Author: Decentralised.Co; Compiler: TechFlow

Is L2 plundering the interests of L1?

L2 uses L1 for settlement while providing cheaper transaction services to users. They act as an intermediary between L1 and users and capture part of the value by charging fees (including MEV). So, are they paying enough for using the precious block space of L1? Let's analyze the impact of L2 on Ethereum through four charts.

1. How does L2 help the Ethereum ecosystem?

Let's not talk about L2 tokens for now, let's take a look at their contribution to the entire Ethereum ecosystem. One way to measure this is to look at the increase in the market value of ETH by L2 tokens.

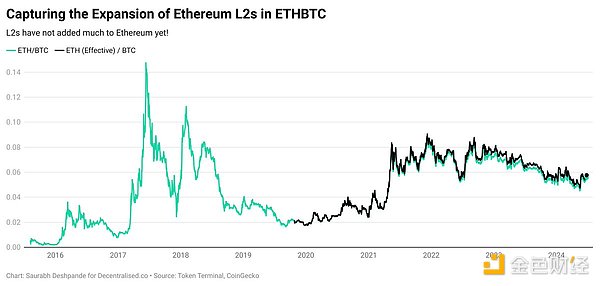

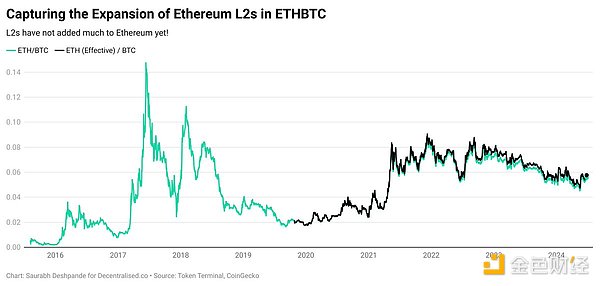

For comparison, I use the ETHBTC ratio as a benchmark for how the Ethereum ecosystem is trending relative to Bitcoin.

To capture the value of Ethereum as a whole, I add the top 10 L2 tokens by market cap to ETH and consider that as “effective ETH” or the value of the entire Ethereum ecosystem.

Currently, the top 10 L2s have little impact on the ETHBTC ratio. With Bitcoin’s market dominance exceeding 50%, the chart below shows that L2s have not significantly boosted the ETH (effective) / BTC ratio (see black line vs. green line).

2. So, where is value capture happening?

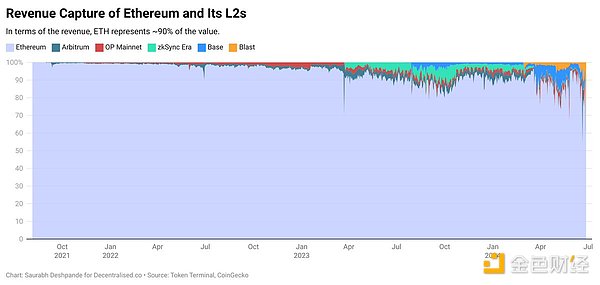

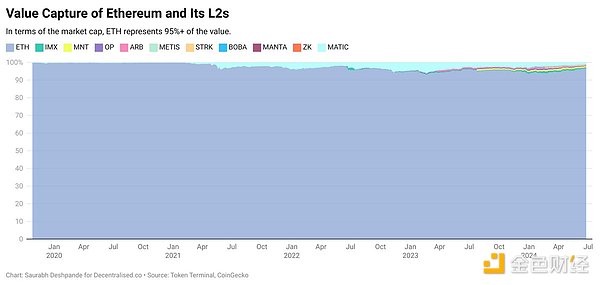

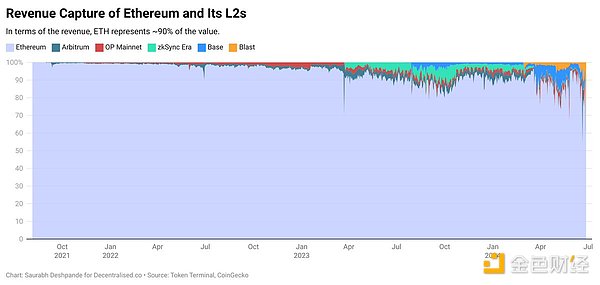

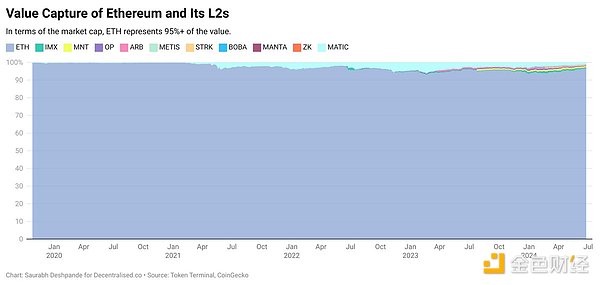

In simple terms, value capture can be measured by two metrics: revenue and market cap. If value is generated, it is reflected in the price.

a. Where is revenue captured? Ethereum regularly captures ~90% of the total revenue in the Ethereum ecosystem. In Q2 2024, Base has been the leading L2 by revenue, followed by Blast.

b. In terms of market cap, ETH still accounts for over 95% of the top 10 L2 market caps.

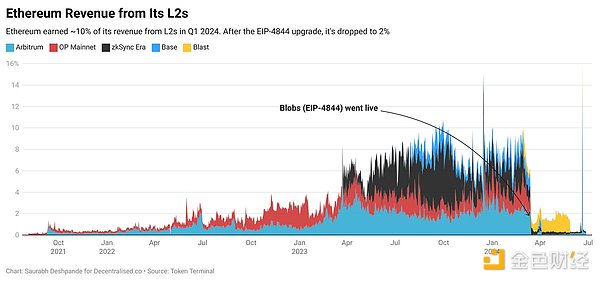

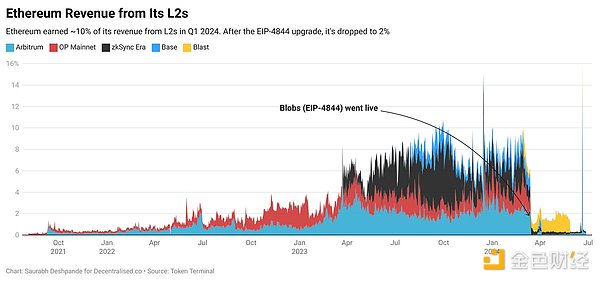

3. How much revenue does L2 pass to Ethereum?

L2 incurs costs for storing data on Ethereum. This is the operating cost of L2. This cost needs to be balanced. If the cost is too high, L2 operations will become difficult; if the cost is too low, although Ethereum provides key settlement services, not much revenue is earned from L2.

Ethereum's 4844 upgrade (also known as Proto Danksharding) reduces L2's operating costs. The reduction in L2 data storage costs has reduced L2's contribution to Ethereum's revenue from about 10% to about 2%. While this may seem like a setback, it makes L2 ready for more users because transaction costs are reduced.

So far, blobs seem like a bad idea from Ethereum’s perspective. So what’s the end goal? Scaling.

In one week in 2024, Ethereum supported 7.1 million transactions with $10.6 million in revenue. The cost per transaction to users was about $1.5. Meanwhile, five L2s (Arbitrum, Base, Blast, Optimism, and Polygon) supported over 70 million transactions with $2.75 million in fees. The cost per transaction was just $0.03.

We can discuss the quality of transactions, whether they are bots or their value, etc. But the fact is that Ethereum can’t support that many transactions.

In general, by building L2 and lowering transaction costs on L2 by providing them with cheaper data storage options on L1, this is good for users, but not so good for Ethereum (L1). If most users choose to transact on L2, more data will be pushed to L1. As L2 pushes more data and competes with each other for L1's block space, L1's base fee will increase, thereby increasing Ethereum's revenue. Therefore, when more people start using L2, it can be a win-win for Ethereum and users.

JinseFinance

JinseFinance