Author: 0xTodd Source: X, @0x_Todd

Why is it so hard to wait for SOL ETF? Because it may not make money. Last week, Cathie Wood's Ark Fund decided to withdraw the ETH ETF application.

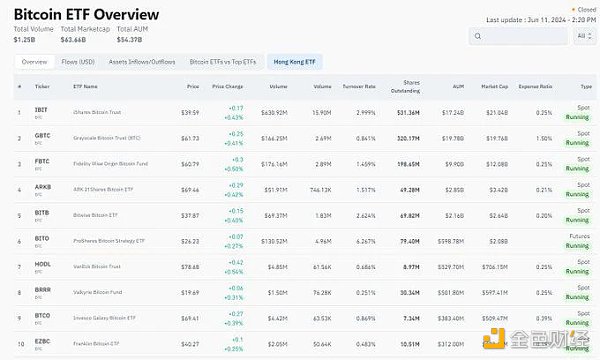

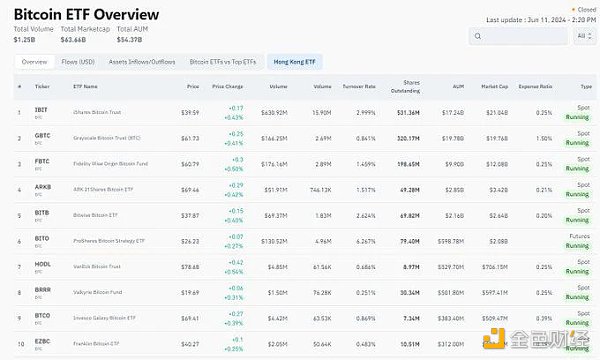

Ark BTC ETF ranks fourth (market share 6%, the top 3 are BlackRock, Grayscale and Fidelity), but according to market speculation, it is "not very profitable." The main reason is that the fee rate of BTC ETF is relatively low compared to traditional ETFs, many of which are in the range of 0.19-0.25%, and ETFs are also engaged in a "fee rate competition".

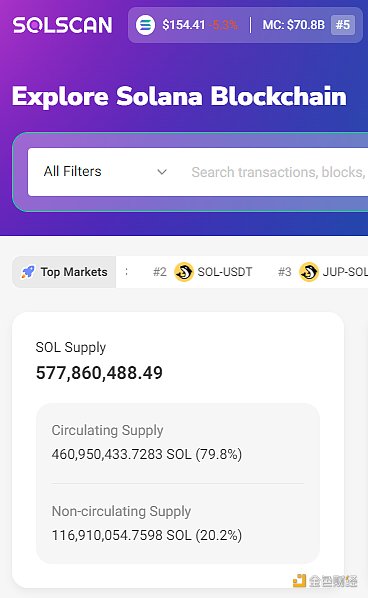

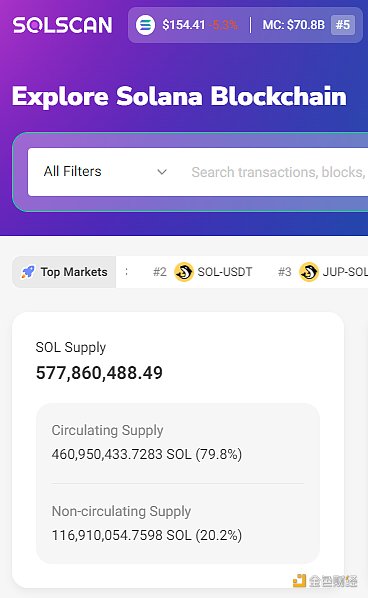

A simple estimate shows that with the current scale of Ark BTC ETF, it can earn about 7 million US dollars in management fees a year, so the corresponding costs are probably of the same order of magnitude. Therefore, if Ark BTC ETF is still hovering near the profit line, then for Ark, pushing ETH ETF may become a loss-making transaction. So even Ark can only reluctantly give up ETH ETF. From a business perspective, mainstream coins with lower market capitalization, such as $SOL, have a market capitalization of 5% of $BTC. To recover the annual cost of $7 million, an ETF must manage at least 20 million SOL. Currently, BlackRock, the leader in crypto ETFs, only manages 1.5% of BTC in the entire network, while 20 million SOL means 4.5% of $SOL in paper circulation.

In addition, consider:

(1) SOL is naturally more difficult to raise than BTC, which has no interest. SOL's on-chain income can reach about 8%, but ETFs are prohibited from including staking functions. Holding SOL ETF means that it will naturally underperform SOL on the chain by 8%, while Bitcoin only underperforms by 0.2% management fees.

Take Grayscale as an example. The peak of GBTC was 600,000, while the peak of SOL was only 450,000, which is much lower than BTC.

(2) The paper circulation of SOL is 460 million, which may be much lower than this. Everyone knows this.

The lower circulating market value requires a larger holding while bearing high interest rates and regulatory pressure. Therefore, if SOL's current market value and circulation are considered, it is probably difficult for these institutions to make money.

Business is business, who has the motivation to promote a business that does not make money?

JinseFinance

JinseFinance