPU owners can connect their devices to the Render Network and utilize the OctaneRender software developed by OTOY to accept and complete rendering tasks. In exchange, users pay RNDR tokens to individuals who complete rendering tasks, and OTOY takes a small portion of RNDR as a fee to facilitate transactions and network operations.

Render Network is headquartered in the United States and was founded by Jules Urbach. Urbach is not only the founder of Render Network, but also the founder and CEO of OTOY. He has profound insights and contributions to the development of 3D rendering technology and decentralized computing platforms.

Render Network has completed several rounds of financing, including strategic financing. On December 21, 2021, Render Network successfully raised US$30 million in a round of strategic financing. Investors in this round of financing include well-known investment institutions such as Multicoin Capital, Alameda Research, Sfermion, Solana Ventures, Vinny Lingham, and Bill Lee. personal. In addition, Render Network also raised US$1.16 million in funds through ICO in January 2018. The successful raising of these funds not only provided support for Render Network's technology development and market expansion, but also reflected the market's potential for decentralized rendering services. recognition.

Render Network leverages the peer-to-peer network capabilities of RNDR tokens to effectively distribute workloads among idle GPU resource providers, while encouraging nodes to share their unused computing power through an incentive mechanism. This move not only maximizes resource utilization efficiency, but also creates value for participants and promotes the prosperity of the decentralized rendering ecosystem.

In December 2023, Render achieved a major technological leap and migrated its infrastructure from Ethereum to Solana. This transition brought Render including real-time streaming, dynamic NFT, and state compression. The new capabilities significantly improve the performance and scalability of the network, while opening up richer and more diverse application scenarios for users.

DePIN (Decentralized Physical Infrastructure Network), as a brand new concept, consists of two main areas: digital resource network and physical resource network. It aims to motivate through the physical proof of work (PoPW) mechanism. Individuals participate in the construction and efficient use of real-world infrastructure. The emergence of DePIN not only brings innovative solutions to the traditional information and communication technology (ICT) industry, but also heralds the arrival of a more decentralized and efficient infrastructure network model.

Although the current ICT industry faces challenges such as high thresholds and inefficient resource utilization, DePIN has introduced a peer-to-peer network-based model to reuse idle resources and reduce participation through disintermediation. threshold, enhancing the competitiveness and efficiency of the market.

The successful upgrade of Render Network and its tight integration with Solana demonstrate the advantages of the decentralized rendering platform in responding to real-time responses and reducing transaction costs, which not only strengthens Render's leadership in the DePIN field status, and also opened up a new path for its future development.

As Render Network continues to promote technological innovation and ecosystem construction, its potential in multiple frontier fields such as decentralized rendering, artificial intelligence, and digital rights management is gradually emerging. Render is not only a rendering service platform, but also a powerful engine that promotes innovation, connects resources and needs, and promotes decentralization and digital transformation. With the continuous advancement of technology and the growth of market demand, Render Network is expected to become one of the key forces driving new development of the digital economy.

Source: https://dune.com/lviswang/render-network-dollarrndr-mterics

Arweave

Arweave is an innovative decentralized data storage protocol designed to achieve permanent storage of data. Through its unique permaweb, Arweave makes stored data accessible in human-readable form (e.g., via a web browser), creating a durable, immutable Internet. This permanent storage capability is revolutionary for ensuring the immutability and permanent accessibility of information, especially in application scenarios that require a high degree of data integrity and durability, such as legal document storage and academic research archiving. and areas such as copyright protection.

Arweave incentivizes data storage providers in the network through its native token AR. This economic incentive mechanism ensures the sustainability of the network and the expansion of storage capabilities. As an infrastructure and storage network project, Arweave aims to reshape the way data is stored and accessed. Originally named Archain, it was founded in 2017 and is headquartered in Germany. Arweave’s founding team includes co-founders and CEOs Sam Williams and COO Sebastian Campos Groth, as well as legal director Giti Said. They have extensive experience in technology, operations and legal fields and are a key force in promoting the development of the Arweave project.

Since the launch of the mainnet in June 2018, Arweave has attracted widespread attention and received support from multiple important investors, including the well-known a16z Crypto, Coinbase Ventures and Union Square Ventures. A public fundraising round in May 2018 raised $1.57 million. Since then, the project has conducted two rounds of financing in November 2019 and March 2020, raising US$5 million and US$8.3 million respectively, with investors including a16z Crypto, Multicoin Capital, Union Square Ventures, and Coinbase Ventures.

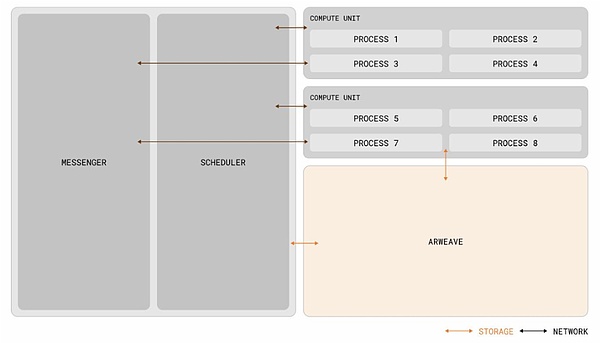

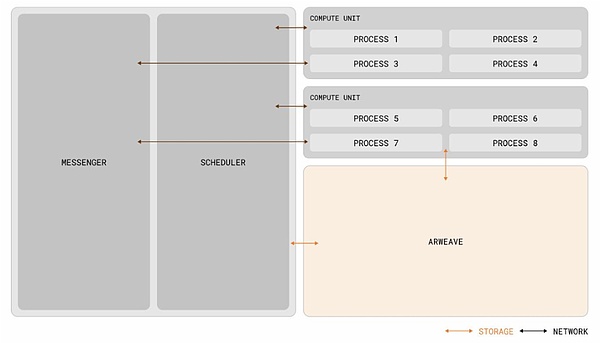

The AO solution launched by Arweave represents a major innovation in blockchain technology, mainly reflected in the hyper-parallel computer architecture it provides. This architecture allows any number of processes to be run in parallel at the same time in a decentralized computing environment, greatly improving computing efficiency and scalability. The core features of AO include large-scale computing capabilities, the implementation of verifiable calculations, and the highly parallel processing capabilities and reliability achieved by building three different sub-networks (messenger unit, scheduling unit, computing unit) and using Arweave as the base layer. Scalability.

Named AO (Actor Oriented), it is inspired by the Actor model in computer science. This model is particularly suitable for designing and implementing high-concurrency, distributed, and fault-tolerant systems. Through AO, the Arweave team demonstrated its deep understanding and innovative solutions for the future development of the decentralized computing environment.

Source: https://foresightnews.pro/article/detail/54511

AO is built on top of the Arweave base layer. Using Arweave's on-chain storage as a permanent host for its running data strengthens its decentralized computing capabilities and allows any number of parallel processes to run simultaneously, achieving a collaboration approach similar to that of data centers and Internet computers. In addition, a key part of AO is AOS, a specific operating system based on the AO architecture that allows developers to develop applications using the Lua language, further enhancing its ease of use and flexibility.

The launch of AO aligns with Arweave’s long-term goal of supporting a highly scalable blockchain network through its data storage platform. Although the Arweave team encountered challenges in achieving this goal, their persistence and innovation ultimately made AO possible. This not only enhances the functionality of the Arweave chain, enabling it to support more smart contracts and blockchain protocols, but also provides a new and powerful solution for decentralized computing.

Arweave AO works beyond the limitations of traditional blockchain technology, achieving unprecedented results by breaking down the three main parts of the blockchain into independent components that can communicate with each other and execute large numbers of transactions simultaneously. Horizontal expansion capabilities. This innovation not only opens up new possibilities for the development of Arweave itself, but also provides new perspectives and inspiration for the entire blockchain and decentralized technology fields.

Ultimately, Arweave’s goal is to make AO a stable system that requires only infrequent updates, similar to Bitcoin, ensuring the continuity of core functionality and user rights. This stability and transparency is very important to users as it allows them to have a deeper trust and understanding of the protocols they use. As Arweave AO continues to develop and improve, it has the potential to become an important player in the decentralized smart contract platform, forming a strong competition with existing blockchain technologies such as Ethereum.

Akash Network

The core value of Akash Network is that as a decentralized computing platform, it takes advantage of the world's underused GPU resources and connects these resources with those who need GPU computing. capabilities among users. This platform not only provides profit opportunities for owners of GPU resources, but also provides more cost-effective options for users who need these resources. According to data from September 2023, Akash Network has successfully deployed 150 to 200 GPUs on its network and achieved utilization rates of 50% to 70%. This achievement is reflected in the total annual transaction value of US$500,000 to US$1 million, demonstrating the market potential of the decentralized computing resource sharing model.

Further analysis of Akash Network’s business model shows that the analogy with Airbnb in the real estate market is quite appropriate. Akash creates a marketplace where owners of GPU resources can rent out their unused computing power like Airbnb hosts, while users who need these resources can obtain the computing power they need at a lower cost. This model not only increases the utilization of GPU resources, but also lowers the threshold for entering the fields of artificial intelligence and machine learning.

With the rapid development of artificial intelligence, the demand for high-performance computing resources such as GPUs has increased dramatically. Nvidia, the leader in GPU manufacturing, expects its revenue to grow significantly in a few years, from $27 billion in 2022 to $60 billion in 2023, and is expected to reach about $100 billion by 2025. This growth forecast reflects the strong global demand for GPU computing power and also provides Akash Network with a broad market space.

Akash Network’s decentralized model is particularly well-suited to the current market environment, where demand for cloud computing services is increasing and the world’s vast amounts of GPU computing power are underutilized. Through Akash, the supply side can provide idle GPU resources, while the demand side can obtain the necessary computing power at a lower cost. This model not only optimizes the allocation of resources, but also promotes the democratization of computing power, allowing more enterprises and individuals to participate in the research and development of artificial intelligence and high-performance computing.

The native token of Akash Network is AKT, which plays several important roles in the network. First, AKT is used to pay for computing resources on the network, including but not limited to GPU computing, storage and bandwidth. Secondly, AKT is also part of network governance, and holders can participate in the network decision-making process through token voting, such as protocol updates and improvement proposals. In addition, AKT also serves as an incentive mechanism to encourage users to participate in network maintenance, including providing computing resources, verifying transactions, etc.

In order to encourage more users to provide unused computing resources, Akash has designed an incentive mechanism, which is mainly implemented in two ways: token rewards and transaction fees.

Token rewards: The Akash network provides rewards to users who provide computing resources through the issuance of new tokens. These newly issued tokens are distributed to resource providers as incentives to encourage them to connect more resources to the Akash network. In addition, network validators and users participating in network governance can also be rewarded with AKT tokens to incentivize them to participate in the security and governance of the network.

Transaction Fees: The Akash network charges fees for transactions using its services, which are paid in AKT tokens. According to Akash’s policy, a portion of transaction fees are allocated to nodes that provide computing resources as a direct economic incentive for them to provide services.

Akash charges a 4% fee for transactions paid with AKT, and a higher 20% fee for transactions paid with USDC (a stable currency) . This differentiated fee structure is designed to promote the circulation and use of AKT tokens, while also providing financial support for the maintenance and development of the network.

Akash Network has also set up a community pool that collects a portion of network revenue, including tokens generated by inflation and transaction fees. Funds from the community pool are used to fund projects and proposals for network development, such as technical improvements, marketing activities, etc. The community votes to determine the allocation of funds.

Through this complex but effective token model and incentive mechanism, Akash Network not only ensures the active and healthy development of the network, but also provides users with the opportunity to participate in the network and benefit from it. These incentives help attract more resource providers and users to join the Akash ecosystem, driving the long-term success and continued growth of the decentralized computing platform.

However, despite the promising market prospects of Akash Network, the challenges it faces cannot be ignored. In addition to competing with traditional cloud service providers, Akash must constantly optimize its technology platform to ensure efficient and secure services. In addition, building and maintaining a decentralized market also requires constantly attracting new resource providers and users and maintaining a high degree of market activity.

Source: https://www.modularcapital.xyz/writing/akash

Bittensor

Bittensor is powered by AI Founded in 2019 by researchers Ala Shaabana and Jacob Steeves, it was originally conceived as a parachain for Polkadot. In March 2023, the project changed its strategy and decided to develop its own blockchain, aiming to incentivize global machine learning nodes through cryptocurrency and promote the decentralization of AI development. By letting these nodes train and learn collaboratively with each other, Bittensor introduces a new paradigm that enhances the collective intelligence of the network by integrating incremental resources, expanding the contribution of individual researchers and models to the whole.

Bittensor introduces multiple innovative concepts and mechanisms, such as distributed expert model (MoE) and proof of intelligence (Proof Of intelligence), aiming to promote decentralization by rewarding useful machine learning models and results. development of the AI ecosystem. Its token economics design and ecosystem structure are designed to support and reward network participants, incentivizing fair distribution practices and network participation through TAO tokens.

Bittensor’s architectural design reflects its pursuit of building a robust AI ecosystem. Through the hierarchical structure of miner layer, verifier layer, enterprise layer and consumer layer, Bittensor aims to build a network that fully supports AI innovation. Among them, the AI model of the miner layer drives innovation, the verifier layer maintains the security and integrity of the network, and the enterprise layer and consumer layer ensure that technological achievements can be transformed into practical applications to meet the needs of the market and society.

The core participants of the Bittensor network include miners and verifiers. Miners submit pretrained models in exchange for rewards, while validators are responsible for confirming the validity of model outputs. Bittensor creates a positive feedback loop through an incentive mechanism, encouraging competition among miners and promoting model refinement and performance improvement.

Although Bittensor itself does not directly participate in the training of the model, its network provides a platform that allows miners to upload and fine-tune their own models. This approach allows Bittensor to integrate multiple models and handle different tasks through specific sub-networks, such as text generation and image generation.

Source: https://futureproofmarketer.com/blog/what-is-bittensor-tao

The sub-network model used by Bittensor is A major feature of its architecture is that these sub-networks focus on the execution of specific tasks. In this way, Bittensor attempts to achieve composite and decentralized intelligence of models, although this goal still faces challenges within the limitations of current technology and theory.

Bittensor’s token economic model is deeply influenced by Bitcoin and adopts a similar token issuance mechanism and incentive structure. TAO tokens are not only part of the network rewards, but also the key to access Bittensor network services. The long-term goal of the project is to promote the democratization of artificial intelligence technology and promote model iteration and learning in intelligent networks through a decentralized approach.

Compared with traditional centralized AI models, the biggest advantage of Bittensor is that it promotes the opening and sharing of AI technology, allowing AI models and algorithms to be iterated and optimized in a wider community, accelerating technological progress. In addition, Bittensor is expected to reduce the application cost of AI technology through its decentralized network structure, allowing more individuals and small businesses to participate in AI innovation.

io.net

io.net is an innovative decentralized GPU network designed to solve the problem of computing resource acquisition in the field of machine learning (ML). The project creates a massive pool of computing power by integrating GPU resources from independent data centers, cryptocurrency miners, and participating projects such as Filecoin and Render. Founder Ahmad Shadid came up with this idea when he was faced with high costs and resource acquisition problems in the process of building a GPU computing network for the machine learning quantitative trading company Dark Tick in 2020. Subsequently, at the Austin Solana Hacker House, the project gained wider attention and recognition.

The main challenge faced by io.net is addressing the limited availability, lack of choice and high cost of computing resources. By aggregating underutilized GPU resources, io.net provides a distributed solution that enables machine learning teams to build and scale their model serving workflows across a distributed network. In this process, it uses advanced distributed computing libraries, such as RAY, to support parallel processing of data and models, thus optimizing the task scheduling and hyperparameter adjustment process.

In terms of products, io.net provides a series of tools and services, including IO Cloud, IO Worker and IO Explorer. IO Cloud is designed to deploy and manage decentralized GPU clusters, achieving seamless integration with IO-SDK and providing a comprehensive solution for the expansion of AI and Python applications. IO Worker provides a comprehensive user interface that enables users to effectively manage their computing resource provisioning operations, including features such as account management, real-time data display, and temperature and power consumption tracking. IO Explorer provides comprehensive visualization of network activities and important statistics, helping users better monitor and understand network status.

To incentivize participation and balance demand and supply, io.net introduced the IO token, whose functions include rewarding continued use by AI and ML deployment teams, pricing IO Worker compute units, and participating in community governance wait. In addition, taking into account the price volatility of cryptocurrencies, io.net has also specially developed IOSD, a stable currency pegged to the US dollar, to stabilize the payment system and incentive mechanism.

Source: https://io.net/

io.net in technology and Both business models show strong innovation capabilities and market potential. Through cooperation with Filecoin, it is expected to further expand its capabilities in model storage and computing resources, providing strong support for the development and expansion of decentralized AI applications. At the same time, by providing a cost-effective, easy-to-access and use platform, io.net aims to become a strong competitor to traditional cloud computing service providers such as AWS and promote innovation and progress in the entire AI field.

In terms of capital, io.net has successfully completed Series A financing, raising US$30 million and reaching a valuation of US$1 billion. This round of financing attracted the participation of many well-known investment institutions including Hack VC, Multicoin Capital, Delphi Digital, Animoca Brands, Solana Ventures, Aptos, OKX Ventures, Amber Group, etc. This series of investments reflects the market’s high recognition of io.net’s innovative capabilities and market potential in the fields of decentralized computing and artificial intelligence.

Summary

With the continuous progress of AI and blockchain technology, the field of AI x Crypto has shown great potential and opportunities, and also faces a series of challenges. Through an in-depth analysis of the three core scenarios of "computing power assetization", "model/agent assetization" and "data assetization", we can see the innovation path and existing obstacles in this field. Decentralized computing power opens up new possibilities for AI training and inference, although the dependence on high-performance computing resources and communication bandwidth needs to be addressed. The assetization of models and agents provides proof of ownership through NFT and improves the interactive experience, but technology integration still needs to be deepened. Data capitalization unlocks the potential of private domain data. Facing the challenges of data standardization and market liquidity, it also opens up new avenues for AI efficiency and specialization.

It is worth noting that as AI technology continues to develop and iterate, it will periodically attract hot spots and funds to flow into the AI x Crypto field, bringing a continuous wave of development to AI rather than a single stage. opportunities. The enduring value and innovation potential of the AI x Crypto field mark it as a key track in the technology and investment fields.

Looking to the future, the development of AI x Crypto will rely on technological innovation, interdisciplinary cooperation and the exploration of market demand. By breaking through technical limitations, deepening the integration of AI and blockchain, and developing practical application scenarios, this field is moving towards long-term development and providing more secure, transparent and fair AI services. In this process, the concept and technical practice of decentralization will continue to promote the development of the AI x Crypto field in a more open, efficient and innovative direction, and ultimately achieve a double leap in technological innovation and value creation. Therefore, the AI x Crypto track in the current cycle is an important opportunity that cannot be missed. It not only represents the forefront of technological innovation, but also heralds important trends in future technological progress and investment direction.

JinseFinance

JinseFinance